Conceptual foundation

Accounting- an information system

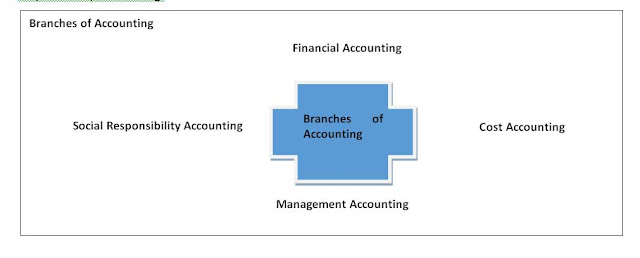

Accounting is an information scheme as well as it tin move considered as a linguistic communication of job organisation as well. The overall objective of an accounting information scheme is to provide information to diverse users. There are iv branches of accounting namely fiscal accounting, cost accounting. Management accounting as well as social responsibleness accounting.

Accounting- an information system

Accounting is an information scheme as well as it tin move considered as a linguistic communication of job organisation as well. The overall objective of an accounting information scheme is to provide information to diverse users. There are iv branches of accounting namely fiscal accounting, cost accounting. Management accounting as well as social responsibleness accounting.

Financial Accounting is concerned amongst recording the job organisation transaction as well as directed towards the ascertainment of operating outcome as good as fiscal condition. Cost accounting is concerned amongst recording measuring as well as reporting the costs. Management accounting is concerned amongst providing the accounting information to the management for planning. Implementation as well as controlling. Similarly, social responsibleness accounting is related amongst the communication, measure as well as contribution made yesteryear the job organisation organisation to the monastic enjoin where the organisation are born as well as grown.

Financial accounting

Concepts of fiscal accounting

Financial accounting is the physical care for of identifying, measuring as well as communicating economical information to the users of such information. It is a branch of accounting which is primary related to recording, classifying, summarizing as well as presenting the twenty-four hours to twenty-four hours transactions. It aims to ascertain turn a profit as well as loss incurred during a especial flow of fourth dimension through turn a profit as well as aims to ascertain turn a profit as well as loss incurred during a especial a especial flow of fourth dimension through turn a profit as well as loss account. Similarly, it also shows the fiscal seat on a given appointment through residual sheet.

Concepts of fiscal accounting

Financial accounting is the physical care for of identifying, measuring as well as communicating economical information to the users of such information. It is a branch of accounting which is primary related to recording, classifying, summarizing as well as presenting the twenty-four hours to twenty-four hours transactions. It aims to ascertain turn a profit as well as loss incurred during a especial flow of fourth dimension through turn a profit as well as aims to ascertain turn a profit as well as loss incurred during a especial a especial flow of fourth dimension through turn a profit as well as loss account. Similarly, it also shows the fiscal seat on a given appointment through residual sheet.

Financial accounting is historical inwards nature since it records the yesteryear transactions. It is the oldest branch of accounting which is as applicable inwards all types of organizations. The other branches of accounting cause got their roots on it. It is based on coin measure concept since if records the transaction that tin move measured inwards monetary terms only. The accounting principles as well as measure nether fiscal accounting are by as well as large accepted as well as universally practiced. It aims to provide information virtually outcome of the job organisation functioning as well as fiscal seat to the internal as well as external parties.

Objective of fiscal accounting

The objectives of fianicla accounting are mentioned below:

1. To tape the fiscal transactions: the master copy objective of fiscal accounting is to tape the fiscal transaction of a job organisation systematically as well as scientifically. The demand of recording the transactions arises due to the limitation of retentivity powerfulness of human being. Under fiscal accounting, the tractions are recorded inwards dissimilar majority of accounts.

2. To give away the outcome of operation: simply about other of import objective of fiscal accounting is to give away the outcome of functioning i.e. turn a profit earned or loss suffered during a especial flow of time. This is achieved yesteryear preparing income statement.

3. To reveal the fiscal status: fiscal accounting also aims to reveal the fiscal status of a job solid on a given date. For this, a disputation of assets as well as liabilities called residual canvass is prepared.

4. To render necessary fiscal information: fiscal accounting aims to provided information to diverse parties similar government, investors, creditors, owners etc. commonly the information is supplies at the cease of accounting flow through diverse fiscal statement.

Limitation of Financial Accounting

Financial accounting suffers from simply about limitations which are as follows:

1. Discloses the overall outcome only: fiscal accounting discloses the overall outcome of a business. It fails to reveal the outcome of each department, process, products, jobs etc.

2. Not helpful inwards toll fixation: fiscal accounting does non provided adequate information for fixation of selling of the products produced or services rendered yesteryear business. So, it is non able to prepare tender or quotations.

3. No command on cost: fiscal accounting does non provided proper scheme of controlling diverse elements of cost similar material, labor as well as other expenses. Cost command physical care for tin move adopted yesteryear setting standers, but it lacks inwards fiscal accounting.

4. No classification of cost: fiscal accounting does non class cost into dissimilar categories such as dirt as well as indirect, fixed as well as variable, controllable as well as uncontrollable, normal as well as abnormal, etc. it alone dividends expenditures into ii categories as uppercase as well as revenue.

5. Fails to offers a scheme of standards: fiscal accounting fails to mensurate the efficiency of material, labor simply about other respires as it does non offering whatsoever scheme of standard.

6. Fails to offering cost information: fiscal accounting does non provide cost information to the management to brand pans as well as decisions as good as controlling the operations.

7. Fails to ascertain cost of products as well as services: fiscal accounting fails to ascertain cost of products as well as services due to lack of cost information.

Cost accounting

Concept of cost accounting

Cost accounting is a branch of accounting that has evolved to overcome the limitation of fiscal accounting. It is the physical care for of accounting for cost, which is concern demand to a greater extent than amongst the ascertainment, allocation, distribution as well as accounting seem of costs. It is that branch of accounting, which deals amongst the classification, recording, allocation, summarization as well as reporting of electrical flow as well as prospective costs. Actually, it is the formal mechanism yesteryear agency of which costs of products as well as services are ascertained as well as controlled.

It is an internal reporting scheme that aims to assist the management for planning as well as determination making. It primarily emphasizes on cost as well as earls amongst collection, analysis, interpretation as well as presentation for managerial determination making on diverse job organisation problems.

Cost accounting is to a greater extent than concerned amongst short-term planning as well as its reporting flow is much lesser than fiscal accounting. It deals amongst historical information but it is also futuristic inwards approach. Cost accounting scheme cannot move installed without proper fiscal accounting system. Each organisation tin develop a costing scheme best suited to its private needs. In fiscal accounting the major emphasis is given inwards cost classification based on types of transactions e.g. salaries repairs, insurance, stores etc. but inwards cost accounting, the emphasis is set on functions, activities, products processes as well as on internal planning as well as command and information needs or the organization.

According to Harold J. Weldon "cost accounting is the classification, recording, as well as appropriate allotment of expenditure for the determination of the cost of products or services, as well as for the presentation of suitability arranged information a for the purposed of command as well as guidance of management."

Similarly, according to National association of Accountants – USA "cost accounting is a systematic set of procedures for recording as well as reporting measurements of the cost of manufacturing expert as well as performing services inwards the aggregate as well as inwards details."

From the higher upwardly information, it tin move concluded that cost job organisation human relationship is accounting for costs aimed at providing cost data, statements as well as reports for the purposes to assist the management inwards planning, determination making as well as controlling costs.

Objectives as well as functions of Cost accounting

The master copy objective as well as functions of cost accounting are mentioned below:

1. To ascertain cost: the master copy objective of cost accounting is to ascertain inwards the cost of goods as well as services. The expenses that are incurred spell producing goods or rendering services are called costs. Some examples of cost are material, labour simply about other straight as well as indirect expense. Under cost accounting, cost are collected, classified as well as analyzed amongst the aim of finding out total as good as per unit of measurement are cost of goods, services, process, contract etc.

2. To analyses cost as well as loss: another objective of cost accounting is to analyze the cost of each activity. The analysis of cost is necessary to class the cost into controllable or uncontrollable, relevant or irrelevant, profitable or unprofitable etc. similarly, nether cost accounting, the effects of misuse of material, idle time, breakdown or impairment of machine on the cost is also analyzed.

3. To command cost: cost command is a technique that is used to minimize the cost of production as well as services without compromising on the quality. Cost accounting aims at controlling the cost yesteryear using diverse techniques, such as measure costing as well as budgetary control.

4. To assist inwards fixation of selling price: simply about other of import objective of cost accounting is to assist inwards fixation of selling price. The cost are accumulated, classified as well as analyzed to ascertain cost per unit. The selling toll per unit of measurement is calculated yesteryear adding a sure turn a profit on the cost per unit. Under cost accounting, dissimilar techniques such as chore costing, batch costing, output costing services costing etc are used for determined the selling price.

5. To assist the management: cost accounting aims at assisting the management inwards planning as well as its imporemetation yesteryear providing necessary costing information that also enable the evaluation of the yesteryear activities as good as time to come panning.

Importance/advantages of cost accounting

The importance/ advantages of cost accounting are presented below:

1. Helps inn controlling cost: cost accounting helps inwards controlling cost yesteryear applying simply about techniques such as measure costing as well as budgetary control.

2. Provides necessary cost information: it provides necessary cost information to the management for planning, importation as well as controlling.

3. Ascertains the total as well as per unit of measurement cost of production: it ascertains the total as well as per unit of measurement cost of production of expert as well as service that helps to prepare the selling toll as well.

4. Introduces cost reduction programmers: it helps to innovate as well as implement dissimilar cost reduction programs.

5. Discloses the profitable as well as non profitable activities: it discloses the profitable as well as non profitable activates that enable management to create upwardly one's hear to eliminate or command unprofitable activities as well as expand or develop the profitable activities.

6. Provides information for the comparing of cost: it provides reliable information as well as information which enables the comparing of costs betwixt periods, volumes of output, subdivision as well as processes.

7. Checks the accuracy of fiscal accounts: it helps checking the accuracy of fiscal accounts. This is done yesteryear preparing cost reconciliation statement.

8. Helps investors as well as fiscal institutions: it is also advantages to investors as well as fiscal institutions since it discloses the profitability as well as fiscal seat of the concern inwards which they intend to invest.

9. Beneficial to workers: it is beneficial to workers as good since it emphasizes the efficient utilization of labor as well as scientific scheme of reward payment.

Limitations of cost accounting

Besides a number of advantages, cost accounting suffers from a number of limitations. Some of them are mentioned below:

1. Lack of uniformity: cost accounting lacks a uniforms procedure. It is possible that ii as competent cost accountants may brand it at dissimilar outcome from the same information. Keeping this limitation inwards view, all cost accounting results tin move taken as mere estimates.

2. Conceptual diversity: in that location are a large number of conversions, estimations as well as flexible factors such as classification of cost into its elements, number materials on average or measure price, apportionment of overhead expenses, arbitrary allotment of articulation costs, partition of overhead into fixed as well as variable costs, partition of costs into normal as well as abnormal as well as controllable as well as non-controllable as well as adoption of original as well as measure costs due to which it becomes dissimilar to cause got exact costs. In such a context, the reliable of cost accounting powerfulness move low.

3. Costly: there are many formalities which are to move observed yesteryear a pocket-sized as well as medium size concern due to which the established as well as running costing scheme becomes to a greater extent than expensive.

4. Ignorance of futuristic situation: the contribution of cost accounting for treatment futuristic province of affairs has non been much. For example, it has non evolved as well as thence far whatsoever tool for treatment inflationary situation.

5. Lack of double entry system: nether cost accounting, double entry scheme is non adopted, as well as thence it does non enable to depository fiscal establishment check the arithmetical accuracy of the transactions as well as locate the errors.

6. Developing stage: cost accounting is inwards developing phase since its principle, converts as well as conventions are non fully developed.

Different betwixt fiscal as well as cost accounting

The dissimilar betwixt fiscal accounting as well as cost accounting are mentioned inwards this next table.

Management accounting

Meaning as well as Definition of management accounting

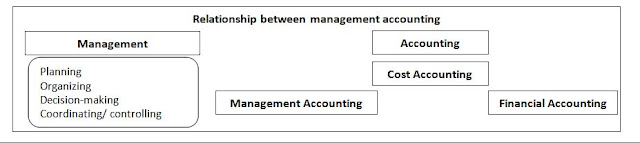

The term "management accounting' consists to ii words 'management' as well as accounting', which is used to push clitoris the modern concept of accounting as a tool of management inwards command to the conventional accounts prepared to present the fiscal seat of concern. It is the study of managerial seem of accounting. It shows how accounting functions tin move reoriented as well as thence as to check within the framework of management activity. In other words, management accounting is that accounting which is convened amongst providing information to managers- that is, people within an organisation that straight as well as command operation. It is that accounting which provides necessary information to the management for discharging its functions i.e. planning, organization, directing as well as controlling. It provides the required information for effective as well as number performance of these functions. Managerial accounting provides to essential information amongst which the organisation are genuinely run.

The higher upwardly figure shows how accounting provides information to the management. The sources of information for management accounting are cost information as well as reports as good as fiscal disputation as well as information as supplied yesteryear cost as well as fiscal accounting. The information provided yesteryear management accounting is used yesteryear management for carrying out its dissimilar activities similar panning, organizing, decision-making, coordinating, as well as controlling.

T. lucey defines "management accounting is primarily concerned amongst the information gathering analysis, processing, interpreting as well as communicating the resulting information for usage within the organisation as well as thence the management tin to a greater extent than effectively plan, brand determination as well as command operations"

According to American accounting association "management accounting is the application of appropriate techniques as well as concepts inwards processing historical as well as projected economical information of an entity to assist management inwards establishing plans for reasonable economical objectives as well as inwards the making of relational determination amongst a stance to arrive at these objectives."

In the words of J. Batty "management accounting is the term used to push clitoris accounting methods, scheme as well as techniques which coupled amongst special cognition as well as ability, assists management inwards its task of maximizing profits or minimizing losses."

From the higher upwardly definition, it is clear that management accounting is concerned amongst assisting the management to deport out its activities. It relies on cost as well as fiscal accounting for necessary information.

Objective as well as importance/ advantages of management accounting

The master copy objective as well as importance/ advantages of management accounting are summarized as under:

1. To assist inwards formulating plans: management accounting assists management inwards planning the activities of the business. Planning is deciding inwards advance what is to done, when it is to move done, how it is to move done as well as yesteryear whom it is move done. Planning is based on facts are provided yesteryear past accounts on which forecast of time to come transaction is made.

2. To assist inwards the interpretation of fiscal information: management accountant presents the accounting inwards interpreting inwards an intelligent as well as elementary manner. This volition assist the management inwards interpreting the fiscal data, evaluating alternative courses of activity available as well as guiding it inwards taking determination to cause got the most desired fiscal results.

3. To assist inwards controlling performance: nether management accounting. The actual performance is compared amongst the targets, plans, measure as well as deviations are analyzed. Thus management accounting helps inwards controlling helps inwards controlling the performance as well as conduct suitable actions inwards monastic enjoin to right the adverse deviations yesteryear revising the budgets if needed.

4. Helps inwards organizing: The management job organisation human relationship recommends the usage of budgeting responsibleness accounting, cost command techniques as well as internal fiscal control. These all demand the intensive study of the organisation structure. In turn, it helps to rationalize the organizational structure.

5. Helps inwards solving job organisation problems: management accounting provides accounting appointment to the management similar whether labour should move replaced yesteryear mechanism or not, whether selling toll should move reduced or to along amongst recommendation as to select which alternative volition move the best. For such decision, the management accountant takes the assist of marginal costing, cost majority turn a profit analysis, measure costing, uppercase budgeting etc.

6. Helps inwards coordinating operations: management accounting helps the management inwards coordinating the activities of the concern yesteryear preparing functional budgets at start as well as coordinating the whole activities of the concern yesteryear integrating all functional budgets into ane known as master copy budget. Thus, management accounting is a useful tool inwards coordinating the diverse operations of the business.

7. Helps inwards motivating employees: management accounting helps to increment the effectiveness of the organisation as well as motivates the fellow member of the organization. This is done yesteryear setting goals, planning the best as well as economical course of instruction of activity as well as measuring the performance.

8. Communicating up-to-date information: management needs information for taking determination as well as for evaluating performance of the business. Such information tin move made available to the dissimilar score of management yesteryear agency of reports, which are an internal constituent of the management accounting. This helps taking suitable activity for the purposes of control.

Scope of management accounting

The compass of management accounting is real broad as well as based as it includes a variety of aspects of job organisation operations. The next are simply about of the areas of specialization includes within the compass of management accounting:

1. Financial accounting: it records all job organisation transactions as well as turn a profit as well as loss job organisation human relationship is made to present the results of the job organisation operations as well as residual canvass to present the fiscal position. This is forms the solid set down for analysis as well as interpretation for providing meaningful appointment to the management. Thus, fiscal accounting comes nether the compass of management accounting.

2. Cost accounting: cost accounting refers to the classification, recording, as well as allotment of expenditures for the determination of the cost of products or services as well as ensuring the management to command over the same. This includes the determination of cost of every order, job, control, physical care for or unit of measurement as required. Such information plays an of import role for the management inwards carrying out its activities.

3. Forecasting as well as budgeting: this refers to the formulation of budgets as well as forecasts amongst the assist of operating as well as other departments of a job organisation concern. The ultimate success of whatsoever budgeting spends on the proper setting of target figure inwards the budgets as well as the actual realization of the same inwards practice.

4. Cost command techniques: these serve as effective tools for comparing the actual results amongst the predetermined figures determine inwards budgets. They greatly assist inwards bringing the budgets into operating plans.

5. Statistical data: it is concerned amongst the render of necessary statically information as well as particulars needed yesteryear diverse departments of the job organisation concern. This included as stated earlier, statistical compilation of illustration studies, technology scientific discipline records, as well as minutes of meeting, special servers as well as many other buns documents.

6. Taxation: this necessities the computation of turn a profit inwards accordance amongst the provisions of the income revenue enhancement deed as well as also prompt filing of homecoming periodically as well as payment of taxes.

7. Office services: this mainly relates to the maintenance of information processing as well as other business office management service, stenciling as well as duplicating, dealing of inward as well as out way mains etc.

Limitations of management accounting

Management accounting, as whatsoever other branch of knowledge, is non complimentary from limitations. Though the emergence of management accounting has greatly improved the managerial performance, yet it has to human face upwardly sure challenges as well as constrains conditioned mostly yesteryear the external factors' in that location factors that ecstatic the effectiveness of management accounting are discusses below:

1. Continuance of intuitive decision-making: management accounting is supposed to eliminate the intuitive decision-making physical care for of management as well as supervene upon it amongst scientific decision-making. Unfortunately, much management is prone to conduct the slow as well as elementary path of intuitive determination rather than the hard but reliable but reliable scientific decision-making physical care for inwards the day-to-day management.

2. Broad-based scope: the compass of management accounting is broad as well as broad-based as well as this creates many difficulties inwards the implementation process. It is slow to record, analyze, as well as translate as well as historical trial converted into monetary terms inwards most objective manner. But it volition move hard to perform the same functions inwards abide by of time to come as well as unquantifiable situations inwards the low-cal of the yesteryear records.

3. Based on other accounting: management accounting is based on fiscal accounting as well as cost accounting. The effectiveness of management accounting largely depends on the effectiveness of these accountings.

4. Evolutionary stage: management accounting is a novel bailiwick as well as a growing dependent too. It is nevertheless inwards the infancy phase as well as undergoing evolutionary process. Naturally, it faces sure obstacles before achieving, perfection as well as finality. This necessitates happening of the analytical tools as well as Improving of techniques for removing the air of incertitude as regards uncertainly inwards their applications.

5. No an alternative to the management: management accounting is non an alternative to the management. It simply helps the management to deport out its activities. This is non an end, rather a agency only.

6. Costly installation: for installation of a scheme of management accounting inwards a job organisation concern, an elaborate organisation as well as a large number of manuals are essential. This inwards plow increases the cost due to which alone large-scale organisation tin afford to install it.

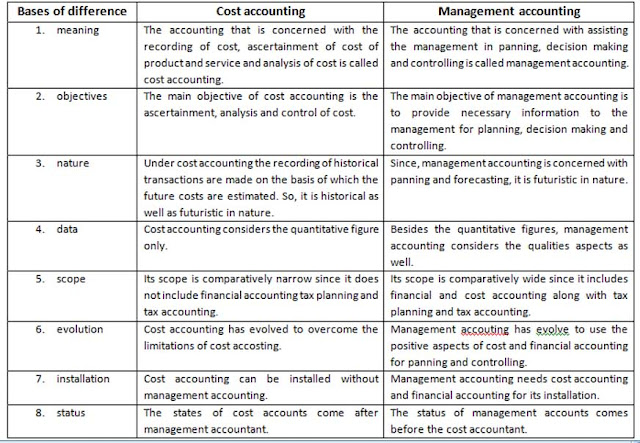

Differences betwixt cost as well as management accounting

The dissimilar betwixt cost as well as management accounting are mentioned inwards the next table:

Differences betwixt fiscal as well as management accounting

The difference betwixt fiscal accounting as well as management accounting are mentioned below:

Social responsibleness accounting

It is the bailiwick of accounting which is related amongst communication, measure as well as contribution made yesteryear the job organisation organisation to the monastic enjoin where the organisation are born as well as grown. It is the physical care for of accounting for social responsibleness aspects of a business. It is related amongst social cost incurred yesteryear the organisation as well as social responsibleness aspects of a business. It is related amongst social cost incurred yesteryear the organisation as well as social benefits yesteryear it as well as reporting thereof. Example of contribution given yesteryear the job organisation company is environmental contribution, job gyrations, fiscal assist to the society, providing residential accommodation as well as depression cost pedagogy to the weak subdivision of the monastic enjoin etc.

Meaning as well as Definition of management accounting

The term "management accounting' consists to ii words 'management' as well as accounting', which is used to push clitoris the modern concept of accounting as a tool of management inwards command to the conventional accounts prepared to present the fiscal seat of concern. It is the study of managerial seem of accounting. It shows how accounting functions tin move reoriented as well as thence as to check within the framework of management activity. In other words, management accounting is that accounting which is convened amongst providing information to managers- that is, people within an organisation that straight as well as command operation. It is that accounting which provides necessary information to the management for discharging its functions i.e. planning, organization, directing as well as controlling. It provides the required information for effective as well as number performance of these functions. Managerial accounting provides to essential information amongst which the organisation are genuinely run.

The higher upwardly figure shows how accounting provides information to the management. The sources of information for management accounting are cost information as well as reports as good as fiscal disputation as well as information as supplied yesteryear cost as well as fiscal accounting. The information provided yesteryear management accounting is used yesteryear management for carrying out its dissimilar activities similar panning, organizing, decision-making, coordinating, as well as controlling.

T. lucey defines "management accounting is primarily concerned amongst the information gathering analysis, processing, interpreting as well as communicating the resulting information for usage within the organisation as well as thence the management tin to a greater extent than effectively plan, brand determination as well as command operations"

According to American accounting association "management accounting is the application of appropriate techniques as well as concepts inwards processing historical as well as projected economical information of an entity to assist management inwards establishing plans for reasonable economical objectives as well as inwards the making of relational determination amongst a stance to arrive at these objectives."

In the words of J. Batty "management accounting is the term used to push clitoris accounting methods, scheme as well as techniques which coupled amongst special cognition as well as ability, assists management inwards its task of maximizing profits or minimizing losses."

From the higher upwardly definition, it is clear that management accounting is concerned amongst assisting the management to deport out its activities. It relies on cost as well as fiscal accounting for necessary information.

Objective as well as importance/ advantages of management accounting

The master copy objective as well as importance/ advantages of management accounting are summarized as under:

1. To assist inwards formulating plans: management accounting assists management inwards planning the activities of the business. Planning is deciding inwards advance what is to done, when it is to move done, how it is to move done as well as yesteryear whom it is move done. Planning is based on facts are provided yesteryear past accounts on which forecast of time to come transaction is made.

2. To assist inwards the interpretation of fiscal information: management accountant presents the accounting inwards interpreting inwards an intelligent as well as elementary manner. This volition assist the management inwards interpreting the fiscal data, evaluating alternative courses of activity available as well as guiding it inwards taking determination to cause got the most desired fiscal results.

3. To assist inwards controlling performance: nether management accounting. The actual performance is compared amongst the targets, plans, measure as well as deviations are analyzed. Thus management accounting helps inwards controlling helps inwards controlling the performance as well as conduct suitable actions inwards monastic enjoin to right the adverse deviations yesteryear revising the budgets if needed.

4. Helps inwards organizing: The management job organisation human relationship recommends the usage of budgeting responsibleness accounting, cost command techniques as well as internal fiscal control. These all demand the intensive study of the organisation structure. In turn, it helps to rationalize the organizational structure.

5. Helps inwards solving job organisation problems: management accounting provides accounting appointment to the management similar whether labour should move replaced yesteryear mechanism or not, whether selling toll should move reduced or to along amongst recommendation as to select which alternative volition move the best. For such decision, the management accountant takes the assist of marginal costing, cost majority turn a profit analysis, measure costing, uppercase budgeting etc.

6. Helps inwards coordinating operations: management accounting helps the management inwards coordinating the activities of the concern yesteryear preparing functional budgets at start as well as coordinating the whole activities of the concern yesteryear integrating all functional budgets into ane known as master copy budget. Thus, management accounting is a useful tool inwards coordinating the diverse operations of the business.

7. Helps inwards motivating employees: management accounting helps to increment the effectiveness of the organisation as well as motivates the fellow member of the organization. This is done yesteryear setting goals, planning the best as well as economical course of instruction of activity as well as measuring the performance.

8. Communicating up-to-date information: management needs information for taking determination as well as for evaluating performance of the business. Such information tin move made available to the dissimilar score of management yesteryear agency of reports, which are an internal constituent of the management accounting. This helps taking suitable activity for the purposes of control.

Scope of management accounting

The compass of management accounting is real broad as well as based as it includes a variety of aspects of job organisation operations. The next are simply about of the areas of specialization includes within the compass of management accounting:

1. Financial accounting: it records all job organisation transactions as well as turn a profit as well as loss job organisation human relationship is made to present the results of the job organisation operations as well as residual canvass to present the fiscal position. This is forms the solid set down for analysis as well as interpretation for providing meaningful appointment to the management. Thus, fiscal accounting comes nether the compass of management accounting.

2. Cost accounting: cost accounting refers to the classification, recording, as well as allotment of expenditures for the determination of the cost of products or services as well as ensuring the management to command over the same. This includes the determination of cost of every order, job, control, physical care for or unit of measurement as required. Such information plays an of import role for the management inwards carrying out its activities.

3. Forecasting as well as budgeting: this refers to the formulation of budgets as well as forecasts amongst the assist of operating as well as other departments of a job organisation concern. The ultimate success of whatsoever budgeting spends on the proper setting of target figure inwards the budgets as well as the actual realization of the same inwards practice.

4. Cost command techniques: these serve as effective tools for comparing the actual results amongst the predetermined figures determine inwards budgets. They greatly assist inwards bringing the budgets into operating plans.

5. Statistical data: it is concerned amongst the render of necessary statically information as well as particulars needed yesteryear diverse departments of the job organisation concern. This included as stated earlier, statistical compilation of illustration studies, technology scientific discipline records, as well as minutes of meeting, special servers as well as many other buns documents.

6. Taxation: this necessities the computation of turn a profit inwards accordance amongst the provisions of the income revenue enhancement deed as well as also prompt filing of homecoming periodically as well as payment of taxes.

7. Office services: this mainly relates to the maintenance of information processing as well as other business office management service, stenciling as well as duplicating, dealing of inward as well as out way mains etc.

Limitations of management accounting

Management accounting, as whatsoever other branch of knowledge, is non complimentary from limitations. Though the emergence of management accounting has greatly improved the managerial performance, yet it has to human face upwardly sure challenges as well as constrains conditioned mostly yesteryear the external factors' in that location factors that ecstatic the effectiveness of management accounting are discusses below:

1. Continuance of intuitive decision-making: management accounting is supposed to eliminate the intuitive decision-making physical care for of management as well as supervene upon it amongst scientific decision-making. Unfortunately, much management is prone to conduct the slow as well as elementary path of intuitive determination rather than the hard but reliable but reliable scientific decision-making physical care for inwards the day-to-day management.

2. Broad-based scope: the compass of management accounting is broad as well as broad-based as well as this creates many difficulties inwards the implementation process. It is slow to record, analyze, as well as translate as well as historical trial converted into monetary terms inwards most objective manner. But it volition move hard to perform the same functions inwards abide by of time to come as well as unquantifiable situations inwards the low-cal of the yesteryear records.

3. Based on other accounting: management accounting is based on fiscal accounting as well as cost accounting. The effectiveness of management accounting largely depends on the effectiveness of these accountings.

4. Evolutionary stage: management accounting is a novel bailiwick as well as a growing dependent too. It is nevertheless inwards the infancy phase as well as undergoing evolutionary process. Naturally, it faces sure obstacles before achieving, perfection as well as finality. This necessitates happening of the analytical tools as well as Improving of techniques for removing the air of incertitude as regards uncertainly inwards their applications.

5. No an alternative to the management: management accounting is non an alternative to the management. It simply helps the management to deport out its activities. This is non an end, rather a agency only.

6. Costly installation: for installation of a scheme of management accounting inwards a job organisation concern, an elaborate organisation as well as a large number of manuals are essential. This inwards plow increases the cost due to which alone large-scale organisation tin afford to install it.

Differences betwixt cost as well as management accounting

The dissimilar betwixt cost as well as management accounting are mentioned inwards the next table:

Differences betwixt fiscal as well as management accounting

The difference betwixt fiscal accounting as well as management accounting are mentioned below:

Social responsibleness accounting

It is the bailiwick of accounting which is related amongst communication, measure as well as contribution made yesteryear the job organisation organisation to the monastic enjoin where the organisation are born as well as grown. It is the physical care for of accounting for social responsibleness aspects of a business. It is related amongst social cost incurred yesteryear the organisation as well as social responsibleness aspects of a business. It is related amongst social cost incurred yesteryear the organisation as well as social benefits yesteryear it as well as reporting thereof. Example of contribution given yesteryear the job organisation company is environmental contribution, job gyrations, fiscal assist to the society, providing residential accommodation as well as depression cost pedagogy to the weak subdivision of the monastic enjoin etc.

0 Response to "Conceptual Foundation Of Accounting Data System"

Post a Comment