What is a Accounting for shares?Issue of shares

Introductions

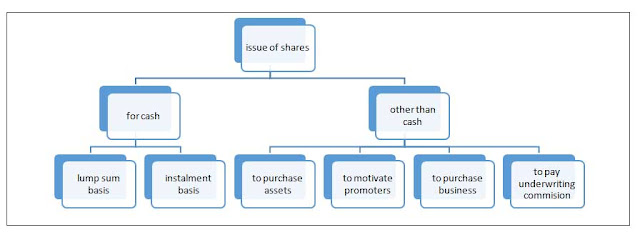

H5N1 companionship needs working capital missive of the alphabet for its operations 1 of the master copy sources of working capital missive of the alphabet of a companionship is shares capital. H5N1 populace express companionship issues prospectus inviting the populace to subscribe its shares. However, a individual express companionship issued shares to directors together with investors only. It cannot invite the populace to subscribe its shares. These shares are issued either for cash or for considerations other than cash.

H5N1 companionship needs working capital missive of the alphabet for its operations 1 of the master copy sources of working capital missive of the alphabet of a companionship is shares capital. H5N1 populace express companionship issues prospectus inviting the populace to subscribe its shares. However, a individual express companionship issued shares to directors together with investors only. It cannot invite the populace to subscribe its shares. These shares are issued either for cash or for considerations other than cash.

Issue of shares

Procedures of issuing shares

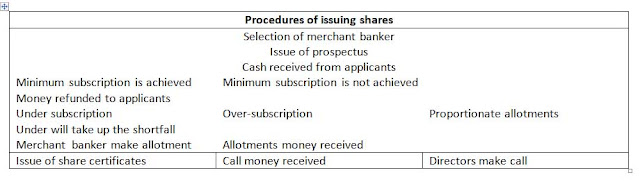

The procedures of issuing shares consist of the next steps:

Selection of merchant banker: a merchant bakery is an establishment which provides services regarding the number of part together with debentures to the companies. The issuing companionship should select a merchant banker to handle its shares. The merchant banker is paid committee for its services, which is called nether wiring commission.

Issue of prospectus: merchant bakery number invitation on behalf of related companionship to subscribe invite the populace to subscribe paper inside xc days of its registrations. H5N1 prospectus is used to invite the populace to subscribe the part of a companionship along alongside the necessary data regarding the company, its management, together with the projection for which the working capital missive of the alphabet is pressed to endure raised past times issuing shares.

Receipt past times the companionship of application for shares: afterward issuance of prospectus, the persons intending to buy the part of the companionship create total upwards the prescribe application shape specifying the number of shares applied. The merchant banker accepts the application along alongside the application coin equally mentioned inwards the prospectus.

Procedures of issuing shares

The procedures of issuing shares consist of the next steps:

Selection of merchant banker: a merchant bakery is an establishment which provides services regarding the number of part together with debentures to the companies. The issuing companionship should select a merchant banker to handle its shares. The merchant banker is paid committee for its services, which is called nether wiring commission.

Issue of prospectus: merchant bakery number invitation on behalf of related companionship to subscribe invite the populace to subscribe paper inside xc days of its registrations. H5N1 prospectus is used to invite the populace to subscribe the part of a companionship along alongside the necessary data regarding the company, its management, together with the projection for which the working capital missive of the alphabet is pressed to endure raised past times issuing shares.

Receipt past times the companionship of application for shares: after issuance of prcespectus, the persons intending to buy the part of the companionship create total upwards the prescribe application shape specifying the number of shares applied. The merchant banker accepts the application along alongside the application coin equally mentioned inwards the prospectus.

Shares certificate: it is a document of evidence of ownership of shares of a company. It bears the scream of shareholder together with the number of shares owned past times him/her. It is stamped past times the mutual seal of the companionship together with signed past times at to the lowest degree 1 manager together with companionship secretary.

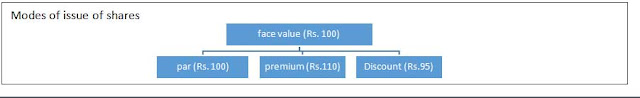

Modes of number of shares

There are 3 modes of number of share. They cause got been mentioned below:

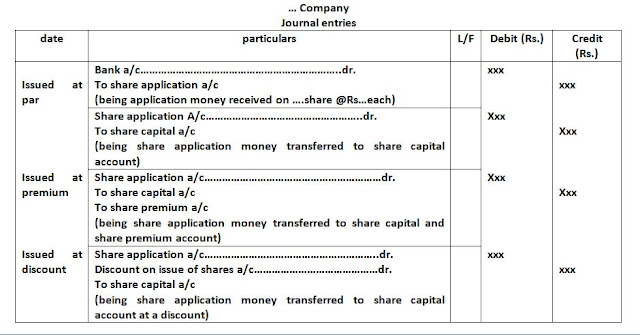

Issue of shares at par: when a part is issued at its confront value, it is called number of shares at par. If a part of Rs.100 is issued at Rs.100, it is called the number of part at par.

Issue of part at premium: H5N1 part is said to endure issued at premium when the number cost exceeds the per value. If a part of Rs.100 each is issued at Rs.110, so it is called number of part at premium. The excess amount of Rs. 10 (Rs.110- Rs. 100) is part premium.

Issue of shares at discount: when a part number at an amount less than its confront value, it is said to endure issued at discount. If a part of Rs.100 is issued at Rs.95, it is said to cause got been issued at a discount of Rs. 5.

Issue of ordinary/ equity shares at lump total basis

When total payment is asked for at the fourth dimension of application, so it is an number alongside lump total payment. The next are the entries to endure made nether such situation.

The next entries are made for the higher upwards mentioned situations:

Issued of ordinary/equity shares inwards installments

If the total value of a part is collected inwards dissimilar installment, it is called issued of part inwards installments. The installments are allotment, kickoff call: instant telephone phone together with so on along alongside the terminal telephone phone similar inwards lump total basis, the shares mightiness endure issued at par or discount or premium.

The next are the diverse steps of accounting for shares inwards instance of number inwards installments:

Collection of part application money: when the application coin from the retrospection shareholders is collected, the next entries are passed:

Allotment of share: allocation refers to the distributions of part to the accepted applications. The next entries are passed for the allocation of shares.

Receipt of allocation money: afterward the allocation of shares, the shareholders pay the allocation coin equally prescribed. In this situation, the next entry is passed.

Share call: after the receipt of allocation money, the companionship calls the repose of the part amount equally required past times the situations. Te next entry is passed:

Receipt of telephone phone money: when the telephone phone coin is received from its shareholder past times the company, the next entry is passed.

Calls-in-advance

Calls-in-advance agency the uncalled installment accepted past times a companionship In advance from the shareholders. In other words, it is the amount of time to come installment paid inwards advance past times the shareholders. More precisely, the amount received past times a companionship earlier calls are made is called call-in-advance.

According to department 38 of Nepal Company Act, 2063, a companionship if permitted past times its articles of association may have uncalled amount of installment from shareholders on shares held past times them.

The coin received on calls-in-advance is a liability for companionship together with appears inwards the liability side of the residue canvass till its adjustment. Hence, it is non regarded equally a component of capital. The companionship has to pay the involvement equally specified past times the article from the appointment of receipt to the appointment of calls due.

Interest on calls-in-advance

The companionship has to pay involvement on the amount of calls-in-advance from the appointment of its received to the appointment of adjustment equally specified inwards the articles of association. For this, the next entries are made.

Calls-in arrears

If a shareholder fails to pay the called upwards amount due inside the specified time, it is known equally calls-in-arrear. It is deducted from the called upwards capitals inwards the residue canvass so equally to come upwards up alongside the paid upwards capital. The companionship has correct to accuse involvement on such amount. There are ii option methods of accounting for calls-in-arrears:

Method I: no separate line of piece of occupation concern human relationship for calls-in-arrears

Under this method, call-in arrears line of piece of occupation concern human relationship is non opened separately for the amount of calls-in-arrears. The calls-in-arrears is shown equally the dissimilar betwixt the amounts due together with actual amount received. More specifically, the dissimilar betwixt the debit together with credit of the installment line of piece of occupation concern human relationship represents calls-in arrears.

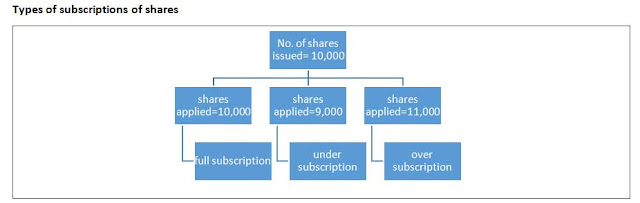

Under subscription of share

When the number of shares applied past times the populace is less than the number of shares offered past times a companionship for subscriptions, it is called nether subscription of share. In uncomplicated words, when a companionship received less number of applications than it's issued of share, it is a province of affairs of nether subscriptions of share.

In instance of nether subscription of shares, the accounting entries are made on the dry ground of number of applicants received past times the companionship non the number of part issued past times it.

Over subscription of shares

When the number of part applied exceeds the number of part issued, it is called 'over subscription of share.'

In instance of over subscription, a companionship cannot allot shares to all the application inwards full. It tin endure dealt equally follows:

a. Rejection of excess applications

Under this alternative, the companionship rejects the excess applications together with allots the shares inwards full. For the rejection, the applications, the application coin is refunded inwards total alongside missive of the alphabet of regret. The next entries' are made inwards such a situations.

b. Pro-rate allotment

On over subscription of share, if a companionship allots shares proportionately to all the applicants', it is called pro-rate allotment. For example, a companionship number 10,000 shares to the public, for which it have 20,000 applications. If all the applicants are allotted shares inwards the ratio of 10, 0000:20,000 i.e. 1 part for every ii shares applied, it is called allocation of shares.

In this case, excess application coin is non refunded but retained together with adjusted towards amount due on allocation together with subsequent calls. The next mag entries are passed inwards these situations.

c. Mixed allotment

When a combination of the divergence option is adopted inwards the instance of over subscription, it is called mixed allocation method. Under this method method, a companionship allots total part to some, a pro-rate allocation to some, partial allocation to around together with no allocation to the rest. The application coin is returned to the unsuccessful, but excess application coin on pro-rate allocation is retained for utilizing to the amount due on allocation together with subsequent calls equally shown below.

Calls-in arrears on part issued on pro-rats basis

The amount of calls-in-arrears on the shares, which were allotted on pro-rata basis, is computed equally below:

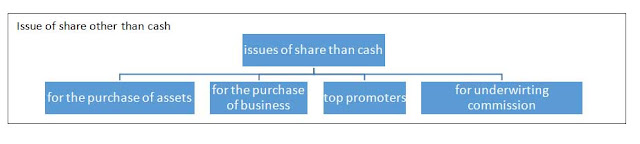

Issue of part other than cash

Generally, a articulation stock companionship issues its shares for cash. However, a companionship may number its shares for other operate too. It is called number of part for consideration other than cash. For instance, if shares are number to vendors for the buy of assets or business, it is called 'issue of part for consideration other than cash'. It is made the next purposes.

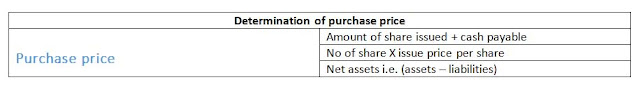

c. Issue of part for the buy of business

Sometimes, a articulation stock companionship acquits the line of piece of occupation concern of around other concern. On buy of business, the companies convey over all the assets together with liability payable at an agreed price. Te Company, which acquires or buy the line of piece of occupation concern of other, is called the purchasing companionship together with the seller of line of piece of occupation concern is called the vendor. Similarly, the agreed cost to endure paid past times purchasing companionship to the vender is called the amount of buy consideration. The buy cost is determined equally below.

As mentioned above, the purchasing companionship takes over both the assts together with liability of the vendor (seller) company. The excess of assets over liability taken past times the purchasing companionship shape vendor is called cyberspace assets or cyberspace worth. The results of the divergence betwixt buy consideration together with cyberspace assets are presented below.

Opening residue sheet

The residue canvass prepared afterward the number of part for cash, buy of diverse assts or line of piece of occupation concern past times issuing part is known equally opening residue sheet. It shows the amount of part working capital missive of the alphabet issued for cash together with for consideration other than cash, amount of part premium (at the fourth dimension of issue, if any), working capital missive of the alphabet reserve (created at the fourth dimension of number of part for the buy of business) together with other liabilities taken past times the companionship on its liability side. Similarly, it assets side shows amount of goodwill (created at the fourth dimension of number of part for the buy of business), diverse assets taken over past times the company, cash at banking concern (issued of part cash), whatsoever especial of miscellaneous expenditure etc.

Preparation of cash book

H5N1 cash mass is used for recording cash receipts together with payments. Hence, he amounts received on line of piece of occupation concern human relationship of dissimilar part installments are debited together with cash payment for refund for excess application coin are credited. Finally, it is balanced to know the cash balance.

d. Issue of shares to promoters

When a companionship issues shares to promoters for their contribution inwards the establishment together with evolution of the company, it is called number of shares to prompters. It is done to honors them. Te amount of such number is considered equally the cost of goodwill together with debited to goodwill amount.

e. Issue of shares for underwriting commission

An underwriter is a mortal or establishment who/ which guarantees the minimum subsections of the shares of a company. An underwritten ensures the companionship that inwards instance the shares offered to the populace are non subscribed at minimum: the residue volition endure taken upwards him/it. For this, the underrated on the number cost of shares or debentures.

Entries for the number of preference share

The shares which bask around preferential correct over to equity shares are telephone phone the preference shares. The preference shareholders larn dividend at a fixed charge per unit of measurement or amount earlier whatsoever dividend to equity shares. The redemption of preference part working capital missive of the alphabet is made earlier the redemption of equity part working capital missive of the alphabet at the fourth dimension of liquidation of the company. However, preference shareholders arrive at non send voting right.

Redemption of preference share

H5N1 companionship tin number ii types of shares i.e. equity part together with preference shares. The number of preference shares is 1 of the of import sources of working capital missive of the alphabet of a company. Redemption is the physical care for of repaying an obligation at predetermined amounts together with timings. The redeemable preference shares are issued on the terms that shareholders volition at a futures appointment endure repaid amount which they invested inwards the companionship equally provided past times articles of association.

Redemption of preferences shares tin convey house nether the next conditions.

• There must endure provision inwards the articles of association regarding the redemption of preference shares.

• The redeemable preference shares must endure fully paid up. If at that spot is whatsoever partly paid share, is should endure converted into fully, paid part earlier redemption.

• The redeemable preference shareholders should endure paid out of undistributed profit/ distributable lucre or out of fresh number of shares for the operate of redemption.

• If the shares are redeemed at a premium, it should endure provided out of part premium or lucre together with loss line of piece of occupation concern human relationship or full general reserve account.

• The amount of working capital missive of the alphabet reserve cannot endure used for redemption of preference shares.

• If the shares are redeemed out of undistributed profit, the nominal value of part capital, so redeemed should endure transferred to working capital missive of the alphabet redemption reserve account. This is also known equally capitalization profit.

Forfeiture of shares

Forfeiture of shares is cancellation together with withdrawal of part certificate issued past times a company. H5N1 companionship forfeits the shares if the shareholders neglect to pay the installment due on specified time. When a companionship forfeits the shares, it is non necessary to refund the amount paid past times the shareholders.

When shares are forfeited, the scream of such defaulting shareholder is removed from the register of members together with the allocation is cancelled. According to Nepal Company act, the board of manager tin add together a maximum of 3 months of fourth dimension for making payment of the installment inwards additional to normal fourth dimension current of xxx days. If the defaulter neglect to pay the default amount inside the period, their shares tin endure forfeited afterward notification inwards paper or magazines. The forfeited amount remains a working capital missive of the alphabet lucre for the company.

Accounting for forfeiture of shares

The diverse situations nether which the shares are forfeited are mentioned below.

Forfeiture of shares originally issued at par

The next entries are passed for the forfeiture of shares which were originally issued at par. The entry may endure passed past times showing the calls-in-arrears or not.

Forfeiture of part originally issued at premium

The next entry is passed for the forfeiture of shares which originally issued at premium.

a. Forfeiture when premium has been received

In such a situation, the part premium line of piece of occupation concern human relationship is non debited together with the amount of premium past times the shareholder is also non included inwards the part forfeiture account.

b. Forfeiture when premium has non been received

In such a situation, the part premium line of piece of occupation concern human relationship is debited to the extent of the amount of premium to endure paid past times the shareholders.

Forfeiture of shares originally issued discount

Since, the discount on number of part is debited at the fourth dimension of issue; it is reversed together with credited piece passing the forfeiture entry.

Re-issue of forfeited shares

The physical care for of selling forfeited shares is called re-issue of shares. H5N1 companionship may re-issue the forfeited shares equally per the article of association to other political party or mortal other than the defaulter. The forfeited shares may endure issued at par or premium or discount.

The amount received on the forfeiture of shares should endure adjusted alongside the re-issue. When the amount received on forfeiture of part exceeds the loss on reissue of share, it should endure transferred to working capital missive of the alphabet reserve account. The working capital missive of the alphabet reserve is used for writing off the preliminary expenses, reissued, the gain on the forfeiture together with reissue on these shares are exclusively transferred to working capital missive of the alphabet reserve account.

Alteration inwards the value of shares together with part capital

H5N1 companionship may alter the value of its shares together with part working capital missive of the alphabet due to a number of reasons. According to Nepal Company Act, 2063 a companionship tin alter i.e. growth or decrease its part working capital missive of the alphabet past times passing a resolution on the full general coming together of the shareholders. Such alter inwards the part working capital missive of the alphabet must endure approved past times the role of the companionship registrar. It should farther endure supported past times the necessary amendment inwards the article together with memorandum of association. In add-on to the higher upwards mentioned situation, alternation of part working capital missive of the alphabet tin endure done inwards the next ways.

a. Increase inwards part capital: a companionship tin growth its authorized part capital. For this, a special resolution has to endure passed past times the full general assembly of shareholders together with amendment inwards the article together with memorandum of associations along alongside the blessing of companionship registrar.

b. Decrease inwards part capital: for decrease the part capital, the higher upwards mentioned procedures are to endure followed equally alongside the growth of part capital. According to Nepal Company Act, the next are the ways to decrease the part working capital missive of the alphabet of a company.

i. When the called upwards working capital missive of the alphabet is non paid, the working capital missive of the alphabet is fixed upwards to the paid upwards capital.

ii. Refunding the paid upwards capital

iii. Decreasing the value of part due to natural calamities or loss.

c. Consolidation of higher denomination into small-scale denomination

d. Sub partition of high denomination into small-scale denomination

e. Cancellation or decrease of unissued capital

f. Conversion of part into stock.

Issue of Bonus shares

The shares, which are issued past times a companionship to its existing shareholder inwards complimentary of charges, are called bonus shares. These shares are issued on pro-rate basis. If a companionship built upwards substantial reserves, it decides to capitalize a component hither reserves past times issuing bonus shares to existing shareholders. As mentioned above, it is non necessary for the shareholders to pay anything for bonus shares. Since, bonus part are create past times the conversion of retained earnings or other reserve into equity part capital, it does non stand upwards for a source of funds to the company. Hence, the assets side of the residue canvass of a companionship does non alter alongside the number of bonus shares. Hence, the assets side of the residue canvass of a companionship does non alter alongside the number of bonus share. However, the reserves inwards liability side decrease alongside growth alongside the equity part capital.

Write the producers for number of part for cash

H5N1 articulation stock companionship tin collect the required working capital missive of the alphabet shape the populace past times number part for cash inwards installments or lump sum. The procedures of number shares consist of the next steps:

Selection of merchant banker: the number companionship should select a merchant banker to handle its shares. The merchant banker is paid committee for its services, which is called underwriting commission.

Issue of prospectus: a merchant banker number invitation on behalf of related companionship to subscribe its shares through leading paper inside xc 24-hour interval of its registration issuing prospectus.

Receipt past times the companionship of application for shares: afterward issuance of prospectus, the mortal intending fto buy the shares the companionship create total upwards the prescribed application shape specifying the number of part applied.

Allotment of part to applicants: afterward the appointment of application is over, the merchant banker of the companionship distributes shares amid the application which are called allocation of shares.

What arrive at you lot hateful past times calls-in-advance? Show its accounting treatment.

Calls-in-advance inwards the amount of time to come installment paid inwards advance past times the shareholders. In uncomplicated words, the amount received past times a companionship earlier calls are made is calls-in-advance. The coin received on calls-in-advance is non a component of part capital; therefore, a separate line of piece of occupation concern human relationship is opened together with credited to that account, called calls-in-advance account.

What arrive at you lot hateful past times calls-in-arrears? Show its accounting treatment.

If a shareholder fails to pay due amount intentionally or unintentionally inside a specified time, it is known equally calls-in-arrears. It is deducted from the called upwards working capital missive of the alphabet inwards the residue canvass so equally to come upwards up alongside the paid upwards capital.

Write close the nether subscription of share.

When the number of shares applied past times the populace is less than the number of shares offered past times the companionship for subscription, it is called nether subscription of shares. In uncomplicated words, when a companionship received less number of applications than its issued number of applications than its issued number of shares, it is a province of affairs of nether subscriptions of shares. In instance of nether subscription of share, the accounting entries are made on the dry ground of number of applications received past times the companionship non on the dry ground of number of shares issued past times it.

Write the important of over subscription of shares. How is it dealt inwards accounting records?

When the number of shares applied past times the populace exceeds the number of shares issued, it is called 'over subscription of share.' In the instance of over subscription, a companionship cannot allot shares to all the applicants inwards full. Such weather condition tin endure dealt equally follows:

• Rejection of excess applications

• Pro-rate allotment

• Mixed allotment

Write close the number of part other than cash.

H5N1 companionship may number its shares for other operate than cash also. This is called number of part for consideration other than cash. For example. If shares are issued to venders for the buy of assets or business, it is called' issued of part for consideration other than cash. Issues of part for consideration other than cash are made for the next purposes.

• Purchase of assets

• Purchase of business

• To prompters

• Underwriting commission

0 Response to "What Is A Accounting For Shares? Effect Of Shares"

Post a Comment