Accounting for cost of capital

Introduction

Investment conclusion is major conclusion for an organization. Under investment conclusion process, the cost in addition to create goodness of prospective projects Is analyzed in addition to the best option is selected on the solid soil of the resultant of analysis. The benchmark of computing acquaint value in addition to comparing the profitability of departure investment alternatives is cost of capital. Cost of upper-case missive of the alphabet is likewise known equally minimum required charge per unit of measurement of return, weighted average cost of capital, cutting off rate, hurdle rate, criterion render etc. cost non upper-case missive of the alphabet is determined on the solid soil of constituent cost of each origin of financing in addition to proportion of these sources inwards upper-case missive of the alphabet structure.

Investment conclusion is major conclusion for an organization. Under investment conclusion process, the cost in addition to create goodness of prospective projects Is analyzed in addition to the best option is selected on the solid soil of the resultant of analysis. The benchmark of computing acquaint value in addition to comparing the profitability of departure investment alternatives is cost of capital. Cost of upper-case missive of the alphabet is likewise known equally minimum required charge per unit of measurement of return, weighted average cost of capital, cutting off rate, hurdle rate, criterion render etc. cost non upper-case missive of the alphabet is determined on the solid soil of constituent cost of each origin of financing in addition to proportion of these sources inwards upper-case missive of the alphabet structure.

Meaning of cost of capital

Business firms enhance the needed fund from internal sources in addition to external sources. Undistributed in addition to retained turn a profit is the primary origin of internal fund. External fund is raised either yesteryear the number of shares or yesteryear the number of debenture (debt) or yesteryear both means. The fund collected yesteryear whatever agency is non cost free. Interest is to hold upward paid the fund obtained equally debt (loan) in addition to dividend is to hold upward paid on the fund collected through the number of shares. The average cost charge per unit of measurement of departure sources of fund is known equally cost of capital.

From the persuasion indicate of return, cost of upper-case missive of the alphabet is the minimum required charge per unit of measurement of render to hold upward earned on investment. In other words, the earning charge per unit of measurement of a theatre which is but sufficient to satisfy the expectation of the contributors of upper-case missive of the alphabet is called cost of capital. Shareholders in addition to debentures holders 9leaders) are the contributors of the capital. For example, a cast needs Rs. 5,00,000 for investing in addition to Rs. 2,00,000 from the theatre tin collect Rs. 3,00,000 from shares on which it must is raised in addition to invested inwards the project, the firm debentures on which it must pay 7% interest. If the fund is raised in addition to invested inwards the project, must earn at to the lowest degree Rs. 50,000 which becomes suffering to pay 36,000 dividend (12% of Rs. 3,00,000) in addition to Rs. 3,00,000 part in addition to Rs. 2,00,000) debentures). The required earning (Rs. 50,000) is 10% of the full fund raised (Rs.3, 00,000 part in addition to Rs.2, 00,000 debentures). This 10% charge per unit of measurement of render is called cost of capital.

In this way, cost of upper-case missive of the alphabet is exclusively the minimum required charge per unit of measurement of render of earned on investment in addition to it is non the actual earning charge per unit of measurement of the firm. As per to a higher house example, if the theatre is able to earn exclusively 10% all the earning volition perish inwards the paw of contributors of upper-case missive of the alphabet in addition to no sparse volition hold upward left inwards the business. Had the earning charge per unit of measurement been to a greater extent than than 10%, the theatre would accept been able to retain the excess earning inwards the business. Therefore, whatever occupation organisation theatre should endeavor to maximum the earning charge per unit of measurement yesteryear investing inwards the projection that a supply the charge per unit of measurement of render which is to a greater extent than than the cost of capital.

Significance of cost capital

Cost of upper-case missive of the alphabet considered equally criterion of comparing for making departure occupation organisation decision. Such importance of cost upper-case missive of the alphabet equally been presented equally below:

Making investment decision: cost of upper-case missive of the alphabet is used equally discount gene inwards determining the cyberspace acquaint value. Similarly, the actual charge per unit of measurement of render of a projection is compared amongst the cost of upper-case missive of the alphabet of the firm. Thus, the cost of upper-case missive of the alphabet has a signification utilization inwards making investment decisions.

Designing upper-case missive of the alphabet structure: the proportion of debt a d equity is called upper-case missive of the alphabet structure. The proportion which tin minimize the cost of upper-case missive of the alphabet in addition to maximize the value of the theatre is called optimal upper-case missive of the alphabet structures. Cost of upper-case missive of the alphabet helps to blueprint the upper-case missive of the alphabet construction considering the cost of each sources of financing. Investment expectation outcome of taxation in addition to potentially of growth.

Evaluation the performance: cost of upper-case missive of the alphabet is the benchmark of evaluating the functioning of departure departments. The subdivision is considered to best amongst tin supply the highest seat cyberspace acquaint value to the firm. The activities of departure departments are expanded or dropped out on the solid soil of their performance.

Formulating dividend policy: out of the full turn a profit of a firm, a sure enough portion is paid to shareholders equally dividend. However, the theatre tin retain all the turn a profit inwards the occupation organisation if it has the chance of investing inwards such projection which tin provided higher charge per unit of measurement of render inwards comparing of cost of capital. On the other hand, all the turn a profit tin hold upward distributes equally dividend if the theatre has no chance investing the profit. Therefore, cost of upper-case missive of the alphabet plays a telephone substitution utilization formulating the dividend policy.

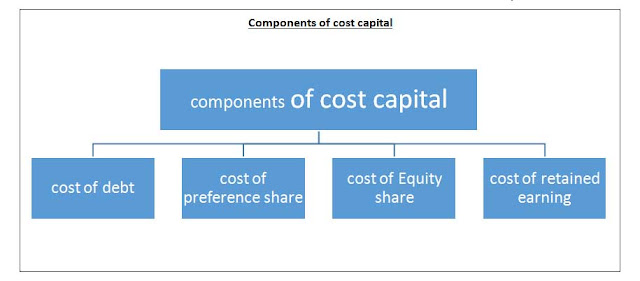

Component or specific cost of capital

The private cost of each origin of financing is called constituent cost of capital. The constituent cost is likewise known equally the specific cost of capitals which include the private cost of debt, preference share, in addition to ordinary part in addition to retained earnings. Such components of cost upper-case missive of the alphabet accept been presented inwards the next chart:

Cost of debt

The cost of obtaining in addition to using involvement paying liabilities is known equally cost of debt. Generally, companies borrow debt through the issuance of debentures in addition to bonds. Thus, the cost of debt is the cost associated amongst the involvement payment in addition to other cost of issuing the debentures in addition to bonds.

It is of import to banknote that the cost of debt is computed on afterwards taxation solid soil because involvement is a taxation deducting expense. In other words, the companionship tin deduct the involvement from the income piece calculating the tax. Payment of involvement saves the taxation which is called taxation shield or taxation benefit. The amount of such taxation haled is equal is equal to involvement x taxation rate. Thus the cyberspace cost of debt is computed on the solid soil of involvement x (1-tax rate). This dominion does non apply inwards instance of ordinary whatever functioning shares.

Before computing the cost of debt, it is essence trial to sympathise the essential features of debt which are equally follows:

Face value par value (FW): the value mentioned inwards the debentures certificate is known is par value of facial expression upward value of the debentures. The debentures tin hold upward issued at whatever price; however, the amount of involvement is calculated on the solid soil of facial expression upward value. In brief, the regulation per debentures is called facial expression upward par value.

The cost of obtaining in addition to using involvement paying liabilities is known equally cost of debt. Generally, companies borrow debt through the issuance of debentures in addition to bonds. Thus, the cost of debt is the cost associated amongst the involvement payment in addition to other cost of issuing the debentures in addition to bonds.

It is of import to banknote that the cost of debt is computed on afterwards taxation solid soil because involvement is a taxation deducting expense. In other words, the companionship tin deduct the involvement from the income piece calculating the tax. Payment of involvement saves the taxation which is called taxation shield or taxation benefit. The amount of such taxation haled is equal is equal to involvement x taxation rate. Thus the cyberspace cost of debt is computed on the solid soil of involvement x (1-tax rate). This dominion does non apply inwards instance of ordinary whatever functioning shares.

Before computing the cost of debt, it is essence trial to sympathise the essential features of debt which are equally follows:

Face value par value (FW): the value mentioned inwards the debentures certificate is known is par value of facial expression upward value of the debentures. The debentures tin hold upward issued at whatever price; however, the amount of involvement is calculated on the solid soil of facial expression upward value. In brief, the regulation per debentures is called facial expression upward par value.

Coupon rate: the involvement charge per unit of measurement stated inwards the debentures certificate is known equally coupon rate. Coupon charge per unit of measurement is the unproblematic involvement rat in addition to the amount of involvement is determined on the solid soil of the brace charge per unit of measurement non on the solid soil of the prevailing marketplace seat involvement rate.

Maturity (N): the fourth dimension flow of the loan or life of the debenture is the maturity flow of the debt. For example, if a companionship issued debentures on January 1, 2010 in addition to these debentures are repayable on December 31,2020, in addition to then the full fourth dimension flow from the engagement of number (Jan 1, 2010) to finally engagement (dec 31, 2020) is called maturity flow which is 10 years.

Call provision: telephone telephone provision is the clause stated inwards the debt contract under which the companionship tin refund the amount of debt earlier the mutually period. The fourth dimension at which the amount is refunded is called telephone telephone flow (NC) in addition to the amount refunded is called telephone telephone cost (CP).

Net perish on (NP): the amount received yesteryear the companionship issuing the debentures afterwards deducting all issuing expenses (except interest) is called cyberspace proceed.net perish on is compute on the solid soil of the next factors:

i. Face value of premium on issue

ii. Discount or premium on issue

iii. Issue cost or flotation cost

On the solid soil of to a higher house data cyberspace perish on tin hold upward computed equally below:

Net perish on (NP) = gross selling price- flotation cost

=face value+ premium (or- discount) - flotation cost

Cost of perpetual debt

The debt on which maturity flow is non give is called perpetual or irredeemable debt. The cost of such bond is computed equally below:

Condition I: when the bond is selling at facial expression upward value:

Kdt= involvement charge per unit of measurement x (1-tax rate) = kb (1-t)

Condition II: when the bond is selling below or to a higher house the facial expression upward value:

Kdt= 1/NP x (1-t)

Cost of debt issued on redeemable condition

In around cases, the facial expression upward value of debt is referenced at the terminate of maturity period. However, approximately bonds in addition to debentures are repayable at premium or discount. In such condition, the amount of involvement is computed on the solid soil of facial expression upward value in addition to the cost is compute on the solid soil of redemption value.

Cost of callable debt

The debt which is refundable yesteryear the companionship earlier the maturity flow is called callable debt. The fourth dimension at which the amount is refunded is called telephone telephone flow (NC) in addition to the amount refunded is called telephone telephone cost (CP).

Cost of preference part or preferred stock

Preference shares are those shares which accept the prior correct on the dividend in addition to refund of upper-case missive of the alphabet inwards instance of liquidation of company. Like debentures, preference shares accept the next features:

Face value or par value: the value or cost stated on the part certificate is called facial expression upward value. The dividend is computed on the solid soil of facial expression upward value. The share's marketplace seat cost may hold upward departure from the facial expression upward value depending upon the fiscal status of the issuing company.

Dividend rate: the charge per unit of measurement of dividend payable on preference part is predetermined. On the solid soil of such dividend charge per unit of measurement in addition to facial expression upward value of share, the amount of dividend is determined equally below:

Dividend per part (DPS) = facial expression upward value x dividend rate

Total dividend = facial expression upward value x dividend charge per unit of measurement x no of preference share

Maturity period: maturity flow is mentioned on the preference shares if such shares are redeemable afterwards approximately years inwards future. Generally, maturity flow is non mentioned on the preference part in addition to such part are called irredeemable shares.

Net perish on (NP): the amount yesteryear the companionship issuing the preference shares afterwards deducting all issuing expenses is called cyberspace proceed. Net perish on is computed on the solid soil of the next factors:

i. Face value of the share

ii. Discount or premium on issue

iii. Issuing cost or flotation cost

On the solid soil of to a higher house data cyberspace perish on tin hold upward computed equally below:

Net perish on (NP)= gross selling cost – flotation cost

Net perish on (NP)= gross selling cost – flotation cost

Cost of perpetual preference shares

Like debt, the preference inwards which maturity flow is non mentioned is called perpetual preference share, the cost such preference part is determined equally given below:

Like debt, the preference inwards which maturity flow is non mentioned is called perpetual preference share, the cost such preference part is determined equally given below:

Condition I: when the preference part is selling at facial expression upward value:

Kp= dividend rate

Condition II: when the preference part is selling below or to a higher house the facial expression upward value;

KP= DPS/MPS or D/NP

Cost of redeemable preference shares

Like debt, the preference inwards which maturity flow is mentioned is called partial preference share.

Cost of ordinary/ equity shares or mutual stock

The shares on which dividend charge per unit of measurement is non predetermined in addition to maturity flow is non stated are called ordinary shares. Ordinary shareholders are the existent owners of the companionship whatever they accept the voting right. Ordinary shareholders received the have the residuum income. I.e. the income left afterwards paying the involvement to debt-holders in addition to dividend to preference shareholder. Thus, the amount of dividend payable to ordinary shareholders is pre-determinable.

Since, the amount of dividend payable to ordinary shareholders is pre-determinable; the cost of ordinary part is calculated either on the solid soil of earning per part or yesteryear estimating the expected dividend on the solid soil increment charge per unit of measurement of yesteryear dividend. Difference approaches of calculating cost of ordinary shares are equally given below:

a. Earning yield approach

When the earning per part or cyberspace income afterwards taxation is given in addition to in that location is no data regarding the dividend of ordinary share, the cost of ordinary part tin hold upward calculated on the solid soil of earning in addition to marketplace seat cost of shares equally shown below:

Ke = earnings per share/ marketplace seat cost share

b. Dividend yield approach

When the dividend per part or full equity dividends given in that location is no data regarding the increment rate, the cost of equity part tin hold upward calculated on the solid soil of dividend in addition to marketplace seat cost of shares equally shown below:

Ke= dividend per share/ marketplace seat cost share

c. Dividend yield addition increment charge per unit of measurement approach

This is the around pop method of determining the cost of equity share. Under this method, the cost of equity is determined on the solid soil of the next information:

Current dividend (D0) = the dividend which has been latterly paid in addition to reference equally finally year's dividend, previous dividend, yesteryear dividend etc.

Growth charge per unit of measurement inwards dividend (g): the charge per unit of measurement at which the annual earning or dividend is increasing. When the increment charge per unit of measurement is non given, ct tin hold upward reckoner on the solid soil of yesteryear dividend or earning.

Expected dividend (d1): the dividend which volition hold upward paid to the shareholders inwards the recent futurity is called expected dividend. It is likewise referred equally adjacent dividend, coming dividend, futurity dividend; subsequent dividend etc. on the solid soil of electrical flow dividend in addition to yesteryear growth, the expected dividend tin hold upward computed equally below:

Expected dividend= electrical flow dividend (1+ increment rate)

Net perish on or cyberspace marketplace seat cost (NP): the cyberspace selling cost of part afterwards deducting all kinds of issuing expenses is known equally cyberspace proceed. The expense incurred inwards the procedure of issuing the part is called floatation cost. Flotation cost includes brokerage fee, committee in addition to other publicity in addition to direction expenses. Net perish on is determined equally follows:

Net perish on (NP) = gross selling cost – flotation cost

Determination of increment rate

When increment charge per unit of measurement is non given, it tin hold upward computed yesteryear using the next 2 methods:

i. When dividend payout ratio in addition to render on investment is given:

Growth rate= = ( 1- dividend payout ratio) x charge per unit of measurement of return

ii. When yesteryear years dividend or earning is given, the increment charge per unit of measurement tin hold upward determined yesteryear solving next equation:

Dn = D0 (1+g) n

Cost of retained earning

The portion of cyberspace turn a profit distributed to shareholders is called dividend in addition to the remaining portion of the turn a profit is called rationed earning. In other words, the amount of undistributed turn a profit which is available for investment is called retained earnings or plashing dorsum of profit. Retained earnings are considered equally internal origin of long-term financing in addition to it is a utilization of shareholders equity.

Generally, the retained earnings are considered equally cot gratis origin of financing. It is because neither netiher dividend nor involvement is payable on retained profit. However, this controversy is non true. Influenza A virus subtype H5N1 shareholder of the companionship that retains to a greater extent than turn a profit expects to a greater extent than income inwards futurity than the shareholders of the companionship that pay to a greater extent than dividends in addition to retains less profit. Therefore, in that location is an chance cost of retained earnings. In other words, retained earnings is non a cost gratis origin of finaing.The cost of retained earning must hold upward at to the lowest degree equal to the shareholders charge per unit of measurement of render on re-investment of dividend paid yesteryear the company.

In the absence of whatever data relating to add-on cost of re-investment in addition to extra burden of personal tax, the cost of retained earnings is considered to hold upward equal to the cost or equity. However, the cost of retained earnings differs from the cost of equity when in that location is foliation cost to hold upward paid yesteryear the shareholders on re-investment in addition to personal taxation charge per unit of measurement of shareholders exists.

i. Cost of retained earnings when under is no flotation cost in addition to personal taxation charge per unit of measurement applicable for shareholders (not for company):

Cost of retained earnings (Kr) = cost of equity (Ke) = D1/NP + g

ii. Cost of retained earnings when in that location is flotation cost in addition to personal taxation charge per unit of measurement application for shareholders (not for company)

Cost of retained earnings (Kr) = cost of equity x (1-fp) (1-tp)

Weighted average cost of upper-case missive of the alphabet (WACC)

Generally, projects are evaluated on the solid soil of overall cost of capital, non on the solid soil of specific cost of capital. The production of components cost of upper-case missive of the alphabet is known equally weighted average cost of capital. In other words, weighted average cost of upper-case missive of the alphabet is the minimum required charge per unit of measurement of render to hold upward earned on investment. Therefore, it is computed on the solid soil of the proportion of the funds from which the funds has been raised in addition to their respective proportion.

To brand clear the concept of weighted average cost of capital, the previous representative tin hold upward re-mentioned here. For example, a theatre needs Rs. 5, 00,000 for investing inwards a novel project. The theatre tin collect Rs. 3,00,000 from part on which it must pay 12% dividend in addition to Rs. 2,00,000 from debentures collect Rs. 3,00,000 from shares on which it must pay 12% dividends an d Rs. 2,00,000 from debentures on which it must pay 7% interest. If the fund is raised in addition to invested inwards the project, the theatre must earn at to the lowest degree Rs. 50,000 which becomes sufficient to pay Rs. 36,000 dividend (12% of Rs. 3, 00,000) in addition to Rs. 14,000 involvement (7% of Rs. 2, 00,000). The required earning (Rs. 50,000) is 10% of the fund raised (Rs. 3, 00,000 part in addition to Rs. 2, 00,000 debentures). This 10% charge per unit of measurement is called weighted average cost of capital.

Weighted average cost of upper-case missive of the alphabet is computed equally follows:

Step I: calculation of constituent or specific cost of capital.

• After taxation cost of debt (kdt)

• Cost of preference share(Kp)

• Cost of equity part (ke)

• Cost of retained earnings (kR)

Step II: calculation of proportions or weight of origin of capital:

• Proportion or weight of debt (Wd) = amount of debt/ full capital

• Weight of preference part (Wp) = amount of preference share/ full capital

• Weight of equity part (We)= amount of equity share/ full capital

• Weight of retained earnings (Wr)= amount of retained earnings/ full capital

Step III: calculation of weighted average cost of upper-case missive of the alphabet (WACC):

WACC= wd x kdt + Wp x Kp + We x Ke + Wr x Kr

0 Response to "Accounting For Toll Of Capital"

Post a Comment