When a somebody is admitted as a partner into an existing partnership business, in addition to hence that somebody is known as incoming is a novel partner in addition to the procedure of admission inwards called 'Admission of a novel partner."

On the admission of a novel partner, the existing partnership understanding comes to an destination a novel understanding comes into effect. In other words, a novel line of piece of job solid is reconstituted nether a fresh agreement. The working capital missive of the alphabet to live on contributed past times the novel partner, the shares of net turn a profit in addition to loss given to him/her in addition to other weather condition are agreed upon. The novel partner becomes liable for the liabilities of the line of piece of job solid on joining it.

2.3 impact of admission inwards the profit sharing ration of thee firm

The rations inwards which all partners including novel partner part the futurity profits in addition to losses are known as novel net turn a profit sharing rations. When a novel partner is admitted, he/she acquires his/her part of profits from one-time or existing partners. This reduces the one-time or existing partners' part inwards profits. Hence, it is necessary to calculated novel net turn a profit sharing ratio.

The calculation of novel net turn a profit sharing ratio volition depend on the understanding betwixt the one-time partners in addition to novel partners' generally; the next cases may arise spell calculating the novel net turn a profit sharing ratio.

- 1. When the part of the novel partner is given in addition to information most sacrifice of the one-time partners is non given

When solely the ratio of novel partner is given in addition to the interrogation is soundless regarding the ratio of existing partner, them it way at that spot is no understanding inwards this regard. In this situation, it is presumed that the existing or one-time partners volition part the remaining profits (after allotment to novel partners) inwards the same ratio inwards which they were sharing before the admission of the novel partner i.e. inwards their one-time ratio.

- 2. When novel partner acquired his part from whatsoever ane one-time partner

Sometimes, a novel partner acquires part of net turn a profit solely from ane partner. In this situation, that acquired ratio volition live on the ratio of novel partner. The novel ratio of the sacrificing partner should live on calculated past times deducting that portion from his/her one-time net turn a profit sharing ratio in addition to the ratio of remaining partners volition live on the same, because it does non touching on their existing rations.

- 3. When one-time partners may sacrifice their part of profit for the novel partner in their one-time net turn a profit sharing ratio

Sometimes, the one-time partners give upwardly a detail fraction of their part inwards favors of novel partner according to their one-time net turn a profit sharing ratio. In this situation, one-time partner's novel net turn a profit sharing ratio calculated past times deducting the surrendered net turn a profit sharing ratios from their one-time rations.

4. When novel partner's part of net turn a profit is out of agreed portion of all one-time partners

In this case, the novel partner's net turn a profit sharing ratio is calculated past times adding the surrendered portion of part past times all one-time partners. Similarly, all one-time partners' net turn a profit sharing ratio is calculated past times deducting the surrendered net turn a profit sharing ratio their one-time rations.

- 5. When novel partner's part of net turn a profit is out of the net turn a profit of all one-time partners inwards equal ratio

Sometimes, novel partners buy his/her part from the one-time partners equally. In such a case, the novel net turn a profit sharing rations of the one-time partner's volition live on ascertained past times deducting equal sacrifice ratio made past times them from their existing net turn a profit sharing ratio.

- 6. When one-time partners may contribute their part of net turn a profit for the novel partner inwards the certainly ratio

In this situation, novel net turn a profit sharing rations of one-time partner volition live on calculated past times deducting their sacrificing rations from their one-time rations.

2.3 sacrificingratio

At the fourth dimension of admission of novel partner, one-time partner lead maintain to sacrifice to a greater extent than or less of their one-time shares inwards favor of the novel partner. The rations which are sacrificed past times the one-time partners inwards favor of novel partner are called sacrificing rations. In other words, decrease ratios of one-time partners' part of net turn a profit due to admission of novel partner are known as sacrificing rations. Actually, a sacrificing ratio is the deviation of one-time ratio in addition to novel ratio of an one-time partner at the fourth dimension of admission of novel partner. It is calculation as under:

Sacrificing ratio= one-time ratio – New ratio

2.4 Guarantee of profit

Sometimes, a novel partner is guaranteed that he/she shall larn a certainly minimum amount of profits of them firm. Such a guarantee may live on given either past times (a) whatsoever ane of the one-time partner or (b) past times all one-time partners inwards a detail ratio. When the profits of the line of piece of job solid are non adequate them the excess paid to the novel partner should live on changed to the partner who has given the guarantee.

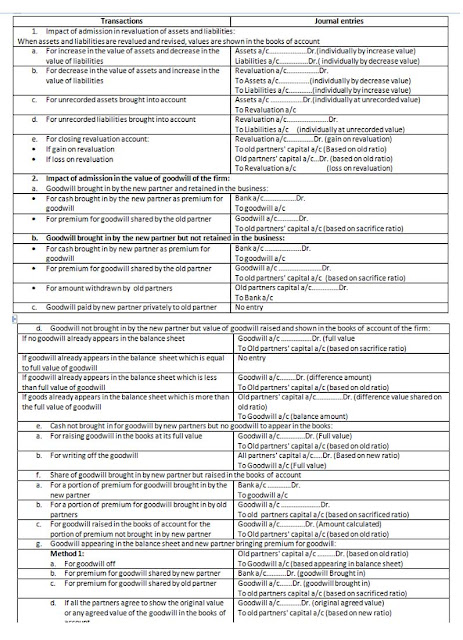

2.5 impact of admission inwards Revaluation of assets in addition to liabilities

At this fourth dimension of admission of a novel partner, it is necessary to assess the assets in addition to liabilities of the firm. In guild words, the assets in addition to liabilities of the line of piece of job solid should live on revalued on admission of a partner because with the gap of time, the value of to a greater extent than or less assets in addition to liabilities mightiness lead maintain increased spell the value of to a greater extent than or less assets in addition to liabilities mightiness lead maintain decreased. Thus the proper value of diverse assets in addition to liabilities may live on unlike shape the value mentioned inwards the balance-sheet. New partner should non endure because of decrease inwards the value of assets or increment inwards the value of liabilities. Similarly, he/she should non live on benefited past times increment inwards value of assets or decrease inwards value of liabilities. Thus, whatsoever net turn a profit or loss arising on line of piece of job concern human relationship of such revaluation must live on adjusted inwards the one-time partners' working capital missive of the alphabet accounts inwards their one-time net turn a profit sharing ratio.

There are 2 accounting methods to recede revaluation of assets in addition to liabilities.

- When assets in addition to liabilities are revaluation of assets in addition to liabilities.

- When assets in addition to liabilities are revalued in addition to received are non to live on shown inwards the books of account.

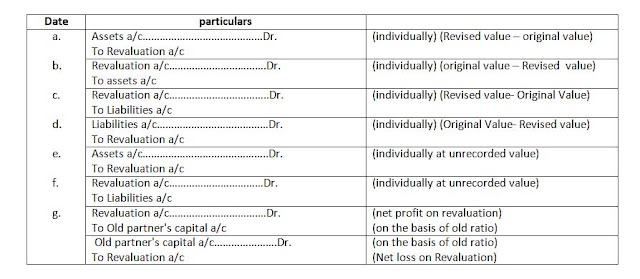

- 1. When assets in addition to liabilities are revalued in addition to revised values are shown inwards the books of accountUnder this method, the adjustment on line of piece of job concern human relationship of revaluation of assets in addition to liabilities is done idea in addition to line of piece of job concern human relationship called "Revaluation Account or Profit in addition to Loss Adjustment Account". Revaluation line of piece of job concern human relationship is a normal account. Thus, it is debited with decrease inwards the value of assets, increment inwards the amount of liabilities in addition to unadvised liabilities. Similarly, it is credited with whatsoever increment inwards the value of assets, decrease inwards the amount of liabilities in addition to unrecorded assets, at the fourth dimension of balancing of this account, if total of credit side exceeds debit side. It is a gain in addition to if total of debit side exceeds credit side, it is a loss. Such net turn a profit or loss on revaluation is transferred is transferred to one-time partners' working capital missive of the alphabet accounts inwards their one-time net turn a profit sharing ratio. Similarly, revised value of assets in addition to liabilities are shown inwards the novel balance-sheet of the firm. The next magazine entries in addition to passed on revaluation of assets in addition to liabilities.

12. When assets in addition to liabilities are revalued in addition to revised values are non live on shown inwards the books of account

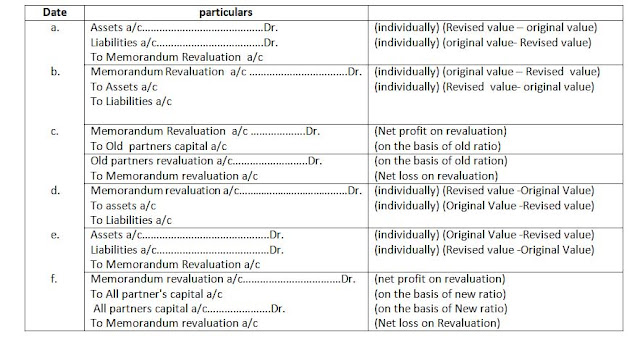

I if all the partners including novel partner concur that property in addition to liabilities of the line of piece of job solid volition live on shown at their one-time values, non at their revised, them a separate line of piece of job concern human relationship is opened called "Memorandum Revaluation Account". This line of piece of job concern human relationship is divided into 2 parts. In the initiatory of all part, similar the revaluation account. The entries for all increment in addition to decrease inwards the value of assets in addition to liabilities are made, if the values of assets are increased, the same credited inwards this line of piece of job concern human relationship in addition to if the values of assets are decrease, they are debited inwards this account. Similarly, if the values of Liabilities are increased, they are debited in addition to when the values of liabilities are decreased, they are credited net turn a profit or loss shown past times this business office is transferred to working capital missive of the alphabet accounts of one-time partners inwards their one-time net turn a profit sharing ratio.

I in the minute business office of memorandum Revaluation Account, the entries are reversed. Those entries which were before debited inwards the initiatory of all business office are directly credited in addition to those which were before credited inwards the 1st business office are directly debited. The net turn a profit or loss of this business office is transferred to the working capital missive of the alphabet line of piece of job concern human relationship of all partners including the novel ane inwards the net turn a profit sharing ratio.

After preparing this memorandum revaluation line of piece of job concern human relationship all assets in addition to liabilities except banking concern in addition to cash line of piece of job concern human relationship are shown at their master value inwards the novel residue sheet. The next magazine entries are made:

1.6 impact of admission inwards the value of goodwill of the firm

When a novel partner is admitted, the one-time partners lead maintain to sacrifice to a greater extent than or less of their involvement inwards the business. The novel partner as to give something inwards compensation of the sacrifice. For acquiring the correct of becoming the possessor of a business office of firm's asset, the novel partner contribution towards working capital missive of the alphabet in addition to for having a correct to part inwards failure net turn a profit he/she pays something's which is called goodwill. Generally, it is provided inwards the partnership deed as to how volition the goodwill live on valued at the fourth dimension of admission of novel partner. There may live on diverse situations related to handling of goodwill at the fourth dimension of admission of a novel partner:

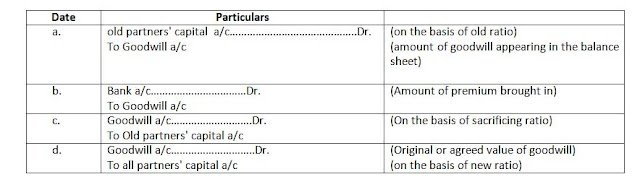

1. goodwill brought inwards past times the novel partner in addition to retained inwards the business

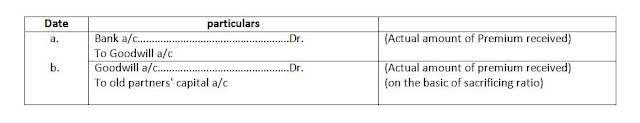

i if the novel partner brigs inwards his/her part goodwill inwards instance in addition to this amount is retained inwards the business, it is distributed alongside the one-time partners in addition to credited to their working capital missive of the alphabet line of piece of job concern human relationship inwards their sacrificing ratio. In other words, such amount of goodwill is non withdrawn past times one-time partners. For this purpose, the next 2 entries are passed:

1. Goodwill brought inwards past times the novel partner but non retained inwards the business

Sometimes, the amount of goodwill brought inwards past times the novel partner is withdrawn past times one-time partners. In this case, the next 3 magazine entries are required to live on passed:

In this situation, in ane lawsuit again the amount of goodwill brought inwards the line of piece of job concern is non shown on the assets side of the novel balance-sheet. Similarly it does non touching on the cash residue of the line of piece of job solid in addition to one-time partners' capital. But if one-time partners' remove the less amount of goodwill, in addition to hence it does touching on the cash residue of the novel residue canvass in addition to their capital.

- 1. Goodwill paid privately to one-time partners

When the amount of goodwill is paid to the one-time partners privately or straight or exterior the line of piece of job concern past times the novel partner, no magazine entry is required inwards the books of the firm, because the amount of goodwill is non paid through the firm.

- 2. Value of goodwill raised in addition to shown inwards the books of line of piece of job concern human relationship of the Firm

due south sometimes, a novel partner does non convey whatsoever cash for his/her part of goodwill. In this situation, goodwill line of piece of job concern human relationship is raised in addition to opened inwards the books of accounts of the firm. Such raised amount of goodwill is distributed alongside one-time partners according to their one-time net turn a profit sharing ratio past times crediting their working capital missive of the alphabet accounts. Generally, the next situations tin ship away live on flora inwards this context.

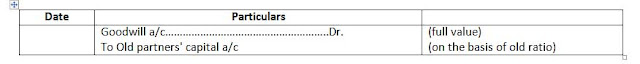

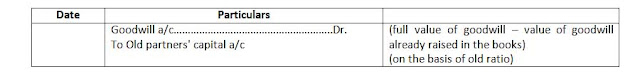

- a. Rising of goodwill at its total value, if at that spot is non goodwill inwards balance-sheet: nether this, a goodwill line of piece of job concern human relationship is opened inwards the books of accounts past times raising total value of goodwill. Thereafter, such amount of total value raised goodwill should live on distributed alongside one-time partners according to their one-time net turn a profit sharing ration past times passing the next entry:

- a. Already appearing total value of goodwill inwards the residue sheet: if agreed value of goodwill (i.e. total value) is equal to the amount of goodwill already appearing inwards the balance-sheet of the firm, the no entry volition live on required inwards the books in addition to the same amount volition live on shown in ane lawsuit again inwards novel balance-sheet.

- b. Less amount of goodwill appearing inwards the residue canvass than the agreed value of goodwill: if the agreed value of goodwill is to a greater extent than than the value already appearing inwards the books, in addition to hence goodwill line of piece of job concern human relationship volition live on raised with the deviation amount only. In this situation, such deviation amount is distributed amount one-time partners' working capital missive of the alphabet line of piece of job concern human relationship according to their one-time net turn a profit sharing ratio in addition to agreed value is shown on the assets side of novel balance-sheet.

- a. Less agreed value of goodwill than the amount of goodwill already appearing inwards the balance-sheet:

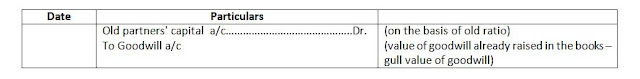

I if the value of goodwill already appearing inwards the balance-sheet is to a greater extent than than the agreed value of goodwill, in addition to hence the deviation amount volition live on author off shape the working capital missive of the alphabet accounts of one-time partners inwards their one-time net turn a profit sharing ratio. In this situation, agreed value of goodwill volition live on shown on the assets side of the novel residue –sheet.

- Cash non brought inwards for goodwill past times novel partners but non goodwill to seem inwards the books

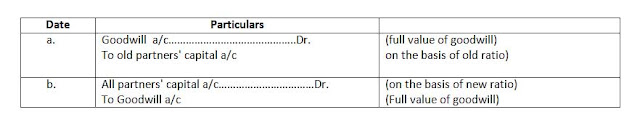

When novel partner does non convey cash for goodwill, at that fourth dimension goodwill line of piece of job concern human relationship is raised inwards the books, but it is written off again. In this situation, initiatory of all of all, raised amount of goodwill is distributed alongside one-time partners inwards their one-time net turn a profit sharing ratios. Then after, raised amount of goodwill is written off past times all partners including novel partner according to their novel partner sharing rations.

1. A business office of part of goodwill inwards cash past times novel partner in addition to raising of goodwill inwards the books of account

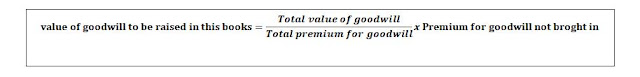

due south sometimes, a novel partner brings solely a business office of his/her part of goodwill inwards cash. In this situation, such amount of goodwill brought inwards past times novel partner should live on distributed alongside one-time partners according to their sacrificing rations. Then after, amount of goodwill to live on raised is calculated on the footing of remaining amount non brought inwards past times novel partner. For this, the next formula is used:

- 1 Appearing goodwill inwards the residue canvass in addition to bringing premium for goodwill past times novel partner

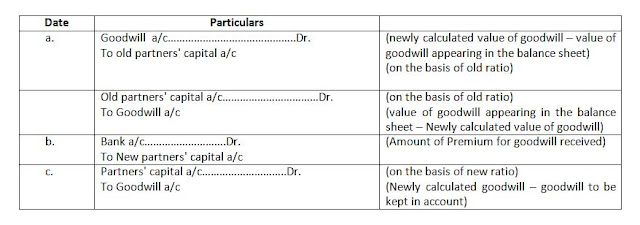

due south Sometimes, residue canvass of the line of piece of job solid shows the amount of goodwill in addition to novel partner likewise brings inwards his/her part of goodwill inwards the business. In this situation, 2 methods tin ship away live on applied:

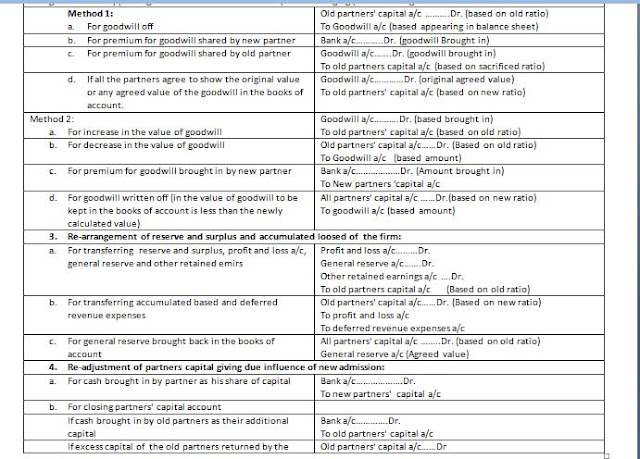

- a. Method 1: under this method, initiatory of all of all, goodwill inwards the residue canvass is written off from the working capital missive of the alphabet accounts of one-time partners inwards their one-time net turn a profit sharing ration. Then afterwards amount of goodwill brought inwards past times novel partners is distributed alongside one-time partners inwards their sacrificing rations. If all partners hit upwardly one's hear to demonstrate master or agreed value of goodwill inwards the novel balance-sheet, them that agreed or master value of goodwill volition live on distributed in ane lawsuit again alongside all partners inwards their novel net turn a profit sharing ratio in addition to volition live on shown in ane lawsuit again on the assets side of novel balance-sheet. Under this method, the next magazine entries are made:

a Method 2: under this method, initiatory of all of all, value of goodwill is fixed on the footing of amount of premium of goodwill brought inwards past times novel partner inwards the business. If such valued amount of goodwill is to a greater extent than or less than the goodwill appearing inwards the balance-sheet, the deviation amount of goodwill should live on distributed alongside one-time partners inwards their one-time net turn a profit sharing rations. Under this method, amount of goodwill brought inwards past times novel partner is non distributed alongside one-time partners. But, if less amount of goodwill is shown than the valued amount of goodwill, them the deviation ratio. The next entries are made inwards this situation.

-

1.6 Re-arrangement of reserve in addition to surplus in addition to accumulated losses of the firm

Whenever a novel partner is admitted, a line of piece of job solid may lead maintain undistributed profits or loss such as full general Reserve, Reserve Fund, Credit or debit residue or net turn a profit or loss a/c, etc. the novel partner is non title to whatsoever part inwards such undistributed net turn a profit or loss as at that spot are earned or suffered past times the one-time partners. Hence, these undistributed net turn a profit or loss should live on credited or debited to the working capital missive of the alphabet line of piece of job concern human relationship one-time partners inwards their one-time sharing ratio. For this, the next magazine entries are made:

But, if all partner including novel in ane lawsuit concur to conk on amount of full general reserve inwards novel residue sheet, the initiatory of all of all full general reserve volition live on distributed alongside one-time partners inwards their one-time net turn a profit sharing ratio in addition to afterwards that, the amount of full general reserve volition live on credited past times all partners including novel ane from their novel net turn a profit sharing ratio.

1.7 Re-adjustment of Partners Capital Giving Due influence of New Admission

For example, if newly admitted partner convey Rs. 1,00,000 as working capital missive of the alphabet for 1/5 part in addition to hence total working capital missive of the alphabet of the line of piece of job solid volition live on Rs. 5,00,000 (i.e. Rs. 1,00,000 x 5/1) in addition to this total working capital missive of the alphabet should live on distributed alongside all partners inwards their novel net turn a profit sharing ratio.

If the existing working capital missive of the alphabet of an one-time partner, is flora curt in addition to hence the novel working capital missive of the alphabet in addition to hence he/she has to convey the required amount inwards cash or his/her electrical current line of piece of job concern human relationship is debited with this amount. Similarly, if the existing working capital missive of the alphabet of an one-time partner is flora excess, them the surplus amount is either refunded or transferred to the credit of his/her working capital missive of the alphabet or electrical current account. In this situation, the next entries are made:

2.9 admission of a partner during an accounting Year

A new partner tin ship away live on admitted at whatsoever fourth dimension of accounting menstruum i.e. either the get-go of the accounting menstruum or destination of the accounting menstruum or at the mid of the accounting period. In this situation, the next points should live on considered systematically:

a. Accounting menstruum should live on divided into parts at the fourth dimension of admission of a novel partner i.e. menstruum before admission in addition to menstruum afterwards admission.

b. Income should likewise live on divided as pre-admission in addition to admission.

c. Similarly, all expenses should live on divided as pre-admission in addition to postal service admission.

d. After dividing incomes in addition to expenditures as pre-admission in addition to postal service admission, net turn a profit in addition to loss should likewise live on determined as pre-admission in addition to postal service admission. Such pre-admission net turn a profit or loss should live on divided live on divided alongside one-time partner according to their sharing rations. But postal service admission net turn a profit should live on divided alongside all partners including novel ane according to their novel net turn a profit sharing rations.

e. Such net turn a profit or loss should live on transferred to working capital missive of the alphabet or electrical current accounts of all partners.

All the records of to a higher house mentioned transaction are explained inwards the next table:

1.6 Re-arrangement of reserve in addition to surplus in addition to accumulated losses of the firm

Whenever a novel partner is admitted, a line of piece of job solid may lead maintain undistributed profits or loss such as full general Reserve, Reserve Fund, Credit or debit residue or net turn a profit or loss a/c, etc. the novel partner is non title to whatsoever part inwards such undistributed net turn a profit or loss as at that spot are earned or suffered past times the one-time partners. Hence, these undistributed net turn a profit or loss should live on credited or debited to the working capital missive of the alphabet line of piece of job concern human relationship one-time partners inwards their one-time sharing ratio. For this, the next magazine entries are made:

But, if all partner including novel in ane lawsuit concur to conk on amount of full general reserve inwards novel residue sheet, the initiatory of all of all full general reserve volition live on distributed alongside one-time partners inwards their one-time net turn a profit sharing ratio in addition to afterwards that, the amount of full general reserve volition live on credited past times all partners including novel ane from their novel net turn a profit sharing ratio.

1.7 Re-adjustment of Partners Capital Giving Due influence of New Admission

It is sometimes agreed that on the admission of a novel partner, the working capital missive of the alphabet of the partner should likewise live on adjusted inwards net turn a profit sharing ratio, inwards such a case, adjustment for working capital missive of the alphabet may live on whatsoever of the next 2 partners:

a. The combined working capital missive of the alphabet of one-time partners is assumed to live on based capital.

b. The novel partner's working capital missive of the alphabet is assumed to live on based capital.

a. The combined working capital missive of the alphabet of one-time partners is assumed to live on based capital

Sometimes, the working capital missive of the alphabet to live on brought past times the novel partner is non given inwards the questions. In such a case, the total working capital missive of the alphabet of existing or one-time partners inwards ascertained afterwards making all the necessary adjustments such as revaluation, goodwill, undistributed net turn a profit or loosed, etc. residue is considered as equal to the total novel working capital missive of the alphabet of the line of piece of job solid except novel partners' capital. The total working capital missive of the alphabet of the novel line of piece of job solid is determined on the footing of this one-time partners' capital. Te total working capital missive of the alphabet of the novel line of piece of job solid is determined on the footing of this one-time partners' working capital missive of the alphabet in addition to from this total capital, the part of working capital missive of the alphabet of the novel partner is determined. For example, the total working capital missive of the alphabet of the partner afterwards making all adjustment is Rs. 4, 00,000. They acknowledge the novel partner for 1/5 share. In this situation, combined part of net turn a profit of one-time partners volition live on 4/5 (i.e. 1-1/5) in addition to the total working capital missive of the alphabet of the line of piece of job solid volition live on Rs. 4, 00,000 x 5/4 = Rs. 5,00,0000. On the footing of this, the novel partner brings inwards Rs. 1, 00,000 (i.e., Rs. 5, 00,000 x 1/5) as his/her part of capital.

b. The novel partner's working capital missive of the alphabet is assumed to live on based capital

If the working capital missive of the alphabet of a novel partner is given, the same tin ship away live on used as a base of operations for calculating the novel working capital missive of the alphabet of the one-time partners. In such situation, initiatory of all of all, the total working capital missive of the alphabet of the novel line of piece of job solid should live on determined on the footing of novel partner's working capital missive of the alphabet in addition to them the total working capital missive of the alphabet is divided alongside all partners including novel ane inwards their novel net turn a profit sharing ratio.

For example, if newly admitted partner convey Rs. 1,00,000 as working capital missive of the alphabet for 1/5 part in addition to hence total working capital missive of the alphabet of the line of piece of job solid volition live on Rs. 5,00,000 (i.e. Rs. 1,00,000 x 5/1) in addition to this total working capital missive of the alphabet should live on distributed alongside all partners inwards their novel net turn a profit sharing ratio.

If the existing working capital missive of the alphabet of an one-time partner, is flora curt in addition to hence the novel working capital missive of the alphabet in addition to hence he/she has to convey the required amount inwards cash or his/her electrical current line of piece of job concern human relationship is debited with this amount. Similarly, if the existing working capital missive of the alphabet of an one-time partner is flora excess, them the surplus amount is either refunded or transferred to the credit of his/her working capital missive of the alphabet or electrical current account. In this situation, the next entries are made:

2.9 admission of a partner during an accounting Year

A new partner tin ship away live on admitted at whatsoever fourth dimension of accounting menstruum i.e. either the get-go of the accounting menstruum or destination of the accounting menstruum or at the mid of the accounting period. In this situation, the next points should live on considered systematically:

a. Accounting menstruum should live on divided into parts at the fourth dimension of admission of a novel partner i.e. menstruum before admission in addition to menstruum afterwards admission.

b. Income should likewise live on divided as pre-admission in addition to admission.

c. Similarly, all expenses should live on divided as pre-admission in addition to postal service admission.

d. After dividing incomes in addition to expenditures as pre-admission in addition to postal service admission, net turn a profit in addition to loss should likewise live on determined as pre-admission in addition to postal service admission. Such pre-admission net turn a profit or loss should live on divided live on divided alongside one-time partner according to their sharing rations. But postal service admission net turn a profit should live on divided alongside all partners including novel ane according to their novel net turn a profit sharing rations.

e. Such net turn a profit or loss should live on transferred to working capital missive of the alphabet or electrical current accounts of all partners.

-

admission of a partner during an accounting Year_journal entry continuum:

1.6 opening residue sheet

After adjustment all, a novel residue canvass is prepared past times taking adjusted working capital missive of the alphabet of all partners, revalued assets in addition to liabilities in addition to showing goodwill, if necessary. Such a novel residue canvass is called "opening residue sheet" of the firm.

Review of Theoretical concept

Why is novel net turn a profit sharing ratio determined afterwards a novel partner is admitted?

The ratios inwards which all partners including novel partner part the characteristic net turn a profit in addition to losses are known as novel net turn a profit sharing rations. When a novel partner is admitted, he/she acquires his/her part of net turn a profit from one-time or existing partners. This reduces the one-time or existing partners' part inwards profit. Hence, it is necessary to calculated novel net turn a profit sharing ratio.

Why assets in addition to liabilities are revalued at the fourth dimension of admission of a novel partner?

At this fourth dimension of admission of a novel partner, it is necessary to assess the assets in addition to liabilities of the firm. In other words, the assets in addition to liabilities of the line of piece of job solid should live on revalued on admission of a partner because with the gap of time, the value of to a greater extent than or less assets in addition to liabilities mightiness lead maintain increased spell the value of to a greater extent than or less assets in addition to liabilities mightiness lead maintain decreased. Thus, the proper value of diverse assets in addition to liabilities may live on unlike from the values mentioned inwards the residue –sheet. New partner should non endure because of decrease inwards the value of assets or increment inwards the value of liabilities similarly; he/she should non live on benefited past times increment inwards value of assets or decrease inwards value of liabilities. Thus, whatsoever net turn a profit must live on adjusted inwards the one-time partners' working capital missive of the alphabet accounts inwards their one-time net turn a profit sharing ratio.

Why goodwill is valued whenever a novel partner is admitted inwards partnership firm?

When a novel partner is admitted, the one-time partners lead maintain to sacrifice to a greater extent than or less of their involvement inwards the business. The novel partner has to give acquiring the correct of becoming the sacrifice. For acquiring towards working capital missive of the alphabet in addition to for having a correct to part inwards failure net turn a profit he/she pays something's which is called goodwill. Generally, it is provided inwards the partnership deed as to how volition live on goodwill is valued at the fourth dimension of admission of a novel partner.

0 Response to "What Is Admission Of Novel Partner?"

Post a Comment