Analysis of fiscal statements

Introduction

The primary objective of a fellowship is to earn profit. It prefers a release of activities together with transaction to attain its objective. The transactions are recorded systematically together with scientifically to assess the resultant of job organisation performance together with fiscal condition. Influenza A virus subtype H5N1 job organisation arrangement prepares turn a profit together with loss job organisation human relationship together with balances canvas to known the turn a profit or loss together with fiscal seat respectively. Profit together with loss job organisation human relationship is prepared to ascertain turn a profit or loss together with residual canvas to reveal the fiscal position. Similarly, it also prepares cash flow statements. They are farther analyzed inwards price of profitability, liquidity, solvency, operational efficiency together with growth potentially.

Financial statement

Meaning of fiscal statement

Financial statements are the summary reports of fellowship fiscal transaction. They study the terminate resultant of accounting activities during a given menses of time. They provide the income/ turn a profit or loss together with fiscal seat of a company. Financial statements are terminate of the menses accounts prepared to present the turn a profit or loss province of affairs for a menses of fourth dimension together with to assess the fiscal seat together with cash flow province of affairs on a particulars date. Finical disceptation reports the resultant of past times activities. Therefore, they are also called as the historical records of a company. Financial statements included:

The primary objective of a fellowship is to earn profit. It prefers a release of activities together with transaction to attain its objective. The transactions are recorded systematically together with scientifically to assess the resultant of job organisation performance together with fiscal condition. Influenza A virus subtype H5N1 job organisation arrangement prepares turn a profit together with loss job organisation human relationship together with balances canvas to known the turn a profit or loss together with fiscal seat respectively. Profit together with loss job organisation human relationship is prepared to ascertain turn a profit or loss together with residual canvas to reveal the fiscal position. Similarly, it also prepares cash flow statements. They are farther analyzed inwards price of profitability, liquidity, solvency, operational efficiency together with growth potentially.

Financial statement

Meaning of fiscal statement

Financial statements are the summary reports of fellowship fiscal transaction. They study the terminate resultant of accounting activities during a given menses of time. They provide the income/ turn a profit or loss together with fiscal seat of a company. Financial statements are terminate of the menses accounts prepared to present the turn a profit or loss province of affairs for a menses of fourth dimension together with to assess the fiscal seat together with cash flow province of affairs on a particulars date. Finical disceptation reports the resultant of past times activities. Therefore, they are also called as the historical records of a company. Financial statements included:

Income statement

The income statement, sometimes called as the preparation together with turn a profit together with loss job organisation human relationship or an earnings statement, reports the profitability of a job organisation arrangement for a stated menses of time. In accounting, nosotros mensurate profitability for a period, such as a calendar month or twelvemonth past times comparing the revenues generated alongside the expenses incurred to arrive at these revenues.

Statement of retained earnings

The disceptation of retained earnings is also called as turn a profit together with loss appropriation account. One role of this disceptation is to connect the income disceptation together with the residual sheet. The disceptation of retained earnings explains the changes inwards retained earning betwixt 2 balances canvas dates these alter ordinarily consist of the improver of internet income together with the deduction of dividend.

Balance sheet

The residual sheet, sometimes called called the disceptation of fiscal position, listing the company's assets, liabilities together with stockholders' equity as on a exceptional date. Influenza A virus subtype H5N1 residual canvas is similar a snap shot threat captured the fiscal seat of a fellowship at a exceptional hollo for inwards time.

Statement of cash flow

Management is interested inwards the cash inwards bloom to the fellowship together with the cash outflows from the management, because they determine the company's liquidity to pay its bills when due, the disceptation of cash flows shows the inflows together with fountain from operating, investing together with financing activities.

Features of fiscal statements

The next are the features of fiscal statements.

i. They are ever expressed inwards monetary terms. They ignore the qualitative aspects. In other words, tne non-monetary events exercise non come upwardly nether the compass of fiscal statements.

ii. They are ever prepared for a sure as shooting menses of time. They mostly comprehend te menses of 1 year.

iii. They are historical inwards nature since the ever introduce the past times performance. Hence, they exercise non ship the futuristic approach.

Objective of fiscal statements

Financial statements of a fellowship are the resultant of management's past times activeness together with decisions. They are the terminate of products of the accounting process. They hand a moving-picture present of solvency together with profitability of a company. The major objective of the fiscal disceptation tin hand notice move listed as follows:

i. To provide the fiscal information to the internal together with external users.

ii. To provide the information, which are useful inwards the conclusion making process.

iii. To reveal the profitability together with solvency of the company.

iv. To assist to evaluate the fiscal seat together with efficiency of the management.

v. To facility the infra fellowship an inter fellowship comparing of the fiscal performance.

vi. To present the fiscal disceptation wellness of the company.

Importance of fiscal statement

Financial disceptation are the importance sources of information to all the users of accounting information like; management, owners, debtors, creditors, employees, regime agencies, fiscal analysis, etc. The next are the points which highlight the importance of fiscal statements:

i. Financial statements are the summary of information relating to profitability, together with resources owners past times the form.

ii. Financial disceptation provided the information which tin hand notice move compared alongside those of other firms.

iii. Employees tin hand notice utilization them to demand for increment inwards salary together with other benefits.

iv. Bankers together with other fiscal disceptation of the brand the lending decision.

v. Government bases on fiscal disceptation of the companies for the calculating of taxation revenue from the firms.

vi. Financial statements tin hand notice move used as the footing for management decision-making role similar planning, promotion, enquiry together with evolution decisions, etc.

vii. Existing investment tin hand notice utilization them to assess how efficiently the job solid is using their funds.

viii. Potential investment tin hand notice obtain information which tin hand notice move useful to receive got the investment decision.

ix. Financial statements reveal the history of the firm.

x. They tin hand notice move used to assess the forms liquidity together with solvency position.

Limitation of fiscal statements

The fiscal disceptation suffers from the next limitations:

i. They included the quantities information which is expressed inwards monetary units. They exercise non provide whatsoever qualitative information which may receive got greater behave on upon the conclusion makers.

ii. They tape together with reveal exclusively the historical appointment inwards nature. They exercise non include whatsoever characteristic possible result.

iii. Financial statements are strictly inside the boundary of but about accounting principles hi are used as the guidance's inwards recording together with reporting the fiscal transaction.

iv. Financial statements are but the summary reports of the company's fiscal transactions. All besides detailed information regarding to such transaction cannot move disclosed inwards the fiscal statement.

v. Financial disceptation present the information on cost footing i.e. the toll paid on the transaction's date. The outcome of toll marking changes (inflation) is non shown inwards the fiscal statements. In but about other words, the information are non given inwards the electrical flow value.

Objectives of fiscal disceptation analysis

Meaning of fiscal disceptation analysis

Financial disceptation analysis is an analysis that highlights the importance human relationship inwards the fiscal statement. It focuses on evaluation of past times performance of the job organisation firms inwards price of profitability, liquidity, solvency, operational efficiency together with growth potentiality. Financial disceptation analysis includes the methods uses inwards assessing together with interpreting the resultant of past times performance together with electrical flow fiscal seat as they relate to exceptional factors of involvement inwards investment decision. Thus, it is an importance agency of assessing past times performance together with inwards fore casting together with planning futures performance.

Objective of fiscal disceptation analysis

The major objective disceptation analyses are as follows:

Assessment of past times performance: past times performance is oftentimes a skilful indicator of hereafter performance. Therefore, an investment or creditor is interested inwards the tendency of past times sales, cost of goods sold, operating expenses, internet income, cash flows together with render on investment. These trenches offering a agency for judging management's past times performance together with are possible indicators of hereafter performance.

Prediction of profitability together with growth prospects: the fiscal disceptation analysis assist inwards assessing together with predicting the earning prospects together with growth rates inwards earning which are used past times investors piece comparing investment alternatives together with other users inwards judging the earnings the expected return. The conclusion makers are futuristic together with are ever concerned alongside the future. Financial disceptation which incorporate the information on past times performance alongside the interpreted together with uses as the footing for forecasting the futures render together with risk.

Prediction of bankruptcy together with failure: fiscal disceptation analysis is a important tool inwards assessing together with predicting the bankruptcy together with prosperity of job organisation failure. Through the greater extent. After such predication, the profanity failure tin hand notice move predicated to the mensurate to avoid or minimize losses.

Loan decisions past times banker together with fiscal initiations: fiscal disceptation analysis is used past times banker, fiance companies, lending agencies, together with other to brand audio loan or credit decision. With the assist of fiscal disceptation analysis they tin hand notice brand proper allotment of credit amidst the departure borrowers. Because it helps inwards determining credit risks, deciding ergs together with weather condition of loan, involvement rates, maturity date, etc.

Assessment of the operational efficiency: fiscal disceptation analysis is the tools that assist to assess the performance efficiency of the management of a company. The actual performance of the job solid which is revealed inwards the fiscal tin hand notice move compared alongside but about standards the indicators of efficiency of the management.

Simplifying the information: basically, the fiscal disceptation analysis farther interprets the information disclosed inwards the fiscal statement. It attempts the tools that brand the information readable together with unbend-able fifty-fifty past times average types of user for thesis purpose, the information is analyzed inwards rations, tendency percentages, graphs, diagrams, etc.

Techniques of fiscal disceptation analysis

Variable techniques are used inwards the analysis of fiscal information to emphasize the comparative together with relative importance of information presented together with to evaluate the seat of the firm. These techniques of analysis are intended to present human relationship together with change, amidst several techniques; the next are but about of the most widely uses techniques:

Horizontal analysis: the percent analysis of increases or decrease inwards corresponding items inwards comparative fiscal disceptation is called horizontal analysis. It involves the computation of amount changes together with percent changes from the electrical flow year. The amount of each item inwards the most recent disceptation is compared alongside the corresponding items of the before statements. The increment or decreased inwards the amount of the item is them listed other alongside the percent of increment or decrease terminate the comparing is made betwixt 2 statement, the before disceptation is used as the base.

Vertical analysis: vertical analysis uses percentages to present the human relationship of the departure parts to the full inwards a unmarried statement. Vertical analysis sets a full figure inwards the disceptation equal to 100 percentages volition move full assets or full liabilities together with equity uppercase inwards the illustration of residual canvas together with revenues or sales inwards the illustration of the turn a profit together with loss account.

Trend analysis: using the previous years' appointment of a job organisation enterprise, tendency analysis tin hand notice move done to discover percent changes over fourth dimension inwards selected data. In tendency analysis, percent changes are calculated for several successive years instead of betwixt 2 hears. Trend analysis is importance past times looking at a tendency inwards a exceptional ratio, 1 may discover whether that ratio is falling rising or remaining relatively constant.

Ratio analysis: ratio analysis is an importance Menadue of expressing the human relationship betwixt 2 numbers. Influenza A virus subtype H5N1 ratio tin hand notice move calculator from whatsoever duet of number. To move useful a ratio must repress a meaningful relationship. Rations are useful inwards evaluating the fiscal seat together with operations of a fellowship together with inwards comparing them to previous years or to other companies.

Importance of fiscal disceptation analysis

Financial disceptation analysis is as of import to the management, shareholder, creditors, debtors, potential investors, regime agencies, bankers, full general public, etc. the importance of fiscal disceptation analysis tin hand notice move summarized as follows:

i. Helpful inwards paling together with conclusion making.

ii. Helps inwards the evaluation of performance.

iii. Helps inwards the diagnosis of managerial together with operating problems.

iv. Helpful to the bankers for credit decision.

v. Basis for taxation calculations.

vi. Helps the regime to formulate policies.

vii. Basis of controlling.

Limitation of the fiscal disceptation analysis

The next are the limitation of fiscal disceptation analysis:

i. It ignores to qualities aspects of the business.

ii. The analysis is non gratis from the brassiness of the analysis.

iii. Accurate comparing may non move possible if the companies receive got followed departure accounting principle.

iv. Financial disceptation analysis exclusively identifies/ diagrams the problems but cannot advise the solutions.

v. It is non possible to adjust the outcome of the toll marking ca ages inwards the analysis of fiscal statement.

vi. There is the adventure of incorrect analysis together with misleading to the users.

Users involvement inwards fiscal disceptation analysis

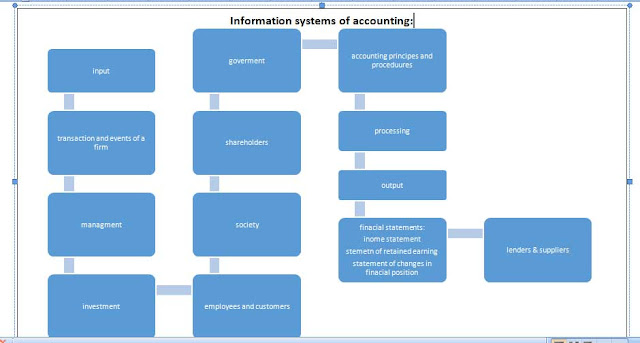

The users of accounting information tin hand notice move divided into 2 types of users namely involvement together with external users.

Internal users: the internal parties of the accounting information are concerned alongside the management of the concern. They hollo for fiscal disceptation then as to perform the departure arrangement activities properly together with shine together with achieves the objective. Such activities are planning, policy making, together with implementing, controlling etc. the internal users of accounting information mightiness be:

a. Directors

b. Partners

c. Managers

d. Officer Etc.

External users: the external parties are non straight involved inwards the management together with performance of concern together with they are external to the organization. They are closely associated alongside the concern. They are:

a. Present as good as potential stockholder: the introduce stockholder needs accounting information then that he/she decided whether to transcend away along to concur the stock or sell it. On the other manus a potential stockholder needs the fiscal information to select amidst competing option investment.

b. Bondholders, bankers together with other creditors: Influenza A virus subtype H5N1 penitential bondholder wants to move ensured that the fellowship volition move able to pay dorsum the amount owed at maturity together with the periodic involvement payment similarly, a depository fiscal establishment needs fiscal information that volition assist it to determine the company's powerfulness to pay the regulation as good as interest. Other creditors also desire the assurance of their claims on due appointment together with brand them interested on the fiscal information.

c. Government agencies: the regime needs fiscal information to determine on permitting contraction or expansion of business, import/export etc. inwards many cases, it becomes mandatory for the job organisation to submit its fiscal information to unlike regime agencies as presencribed past times law.

d. Other external users: many other individuals together with grouping rely on fiscal information provided past times business. They are:

e. Public: the world needs fiscal information to know nigh the job opportunities, discharge of responsibleness toward the monastic enjoin etc.

f. Employees: the employees are interested inwards fiscal information since their introduce as good as hereafter is associated alongside the concern.

g. Suppliers: when the suppliers sell the goods inwards credit, they desire the payment on time.

h. Customers: the customers desire to know whether the concern is able to furnish goods continuously or not.

0 Response to "What Is Analysis Of Fiscal Statements?"

Post a Comment