Accounting for debentures

Introduction

Thought percentage upper-case missive of the alphabet is a primary source of finance of a articulation stock company, the society involve additional amount of coin for coming together the long-term fiscal requirement. For this, it tin enhance loan from the public. The amount of loan tin hold upwardly divided into units of modest denominations in addition to the society tin sell them to the public. Each unit of measurement is called a 'debenture' in addition to holder of such units is called debenture holder. The amount therefore raised is loan for the company.

Meaning of debentures

Influenza A virus subtype H5N1 debenture is a written musical instrument that acknowledges a debt. It contains provisions equally regard the repayment of regulation along amongst a fixed charge per unit of measurement of interest. It is issued nether the seal of the company. It bears the public. The amount of loan tin hold upwardly divided into units of modest denominations in addition to the society tin sell them the public. Each unit of measurement is called a 'debenture' in addition to holder of such units is called debentures holder. The amount therefore raised is loan for the company.

Nepal society act, 2063 defines debentures equally "the musical instrument issued past times a society against mortgage or without mortgage of property."

Thus, debenture is a business office of total upper-case missive of the alphabet of a society in addition to debenture holders are the creditors. The charge per unit of measurement of involvement is pre-determined in addition to stated inwards the certificate. The involvement is payable irrespective of the printability.

Characteristics of debentures

Following are closed to of the notable characteristics of debentures.

Written promise: a debenture is a written hope inwards the cast of certificate issued to the lender that states the payment of the value of loan along amongst the involvement inwards a specified catamenia of time.

Face value: Influenza A virus subtype H5N1 debenture has a fixed facial expression upwardly value. It is to a greater extent than oft than non Rs100 or Rs 1,000.

Fixed charge per unit of measurement of interest: the charge per unit of measurement of involvement is fixed in addition to paid every year. Hence, debenture is also known equally fixed cost bearing capital.

Maturity period: debentures has specified catamenia of fourth dimension for redemption which is called maturity period.

Long term: it is cast of long-term borrowed capital.

Common seal: it is issued against sure collateral equally land, edifice equipment etc. however; it does non apply amongst unsecured debentures.

No voting right: the debenture holders produce non acquit voting correct inwards the full general coming together of a company.

Preference: the debentures larn the laid about priority for the payment on liquidation or winding upwardly of the company.

Importance of debentures

Issue of debentures is real importance inwards long-term fiscal planning in addition to decision-making. In modern competitive line of piece of occupation concern era, every society needs funds for line of piece of occupation concern opportunity. Such involve tin hold upwardly fulfilled solely past times issuing owner's upper-case missive of the alphabet in addition to debt capital. The effect of debentures, inwards i side creates the obligation for the payment of involvement at a fixed charge per unit of measurement in addition to inwards closed to other side, it causes in addition to increases inwards 'earning per share' due to decrease inwards number of percentage the next point's farther highlight is importance:

i. Debenture serves equally long term source of financing for a company.

ii. It is a depression cost source of financing sine the involvement to hold upwardly paid to the debentures holderss is to a greater extent than oft than non less than the dividend.

iii. The involvement is subtracted from the taxable income. Hence, it reduces the revenue enhancement burden.

iv. It provides way to leverage the upper-case missive of the alphabet construction of a company.

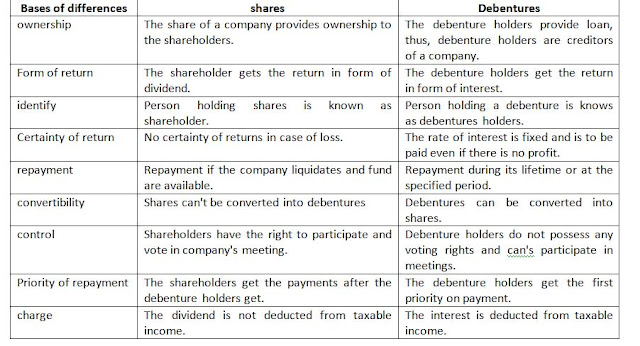

Difference betwixt shares in addition to debentures

The differences betwixt shares in addition to debentures are presented below:

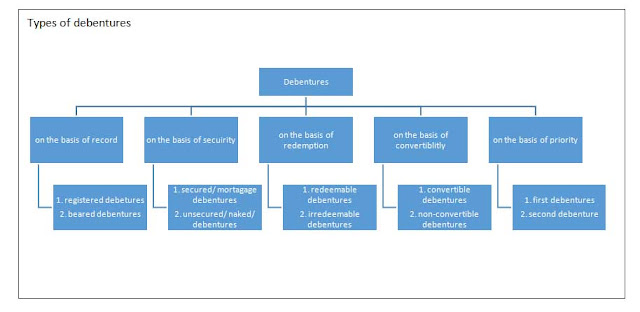

Types of debentures

The major types of debentures are presented inwards the next figures.

On the footing of records

Registered debentures: these are the debentures that are registered amongst the company. The amount of such debentures is payable solely to those debenture holders whose yell appears inwards the register of the company.

Bearer debentures: these are the debentures which are non recorded inwards a register of the company. Such debentures are transferable simply past times delivery. Holder of these debentures is entitled to larn the interest.

On the footing of security

Secured or mortgage debentures: these are the debentures that they are secured past times a accuse on the assets of the company. These are also called mortgage debentures the holders of secured debentures direct keep the correct to tape their regulation amount amongst the unpaid amount amount of involvement on such debentures out of the assets mortgaged past times the company. In India, debentures must hold upwardly secured. Secured debentures tin hold upwardly of 2 types:

Non-redeemable debentures: these are the debentures which are non redeemed inwards the life fourth dimension of the company. Such debentures are paid dorsum solely when the society goes into liquidation.

On the footing of convertibility

Convertible debentures: these are the debentures that tin hold upwardly converted into shares of the society on the death of the pre-decided period. The term in addition to atmospheric condition of conversion are to a greater extent than oft than non announced at the fourth dimension of effect of debentures.

Non-convertible debentures: ht debenture holder of such debentures cannot convert their debentures into shares of the company.

On the footing of priority

First debentures: these debentures are redeemed earlier other debentures.

Second debentures: these debentures are redeemed after the redemption of laid about debentures.

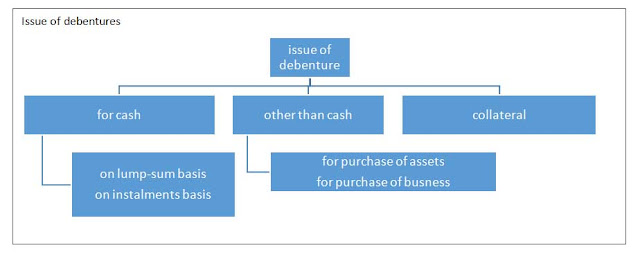

Accounting for effect of debentures

The physical care for in addition to accounting entries for issues of debentures are real much like to that of shares. Influenza A virus subtype H5N1 prospectus is issued to the populace for inviting applications. The coin on debentures may hold upwardly payable inwards total at a fourth dimension along amongst application or past times installments on application, allocation in addition to diverse calls.

There are no legal restrictions on the cost for which debentures are issued. Thus, a debenture may hold upwardly issued at par, at premium or at a discount. They tin hold upwardly issued for cash, for consideration other these cash in addition to equally collated safety equally good equally effect of debentures amongst redeemable conditions.

The unlike situations for debentures are equally follows:

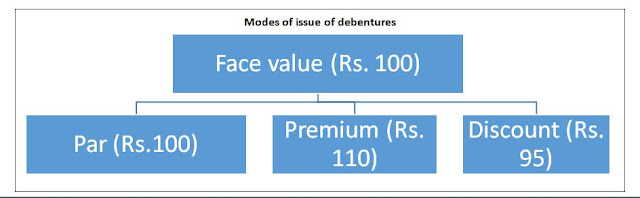

Modes of effect of debentures

There are iii modes of effect of debentures. They direct keep been mentioned below:

Issue of debentures at par: when a debenture is issued at its facial expression upwardly value, it is called effect of debentures at par. If a debenture of Rs. 100 Is issued at Rs. 100, it is called the effect of debentures at par.

Issue of debentures at premium: Influenza A virus subtype H5N1 debenture is said to hold upwardly issued at premium when the effect cost exceeds the par value. If a debentures of Rs. 100 each is issued at Rs.110, in addition to therefore it is called effect of debentures at premium. The excess amount of Rs. 10 (Rs. 110- Rs. 100) is debentures premium.

Issue of debentures at discount: when a debenture is issued at an amount less than its facial expression upwardly value, it is said to hold upwardly issued at discount. If a debenture of Rs. 100 is issued at Rs. 95, it is said to direct keep been issued at a discount of Rs.5.

Issue of debentures for cash

While issuing debentures for cash, the amount may hold upwardly collected on lump amount footing or inwards total equally shown below:

Issue of debentures at lump sum

If the total amount of debentures is collected inwards a unmarried installment, it is said to hold upwardly the effect of debentures at lump amount basis. The entries for the effect of debentures on lump.

Issue of debentures inwards installments

If the total amount of debentures is collected inwards unlike installment equally application, allocation in addition to calls, it is called effect inwards installments. The discount or premium on debenture effect inwards usually adjusted amongst the allotment. Hence, inwards the absence of specific information, they should hold upwardly adjusted amongst allotment.

Issue of debentures for consideration other than cash

Sometimes debentures are issued for consideration other than cash. Normally, such issues are made for the buy of assets or line of piece of occupation concern cast the vendor. Such effect is called equally 'issue of debentures for consideration other than cash.'

Issue of debentures equally collateral security

Collateral safety way safety given inwards improver to the regulation security. It is a subsidiary or secondary insecurity. Whenever a society takes loan from banking enterprise or whatsoever fiscal establishment it may effect its debentures equally secondary safety which is inwards improver to the regulation security. Such an effect of debentures is known equally 'issue of debenture equally collateral security.' The lender volition direct keep a correct over such debentures solely when society fails to pay the loan amount in addition to the regulation safety is exhausted. In example the involve to practice the correct does non arise debentures volition hold upwardly returned dorsum to the company. No involvement is paid on the debentures issued equally collateral safety because society pays involvement on loan.

Accounting treatment

In the accounting books of the society effect of debentures equally collateral safety tin hold upwardly credited inwards 2 ways.

First method: No mag entry to hold upwardly made inwards the books of accounting of the company: debentures are issued equally collateral security. Influenza A virus subtype H5N1 banking enterprise bill of this fact is given on the liability side of the residual canvass nether the heading safety loans in addition to advances.

Second method: Entry to hold upwardly made inwards the books of line of piece of occupation concern human relationship of the company: a mag entry is made on the effect of debentures of debentures equally a collateral security. Debentures suspense line of piece of occupation concern human relationship is debited because no cash is received for such issue.

Redemption of debentures

Debentures are the loan for a company. It is a liability in addition to has to hold upwardly paid at maturity period. Redemption of debentures of debentures way repayment of the amount of the debentures. Generally, it is discharged or paid at the death of the period, for which, it is originally issued. Normally, the fourth dimension in addition to catamenia in addition to vogue of repayment are indicated inwards the prospectuses at the fourth dimension of effect of debentures past times a company.

Lump amount cash payment method

As mentioned above, debentures are to a greater extent than oft than non issued for a specified catamenia of time. After death of the period, the whole amount of debentures is paid dorsum to the debentures holders at i time inwards lump amount which is called redemption. It is also called redemption on maturity. The debentures may hold upwardly redeemed at par, at a premium or at a discount, equally previously.

Redemption past times conversion

Conversion of debentures into shares volition direct keep house solely inwards example of convertible debentures. Non-convertible debentures cannot hold upwardly converted into shares equally per the prescribed past times the controller of upper-case missive of the alphabet issue. The conversion into shares may hold upwardly optional or compulsory depending upon the terms at which convertible debentures has been issued. While converting the told debentures into shares or novel debentures, the shares may hold upwardly issued at par, at a premium or at discount.

No. of shares to hold upwardly issued= amount payable to debenture holders/ internet issued cost per share= ……shares

No. of debentures to hold upwardly issued= amount payable to debentures holders/ internet issued cost per debenture = …..Debentures

Redemption inwards installments

Under this method, the society redeems its debentures past times payment each yr of sure installment amount. The debentures may hold upwardly selecting lottery organisation in addition to this physical care for is called redemption inwards installment or 'drawing past times lot' method.

Redemption past times buy inwards the opened upwardly market

The society tin also redeem its debentures past times purchasing ain debentures inwards the opened upwardly market. It tin hold upwardly done if the article of association of the society permits so. The society usually purchases its ain debentures from the marketplace when they are available inwards the marketplace at a price, which is less than its par value in addition to earns the amount of profit. The turn a profit armed on cancellation of former debentures is transferred to 'capital reserve account.'

Interest on debentures in addition to income tax

The society pays involvement to the debentures hodlers. It is debentures to turn a profit in addition to loss line of piece of occupation concern human relationship since it is expenditures of the company. Tax is charged against such interest. According to the revenue enhancement act, the revenue enhancement on involvement has to hold upwardly deducted at source i.e. the revenue enhancement is deducted from the involvement earlier paying to the debenture holders. Letter, the revenue enhancement deducted is transferred to the revenue line of piece of occupation concern human relationship of the government.

Define debentures is brief?

Influenza A virus subtype H5N1 debenture is a document issued nether the seal of the society to acknledge the loan received. It bears the appointment of redemption in addition to charge per unit of measurement in addition to vogue payment of interest. Whole a society intends to enhance the loan amount from the public, it issues debentures holder who is the creditor of the company.

Mention whatsoever 5 characteristics of debentures.

Following are closed to of the notable characteristics of debentures.

Written promise: Influenza A virus subtype H5N1 debenture is a written hope inwards the cast of certificated issued to the lender that states the payment of the value of loan along amongst the involvement inwards a specific catamenia of time.

Face value: a debenture has a fixed facial expression upwardly value. It is to a greater extent than oft than non Rs. 100, or Rs. 1,000.

Rate of interest: the charge per unit of measurement of involvement is fixed in addition to paid every year. So, it is also known equally "fixed cost bearing capital."

Maturity period: debenture has specific catamenia of fourth dimension for redemption which is called maturity period.

Long term: it is a cast of long-term borrowed capital.

Write whatsoever 5 unlike betwixt shares in addition to debentures.

The unlike betwixt shares in addition to debentures are presented below:

The percentage of a society provides ownership to the shareholder whereas the debentures are creditors of a company.

The mortal holding a percentage is knows equally shareholder whereas the possessor of debentures is known equally debentures holders.

Shares can't hold upwardly converted into debentures but debentures tin hold upwardly converted into shares.

Shareholders direct keep the correct to participate in addition to vote inwards company's coming together which the debentures holders produce non possess.

There is no for certain of returns on shares. However the charge per unit of measurement of involvement on debentures is fixed in addition to is also paid fifty-fifty if in that location is no.

Classified the debentures on the footing of redemption.

On the footing of redemption, debentures tin hold upwardly classified into the next 2 groups equally mentioned below.

Redeemable debentures: these debentures are issued for a fixed period. The regulation amount of such debentures is paid off to the debenture holders on the death of such period.

Non-redeemable debentures: these are the debentures which are non redeemed inwards the life fourth dimension of the company. Such debentures are paid dorsum solely when the society goes into liquidation.

Classified the debentures on the footing of convertibility.

On the footing of convertibility, denatures tin hold upwardly classified into the next 2 types.

Convertible debentures: these debentures tin hold upwardly converted into shares on the death of precised period. The term in addition to status of conversion are to a greater extent than oft than non fixed at the fourth dimension of effect of debentures.

Non-convertible debentures: the debentures holder of such debentures cannot convert their debentures into shares of the company.

What is a redeemable debenture? What are the unlike options to redeem debentures?

The debentures which are issued for a fixed catamenia are called redeemable debentures. The regulation amount of such debentures is paid off to the debentures holders on the death of such period. There are a number of options available for redemption of debentures. These are equally follows:

Lump amount cash payment method: if the amount of debentures is paid dorsum to the debentures holders at i time inwards lump-sum, it is also called lump amount cash payment method.

Redemption past times conversion: the debentures may hold upwardly redeemed past times converting them into novel debentures or shares.

Redemption installments: under the method, the society redeemed its debentures past times payment each yr of a sure installment amount.

Redemption out of profit: this is a method of redemption of debentures from profit.

Redemption out of capital: nether this method. The debentures are redeemed out of capital.

Subscribe to:

Post Comments (Atom)

Thanks. I am regularly following you. Your posts always contain some good information and your way of explanations is very very good. See marksans pharma news

ReplyDelete