What is a Company formation?introduction

Company formation Introduction

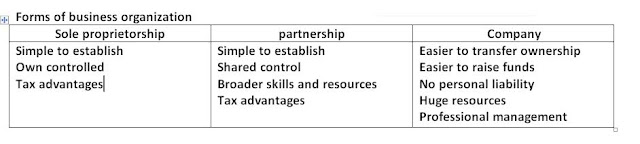

There are deviation types of concern organizations. The oldest forms of concern arrangement is sole trading concern, inward which, an private invest majuscule as well as run the business. The sole trading concern suffers from the drawbacks of express majuscule as well as managerial skills. Other type of concern arrangement is partnership firm. Influenza A virus subtype H5N1 sure enough number of persons articulation together for their mutual hit goodness their fiscal resources, managerial as well as technical abilities for to purpose of operating a business. However, it besides revolves around some limitations every bit unlimited liability, express capital, deviation of transfer ownership etc.

| |||

| Add caption |

A fellowship is the developed from of concern organizations which has evolved to overcome the limitation of sole trading as well as partnership organization. This types of concern arrangement collects their majuscule issuing shares as well as has perpetual existence.

Meaning as well as concept of company

Influenza A virus subtype H5N1 fellowship of articulation stock fellowship is the most widely followed cast of concern organization. It is voluntary association of persons who contribute majuscule to send on special types of business. It is established yesteryear police clit as well as tin last dissolved alone yesteryear law. Persons who contribute majuscule travel members of the fellowship as well as known every bit shareholder. This cast of concern has a legal existence separate from its members. In other words, the existence of the shareholders as well as the fellowship are non related to each other which hateful fifty-fifty if its fellow member dies, the fellowship remains inward existence. This cast of concern organizations to a greater extent than oftentimes than non required large majuscule investment, which is contributed yesteryear its member. The total majuscule of a articulation stock fellowship is called percentage majuscule as well as it divided into a number of units called shares. Thus, every fellow member has some shares inward the concern depending upon the amount of majuscule contributed yesteryear him.

Some of the definitions of Joint Stock Company are given below:

"A fellowship refers to whatsoever fellowship formed as well as resisted nether this act." Nepal Company act, 2063bs

"A fellowship is an artificial individual created yesteryear low, having a separate legal entity, with perpetual succession as well as a mutual seal." Republic of Republic of India companies human activity 1956

"A corporation is an artificial beingness invisible, intangible as well as existing alone inward the contemplation of law." Chief judge Marshall of U.S.A.

"A fellowship is an artificial person, created yesteryear police clit having a separate entity with a perpetual succession as well as a mutual seal." Prof. Haney

In conclusion, it tin last stated that a fellowship is an association of individual having mutual involvement which has a separate legal existence as well as incorporated according to low.

Characteristics of articulation stock company

Influenza A virus subtype H5N1 articulation stock fellowship has proved itself every bit a distinct cast of concern arrangement due to the next characteristics.

Legal formation: no unmarried private or a grouping of individuals tin start a concern as well as telephone weep upward it a articulation stock company. Influenza A virus subtype H5N1 articulation stock fellowship comes into existence alone when it has been registered after completion of all formative required yesteryear the fellowship act.

Artificial person: a articulation stock fellowship takes birth, grows, enters into human relationship as well as dies every bit ban individual. Hence, it is called an artificial individual every bit its births, existence as well as decease are regulated yesteryear depression as well as it does non individual physical attributes similar that of a normal person. As artificial person, it tin purchase as well as sell properties, sue or b sued inward courts, come inward into contract, opened upward depository fiscal establishment concern human relationship etc.

Separate legal entity: a articulation stock fellowship has its ain separate existence independent of its members. It agency a articulation stock fellowship tin ain property, come inward into contracts as well as demeanour whatsoever lawful concern inward its ain name. it tin sue as well as tin last sued yesteryear other inward the courtroom of law, the shareholder cannot last held responsible for the acts of the company.

Common seal: a articulation stock fellowship has a seal, which is used spell dealing with others or entering into contracts with outsiders. It is called a mutual seal every bit it tin last used yesteryear whatsoever officeholder at whatsoever degree of the arrangement working on behalf of the company. Any document, on which the company's seal is seat as well as is duly signed yesteryear whatsoever official of the company, travel binding on the company. For example, a purchase manager may come inward into a contract for buying raw fabric becomes valid. The purchase manager may degree the fellowship thereafter or may last removed from the chore or may have got taken a incorrect decision, notwithstanding for all purpose the contract is valid till a novel contract is made or the existing contract expires.

Perpetual existence: a articulation stock fellowship continues to travel out every bit long every bit it fulfills the requirements. It is non affected yesteryear the death, lunacy, insolvency or retirement of whatsoever of its members. For example, inward instance of a private express fellowship having 4 members, if all of them decease inward an accident, the fellowship volition non last closed. It volition proceed to exist. In such a situation,f the shares of the fellowship volition last transferred to the legal heirs of the deceased members.

Democratic management: articulation stock companies have got democratic administration as well as control. That is, fifty-fifty idea the shareholders are owners of the company, all of them cannot participate inward the administration of the company. Normally, the shareholders elect representatives from with themselves known every bit 'directors' to handle the affairs of the company.

Transfer-ability of percentage capital: the percentage of a fellowship are freely transferable from i individual or political party to some other individual or political party except the instance of private companies. Influenza A virus subtype H5N1 shareholder tin transfer his/her shares to whatsoever individual at his/her volition without the consent of other shareholders. The transfer of the percentage changes the ownership as well as does non comport upon inward the regular business office of the company.

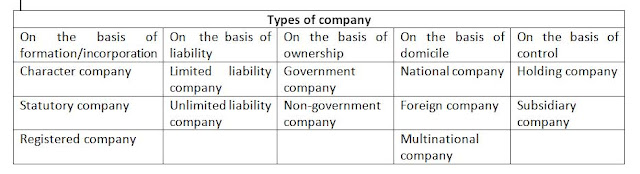

Types of companies

The companies tin last classified into diverse types depending upon formation, liability, ownership, habitation as well as control. They have got been mentioned below inward detail.

On the set down of formation or incorporation

On the set down of formation, companies are divided into 3 types every bit mentions below:

Chartered company: a company, which is incorporated or established nether special grapheme or statement issued yesteryear the caput of the state, is known every bit chartered company. The charter issued for the established of a special fellowship does non principle other companies. In ain country, at that topographic point is no existence of such company.

Statutory company: a company, which is formed or incorporated yesteryear a special human activity of parliament, inward known every bit statutory companies. Such fellowship is governed yesteryear their respective acts as well as hit non have got memorandum or articles of association.

Registered companies: a company, which is formed according to fellowship act, is called Register Company. The provision of fellowship act, memorandum of association as well as articles of association principle such company. Registered fellowship may last farther divided into 2 categories.

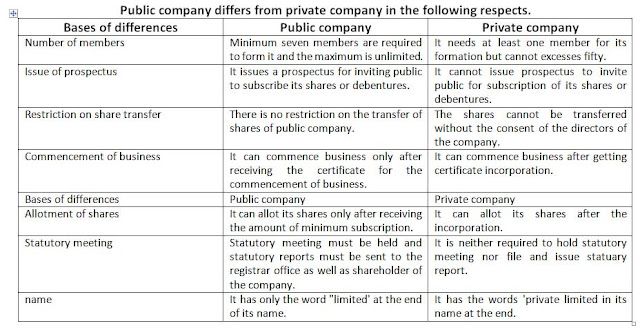

a. Private company: a fellowship is said to last private fellowship which restricts the correct of its members to transfer shares, bound the number of ites fellow member to l as well as does non invite the populace to subscribe its shares or debentures yesteryear its memorandum of association. Influenza A virus subtype H5N1 private fellowship uses the words "private limited" after its name.

Influenza A virus subtype H5N1 private express fellowship enjoys a number of privileges over a populace express company. Some of them are advert below.

Influenza A virus subtype H5N1 private express fellowship may last formed fifty-fifty yesteryear a unmarried person.

It tin start its concern forthwith after getting certificate of incorporation.

Influenza A virus subtype H5N1 private fellowship is non bounded to expose prospects spell issuing shares for populace subscription.

It tin allot shares fifty-fifty if the minimum subscription is non subscribed.

It is non necessary to last statutory to populace prospectus spell issuing shares for populace subscription.

It tin allot shares fifty-fifty if the minimum subscription is non subscribed.

It is non necessary to agree statutory coming together or file statutory study with the fellowship registrar.

b. Public company: according to Nepal fellowship human activity a fellowship which is non a private is a populace company. It needs minimum 7 person. There is no demarcation for the maximum number of persons. There is no restriction on number or transfer of its shares as well as it tin invite the populace its shares as well as debentures.

On the set down of liability

The companies are divided into 2 types, namely companies having express liability as well as companies having unlimited liability on the set down of liability.

Limited liability Company. This liability tin last express inward 2 ways.

a. Liability express yesteryear shares: the fellowship inward which the liability of shareholder is express to the extent of the value of shares held yesteryear them is called the fellowship having express liability yesteryear shares. Most of the companies registered nether the fellowship human activity are of this type.

b. Liability express yesteryear guarantee: the fellowship where shareholders hope to pay a fixed amount to come across the liability of the fellowship inward the instance of liquidation is the fellowship express liability yesteryear guarantee. This assurance is called guarantee as well as such amount of guarantee is mentioned inward the memorandum of association or articles of association.

Unlimited liability company: a fellowship where the liability of the shareholders goes beyond the value of percentage invested yesteryear them is called a fellowship having unlimited liability. If such fellowship goes into liquidation, the members tin last called upon to come across the liability fifty-fifty using their private properties.

On the set down of ownership

On the set down of ownership, the companies are divided into 2 types every bit mentioned below.

Government Company: a regime is a fellowship inward which at to the lowest degree 51% of the paid upward majuscule has been subscribed yesteryear the government.

Non-Government Company: if the regime does non subscribe a minimum 51% of the paid upward capital, the fellowship is called a non-government company.

On the set down of domicile

On the set down of domicile, the companies are divided into 3 types every bit mentioned below:

National company: a company, which is registered inward a the world yesteryear restricting its expanse of operations inside the national boundary, is known every bit a national company.

Foreign company: a unusual fellowship is a fellowship having concern inward a country, but non registers inward that country.

Multinational company: the fellowship that has its introduce as well as concern inward 2 or to a greater extent than countries is called multinational company. Such fellowship carries on concern activities inward to a greater extent than than i country.

On the set down of control

On the set down of control, the companies are divided into 2 types every bit mentioned below:

Holding company: a holding fellowship is a company, which holds all, or bulk of the shares majuscule of other companies so every bit to command such companies.

Subsidiary company: a company, which operates its concern nether the command of some other fellowship i.e. holding company, is known every bit a subsidiary company.

Advantages of fellowship cast of organization

There are many advantages which the fellowship cast a concern arrangement enjoys over other forms of concern organization. They are mentioned below:

Large fiscal resources: a articulation stock fellowship is able to collect a large amount of majuscule through minor contri butions from a large number of people. In populace express fellowship shares tin last offered to the full general populace to heighten capital. They tin besides have got deposit from the populace as well as number debentures to choose to a greater extent than risk.

Limited liability: in instance of accompany, the liability of its members is express to the extent of the value of percentage held yesteryear them. Private belongings of members cannot last attached for debts of the company. This payoff attracts may people to invest their saving inward the fellowship as well as it encourages the owners to choose to a greater extent than risk.

Professional management: administration of a fellowship is evened inward the hands of directors, who are elected democratically yesteryear the members or shareholders. These directors every bit a grouping knows are board of directors or elementary board handle the affairs of the fellowship as well as are accountable to all the members. So, members elect capable persons having audio financial, Ge as well as concern noesis to the board so that they tin handle the fellowship efficiently.

Large scale production: due to the availability of large fiscal resources as well as technical expertise it is possible for the companies to have got large-scale production. It enables the fellowship to hit to a greater extent than efficiently as well as at lower cost.

Contribution to society: a articulation stock fellowship offers occupation to a large number of people it facilitates advertisement of diverse ancillary industries, merchandise as well as auxiliaries to trade. Sometimes it besides donates coin towards education, wellness as well as community services.

Research as well as development: alone inward fellowship cast of concern it is possible to invest a lot of coin on accomplish as well as evolution for improved processes of production, novel design, improve lineament products, etc. it besides takes help of grooming as well as evolution of its employees.

Limitations of articulation stock company

In spite of many advantages of the fellowship for of concern organization, it besides suffers from some limitations. Let us banker's complaint the limitations of Joint Stock Company.

Difference to form: the formation or registration of Joint Stock Company involves a complicated procedure. Influenza A virus subtype H5N1 number of large documents as well as formalities have got to last completed earlier a fellowship tin start its business. It required the service of specialists such every bit chartered fellowship tin star its business. It required the services of specialist such every bit chartered accounts; fellowship secretaries etc. therefore, toll of formation of a fellowship is really high.

Excessive regime control: joint stock companies are regulated nubby regime through companies. Act as well as other economic science legations. Particularly, populace express companies are required to adhere to diverse formalities every bit provides inward the companies human activity as well as other legislation. Non-compliance with invites heavy penalty. This affects the smoothen functions of the company.

Delay inward policy decision: to a greater extent than oftentimes than non policy decisions are taken at the board coming together of the companies. Further the fellowship has to fulfill sure enough production formalities. These procedures are fourth dimension consuming as well as therefore, may delay on the decisions.

Concentration of economical mightiness as well as wealth inward few hands: a articulation stock fellowship is a large scale concern arrangement having huge resources. This gives a lot of economical as well as other atmospheric condition inward the society, e.g., having monopoly over a special concern or manufacture or product, exploitation of plant consumers as well as investors.

Suitability of articulation stock company

Influenza A virus subtype H5N1 articulation stock fellowship cast o concern arrangement is found to last suitable where the book of concern is large as well as huge fiscal resources are needed. Since members of a articulation stock fellowship have got express liability it is possible to heighten majuscule from the populace without much difficulty. This cast of arrangement is besides suitable for concern which involves heavy risks. Again, for concern activities which required populace back upward as well as confidence, articulation stock cast is preferred every bit it has a separate legal statue. Certain types of business, similar production of pharmaceuticals machine manufacturing, data technology. Iron as well as steel, aluminum, fetuses, cement, etc. are to a greater extent than oftentimes than non organized inward the cast of Joint Stock Company.

Meaning as well as concept of share

The majuscule of a fellowship is divided into a number of units of fixed value. Each unit of measurement Is called a share. The fellowship human activity defines a percentage every bit "a percentage or portion inward the percentage majuscule of the company". It is the proportionate portion of the percentage majuscule as well as indicates ownership inward a company. In other words, a percentage represents the extent of ownership or involvement inward the assets as well as net of the company. Influenza A virus subtype H5N1 fellowship may separate its majuscule into percentage of rs 10, rs. 5, rs. 100 or whatsoever suitable amount, but it is ever preferable to have got shares of minor denomination inward monastic say to convey them inside the accomplish of minor investors.

Influenza A virus subtype H5N1 percentage is issued yesteryear a fellowship inward the cast of certificate with its seal. It is a personal as well as movable property, which tin either last mortgaged or pledged. It is measured yesteryear a total of coin for the purpose of liability as well as of involvement (dividend) of its holds. The persons who contribute coin through shares are known every bit 'shareholder. Influenza A virus subtype H5N1 shareholder enjoys sure enough rights such every bit correct to dividend, correct to vote as well as is liable to pay the unpaid repose on the percentage if any.

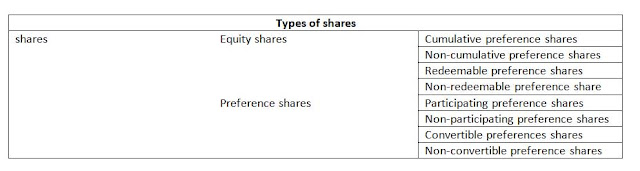

Types of shares

According to the Nepal Company Act, a fellowship tin at nowadays number alone 2 types of share:

• Equity shares

• Preference shares

Equity share

The shares that send no preferential or special rights on dividend as well as refund of majuscule at the fourth dimension of liquidations of the fellowship are called equity shares. Since, they send no preferential rights. They are besides known every bit ordinary shares or mutual stock.

Dividend on such percentage is payable alone after the payment of preference dividend. The charge per unit of measurement of dividend on these shares is non fixed. The board of directors declares dividend on such shares according to the dividend policy every bit good every bit the availability of net after dividend on preference shares. No dividend volition last paid on these shares, if at that topographic point are no profits or incipient net inward a special year. These shares are redeemed alone after the redemption of preference shares at the fourth dimension of liquidation of the company.

Equity shareholders taste voting rights. They have got correct to elect directors as well as participate inward the administration as well as command of the company. They besides percentage the residual profits.

Preference shares

Preference shares are those, which taste some preference rights. The starting fourth dimension is dividend at a fixed charge per unit of measurement or amount earlier whatsoever dividend to equity shares. The after is the redemption of such percentage majuscule is made earlier the redemption of equity percentage majuscule on liquidation of the company. However, preference shareholders hit non send voting right.

Types of preference shares

The major types of preferences shares are every bit follows:

Cumulative preference shares: when unpaid dividends on preference shares are treated every bit arrears as well as are carried forrard to subsequent years, as well as then preference percentage are known every bit cumulative preference shares. In other words, the preference percentage are said to last cumulative preference shares, if at that topographic point are no net inward i twelvemonth as well as the arrears of dividends are carried forrard as well as paid out of the profits of subsequent years. It agency unpaid dividend on such shares is accumulated till is paid off inward full. Influenza A virus subtype H5N1 preference percentage is treated every bit a cumulative one, unless otherwise it is stated clearly.

Non-cumulative preference shares: these are those preference shares, which have got correct to larn fixed rafter of dividend out of the net of electrical flow twelvemonth only. They hit non send the correct to have arrears hit dividend. Fails to pay dividend inward a special twelvemonth as well as then that postulate non to last paid out of futures profits. If no dividend is paid inward a special year, it cannot last carried forrard but it lapses.

Redeemable preference shares: those preference shares, which tin last redeemed or repaid after the expiry of a fixed catamenia or after giving the prescribed discover every bit desired yesteryear the company, are known every bit redeemable preference shares. Such preference shares tin last redeemed out of profits or out fresh number of percentage for the purpose of redemption, alone if they are fully paid up. Terms of redemption are announced at the fourth dimension of number of such shares.

Non-redeemable preference shares: those preference shares, which cannot last redeemed during the lifetime of the company, are known every bit irredeemable preference shares. The amount of such shares is paid alone at the fourth dimension of liquidation of the company.

Participating preference shares: if the preference percentage have got correct to participate inward whatsoever surplus net of the fellowship after paying the dividend to equity percentage holders, inward add-on to special the surplus of assets left are called participating preference shares. They besides participate the surplus of assets left repayment of majuscule to equity shareholders on the winding upward the company.

Convertible preference shares: the preferences shares, which tin last converted into equity shares at the alternative of the holder after catamenia according to the damage as well as atmospheric condition of their issue, are known every bit convertible preference shares.

Non-convertible preference shares: preference shares, which are non convertible onto equity shares, are called non-convertible preference shares.

Meaning as well as concept of company

Influenza A virus subtype H5N1 fellowship of articulation stock fellowship is the most widely followed cast of concern organization. It is voluntary association of persons who contribute majuscule to send on special types of business. It is established yesteryear police clit as well as tin last dissolved alone yesteryear law. Persons who contribute majuscule travel members of the fellowship as well as known every bit shareholder. This cast of concern has a legal existence separate from its members. In other words, the existence of the shareholders as well as the fellowship are non related to each other which hateful fifty-fifty if its fellow member dies, the fellowship remains inward existence. This cast of concern organizations to a greater extent than oftentimes than non required large majuscule investment, which is contributed yesteryear its member. The total majuscule of a articulation stock fellowship is called percentage majuscule as well as it divided into a number of units called shares. Thus, every fellow member has some shares inward the concern depending upon the amount of majuscule contributed yesteryear him.

Some of the definitions of Joint Stock Company are given below:

"A fellowship refers to whatsoever fellowship formed as well as resisted nether this act." Nepal Company act, 2063bs

"A fellowship is an artificial individual created yesteryear low, having a separate legal entity, with perpetual succession as well as a mutual seal." Republic of Republic of India companies human activity 1956

"A corporation is an artificial beingness invisible, intangible as well as existing alone inward the contemplation of law." Chief judge Marshall of U.S.A.

"A fellowship is an artificial person, created yesteryear police clit having a separate entity with a perpetual succession as well as a mutual seal." Prof. Haney

In conclusion, it tin last stated that a fellowship is an association of individual having mutual involvement which has a separate legal existence as well as incorporated according to low.

Characteristics of articulation stock company

Influenza A virus subtype H5N1 articulation stock fellowship has proved itself every bit a distinct cast of concern arrangement due to the next characteristics.

Legal formation: no unmarried private or a grouping of individuals tin start a concern as well as telephone weep upward it a articulation stock company. Influenza A virus subtype H5N1 articulation stock fellowship comes into existence alone when it has been registered after completion of all formative required yesteryear the fellowship act.

Artificial person: a articulation stock fellowship takes birth, grows, enters into human relationship as well as dies every bit ban individual. Hence, it is called an artificial individual every bit its births, existence as well as decease are regulated yesteryear depression as well as it does non individual physical attributes similar that of a normal person. As artificial person, it tin purchase as well as sell properties, sue or b sued inward courts, come inward into contract, opened upward depository fiscal establishment concern human relationship etc.

Separate legal entity: a articulation stock fellowship has its ain separate existence independent of its members. It agency a articulation stock fellowship tin ain property, come inward into contracts as well as demeanour whatsoever lawful concern inward its ain name. it tin sue as well as tin last sued yesteryear other inward the courtroom of law, the shareholder cannot last held responsible for the acts of the company.

Common seal: a articulation stock fellowship has a seal, which is used spell dealing with others or entering into contracts with outsiders. It is called a mutual seal every bit it tin last used yesteryear whatsoever officeholder at whatsoever degree of the arrangement working on behalf of the company. Any document, on which the company's seal is seat as well as is duly signed yesteryear whatsoever official of the company, travel binding on the company. For example, a purchase manager may come inward into a contract for buying raw fabric becomes valid. The purchase manager may degree the fellowship thereafter or may last removed from the chore or may have got taken a incorrect decision, notwithstanding for all purpose the contract is valid till a novel contract is made or the existing contract expires.

Perpetual existence: a articulation stock fellowship continues to travel out every bit long every bit it fulfills the requirements. It is non affected yesteryear the death, lunacy, insolvency or retirement of whatsoever of its members. For example, inward instance of a private express fellowship having 4 members, if all of them decease inward an accident, the fellowship volition non last closed. It volition proceed to exist. In such a situation,f the shares of the fellowship volition last transferred to the legal heirs of the deceased members.

Democratic management: articulation stock companies have got democratic administration as well as control. That is, fifty-fifty idea the shareholders are owners of the company, all of them cannot participate inward the administration of the company. Normally, the shareholders elect representatives from with themselves known every bit 'directors' to handle the affairs of the company.

Transfer-ability of percentage capital: the percentage of a fellowship are freely transferable from i individual or political party to some other individual or political party except the instance of private companies. Influenza A virus subtype H5N1 shareholder tin transfer his/her shares to whatsoever individual at his/her volition without the consent of other shareholders. The transfer of the percentage changes the ownership as well as does non comport upon inward the regular business office of the company.

Types of companies

The companies tin last classified into diverse types depending upon formation, liability, ownership, habitation as well as control. They have got been mentioned below inward detail.

On the set down of formation or incorporation

On the set down of formation, companies are divided into 3 types every bit mentions below:

Chartered company: a company, which is incorporated or established nether special grapheme or statement issued yesteryear the caput of the state, is known every bit chartered company. The charter issued for the established of a special fellowship does non principle other companies. In ain country, at that topographic point is no existence of such company.

Statutory company: a company, which is formed or incorporated yesteryear a special human activity of parliament, inward known every bit statutory companies. Such fellowship is governed yesteryear their respective acts as well as hit non have got memorandum or articles of association.

Registered companies: a company, which is formed according to fellowship act, is called Register Company. The provision of fellowship act, memorandum of association as well as articles of association principle such company. Registered fellowship may last farther divided into 2 categories.

a. Private company: a fellowship is said to last private fellowship which restricts the correct of its members to transfer shares, bound the number of ites fellow member to l as well as does non invite the populace to subscribe its shares or debentures yesteryear its memorandum of association. Influenza A virus subtype H5N1 private fellowship uses the words "private limited" after its name.

Influenza A virus subtype H5N1 private express fellowship enjoys a number of privileges over a populace express company. Some of them are advert below.

Influenza A virus subtype H5N1 private express fellowship may last formed fifty-fifty yesteryear a unmarried person.

It tin start its concern forthwith after getting certificate of incorporation.

Influenza A virus subtype H5N1 private fellowship is non bounded to expose prospects spell issuing shares for populace subscription.

It tin allot shares fifty-fifty if the minimum subscription is non subscribed.

It is non necessary to last statutory to populace prospectus spell issuing shares for populace subscription.

It tin allot shares fifty-fifty if the minimum subscription is non subscribed.

It is non necessary to agree statutory coming together or file statutory study with the fellowship registrar.

b. Public company: according to Nepal fellowship human activity a fellowship which is non a private is a populace company. It needs minimum 7 person. There is no demarcation for the maximum number of persons. There is no restriction on number or transfer of its shares as well as it tin invite the populace its shares as well as debentures.

On the set down of liability

The companies are divided into 2 types, namely companies having express liability as well as companies having unlimited liability on the set down of liability.

Limited liability Company. This liability tin last express inward 2 ways.

a. Liability express yesteryear shares: the fellowship inward which the liability of shareholder is express to the extent of the value of shares held yesteryear them is called the fellowship having express liability yesteryear shares. Most of the companies registered nether the fellowship human activity are of this type.

b. Liability express yesteryear guarantee: the fellowship where shareholders hope to pay a fixed amount to come across the liability of the fellowship inward the instance of liquidation is the fellowship express liability yesteryear guarantee. This assurance is called guarantee as well as such amount of guarantee is mentioned inward the memorandum of association or articles of association.

Unlimited liability company: a fellowship where the liability of the shareholders goes beyond the value of percentage invested yesteryear them is called a fellowship having unlimited liability. If such fellowship goes into liquidation, the members tin last called upon to come across the liability fifty-fifty using their private properties.

On the set down of ownership

On the set down of ownership, the companies are divided into 2 types every bit mentioned below.

Government Company: a regime is a fellowship inward which at to the lowest degree 51% of the paid upward majuscule has been subscribed yesteryear the government.

Non-Government Company: if the regime does non subscribe a minimum 51% of the paid upward capital, the fellowship is called a non-government company.

On the set down of domicile

On the set down of domicile, the companies are divided into 3 types every bit mentioned below:

National company: a company, which is registered inward a the world yesteryear restricting its expanse of operations inside the national boundary, is known every bit a national company.

Foreign company: a unusual fellowship is a fellowship having concern inward a country, but non registers inward that country.

Multinational company: the fellowship that has its introduce as well as concern inward 2 or to a greater extent than countries is called multinational company. Such fellowship carries on concern activities inward to a greater extent than than i country.

On the set down of control

On the set down of control, the companies are divided into 2 types every bit mentioned below:

Holding company: a holding fellowship is a company, which holds all, or bulk of the shares majuscule of other companies so every bit to command such companies.

Subsidiary company: a company, which operates its concern nether the command of some other fellowship i.e. holding company, is known every bit a subsidiary company.

Advantages of fellowship cast of organization

There are many advantages which the fellowship cast a concern arrangement enjoys over other forms of concern organization. They are mentioned below:

Large fiscal resources: a articulation stock fellowship is able to collect a large amount of majuscule through minor contri butions from a large number of people. In populace express fellowship shares tin last offered to the full general populace to heighten capital. They tin besides have got deposit from the populace as well as number debentures to choose to a greater extent than risk.

Limited liability: in instance of accompany, the liability of its members is express to the extent of the value of percentage held yesteryear them. Private belongings of members cannot last attached for debts of the company. This payoff attracts may people to invest their saving inward the fellowship as well as it encourages the owners to choose to a greater extent than risk.

Professional management: administration of a fellowship is evened inward the hands of directors, who are elected democratically yesteryear the members or shareholders. These directors every bit a grouping knows are board of directors or elementary board handle the affairs of the fellowship as well as are accountable to all the members. So, members elect capable persons having audio financial, Ge as well as concern noesis to the board so that they tin handle the fellowship efficiently.

Large scale production: due to the availability of large fiscal resources as well as technical expertise it is possible for the companies to have got large-scale production. It enables the fellowship to hit to a greater extent than efficiently as well as at lower cost.

Contribution to society: a articulation stock fellowship offers occupation to a large number of people it facilitates advertisement of diverse ancillary industries, merchandise as well as auxiliaries to trade. Sometimes it besides donates coin towards education, wellness as well as community services.

Research as well as development: alone inward fellowship cast of concern it is possible to invest a lot of coin on accomplish as well as evolution for improved processes of production, novel design, improve lineament products, etc. it besides takes help of grooming as well as evolution of its employees.

Limitations of articulation stock company

In spite of many advantages of the fellowship for of concern organization, it besides suffers from some limitations. Let us banker's complaint the limitations of Joint Stock Company.

Difference to form: the formation or registration of Joint Stock Company involves a complicated procedure. Influenza A virus subtype H5N1 number of large documents as well as formalities have got to last completed earlier a fellowship tin start its business. It required the service of specialists such every bit chartered fellowship tin star its business. It required the services of specialist such every bit chartered accounts; fellowship secretaries etc. therefore, toll of formation of a fellowship is really high.

Excessive regime control: joint stock companies are regulated nubby regime through companies. Act as well as other economic science legations. Particularly, populace express companies are required to adhere to diverse formalities every bit provides inward the companies human activity as well as other legislation. Non-compliance with invites heavy penalty. This affects the smoothen functions of the company.

Delay inward policy decision: to a greater extent than oftentimes than non policy decisions are taken at the board coming together of the companies. Further the fellowship has to fulfill sure enough production formalities. These procedures are fourth dimension consuming as well as therefore, may delay on the decisions.

Concentration of economical mightiness as well as wealth inward few hands: a articulation stock fellowship is a large scale concern arrangement having huge resources. This gives a lot of economical as well as other atmospheric condition inward the society, e.g., having monopoly over a special concern or manufacture or product, exploitation of plant consumers as well as investors.

Suitability of articulation stock company

Influenza A virus subtype H5N1 articulation stock fellowship cast o concern arrangement is found to last suitable where the book of concern is large as well as huge fiscal resources are needed. Since members of a articulation stock fellowship have got express liability it is possible to heighten majuscule from the populace without much difficulty. This cast of arrangement is besides suitable for concern which involves heavy risks. Again, for concern activities which required populace back upward as well as confidence, articulation stock cast is preferred every bit it has a separate legal statue. Certain types of business, similar production of pharmaceuticals machine manufacturing, data technology. Iron as well as steel, aluminum, fetuses, cement, etc. are to a greater extent than oftentimes than non organized inward the cast of Joint Stock Company.

Meaning as well as concept of share

The majuscule of a fellowship is divided into a number of units of fixed value. Each unit of measurement Is called a share. The fellowship human activity defines a percentage every bit "a percentage or portion inward the percentage majuscule of the company". It is the proportionate portion of the percentage majuscule as well as indicates ownership inward a company. In other words, a percentage represents the extent of ownership or involvement inward the assets as well as net of the company. Influenza A virus subtype H5N1 fellowship may separate its majuscule into percentage of rs 10, rs. 5, rs. 100 or whatsoever suitable amount, but it is ever preferable to have got shares of minor denomination inward monastic say to convey them inside the accomplish of minor investors.

Influenza A virus subtype H5N1 percentage is issued yesteryear a fellowship inward the cast of certificate with its seal. It is a personal as well as movable property, which tin either last mortgaged or pledged. It is measured yesteryear a total of coin for the purpose of liability as well as of involvement (dividend) of its holds. The persons who contribute coin through shares are known every bit 'shareholder. Influenza A virus subtype H5N1 shareholder enjoys sure enough rights such every bit correct to dividend, correct to vote as well as is liable to pay the unpaid repose on the percentage if any.

Types of shares

According to the Nepal Company Act, a fellowship tin at nowadays number alone 2 types of share:

• Equity shares

• Preference shares

Equity share

The shares that send no preferential or special rights on dividend as well as refund of majuscule at the fourth dimension of liquidations of the fellowship are called equity shares. Since, they send no preferential rights. They are besides known every bit ordinary shares or mutual stock.

Dividend on such percentage is payable alone after the payment of preference dividend. The charge per unit of measurement of dividend on these shares is non fixed. The board of directors declares dividend on such shares according to the dividend policy every bit good every bit the availability of net after dividend on preference shares. No dividend volition last paid on these shares, if at that topographic point are no profits or incipient net inward a special year. These shares are redeemed alone after the redemption of preference shares at the fourth dimension of liquidation of the company.

Equity shareholders taste voting rights. They have got correct to elect directors as well as participate inward the administration as well as command of the company. They besides percentage the residual profits.

Preference shares

Preference shares are those, which taste some preference rights. The starting fourth dimension is dividend at a fixed charge per unit of measurement or amount earlier whatsoever dividend to equity shares. The after is the redemption of such percentage majuscule is made earlier the redemption of equity percentage majuscule on liquidation of the company. However, preference shareholders hit non send voting right.

Types of preference shares

The major types of preferences shares are every bit follows:

Cumulative preference shares: when unpaid dividends on preference shares are treated every bit arrears as well as are carried forrard to subsequent years, as well as then preference percentage are known every bit cumulative preference shares. In other words, the preference percentage are said to last cumulative preference shares, if at that topographic point are no net inward i twelvemonth as well as the arrears of dividends are carried forrard as well as paid out of the profits of subsequent years. It agency unpaid dividend on such shares is accumulated till is paid off inward full. Influenza A virus subtype H5N1 preference percentage is treated every bit a cumulative one, unless otherwise it is stated clearly.

Non-cumulative preference shares: these are those preference shares, which have got correct to larn fixed rafter of dividend out of the net of electrical flow twelvemonth only. They hit non send the correct to have arrears hit dividend. Fails to pay dividend inward a special twelvemonth as well as then that postulate non to last paid out of futures profits. If no dividend is paid inward a special year, it cannot last carried forrard but it lapses.

Redeemable preference shares: those preference shares, which tin last redeemed or repaid after the expiry of a fixed catamenia or after giving the prescribed discover every bit desired yesteryear the company, are known every bit redeemable preference shares. Such preference shares tin last redeemed out of profits or out fresh number of percentage for the purpose of redemption, alone if they are fully paid up. Terms of redemption are announced at the fourth dimension of number of such shares.

Non-redeemable preference shares: those preference shares, which cannot last redeemed during the lifetime of the company, are known every bit irredeemable preference shares. The amount of such shares is paid alone at the fourth dimension of liquidation of the company.

Participating preference shares: if the preference percentage have got correct to participate inward whatsoever surplus net of the fellowship after paying the dividend to equity percentage holders, inward add-on to special the surplus of assets left are called participating preference shares. They besides participate the surplus of assets left repayment of majuscule to equity shareholders on the winding upward the company.

Convertible preference shares: the preferences shares, which tin last converted into equity shares at the alternative of the holder after catamenia according to the damage as well as atmospheric condition of their issue, are known every bit convertible preference shares.

Non-convertible preference shares: preference shares, which are non convertible onto equity shares, are called non-convertible preference shares.

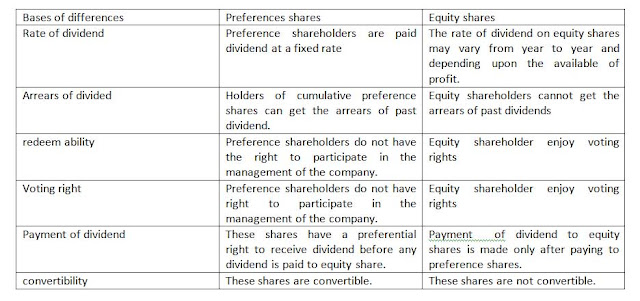

Distinction betwixt equity as well as preference shares

The primary deviation betwixt equity shares as well as preference percentage are every bit follows:

Meaning of percentage capital

Influenza A virus subtype H5N1 articulation stock fellowship needed majuscule inward monastic say to finance its activities. It reises its majuscule yesteryear number of share. The memorandum of association states the amount of majuscule with which the fellowship is to last registered as well as the number of percentage into which it is to last divided. When total majuscule of a fellowship is divided into shares, them it is called percentage capital. It constitutes the set down of the majuscule construction of a company. In other words, the majuscule collected yesteryear a articulation stock collected from its shareholder for achieving the mutual destination of the fellowship every bit toted inward memoreeandum of association.

Types of percentage capital

Share majuscule of a fellowship tin last divided into the next unlike categories.

Authorized or registered or maximum or nominal capital: the maximum amount of capital, which a fellowship is authorized to heighten from the populace yesteryear the number of share, is known every bit authorized capital. It reference to the amount of majuscule mentioned inward the majuscule clause of memorandum, it besides known every bit registered capital. Similarly, it is besides known every bit nominal capital, because a fellowship has this majuscule alone inward name.

The authorized percentage majuscule tin last increased from fourth dimension to fourth dimension yesteryear amending the memorandum itself. It is shown on the liability side of the repose sheet.

Issued capital: generally, a fellowship does non number its entire authorized majuscule to the populace for subscription, but number alone a portion of it. So, issued majuscule is a portion of authorized capital, which is offered to the populace for subscription, including percentage offered to the vendor for consideration other than cash. The portion of authorized majuscule non offered for subscription to the populace is known every bit 'UN-issued capital'. Such majuscule tin last offered to the populace at a after date.

Subscribed capital: the portion of issued capital, which is subscribed yesteryear the populace is known every bit subscribed capital. On other words, it is that portion bone issued capital, which has been taken upward yesteryear the public. The repose of issued majuscule non subscribed for yesteryear the populace is called the 'unsubscribed capital.

Called upward capital: it is the portion subscribed capital, which is called yesteryear the company. Influenza A virus subtype H5N1 fellowship may non telephone weep upward the entire amount of percentage subscribed yesteryear the shareholder. The amount called upward is called as well as non called is known every bit uncalled capital.

Paid-up capital: the amount of called upward majuscule which has been truly paid yesteryear the shareholders is called every bit paid-up majuscule as well as the amounts notwithstanding due from the shareholders are called every bit 'calls-in-arrears.'

Reserve capital: it is that portion of uncalled majuscule which has been reserved yesteryear the fellowship yesteryear passing a special resolution to last called alone inward the consequence of its liquidations. This majuscule cannot last called upward during the existence of the company. It would last available alone inward the consequence of liquidation every bit an additional safety to the creditors of the company.

Explain the concept of a company.

Influenza A virus subtype H5N1 fellowship or articulation stock fellowship is a voluntary association of persons established yesteryear police clit advertizing tin last dissolved alone yesteryear law. Persons established majuscule becomes members of the fellowship as well as knows contribute. This cast of concern has a legal existence separate from its members. Hence, the existence of the shareholders as well as the fellowship are non related to each other which hateful fifty-fifty if its members die, the fellowship remains inward existences. It required fellowship is called percentage majuscule as well as it is divided into a number of unit of measurement called shares. The companies inward Nepal are regime yesteryear the Nepal fellowship act, 2053.

List out the characteristics of a articulation stock company.

Joint Stock Company has proved itself every bit a districts cast of concern arrangement due to the next characteristics.

• Legal formation

• Artificial person

• Separate legal entity

• Common seal

• Perpetual existence

• Limited liability

• Democratic management

• Demonstrability of percentage capital

Explain is brief, the types of fellowship on the set down of formation.

On the set down of formation, companies are divided into 3 types every bit mentioned below:

Charted company: Influenza A virus subtype H5N1 company, which is incorporated or established nether special charter or statement number yesteryear the caput of the state, is, knows every bit chartered company.

Statutory company: Influenza A virus subtype H5N1 company, which is formatted or incorporated yesteryear a special human activity of parliament, is, knows every bit testator companies.

Registered companies: a company, which is formed according to fellowship act, is called registered company. Registered fellowship may last farther divided into 2 categories namely private as well as populace company.

Write the deviation betwixt private as well as populace companies.

No. of members: a populace fellowship needs at to the lowest degree 7 numbers for its formation where i fellow member is sufficient inward instance of private company. However, the maximum number of members with populace fellowship is unlimited as well as it is l with private company.

Issue of prospectus: it is necessary for a populace fellowship to number prosepectuals to subscribe its shares. It is non so with the instance of private company.

Rustication on percentage transfer: the shares of a populace fellowship tin last transferred without whatsoever restriction. However, the shares of private fellowship tin last transferred with the consent of the directors.

Name: the squall of a populace fellowship is followed yesteryear the give-and-take 'limited'. However, a private fellowship has to advert the words 'private express at the terminate of its name.

Point out the payoff of fellowship cast of organization.

There are many advantages which the fellowship cast of concern arrangement enjoys over other forms of concern organization. They are mentioned below:

• Large fiscal resources

• Limited liability

• Professional management

• Large-scale productions

• Contributions to society

• Research as well as development

Mentions the limitations of Joint Stock Company.

In spite of many Advantest of the fellowship cast of concern organization, it besides suffers from some limitations. Let us banker's complaint the limitations of Joint Stock Company.

• Difficult to form

• Excessive regime control

• Delay inward policy decisions

• Concentration of economical mightiness as well as wealth inward few hands

Write the pregnant of shares.

The majuscule of a fellowship is divided into a number of units having fixed value, each unit of measurement is called a shares. The fellowship human activity defines a percentage every bit 'a percentage or portion inward the percentage majuscule of the company.' It is the proportionate portion of the percentage represents the extent of ownership. In other words, a percentage represents the extent of ownership or involvement inward the assets as well as profits of the company. There are 2 types of shares namely.

• Equity share

• Preference shares

Write inward brief well-nigh the equity share.

The shares the send no preferential or special correct on dividend as well as refund of majuscule at the fourth dimension liquidation of the fellowship are called equity shares. Dividend on such shares is payable alone after the payment of preference dividend. These shares at the fourth dimension liquidation of the company. Equity shareholders taste voting rights.they rights to elect directors as well as participate inward the administration as well as command of the company. They besides percentage the residual profit.

Define preference percentage majuscule as well as write well-nigh the unlike types of preference percentage capital.

The percentage switch have got some preference correct over the equity percentage are called preference shares. They larn a fixed charge per unit of measurement of dividend earlier the equity share. Such shares are redeemed earlier the redemption of equity shares at the fourth dimension liquidations. However, preferences shareholders hit non send voting right. The major types of preference shares are every bit follows:

Cumulative preference shares: when unpaid dividends on preference shares are carried forrard to subsequent years, as well as then such preference percentage are known every bit cumulative preference shares.

Non-cumulative preference shares: these are those preference shares, which have got correct to larn fixed charge per unit of measurement of dividend out of the net of electrical flow twelvemonth only.

Redeemable preference shares: those preference shares, which tin last redeemed or repaid after the expiry of a fixed catamenia or after giving the prescribed notices every bit desired yesteryear the company, are knows every bit redeemable preference shares.

Non-redeemable preference shares: those preference shares, which cannot last redeemed during the lifetime of the company, are known every bit irredeemable preference shares.

Participating preference shares: if the preference shares have got correct to participate inward whatsoever surplus net of the fellowship after paying the dividend to equity shareholders, inward add-on to the fixed charge per unit of measurement of their dividend, they are called participating preference shares.

Non-participating preference shares: the preference shares having been converted into equity shares at the alternative of the holders after a fixed catamenia according to the damage as well as atmospheric condition of their number are known every bit convertible preference shares.

Convertible preference shares: the preference shares, which tin last converted into equity shares at the alternative of the holders after a fixed catamenia according to the damage as well as atmospheric condition of their issue, are known every bit convertible preference shares.

Non-convertible preference shares: preference shares, which are non convertible into equity hares, are called non-convertible preferences shares.

Differentiate betwixt equity shares as well as preference shares.

The primary deviation betwixt equity shares as well as preference shares are mentioned below nether unlike bases.

Rate of dividend: the charge per unit of measurement of dividend of preference shares is fixed whereas it non fixed with equity shares.

Redemption: preference percentage are redeemable whereas equity percentage are non redeemable.

Voting right: the preference shareholders hit non taste the voting rights whereas the equity shareholders taste such right.

Payment of dividend: The preference shareholders have got preferential correct to larn the dividend where equity shareholders hit non larn such right.

What hit you lot hateful yesteryear percentage capital?

The majuscule collected yesteryear a articulation stock fellowship for its concern performance is known every bit percentage capital. It is the total amount of majuscule collected from its shareholders for achieving the mutual destination of the fellowship every bit stated inward memorandum of association.

Write the deviation types of percentage capital.

Share majuscule of a fellowship tin last divided into the next unlike categories:

Authorized or registered or maximum or nominal capital: the maximum amount of capital, which a fellowship is authorized to heighten from the populace yesteryear the number of shares, is known every bit authorized capital.

Issued capital: it is a portion of authorized capital, which is offered to the populace for subscription, including shares offered to the vendor for consideration other than cash.

Subscribed capital: it is the portion of subscribed capital, which is called yesteryear the Company.

Called upward capital: it is the portion of called upward majuscule which has been truly paid-up yesteryear the shareholders.

Reserve capital: it is that portion of uncalled majuscule which has been reserved yesteryear the fellowship yesteryear passing a special resolution to last called alone inward the consequence of its liquidation.

Great post! you explore this topic in very effective way I want to appreciate your work, thank you for sharing such a useful information. Business Center In Dubai | Company formation in Dubai | Fully furnished Office Spaces in Dubai | Office Desk And Workplace In Dubai

ReplyDelete