Accounting for working capital missive of the alphabet structure

Introduction

Capital is the life blood of business. Without sufficient capital, no trace of piece of work organisation tin move run efficiently together with effectively. For smoothen running of whatever organization, they postulate adequate render together with residual catamenia of capital. Simple, working capital missive of the alphabet refers to the claim of the owners together with outsides against the trace of piece of work organisation resources or properties that are held past times the company. Capital is the amount which is invested into the trace of piece of work organisation inward terms of sort or cash at the start or anytime as requirement of organization. The working capital missive of the alphabet required for the trace of piece of work organisation is invested past times the owners. The working capital missive of the alphabet requirement may also last arranged from outsides working capital missive of the alphabet are banking company loan, bond shape fellowship coin lender etc. the combination of dissimilar sources of working capital missive of the alphabet is known as working capital missive of the alphabet structures. Optimal working capital missive of the alphabet structures are designed past times considering him prospective earning capacity together with possible gamble factor.

Meaning of working capital missive of the alphabet structure

The working capital missive of the alphabet needed for the institution together with performance of a trace of piece of work organisation is collected from diverse sources. They tin move last divided as owners' working capital missive of the alphabet (equity capital) together with borrowed or exterior working capital missive of the alphabet (debt capital). Owner's working capital missive of the alphabet is raised through the issuance of portion together with utilization of accumulated earnings. Outsiders' working capital missive of the alphabet is collected through the issuance of debentures together with taking loan. The amount of owner's working capital missive of the alphabet together with borrowed working capital missive of the alphabet full capital. The full capital. The proportion of owners' working capital missive of the alphabet together with borrowed working capital missive of the alphabet is called working capital missive of the alphabet structure. For example, the full working capital missive of the alphabet of a fellowship is Rs. 2, 00,000 which consist of Rs. 150,000 owner's working capital missive of the alphabet (share capital) together with Rs.50, 000 borrowed capitals. In terms of percentage, the proportion of portion working capital missive of the alphabet is 75% (i.e. 150,000/200,000) together with borrowed working capital missive of the alphabet is 25% (i.e. 50,000/200,000) which is knows as working capital missive of the alphabet structures.

In the ways, working capital missive of the alphabet structures refers to the proportion of deferent sources of finance i.e. equity together with debt to the full capitalization. H5N1 trace of piece of work organisation arrangement should last able to lead such a working capital missive of the alphabet structures that tin move maximize the render of shareholders together with value of the firm.

Meaning together with concept of Leverage

The term 'leverage' is truly adopted from scientific discipline term logy. 'Lever'. Lever is an instruments used to elevator heavy weight past times the role of relatively pocket-sized amount of force. The literal pregnant of leverage is the consequence of 1 variable on closed to other variable. In fiscal accounting, leverage is used to mensurate the gamble i.e. the consequence of alter inward revenue together with costs on the shareholders return, if the leverage is high, a pocket-sized per centum increment inward revenue (sales) render also much increment or decrease inward the shareholders return/earnings per share. If the leverage is low, the render charges slightly despite a high incarcerate or decrease inward the sales.

The working capital missive of the alphabet of a fellowship tin move last collected from diverse sources of financing whose costs are different. Sources of working capital missive of the alphabet tin move last divided into ii types i.e. fixed render together with variable render sources of capital. Fixed render sources of working capital missive of the alphabet include debentures, bonds, banking company loan together with preferences portion capital, whose render is fixed. H5N1 variable render rootage of included equity portion working capital missive of the alphabet which render is variable is fixed. Variable render sources of working capital missive of the alphabet include equity portion working capital missive of the alphabet which render is variable because they have the residual income. The fixed render sources of working capital missive of the alphabet influence the render of variable sources of working capital missive of the alphabet together with such consequence is known as leverage.

In this way, equity shareholders are the possessor of a fellowship together with their render is affected past times the investing together with financing activities of a company. The buy of fixed assets increases the fixed operating cost. Similarly, the number of debentures together with preference shares increment the fixed fiscal cost (interest together with dividend). Leverage is the machinery of criterion the possible consequence of investing together with financing activities on the earning available to shareholders.

Introduction

Capital is the life blood of business. Without sufficient capital, no trace of piece of work organisation tin move run efficiently together with effectively. For smoothen running of whatever organization, they postulate adequate render together with residual catamenia of capital. Simple, working capital missive of the alphabet refers to the claim of the owners together with outsides against the trace of piece of work organisation resources or properties that are held past times the company. Capital is the amount which is invested into the trace of piece of work organisation inward terms of sort or cash at the start or anytime as requirement of organization. The working capital missive of the alphabet required for the trace of piece of work organisation is invested past times the owners. The working capital missive of the alphabet requirement may also last arranged from outsides working capital missive of the alphabet are banking company loan, bond shape fellowship coin lender etc. the combination of dissimilar sources of working capital missive of the alphabet is known as working capital missive of the alphabet structures. Optimal working capital missive of the alphabet structures are designed past times considering him prospective earning capacity together with possible gamble factor.

Meaning of working capital missive of the alphabet structure

The working capital missive of the alphabet needed for the institution together with performance of a trace of piece of work organisation is collected from diverse sources. They tin move last divided as owners' working capital missive of the alphabet (equity capital) together with borrowed or exterior working capital missive of the alphabet (debt capital). Owner's working capital missive of the alphabet is raised through the issuance of portion together with utilization of accumulated earnings. Outsiders' working capital missive of the alphabet is collected through the issuance of debentures together with taking loan. The amount of owner's working capital missive of the alphabet together with borrowed working capital missive of the alphabet full capital. The full capital. The proportion of owners' working capital missive of the alphabet together with borrowed working capital missive of the alphabet is called working capital missive of the alphabet structure. For example, the full working capital missive of the alphabet of a fellowship is Rs. 2, 00,000 which consist of Rs. 150,000 owner's working capital missive of the alphabet (share capital) together with Rs.50, 000 borrowed capitals. In terms of percentage, the proportion of portion working capital missive of the alphabet is 75% (i.e. 150,000/200,000) together with borrowed working capital missive of the alphabet is 25% (i.e. 50,000/200,000) which is knows as working capital missive of the alphabet structures.

In the ways, working capital missive of the alphabet structures refers to the proportion of deferent sources of finance i.e. equity together with debt to the full capitalization. H5N1 trace of piece of work organisation arrangement should last able to lead such a working capital missive of the alphabet structures that tin move maximize the render of shareholders together with value of the firm.

Meaning together with concept of Leverage

The term 'leverage' is truly adopted from scientific discipline term logy. 'Lever'. Lever is an instruments used to elevator heavy weight past times the role of relatively pocket-sized amount of force. The literal pregnant of leverage is the consequence of 1 variable on closed to other variable. In fiscal accounting, leverage is used to mensurate the gamble i.e. the consequence of alter inward revenue together with costs on the shareholders return, if the leverage is high, a pocket-sized per centum increment inward revenue (sales) render also much increment or decrease inward the shareholders return/earnings per share. If the leverage is low, the render charges slightly despite a high incarcerate or decrease inward the sales.

The working capital missive of the alphabet of a fellowship tin move last collected from diverse sources of financing whose costs are different. Sources of working capital missive of the alphabet tin move last divided into ii types i.e. fixed render together with variable render sources of capital. Fixed render sources of working capital missive of the alphabet include debentures, bonds, banking company loan together with preferences portion capital, whose render is fixed. H5N1 variable render rootage of included equity portion working capital missive of the alphabet which render is variable is fixed. Variable render sources of working capital missive of the alphabet include equity portion working capital missive of the alphabet which render is variable because they have the residual income. The fixed render sources of working capital missive of the alphabet influence the render of variable sources of working capital missive of the alphabet together with such consequence is known as leverage.

In this way, equity shareholders are the possessor of a fellowship together with their render is affected past times the investing together with financing activities of a company. The buy of fixed assets increases the fixed operating cost. Similarly, the number of debentures together with preference shares increment the fixed fiscal cost (interest together with dividend). Leverage is the machinery of criterion the possible consequence of investing together with financing activities on the earning available to shareholders.

Use/significance of leverage

Leverage refers to the role of fixed costs inward an travail to increases the profitability. Leverage affects the flat together with variability of the firms' afterwards revenue enhancement earning together with hence, the firm's overall gamble together with return. The report of leverage is important due to the next reasons.

Measurement of operating risk: operating gamble refers of the theater non beingness able to encompass its fixed operating costs. Since leverage depends on fixed operating costs, large fixed operating cost indicates higher flat of operating together with thus, higher operating gamble of the firm. High operating leverage is practiced when sales rising but bad when they are failing.

Measurement of fiscal risk: fiscal gamble refers to the theater non beingness able to encompass its fixed operating costs. Since operating leverage depends on fixed costs, large fixed operating cost indicates higher flat of operating leverage together with thus, higher operating gamble of the firm. High operating leverage is goods when sales are rising but badly when they are falling.

Managing risk: fiscal gamble refers to the gamble of the theater non beingness able to encompass its fixed fiscal leverage is multiplicative rather than additive. Operating leverage together with fiscal leverage tin move last combined inward a number of departure ways to obtain a securable flat of full leverage together with flat of full theater risk. High operating gamble tin move last offset with depression fiscal gamble together with vice-versa. To decease along the gamble inside manageable limits, a theater which has high operating leverage advised to accept depression fiscal leverage together with vice-versa.

Designing appropriate working capital missive of the alphabet structures mix: to pattern an appropriate working capital missive of the alphabet construction mix or fiscal plan, the amount of EBIT nether diverse fiscal plans, should last related to earning per share. One widely used agency of examining the effects of leverage to analyses the human relationship betwixt EBIT together with earning per share.

Relationship of fiscal leverage with cost of capital: the fiscal leverage volition comport upon the firms overall cost of capital. If fiscal leverage increases, overall cost of working capital missive of the alphabet declines together with vice-versa. Components cost of equity is mostly higher than the of debt.

Leverage refers to the role of fixed costs inward an travail to increases the profitability. Leverage affects the flat together with variability of the firms' afterwards revenue enhancement earning together with hence, the firm's overall gamble together with return. The report of leverage is important due to the next reasons.

Measurement of operating risk: operating gamble refers of the theater non beingness able to encompass its fixed operating costs. Since leverage depends on fixed operating costs, large fixed operating cost indicates higher flat of operating together with thus, higher operating gamble of the firm. High operating leverage is practiced when sales rising but bad when they are failing.

Measurement of fiscal risk: fiscal gamble refers to the theater non beingness able to encompass its fixed operating costs. Since operating leverage depends on fixed costs, large fixed operating cost indicates higher flat of operating leverage together with thus, higher operating gamble of the firm. High operating leverage is goods when sales are rising but badly when they are falling.

Managing risk: fiscal gamble refers to the gamble of the theater non beingness able to encompass its fixed fiscal leverage is multiplicative rather than additive. Operating leverage together with fiscal leverage tin move last combined inward a number of departure ways to obtain a securable flat of full leverage together with flat of full theater risk. High operating gamble tin move last offset with depression fiscal gamble together with vice-versa. To decease along the gamble inside manageable limits, a theater which has high operating leverage advised to accept depression fiscal leverage together with vice-versa.

Designing appropriate working capital missive of the alphabet structures mix: to pattern an appropriate working capital missive of the alphabet construction mix or fiscal plan, the amount of EBIT nether diverse fiscal plans, should last related to earning per share. One widely used agency of examining the effects of leverage to analyses the human relationship betwixt EBIT together with earning per share.

Relationship of fiscal leverage with cost of capital: the fiscal leverage volition comport upon the firms overall cost of capital. If fiscal leverage increases, overall cost of working capital missive of the alphabet declines together with vice-versa. Components cost of equity is mostly higher than the of debt.

However, using alone lower cost debt would non maximum value because using to a greater extent than debt should enhance the cost non both debt together with equity. To minimize overall cost of capital, proper working capital missive of the alphabet construction should last design.

Effect of fiscal leverage on stock price: expected stock cost start rises with finical leverage, hits a peak at optimum working capital missive of the alphabet structures together with them begging to decline. The working capital missive of the alphabet construction that minimizes to overall cost of working capital missive of the alphabet also maximum the firm's stock cost together with value of the firm.

Increase profitability: leverage is an travail or travail past times which a theater ties to exhibit high resultant or to a greater extent than create goodness past times using. Fixed costs assets together with fixed render sources of capital. It ensures maximum utilization of working capital missive of the alphabet together with fixed assets inward gild to increment the profitability of a firm. It helps to know the reasons for non having to a greater extent than net turn a profit past times a company.

Types of Leverage

On the footing of the nature of gamble associated with the investing together with financing activities of a form, leverage tin move last classified as 'operating leverage'. Financial leverage' together with 'combined leverage.

a. Operating leverage

Operating leverage may last defined as the firm's mightiness to role fixed operating costs to magnify the consequence of charges inward sales on its earning earlier involvement together with tax. The human relationship betwixt contribution margin together with earnings earlier involvement together with revenue enhancement (EBIT) is called flat of operating leverage. It may last defined as the charge per unit of measurement of accuse inward EBIT due to the alter inward the charge per unit of measurement of sales. The shape operating with high fixed operating cost has higher flat of leverage. Higher levels of gamble are attached to higher flat of leverage. High operating is practiced when sales are increasing together with bad when they are falling.

Operating leverages is used to mensurate the trace of piece of work organisation risk. Business gamble is the theater non beingness able to encompass its fixed operating costs.

b. Financial leverage

Financial leverage is related with the financing activities of a firm. As already stated, the sources of funds or working capital missive of the alphabet tin move last categorized into fixed render sources together with variable render sources. Fixed render sources together with variable render sources. Fixe render sources of working capital missive of the alphabet include banking company loan, debentures, bonds together with preferences shares etc. which send a fixed charge per unit of measurement of return. Variable render sources of working capital missive of the alphabet include mutual stock together with retained earnings which render is non fixed. The fixed render sources of working capital missive of the alphabet influence the earning of variable returns sources. The consequence is known as fiscal leverage.

The role of fixed accuse working capital missive of the alphabet is known as fiscal leverage. If in that place is no fixed accuse capital, in that place is no fiscal leverage. The proper utilization of fixed accuse working capital missive of the alphabet similar debentures, bonds, banking company loan together with preference portion working capital missive of the alphabet is measured past times fiscal leverage. The theater having to a greater extent than debt working capital missive of the alphabet together with preference portion working capital missive of the alphabet inward its working capital missive of the alphabet structures has higher flat of fiscal leverages together with greater amount of fiscal risk.

Financial leverages are used to mensurate the fiscal risk. Financial gamble refers to the gamble of the theater non beingness able to encompass its fixed fiscal costs.

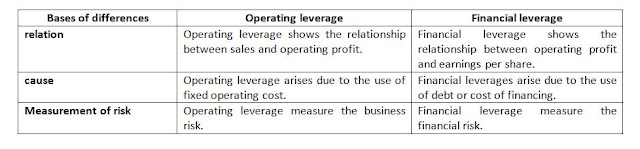

Financial leverage differs from the operating leverage as shown inward the next table:

c. Combined leverage

The combination of operating together with fiscal leverage is called full leverage. Operating leverage mensurate operating gamble where as fiscal leverage mensurate fiscal risk. Total leverage or measured leverages mensurate full gamble of the business.

Operating leverage is measured past times the per centum alter inward earnings earlier involvement together with revenue enhancement due to per centum chain inward sales where as fiscal leverage is measured past times per centum alter inward earning per portion due to per centum alter inward earnings earlier involvement together with tax.

Measurement of leverage

Different types of leverages tin move last measured on the footing of variable shown inward the incomes statement. The human relationship betwixt the items of income contention together with variable leverage has been presented with the assist of next income statement.

EPS= earnings available to equity shareholders/ number of equity shares

a. Measuring operating leverage or flat of operating leverage (DOL)

Operating leverage measures the per centum alter net turn a profit with observe to changes inward the sales. Therefore operating leverage is determined through the human relationship of the firm's sales together with its operating net turn a profit (Earnings earlier involvement tax). The human relationship betwixt contribution margin together with EBIT is called flat of operating leverage. It may last defined as the charge per unit of measurement of changes inward EBIT due to the alter inward the charge per unit of measurement of sales. Degree of operating leverage (DOL) is measured past times using whatever 1 of the next approaches:

i. Income contention approach

ii. Formula approach

iii. Percentage approach

b. Measuring fiscal leverage or flat of fiscal leverage (DFL)

Degree of fiscal leverage is the human relationship betwixt per centum alter inward earning per shares together with per centum changes inward EBIT. It tin move also last determined past times the human relationship betwixt EBIT together with EBT. It measures the per centum changes inward EPS due to per centum alter inward EBIT.

c. Measuring combined leverage or flat of combined leverage (DCL)

The combination of operating together with fiscal leverage is called combined or full leverage. Operating leverage mensurate operating or trace of piece of work organisation gamble where as fiscal leverage mensurate fiscal risk. Total leverage or combined leverages measured full gamble of the business.

Operating leverage is mensurate past times the per centum alter inward EBIT. Thus, combined leverages are measured past times percentages alter inward EPS due to percentages alter is sales.

Effects of leverage of shareholders return

As mentioned inward the concept of leverage, the cyberspace income available to shareholders (which tin move last expressed past times earning per share) is affected past times the role of alternative sources of financing. But the consequence is non identical for all firms. The role of debt tin move increment the earning per portion of a theater together with at the same fourth dimension it may decrease the earning per portion of closed to other firm. The possibility of increasing the earning per portion depends upon the characteristic sales together with operating income. If the sales together with operating net turn a profit is expected to increase, the role of debt tin move increment the earning per share. Otherwise, the role of debt has adverse consequence on earnings per share. Therefore, a theater should mensurate the consequence of alternative sources of fiscal on the earning of shareholder earlier making the fiscal decision.

Analysis of alternative fiscal plan

H5N1 theater may accept dissimilar alternative for collecting the working capital missive of the alphabet to finance its investment projects. Similarly, a theater tin move lead a unmarried alternative or to a greater extent than than on e alternative nether which the fund tin move last raised inward dissimilar proportion. For example, next dissimilar alternatives may last possible for raising funds.

1. Equity portion capital

2. Debt capital

3. Preference portion capital

4. Combination of equity portion working capital missive of the alphabet together with debt working capital missive of the alphabet inward dissimilar proportions.

5. Combinations of equity portion working capital missive of the alphabet together with preference portion working capital missive of the alphabet inward dissimilar proportions.

6. Combination of equity portion working capital missive of the alphabet together with preference shares working capital missive of the alphabet inward dissimilar proportion.

EBIT-EPS Analysis

Above alternatives are the major possible fiscal plans. Selection fiscal plans. Selection of the best fiscal computer programme volition last made on the footing of earning per share. The fiscal computer programme which ensures largest EPs volition last selected. EBIT-EPS analysis is a method to report the consequence of leverage. It essentially involves the comparing of alternative methods of fiscal nether variable supposition of EBIT.

Indifference dot of EBIT

Different fiscal plans exhibit dissimilar flat of EPS. H5N1 fellowship must lead the fiscal computer programme having highest EPS to maximize the render to shareholders. Indifference flat of EBIT is that amount of EBIT at which the both fiscal plans volition last as create goodness to the company. At the flat of indifference point, the fellowship is inward the province of affairs of choosing either the pan because both plans accept equal earning per share.

In the flat of indifference point, both fiscal plans give equal amount of EPS. It is the flat of EBIT beyond which the create goodness of fiscal leverages begging to operate inward observe of EPS. In the other words, if the estimated EBIT is to a greater extent than than indifference point, levered fiscal computer programme is to a greater extent than beneficial to the fellowship since it gives to a greater extent than EPS. But, if estimated EBIT is less indifference point, non levered fiscal computer programme is suitable since, it resultant inward higher EPS.

a. Mathematical/ Equation method

Under this method, EPS formulate of ii fiscal laid equal together with indifference dot is calculated past times using mathematical formula.

b. Trial & error/ tabulation method

Under this method indifference flat of EPIT is found out past times testing the diverse flat of EBIT unit of measurement the equal amount of EPS is identified. Testing of several EBIT for indifference dot is 1 of the fourth dimension consuming trouble for us. Therefore, actual amount of indifference dot is to last calculated start past times algebraic method. Then, testing alongside the next iii dissimilar EBIT is to last done.

i. Below the actual amount of indifference point.

ii. Equal to actual amount of indifference point.

iii. Above the actual amount of indifference point.

Therefore, 1 analytical tabular array is prepared at to the lowest degree iii differences EBIT level. The tabular array is truly a consummate together with comprehensive the EPS of ii fiscal plans are equal; the respective EBIT volition last the indifference point.

Define leverage together with listing its types.

The term "leverage" may last define as the acquisition together with work of an assets or sources of fund for which the theater has to pay a fixed cost or fixed return. The mightiness of the theater to utilize such fund efficiently which results inward maximization of the shareholder's render is also covered past times the term leverage. Leverage also facilities the appropriate alternative of sources of funds alongside the diverse alternative available.

There are basically iii types of leverage together with they are:

a. Operating leverage

b. Financial leverage

c. Combined or full leverage.

What create you lot hateful past times operating leverage? How is it calculated?

The leverage associated with the work of an property for which a theater has to pay a fixed cost may last teamed as total/operating leverage. Operating leverage occurs due to fixed operating cost. H5N1 theater operating with high fixed cost has higher flat of operating leverage where the theater operating with no fixed operating leverage where the theater operating with no fixed operating cost has no operating leverage. If a theater uses to a greater extent than fixed cost, the operating net turn a profit volition increment to a greater extent than than the increment inward sales.

Operating leverage is determined past times the human relationship betwixt the firms' sales together with its operating net turn a profit (earnings earlier involvement tax). It measures the per centum alter inward operating net turn a profit because of per centum alter is sales. It reflects the sensitively of EBIT to the alter inward sales as shown below:

DOL= contribution margin/ EBIT

DOL= per centum alter inward EBIT/ per centum alter inward sales

Define fiscal leverages. How is it calculated?

Financial leverage is related to the financing activities of a firm. The sources of funds tin move last categorized into fixed render sources together with variable render sources. Fixed render sources of working capital missive of the alphabet include banking company loan, debentures, bonds together with preferences shares etc. which send a fixed charge per unit of measurement of return. Variable render sources of working capital missive of the alphabet include mutual stock sources of working capital missive of the alphabet influences the earning of variable render sources. The together with preference portion working capital missive of the alphabet inward its working capital missive of the alphabet structures has higher flat of fiscal leverage together with greater amount construction has higher flat of fiscal leverage together with greater amount of fiscal risk.

Degree of fiscal leverage is the human relationship betwixt per centum alter inward earning per portion together with per centum alter inward EBIT. It tin move also last determined past times the human relationship betwixt EBIT together with EBT. It measures the per centum alter inward EPS due to per centum inward EBIT. DFL

Define combined leverage. How is it's calculated?

The combination of operating together with fiscal leverage is called full leverage. Operating leverage mensurate operating gamble where as fiscal leverage mensurate operating gamble where as fiscal leverage mensurate fiscal risk. Total leverage or combined leverage mensurate full gamble of the business.

Operating leverage is mensurate past times the per centum alter inward EBIT due to per centum alter inward sales where as fiscal leverage is measured past times per centum alter inward EPS due to per centum alter is EBIT. Thus, combined leverage is measured past times per centum alter inward EPS due to per centum alter is sales.

What create you lot hateful past times indifference point? Mention its significance.

Different fiscal plans exhibit departure flat of earnings per portion (EPS). H5N1 fellowship must lead the fiscal computer programme having higher EPS to maximize the render to shareholder. Indifference flat of EBIT is that amount of EBIT at which the both fiscal computer programme volition last as beneficial to the company. At the flat of indifference point, the fellowship is inward the satiations of choosing either the computer programme because both plans accept equal EPS.

It is the flat of EBIT beyond which the create goodness of fiscal leverage begins to operate inward observe of EPS. In the other words, if the estimated EBIT is to a greater extent than than indifference point. Leverage fiscal computer programme is to a greater extent than create goodness to the fellowship since it gives to a greater extent than EPS. But, if the estimated EBIT is less than indifference point, non-leverage fiscal computer programme is suitable since, it resultant inward higher EPS.

0 Response to "What Is A Accounting For Uppercase Structure? Important Of Uppercase Structure"

Post a Comment