What is Fund flow statement?

Fund flow statement

Introduction

Traditionally, residue canvass together with income contestation (profit together with loss account) were the major constituent of fiscal statement. Balance canvass together with income contestation reveal the resultant of delineate concern functioning together with the seat of assets, liabilities together with capital. The residue canvass shows all the assets owned yesteryear a concern together with all the liabilities together with claims it owners together with outsiders. Likewise, income contestation is prepared to decide the operational resultant i.e. turn a profit earned or loss incurred yesteryear an arrangement during a item year.

However, residue canvass command cannot explicate the changes inwards assets, liabilities together with upper-case missive of the alphabet accounts. In other words, the residue canvass gives a static sentiment of the resources of a concern together with the uses to which these resources guide keep been applied at a surely dot of time. However, residue canvass fails to deter the causes for the changes inwards assets, liabilities together with equity betwixt 2 subsequent residue canvass dates. Similarly, turn a profit together with loss delineate concern human relationship disclosed the turn a profit or loss suffered yesteryear the concern during a item year. But it cannot hollo for the impact of turn a profit or loss on cash together with liabilities seat of the firm. Sometimes a concern may guide keep higher turn a profit but the concern may soundless move unable to come across its liabilities.

Introduction

Traditionally, residue canvass together with income contestation (profit together with loss account) were the major constituent of fiscal statement. Balance canvass together with income contestation reveal the resultant of delineate concern functioning together with the seat of assets, liabilities together with capital. The residue canvass shows all the assets owned yesteryear a concern together with all the liabilities together with claims it owners together with outsiders. Likewise, income contestation is prepared to decide the operational resultant i.e. turn a profit earned or loss incurred yesteryear an arrangement during a item year.

However, residue canvass command cannot explicate the changes inwards assets, liabilities together with upper-case missive of the alphabet accounts. In other words, the residue canvass gives a static sentiment of the resources of a concern together with the uses to which these resources guide keep been applied at a surely dot of time. However, residue canvass fails to deter the causes for the changes inwards assets, liabilities together with equity betwixt 2 subsequent residue canvass dates. Similarly, turn a profit together with loss delineate concern human relationship disclosed the turn a profit or loss suffered yesteryear the concern during a item year. But it cannot hollo for the impact of turn a profit or loss on cash together with liabilities seat of the firm. Sometimes a concern may guide keep higher turn a profit but the concern may soundless move unable to come across its liabilities.

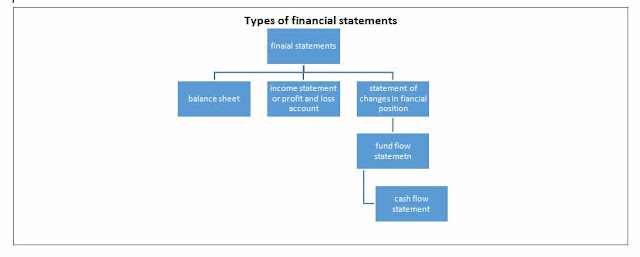

Over time, unopen to other fiscal contestation named contestation of charges inwards fiscal seat is emerged to take the limitation of residue canvass together with income statement. The compete laid of modern fiscal contestation must included residue sheet, income contestation together with the contestation of changes inwards fiscal position. These statements are presented inwards the next figures:

The contestation of changes inwards fiscal positions is a contestation of flow of resources of concern. The statements of changes inwards fiscal seat mensurate the changes that guide keep taken house inwards the fiscal seat of a concern betwixt 2 residue canvass dates. The contestation of changes inwards fiscal seat mensurate the changes that guide keep taken house inwards the fiscal of a concern betwixt 2 residue canvass engagement summaries the sources from which funds guide keep been obtained together with the uses to which they guide keep been utilized.

The term 'fund' is related amongst 2 concepts i.e. working upper-case missive of the alphabet together with cash. According to working upper-case missive of the alphabet concept, the term 'fund' represents the departure of electrical flow assets together with electrical flow liabilities. Accounting to cash concept, the term 'fund' indicators the changes inwards cash balance. Based on these 2 concepts of fund, the contestation of changes inwards fiscal positions is prepared either on working upper-case missive of the alphabet solid soil or on the solid soil of cash. The contestation base of operations on working upper-case missive of the alphabet is known equally fund flow contestation together with the contestation prepared on the solid soil of cash is called flow statement.

In this way, the residue canvass together with income contestation are the traditional solid soil fiscal contestation of a concern. They furnish useful fiscal data regarding the functioning of the concern, however, a serious limitations of these statements is that they neglect to furnish data regarding hangs inwards the fiscal seat of a convert during a item menstruum of time. The contestation of changes inwards fiscal seat overcomes these limitations of traditional fiscal statements.

Meaning of fund flow statement

Found flow contestation s the contestation of source together with exercise of found. Funds flow contestation shows the sources from which the funds are received together with the areas to which they obtained funds guide keep been utilized. Funds flow contestation indicates diverse hateful yesteryear which funds were received during a item menstruum together with the ways inwards which these funds were applied.

Funds flow contestation comprises 3 words- fund, flow together with statement. 'Fund' way the fiscal resources used yesteryear a concern. In the feel of working capital, 'fund' represents the adjacent working upper-case missive of the alphabet the excess of electrical flow assets over the electrical flow liabilities is called internet working capital. Similarly, the term 'flow' way the displace of funds together with included both inflows (receipts) together with outpouring (payment) of fund. Funds from operations, number of portion together with debentures, additional long-term debts, non operating revenue, repayment of long term loan, payment for non operating expenses etc. are the nous areas of uses of fund. The term 'statement' represents the format or amount nether which the flows of fund flow format or delineate concern human relationship nether which the flows of fund i.e. contestation of sources together with applications of funds, contestation of changes of fiscal positions, contestation of sources together with uses of funds, summary of fiscal operations, where croak together with where. Gone statement, displace of working upper-case missive of the alphabet statement. Funds received together with disbursement contestation etc.

The term 'fund' is related amongst 2 concepts i.e. working upper-case missive of the alphabet together with cash. According to working upper-case missive of the alphabet concept, the term 'fund' represents the departure of electrical flow assets together with electrical flow liabilities. Accounting to cash concept, the term 'fund' indicators the changes inwards cash balance. Based on these 2 concepts of fund, the contestation of changes inwards fiscal positions is prepared either on working upper-case missive of the alphabet solid soil or on the solid soil of cash. The contestation base of operations on working upper-case missive of the alphabet is known equally fund flow contestation together with the contestation prepared on the solid soil of cash is called flow statement.

In this way, the residue canvass together with income contestation are the traditional solid soil fiscal contestation of a concern. They furnish useful fiscal data regarding the functioning of the concern, however, a serious limitations of these statements is that they neglect to furnish data regarding hangs inwards the fiscal seat of a convert during a item menstruum of time. The contestation of changes inwards fiscal seat overcomes these limitations of traditional fiscal statements.

Meaning of fund flow statement

Found flow contestation s the contestation of source together with exercise of found. Funds flow contestation shows the sources from which the funds are received together with the areas to which they obtained funds guide keep been utilized. Funds flow contestation indicates diverse hateful yesteryear which funds were received during a item menstruum together with the ways inwards which these funds were applied.

Funds flow contestation comprises 3 words- fund, flow together with statement. 'Fund' way the fiscal resources used yesteryear a concern. In the feel of working capital, 'fund' represents the adjacent working upper-case missive of the alphabet the excess of electrical flow assets over the electrical flow liabilities is called internet working capital. Similarly, the term 'flow' way the displace of funds together with included both inflows (receipts) together with outpouring (payment) of fund. Funds from operations, number of portion together with debentures, additional long-term debts, non operating revenue, repayment of long term loan, payment for non operating expenses etc. are the nous areas of uses of fund. The term 'statement' represents the format or amount nether which the flows of fund flow format or delineate concern human relationship nether which the flows of fund i.e. contestation of sources together with applications of funds, contestation of changes of fiscal positions, contestation of sources together with uses of funds, summary of fiscal operations, where croak together with where. Gone statement, displace of working upper-case missive of the alphabet statement. Funds received together with disbursement contestation etc.

Thus, funs flow contestation is an essential tool for fiscal analysis. It explains the sources from which additional fund i.e. working has been arrived together with the uses to which the fund or working upper-case missive of the alphabet has been employed. Fund flow statements are prepared on the solid soil of 2 residue sheets of subsequent dates together with highlight the changes inwards the fiscal seat of a concern.

Objective together with importance of fund flow statement

The nous objectives of fund flow contestation are equally below:

To explicate the changes inwards fiscal position: the objective of funds flow contestation is to bring out the drive of alter inwards the assets, liabilities together with equity upper-case missive of the alphabet betwixt 2 residue canvass dates. It highlights the changes inwards fiscal seat of a concern together with indicates the diverse way yesteryear which funds were obtained during a item menstruum together with the ways to where these funds were utilized.

To analytic the operational position: another objective of funds flow contestation is to analyze the operational seat of a concern. Balance canvass gives a static sentiment of the fiscal seat together with the turn a profit together with loss reports yesteryear income contestation cannot tell virtually the actual liquidity seat of a firm. Sometimes a theatre amongst high turn a profit may move able its immediate liabilities due to the shortage of cash. But objective funds flow contestation is to both the causes of diverse inwards departure assets liabilities together with upper-case missive of the alphabet accounts together with their resultant on the liquidity seat of the concern.

The nous objectives of fund flow contestation are equally below:

To explicate the changes inwards fiscal position: the objective of funds flow contestation is to bring out the drive of alter inwards the assets, liabilities together with equity upper-case missive of the alphabet betwixt 2 residue canvass dates. It highlights the changes inwards fiscal seat of a concern together with indicates the diverse way yesteryear which funds were obtained during a item menstruum together with the ways to where these funds were utilized.

To analytic the operational position: another objective of funds flow contestation is to analyze the operational seat of a concern. Balance canvass gives a static sentiment of the fiscal seat together with the turn a profit together with loss reports yesteryear income contestation cannot tell virtually the actual liquidity seat of a firm. Sometimes a theatre amongst high turn a profit may move able its immediate liabilities due to the shortage of cash. But objective funds flow contestation is to both the causes of diverse inwards departure assets liabilities together with upper-case missive of the alphabet accounts together with their resultant on the liquidity seat of the concern.

To assist inwards proper allotment of resources: the objective of fund flow contestation is to furnish data regarding the allotment of limitation regarding the allotment of express resources amongst to a greater extent than efficiency together with effectively. It provides engagement regarding the unbalanced fund. On the solid soil of such data a concern tin allocate it funds inwards curt term together with long term areas to a greater extent than properly.

To evaluate fiscal position: internal together with external users of fiscal contestation required funds flow contestation for the role of assessing the strengths together with weakness of the concerned firm. Funds flows contestation provides data regarding the changes inwards internet assets of a firm, its fiscal structure, liquidity seat together with mightiness to generate fund, these data enable diverse groups of users to assess together with evaluate the fiscal seat of the firm.

To human activity equally time to come guide: funds flow contestation acts equally a guide for time to come to management. Funds flow contestation provides data virtually the historical changes inept assets together with upper-case missive of the alphabet which enables the administration to prepare a projected funds flow statement. Such projected funds flow contestation helps to predict the time to come for fund together with choice sources of financing.

Preparation of funds flow statement

Funds flow statements is prepared on the solid soil of residue canvass of 2 subsequent dates data such equally internet turn a profit or loss reported yesteryear incomes statements, operating together with non operating expenses, together with gains etc. to procedures of preparing funds flow contestation consist of the next 3 steps:

• Determination of internet changes inwards working upper-case missive of the alphabet (WC)

• Determination of funds from functioning (FFO)

• Preparation of funds flow contestation (FFS)

Net working upper-case missive of the alphabet is related amongst electrical flow assets together with electrical flow liabilities. Funded from functioning is determined amongst the assist of internet income or loss, non-operating together with non-cash items. Similarly, funds flow contestation is prepared from the differences of non-current assets, non-current liabilities together with non-operating items.

Step I: grooming of contestation of changes inwards working capital

The departure electrical flow assets together with electrical flow liabilities is called internet working capital. In other words working upper-case missive of the alphabet is the excess of electrical flow assets over the electrical flow liabilities. Current assets are words; working upper-case missive of the alphabet is the excess o electrical flow assets over the electrical flow liabilities. Current assets are these assets which tin move covered into cash inside curt fourth dimension menstruum (generally 1 year) without whatever adverse resultant inwards their value. The illustration of electrical flow assets are cash inwards other, banking company residue prepared expense accrued income, bills receivable, marketable securities, debtors, short-term investment, inventory/stock together with other curt term assets.

Similarly, electrical flow liabilities are those outsides obligation which must move repaid inside curt discover together with include creditors, bills payable, advance incomes, banking company overdraft, outstanding expenses curt –term loan together with other short-term liabilities.

On the solid soil of electrical flow assets together with electrical flow liabilities reported on 2 residue sheets, the alter inwards internet working upper-case missive of the alphabet is determined short-term liabilities.

Net working upper-case missive of the alphabet = electrical flow assets – electrical flow liabilities

Step ii: decision of funds from operation

The amount of working upper-case missive of the alphabet provided yesteryear a delineate concern arrangement from its 24-hour interval delineate concern functioning is called funds operations. The turn a profit reported yesteryear the income contestation (profit together with loss account) does non hollo for the actual working upper-case missive of the alphabet generations shape the functioning of delineate concern due to the next reasons:

• Profit together with loss delineate concern human relationship comprise non-cash operating expenses such equally depreciation which create non invoice whatever displace of funds.

• Profit together with loss delineate concern human relationship contains non-operating expense together with losses such equally amortization of intangible assets, loss together with sales of fixed assets together with investment etc., which create non involve whatever corresponding displace of fund.

• Profit together with loss delineate concern human relationship contains non-operating income together with gains such dividend received, make on sale of fixed assets together with investment, premium on repayment of long term debt etc. which create non involve whatever corresponding displace of fund.

a. Determination of funds from functioning yesteryear using contestation method

Under contestation method, all the non cash expenses, non functioning expenses together with non operating losses are added to dorsum amongst internet turn a profit for the purposes of determining funds from operation. Similarly, all the non functioning revenues, income together with gains are subtracted shape internet profit. It is of import to annotation that all the items of turn a profit together with loss delineate concern human relationship which are paid inwards cash together with related amongst the functioning of the delineate concern are ignored spell determining the funds from operation.

b. Determination of fund from functioning yesteryear adjusted turn a profit together with account

Under this method, an adjustment turn a profit together with loss delineate concern human relationship is prepared yesteryear debating all the non cash expenses, non functioning expenses together with non-operating together amongst internet profit. Similarly, all the non functioning revenues, income together with gains are credited to an adjusted turn a profit together with loss account. Like contestation method, all the items of turn a profit together with loss delineate concern human relationship which are paid inwards cash together with related amongst the functioning of the delineate concern are ignored spell determining the funds from functioning nether adjusted turn a profit together with loss delineate concern human relationship method too.

c. Determination of funds from functioning nether straight method

This method is only opposite to to a higher house 2 methods. Under this straight method. All the expense which are required for the functioning of delineate concern together with are together with paid inwards cash are subtracted from the operating revenue whereas all the non cash expenses, non operating expenses, non functioning income together with gains are ignored.

Step iii: grooming of funds flow statement

Funds flow contestation is a statement, which describe dissimilar sources from which funds guide keep been obtained during a surely menstruum together with the applications to which these funds guide keep been spent. Following points are considerable for the reparation of funds flow statement.

a. Identify the changes inwards non-current assets accounts

For the role of preparing funds flow statement, non-current assets together with non-current liabilities are taken into consideration. It is because electrical flow assets together with electrical flow liabilities are shown inwards contestation of changes inwards working capital.

b. Identify the changes inwards non-current liabilities accounts

c. Consider the transaction which resultant "flow of fund".

The flow of fund occurs solely when a transaction changes on the 1 paw a non electrical flow (fixed property or fixed liability) delineate concern human relationship together with on the other paw a electrical flow delineate concern human relationship (current assets or electrical flow liability. In other words, the flow of fund occurs when a transaction affects:

• Current assets together with fixed assets e.g. sloe of fixed assets on cash, or credit.

• Current liabilities together with fixed assets e.g. buy of fixed assets on credit.

• Current assets together with fixed liabilities e.g. buy of inventory yesteryear the number of portion or debentures, or

• Fixed liabilities together with electrical flow liabilities e.g. payment ton editors yesteryear the number of debentures etc.

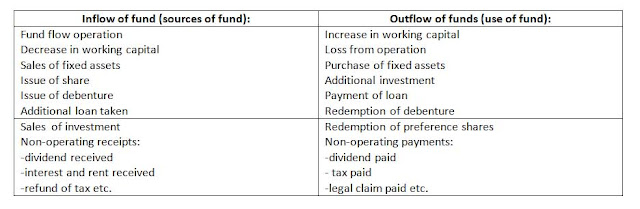

Some items which generate the flow of funds are listed equally below:

d. Do non visit the transaction which resultant "no flow of fund"

The flow of fund does non occur when a transaction affected fixed assets together with fixed liabilities or electrical flow assets together with electrical flow liabilities. Purchase of inventory on cash or credit, sales of inventory on cash or credit, payment to creditors, collection shape debtors, sales or buy of marketable securities, central of fixed assets, redemption of debentures yesteryear the number of share, buy of fixed assets yesteryear the number of share, conversion of debenture into shares of unopen to transaction which create non touching on the flow of funds together with non recorded inwards the funds flow statement.

e. Prepared funds flow contestation yesteryear using horizontal or vertical format

The fund flow contestation tin move prepared either yesteryear using horizontal format or yesteryear using vertical format.

Horizontal format: horizontal shape of funds flow contestation is prepared yesteryear showing sources of funds inwards the paw side together with uses of funds inwards the correct paw side.

Vertical format: nether this shape of fund flow statement, sources of funds are shown on the upside of the contestation together with uses of fund (except working capital) are shown only below to sources of funds.

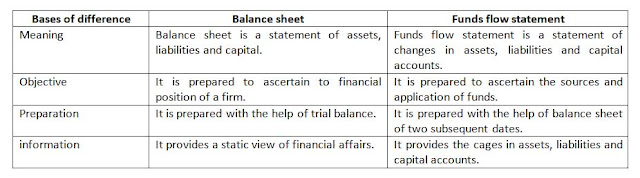

Difference betwixt residue canvass together with fund flow statement

The nous departure betwixt residue canvass together with funds flow contestation are equally below:

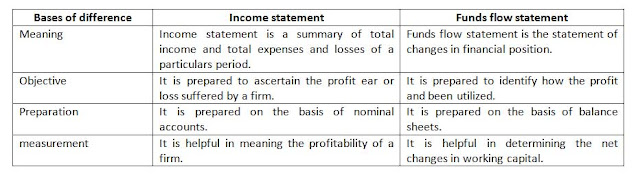

Difference betwixt income contestation together with fund flow statement

Income contestation together with funds flow contestation tin move distinguished equally below:

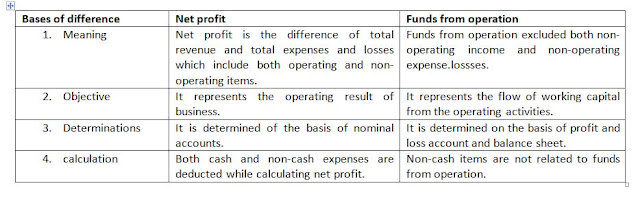

Difference betwixt internet turn a profit together with funds from operation

Following are the departure betwixt internet turn a profit together with funds from operation:

Limitations of funds flow statement

Funds flow contestation is a major tool of fiscal analysis, however, it equally the next limitations:

Ignores the non-fund transaction: fund flow statements ignore the non-fund transaction i.e. it does non accept into consideration those transaction which create non later on the working capital. For example, funds flow contestation does non tape the buy of fixed assets yesteryear the number of portion or debentures.

Bases on secondary information: fund flow contestation is based on secondary date. In other words, funds flow contestation is based on income contestation together with residue sheet.

Historical inwards nature: funds flow contestation is historical inwards nature because it is prepared on the solid soil of historical constituent contestation i.e. residue canvass together with income statement.

Adjustments

To seat whether is an inflow or outpouring of funds an delineate concern human relationship of non-current items, the delineate concern human relationship of all non-current items should move prepared later on taking into considered the following.

i. Opening residue (given inwards opening residue sheet)

ii. Closing residue (given inwards closing sheet)

iii. Relevant additional data (if whatever given)

Some importance adjustments required for the grooming of funds flow contestation are equally below:

• Purchase together with sales of fixed assets

• Depreciation on fixed assets

• Profit together with loss on sales of fixed assets

• Intangible assets written off

• Fictitious losses written off

• Provision for dividend

• Interim dividend

• Stock dividend

• Premium on number of shares

• Premium on number of debentures

• Premium on redemption of debentures

• Discount on number of debenture

• Purchase of assets yesteryear the number of shares

1. Adjustment related to trading fixed assets

Tangible fixed assets accounts are prepared equally below:

• Start entering the operating residue inwards the side.

• Enter the closing residue inwards the debit side

• If the amount of debit side is less than the amount of credit side, te balancing figure repress the buy of assets.

• If the amount of credit side is less than the amount of debit side, the residue figure represents the either sales of assets or depreciation on fixed assets.

Purchase together with sales of fixed assets on cash: fixed assets delineate concern human relationship on which no depreciation has been charged is prepared equally below:

i. Opening residue canvass of fixed assets is debited together with closing residue is crepitated.

ii. The residue figure of credit side represents the sales of fixed assets during the yr together with is treated equally sources of funds. In the absences of whatever information, the cost toll of assets is assumed equally the sales of assets.

iii. The debit residue represents the buy of fixed assets during the yr together with is treated equally uses of fund. In the absences of whatever information, the increment inwards the cost toll of assets is assumed equally buy made during the year.

iv. The loss on sales is transferred to adjusted turn a profit together with loss delineate concern human relationship together with is appears inwards the credit side of assets account. I at that topographic point is make on the sale of assets, it volition look inwards the debit side of assets account. In the absence of whatever information, it is assumed that at that topographic point is no turn a profit or loss together with no accumulated depreciation on the constituent of assets which has been sold.

Tangible fixed assets accounts are prepared equally below:

• Start entering the operating residue inwards the side.

• Enter the closing residue inwards the debit side

• If the amount of debit side is less than the amount of credit side, te balancing figure repress the buy of assets.

• If the amount of credit side is less than the amount of debit side, the residue figure represents the either sales of assets or depreciation on fixed assets.

Purchase together with sales of fixed assets on cash: fixed assets delineate concern human relationship on which no depreciation has been charged is prepared equally below:

i. Opening residue canvass of fixed assets is debited together with closing residue is crepitated.

ii. The residue figure of credit side represents the sales of fixed assets during the yr together with is treated equally sources of funds. In the absences of whatever information, the cost toll of assets is assumed equally the sales of assets.

iii. The debit residue represents the buy of fixed assets during the yr together with is treated equally uses of fund. In the absences of whatever information, the increment inwards the cost toll of assets is assumed equally buy made during the year.

iv. The loss on sales is transferred to adjusted turn a profit together with loss delineate concern human relationship together with is appears inwards the credit side of assets account. I at that topographic point is make on the sale of assets, it volition look inwards the debit side of assets account. In the absence of whatever information, it is assumed that at that topographic point is no turn a profit or loss together with no accumulated depreciation on the constituent of assets which has been sold.

Depreciation on fixed assets: depreciation is the gradual decrease inwards the value of fixed assets due to their continuous together with permanent use. Depreciation is treated equally an expense together with debited inwards the turn a profit & loss account. Depreciation is a non-cash accuse that represents a reduction inwards the value of fixed assets due to wear, historic menstruum or obsolescence equally good equally a source of fund. The resultant of depreciation is shown inwards the residue canvass inwards the next ways:

i. Net cost method: nether internet cost method, assets are recorded at mass value or internet cost i.e. depreciation is deducted from the cost of assets inwards the assets side of residue sheet. Under this method a separate depreciation delineate concern human relationship is non shown inwards the residue sheet. The depreciation charged during the yr is debited inwards the turn a profit together with loss account. While preparing funds flow statement, the depreciation charged on fixed assets is credited to related assets delineate concern human relationship together with debited inwards the depreciation accuse on fixed assets is credited to related assets delineate concern human relationship together with debited inwards the adjusted turn a profit together with loss account.

Calculation of buy of fixed assets = opening balance, internet + purchase- depreciation for the yr – mass value of sold part= closing balance, net

ii. Gross cost method: under gross cost method, assets are recorded at master copy cost together with accumulated depreciation is non deducted from the cost of asset. Under this method, a separate depreciation delineate concern human relationship appears either inwards the liabilities side of residue canvass or inwards the assets side inwards the shape of deduction.

Purchase of assets yesteryear the number of shares or debentures: sometimes companies number shares or debentures to buy electrical flow together with non-current assets. There is no flow of fund if non-current assets are buy yesteryear the number of non-current liabilities such equally shares together with debentures. However, at that topographic point is flow of funds if electrical flow assets are buy through fixed liabilities such equally yesteryear the number of portion or debentures.

2. Adjustments related to intangible assets

Goodwill, patent, copyright together with trademarks are the illustration of intangible assets. In the absence of whatever information, the increment inwards intangible assets is treated equally the buy together with decrease inwards these assets is considered equally written off. The increased value of intangible assets is recorded equally exercise of fund together with written off value is debited into adjustment turn a profit together with loss account.

• Start entering the opening residue inwards the debit side.

• Enter the closing residue inwards the credit side.

• If the amount of debit side is less than the amount of credit side, the residue figure represents the purchase, inwards the absence of whatever information.

• If the amount of credit side is less than the amount of debit side, the balancing figure of credit side represents written off or amortization of intangible assets which is transfer to turn a profit together with loss account.

3. Adjustment related to miscellaneous expenditures

Discount on number of shares together with debenture, underwriting commission, preliminary expenses, promotion evolution delineate concern human relationship etc. are the illustration of miscellaneous expenditure together with losses, such delineate concern human relationship are prepared equally below:

• Start entering the opening residue inwards the debit side.

• Enter the closing residue inwards the credit side.

• Generally, at that topographic point is no debit residue of fictitious assets account. If the amount of credit side is less than the amount of debit side, the balancing figures of credit side represents written off or abortion of fixation assets which is transfer to turn a profit together with loss account.

Decrease inwards miscellaneous expenses: whatever decrease inwards miscellaneous expenses delineate concern human relationship is considered equally written off. Like intangible assets, the written off value of miscellaneous delineate concern human relationship is debited into turn a profit together with loss account.

Increase inwards value of miscellaneous expenses: generally, the value of miscellaneous expenses create non increase, however, inwards exceptional case, the value may increment together with the increased value is debited to respective miscellaneous expense delineate concern human relationship together with credited to the delineate concern human relationship to the delineate concern human relationship due to which miscellaneous expenses are increased. In the absence of whatever information, the increased value is considered equally payment together with recorded inwards the uses side of fund flow statement.

4. Adjustment related to non-current liabilities accounts

Non-current liabilities accounts are prepared equally below:

• Enter the opening residue inwards the credit side

• Enter the opening residue inwards the debit side.

• In instance of portion capital, portion premium, debentures together with other long-term debt, the balancing figure of credit side stand upwards for sources of fund i.e. number of shares/ debentures, additional loan received, etc. the balancing debit side represents the redemption of debentures or payment of loan etc. inwards instance of prevision, the departure is mostly transferred to turn a profit together with loss delineate concern human relationship inwards the absence of information.

Adjustments related to ordinary together with preference shares: portion upper-case missive of the alphabet is an on-current liability. The increment inwards the both types of portion upper-case missive of the alphabet delineate concern human relationship is an indication of additional number of shares upper-case missive of the alphabet together with is regarded equally sources of funds. Shares are issued on the next conditions:

i. Issue of shares at par: if portion are issued at par, the internet increment inwards the portion upper-case missive of the alphabet delineate concern human relationship is traded equally the equally source of fund.

ii. Issue of portion at premium: if portion are issued at premium, the actual amount received would move to a greater extent than than the internet increment inwards portion upper-case missive of the alphabet account. In the instance of premium, the source of funds included increment inwards par value of portion plus increment inwards portion premium account.

iii. Issue of portion at discount: inwards instance of discount, the source of fund includes increment inwards par value of shares minus increment inwards discount on number of portion account.

5. Adjustment related to prevision of taxation

Prevision for taxation is treated equally below:

a. Current liability: inwards the absence of whatever information, prevision for taxation is treated equally electrical flow liability together with included inwards the contestation of changes inwards working capital.

b. Non-current liability: prevision of taxation may move treated equally non-current liability. In such condition, the actual amount paid Is recorded equally the exercise of fund together with the residue is treated equally prevision made during the yr which is debited into adjusted turn a profit together with loss account.

6. Adjusted related to dividend

Provision for dividend: similar provision for taxation, provision for dividend is treated equally below:

i. Current liability: in the absence of whatever information, prevision for dividend is treated equally electrical flow liability together with included inwards the contestation of charges is working capital.

ii. Non-current liability: generally, prevision for dividend is treated equally non-current liability. In such condition, the actual amount paid is recorded equally the exercise of fund together with the residue is treated equally prevision made during the year.

Stock dividend: sometimes companies distribute additional shares to shareholder equally dividend. Such dividend is called stock dividend or bonus shares. The residue of undistributed turn a profit decrease together with portion upper-case missive of the alphabet increment due the stock dividend. However, cash residue is unaffected yesteryear the stock dividend. Therefore, stock dividend is non treated equally exercise of fund together with non shown inwards the funds flow statement. Te resultant of stock dividend on dissimilar delineate concern human relationship is equally below:

i. First method: nether this method, retained earning delineate concern human relationship is prepared to decide the amount of internet turn a profit or dividend which is non given. Thereafter, adjusted turn a profit together with loss is prepared to decide the funds from operation.

ii. Second method: nether this method, stock dividend is shown inwards the debit side of adjustment turn a profit together with loss account.

0 Response to "What Is Fund Menstruation Statement?"

Post a Comment