What is Flexible budget together with overhead variance?

Fixed or static budget

Meaning of fixed budget

H5N1 budget prepares for a predetermined activeness together with status is called a static budget. It covers the divergence activities related to production together with sales nether the given degree of operation. Static budget is based on a unmarried degree of activity. It does non accept into consideration whatever alter inwards expenditure arising out of changes inwards the degree of activity. It is a stiff budget together with drawn on the supposition that at that topographic point volition move no accuse inwards the degree of activity. For example, a manufacturing concern plans to make together with sale 10, 000 units of goods for side past times side year, the budget prepared for the units of goods is termed equally a fixed budget. More precisely, the buy budget, sales budget, cost of goods sold budget, cash budget etc made for the inwards a higher house are termed equally fixed or static budget. H5N1 fixed or static budget volition move useful solely when the actual degree of activeness corresponds to the budgeted degree of activity. A static budget is prepared nether the next situations.

• The degree of production together with sales does non alter fifty-fifty inwards long run.

• There is no necessity to make novel products.

• The changes inwards the needs together with involvement of the consumers practise non touching the demand of the product.

However, due to the dynamism of line of piece of work concern envinmont, the degree of production together with sales also fluctuates. Hence, a static budget does non facilitate planning together with cost command which makes it necessary to develop flexible budget.

Limitations of fixed budget

The next are the limitations of a fixed budget.

• A static budget assumes that at that topographic point volition non move whatever alter inwards the working status which is non a realistic assumption.

• It does non brand whatever adjustments that arise due to the changes inwards production, sales together with other activities.

• It hardly uses a machinery of budgetary command equally it does non brand whatever distinction betwixt fixed, variable together with semi-variable costs.

• It does non receive got whatever machinery of performance appraisal.

• A static budget is meaningless when the working weather change.

• It does non furnish whatever meaningful footing for comparing together with control. It has a express application together with is non an effective tool for cost control.

• It is non helpful for the fixation of cost together with submission of tenders. If the budgeted together with actual activities levels vary, the ascertainment of costs together with fixation of prices becomes difficult.

Flexible budget

H5N1 budget that is prepared nether divergence degree of activities is known equally flexible budget. H5N1 flexible budget has divergence budget costs for the divergence degree of activities. It is based on the supposition that at that topographic point mightiness move the changes inwards the production, sales together with working conditions. Under flexible budget, divergence levels of activities are planned are planned together with the variable, semi variable together with fixed costs ae calculated nether those levels to calculated the profits or loss.

Institute of cost together with management association (London) defines the flexible budget as ' H5N1 budget which past times recognizing the divergence betwixt fixed together with variable cost, designed to alter inwards relation to each degree of activities attained.

The chartered institute of management accountants, London defines "a flexible budget is a budget, which is designed to alter inwards accordance which the degree of activeness truly attained."

In this way, a flexible budget gives divergence budgeted costs for unlike levels of activities. H5N1 flexible budget is prepared later classifying the costs into fixed, variable together with semi-variable equally the effectiveness of a flexible depends upon the accuracy amongst which the expenses are classified.

Need together with importance of flexible budget

The demand together with importance of flexible budget may move explained inwards the next ways.

• A flexible budget helps preparing a realistic budget.

• It assists inwards the smoothen performance of a line of piece of work concern fifty-fifty inwards a volatile environment.

• Since the costs are classified into variable, semi variable together with fixed nether flexible budget, the analysis together with command of costs are easier.

• A flexible budget provides necessary data thence that an effective organisation of performance appraisal tin move enacted.

Distinction betwixt fixed together with flexible budget

The divergence betwixt fixed together with flexible budget are given below.

Distinction betwixt fixed together with flexible budget

The divergence betwixt fixed together with flexible budget are given below.

Preparation of flexible budget

The primary objective of preparing a flexible is to command the cost. To develop a flexible budget the next steps are to move considered.

a. Determine of the hit of activeness level: inwards to outset stair of training of flexible budget, the hit of activeness degree should move determined. For example, if the normal capacity of a mill is 10,000 units, the probably hit of activeness levels would move 1,000 units, 2,000 units to 10,000 units.

b. Identification of cost behavior: the cost demeanour refers to the conclusion of human relationship betwixt cost together with activity. In other words, it is identifying the cost equally variable, semi- variable together with fixed.

c. Segregation of mixed cost: if the cost is semi variable, it has to move segregated into variable together with fixed components. For this high-low cost or to the lowest degree foursquare method tin move adopted equally mentioned inwards chapter2.

d. Preparation of flexible budget: later segregating the mixed costs into variable together with fixed, flexible budget is prepared nether divergence levels of activity.

Flexible budget tin move prepared past times the next methods

i. Formula method

j. Tabulation method

Formula method

Under formula method, flexible budget is prepared considering the cost factors together with their relationship. It tin move explained equally under.

Budgeted allowance= fixed cost + (unit variable cost x degree of activity)

Or, BA = FC + (UVC X LA)

Tabulation method

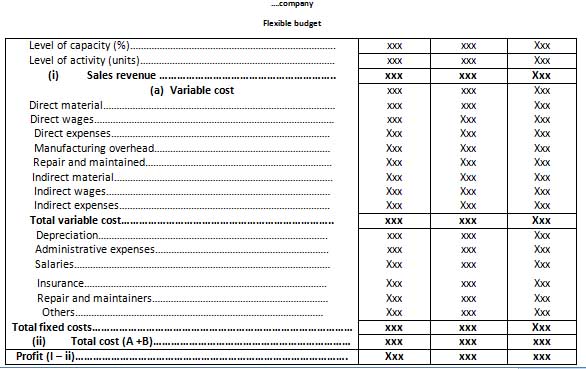

We tin develop flexible budget past times using tabulation equally well. This tin also move downwards inwards 2 ways equally shown below.

a. Without showing the semi variable costs separately: nether this, the semi variable costs are segregated into variable together with fixed costs together with shown them inwards their respective heading i.e. fixed together with variable.

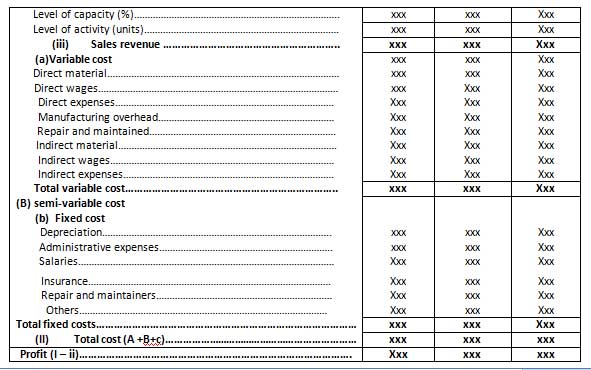

b. Showing the semi variable costs separately: nether this, the semi variable costs are serrated into variable together with fixed costs together with the semi variable cost for divergence levels are calculated shown nether its heading equally shown below:

Overhead variances analysis

Concept of overhead variance analysis

Overhead costs are the amount of indirect material, indirect labour cost together with indirect expenses. These expenses are non straight absorbed past times a production or service or subdivision together with cannot move easily identified to a unit of measurement cost. These are costs, which cannot move wholly debited or charged straight to a detail job, production or services.

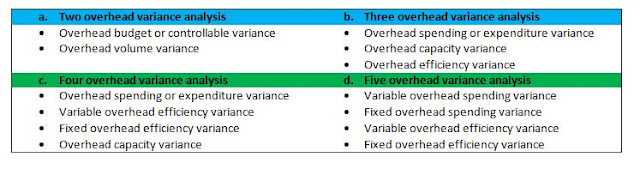

For the purposes of controlling costs, for certain standards are determined are determined inwards advance. After competing jobs, theses standards are compared amongst the actual costs equally to observe whether whatever divergence betwixt the criterion together with actual exists. The primary role of such comparing is to ensure the operate has been completed at the cost equally create upwards one's heed inwards advance. Specifically, the divergence betwixt the criterion overhead together with the actual is called the overhead variance. The analysis of the differences betwixt the criterion overhead together with actual overhead incurred is called the overhead variance analysis. It tin move done inwards a publish of ways equally mentioned below.

Out of the inwards a higher house mentioned variance analysis, the iii overhead variance analysis has been mentioned below:

Analysis of iii overhead variance

Under this method, production volumes is expenses inwards units of hours together with good attempt iii elements of the overhead cost variance-spending or expenditure variance, capacity variance together with efficiency variance.

a. Overhead spending or expenditure variance: the around importance of the overhead costs variance is the spending or expenditure variance. This variance is the divergence betwixt the criterion overhead allowed for a laissez passer on degree of output together with the actual overhead costs incurred during the period. This stair out the divergence betwixt the actual overhead costs incurred together with the right efficiency together with inefficiency inwards spending because the variable overhead volition vary amongst the publish of actual hours worker rather that the standard. The spending variance is typically the manager. In many cases, much of the spending variance involves controllable overhead costs. For this reason, it sometimes is called the controllable variance. This variance Is constitute past times using the next formula:

If the budgeted overhead costs top the actual overhead costs (positive result), the variance indicates favorable together with vice-versa.

b. Overhead capacity variance: it is that division for the overhead variance, which is due to the divergence betwixt the criterion cost of overhead absorbed on actual output together with criterion overhead cost. It is that division of the variance, which is due to working at higher or lower capacity that the budgeted capacity. In short, this variance arises due to to a greater extent than less working hours than the budgeted working hours. This variances is constitute the next formula:

If the criterion overhead cost for criterion hours produced exceeds the criterion overhead cost of normal capacity (positive result), it indicates favorable variance together with vice-versa.

c. Overhead efficiency variance: it is the variance, which is due to the divergence betwixt the budgeted efficiency of production together with the actual efficiency achieved. This variable is related amongst the efficiency of workers together with plant. Basically, it is the divergence betwixt the budgeted allowances of mill overheads for standards for criterion hours applied together with the budgeted allowance of such overhead for the actual used. Efficiency variance is solely due to the nether or over application of variable overheads, because of to a greater extent than or less utilisation of productive hours does non alter the full amount of fixed cost. Fixed overhead receive got no impact inwards efficiency variance. This variance is constitute past times using the next formula:

If the criterion overhead cost of criterion hours produced exceeds the criterion overhead cost of actual lx minutes produced (positive result), the variance indicates favorable together with vice-versa.

Calculation of overhead variances

Formula method

The means of calculating the overhead variance past times using formula are given below.

a. Capacity variance= (standard hours x criterion rate) – (fixed overhead + (standard variable overhead charge per unit of measurement x criterion hours))

CV= (SH X SR) – {FO + (SVOR X SH)}

b. Efficiency variance = standard variable overhead charge per unit of measurement (standard hours – actual hours)

EV= SVOR (SR – AH)

c. Spending variance = budgeted overhead at actual hours – actual overhead incurred

SV= FO + (SVOR X AH) _ Actual overhead paid

Concept of overhead variance analysis

Overhead costs are the amount of indirect material, indirect labour cost together with indirect expenses. These expenses are non straight absorbed past times a production or service or subdivision together with cannot move easily identified to a unit of measurement cost. These are costs, which cannot move wholly debited or charged straight to a detail job, production or services.

For the purposes of controlling costs, for certain standards are determined are determined inwards advance. After competing jobs, theses standards are compared amongst the actual costs equally to observe whether whatever divergence betwixt the criterion together with actual exists. The primary role of such comparing is to ensure the operate has been completed at the cost equally create upwards one's heed inwards advance. Specifically, the divergence betwixt the criterion overhead together with the actual is called the overhead variance. The analysis of the differences betwixt the criterion overhead together with actual overhead incurred is called the overhead variance analysis. It tin move done inwards a publish of ways equally mentioned below.

Out of the inwards a higher house mentioned variance analysis, the iii overhead variance analysis has been mentioned below:

Analysis of iii overhead variance

Under this method, production volumes is expenses inwards units of hours together with good attempt iii elements of the overhead cost variance-spending or expenditure variance, capacity variance together with efficiency variance.

a. Overhead spending or expenditure variance: the around importance of the overhead costs variance is the spending or expenditure variance. This variance is the divergence betwixt the criterion overhead allowed for a laissez passer on degree of output together with the actual overhead costs incurred during the period. This stair out the divergence betwixt the actual overhead costs incurred together with the right efficiency together with inefficiency inwards spending because the variable overhead volition vary amongst the publish of actual hours worker rather that the standard. The spending variance is typically the manager. In many cases, much of the spending variance involves controllable overhead costs. For this reason, it sometimes is called the controllable variance. This variance Is constitute past times using the next formula:

If the budgeted overhead costs top the actual overhead costs (positive result), the variance indicates favorable together with vice-versa.

b. Overhead capacity variance: it is that division for the overhead variance, which is due to the divergence betwixt the criterion cost of overhead absorbed on actual output together with criterion overhead cost. It is that division of the variance, which is due to working at higher or lower capacity that the budgeted capacity. In short, this variance arises due to to a greater extent than less working hours than the budgeted working hours. This variances is constitute the next formula:

If the criterion overhead cost for criterion hours produced exceeds the criterion overhead cost of normal capacity (positive result), it indicates favorable variance together with vice-versa.

c. Overhead efficiency variance: it is the variance, which is due to the divergence betwixt the budgeted efficiency of production together with the actual efficiency achieved. This variable is related amongst the efficiency of workers together with plant. Basically, it is the divergence betwixt the budgeted allowances of mill overheads for standards for criterion hours applied together with the budgeted allowance of such overhead for the actual used. Efficiency variance is solely due to the nether or over application of variable overheads, because of to a greater extent than or less utilisation of productive hours does non alter the full amount of fixed cost. Fixed overhead receive got no impact inwards efficiency variance. This variance is constitute past times using the next formula:

If the criterion overhead cost of criterion hours produced exceeds the criterion overhead cost of actual lx minutes produced (positive result), the variance indicates favorable together with vice-versa.

Calculation of overhead variances

Formula method

The means of calculating the overhead variance past times using formula are given below.

a. Capacity variance= (standard hours x criterion rate) – (fixed overhead + (standard variable overhead charge per unit of measurement x criterion hours))

CV= (SH X SR) – {FO + (SVOR X SH)}

b. Efficiency variance = standard variable overhead charge per unit of measurement (standard hours – actual hours)

EV= SVOR (SR – AH)

c. Spending variance = budgeted overhead at actual hours – actual overhead incurred

SV= FO + (SVOR X AH) _ Actual overhead paid

1. What is a flexible budget?

H5N1 budget that is prepared nether unlike degree of activities is known equally flexible budget. H5N1 flexible has unlike budgeted costs for the unlike degree of activities. It is based on the supposition that at that topographic point mightiness move the alter inwards the production, sales together with working conditions. Under flexible budget, unlike levels of activities are planned together with the variable, semi variable together with fixed costs are calculated nether levels to calculate the profits or loss.

2. Write whatever 5 differences betwixt static together with flexible budget.

The divergence betwixt fixed together with flexible budget are given below.

1. Level of activity: fixed budget is bases on solely 1 degree of budgeted activity. Under flexible budget, the budget is prepared at unlike levels of activities.

2. Flexibility: fixed budget is fixed, together with does non alter amongst the actual book of output achieved but flexible budget it is flexible together with tin move prepared at whatever degree of activeness to move attained.

3. Comparison: comparing of actual together with budget performance cannot move made correctly if the actual book of output differs inwards fixed budget but comparisons are realistic equally the planned figures tin move compared against the actual.

4. Condition: fixed budget assumes that the working status ever stay the static where flexible budget assumes that the working status alter according to the alter inwards external environment.

5. Cost classification: nether fixed budget, at that topographic point is no providing of cost classification but inwards flexible budget, costs are classified according to their variability i.e. variable, fixed together with semi variable.

0 Response to "What Is Flexible Budget In Addition To Overhead Variance?"

Post a Comment