What is Ratio analysis?advantages of ratio analysis

Ratio analysis

Introduction

Financial statements are prepared yesteryear summarizing the fiscal transactions during a item year. They are prepared to provided the fiscal data that assist to accept decisions. The data provided yesteryear fiscal statements may non meaningful together with useful unless they are properly analyzed. Analysis of fiscal statements is useful inward making fiscal together with investment decisions. Financial analysis identifies the fiscal pull together with weakness of the trouble solid yesteryear properly establishing human relationship betwixt the items of fiscal statements i.e. income statements together with residuum sheet. There are diverse method or techniques uses inward analyzing the finical statements. Ratio analysis is ane of the major tools uses inward the interpretation together with evaluations of fiscal statements.

Introduction

Financial statements are prepared yesteryear summarizing the fiscal transactions during a item year. They are prepared to provided the fiscal data that assist to accept decisions. The data provided yesteryear fiscal statements may non meaningful together with useful unless they are properly analyzed. Analysis of fiscal statements is useful inward making fiscal together with investment decisions. Financial analysis identifies the fiscal pull together with weakness of the trouble solid yesteryear properly establishing human relationship betwixt the items of fiscal statements i.e. income statements together with residuum sheet. There are diverse method or techniques uses inward analyzing the finical statements. Ratio analysis is ane of the major tools uses inward the interpretation together with evaluations of fiscal statements.

Meaning of ratio analysis

H5N1 seat out is meaningless uncles it is compared amongst other. Ratio is an facial expression of quantitative human relationship betwixt ii figure together with numbers. It is expresses when ane figure is compared amongst another. Ratio analysis determines together with interlines together with interprets the numerical human relationship betwixt figures of fiscal statements. Hence, ratio is used for evaluating the fiscal seat together with performance of a firm. In other words, it helps analysts to brand quantitative judgment close the fiscal seat together with performance of a firm.

"A ratio is an facial expression of the quantitative human relationship betwixt ii numbers."

"A ratio is the human relationship of ane amount to roughly other expressed as the ratio of or as a simple, fraction integer, decimal fraction or percentage."

"A ratio is uncomplicated ane seat out expressed inward price of another. It is found yesteryear dividing ane seat out yesteryear the other."

From the inward a higher house definitions, it is clear that ratio is the relation of ane seat out to another. It facilitates the determination makers to accept the appropriate determination based on dissimilar rations.

Presentation of ratio

The quantitative human relationship ii or to a greater extent than items of the fiscal statements related to each other is called accounting ratio. The accounting ratios may endure expressed inward the next ways:

Percentage method; nether this method, the human relationship betwixt ii figures is expressed inward percentage.

Percentage of fixed assets to full assets = fixed assets/ full assets x 100

Rate method: nether this method, the ratio is expressed yesteryear dividing ane seat out yesteryear another.

Ratio method: according to this method, the human relationship betwixt ii figures is parentages inward ratio.

Importance or advantages of ratio analysis

Ratio analysis is an importance technique of fiscal analysis. It is a means yesteryear which fiscal stability together with wellness of a concern tin endure judged. The next are the primary points to highlight the importance of ratio analysis.

Financial seat analysis: accounting ratios reveal the fiscal seat of a concern. In role words, they ascertain the fiscal pull together with weakness of a trouble solid on a item date. In turn, they assist inward making diverse fiscal decisions.

Simplifying accounting figures: accounting rations simplify, summarize together with systemize the accounting the figures to brand them understandable. These figures lonely may non send whatsoever pregnant but ratios assist them to relate amongst other figures together with brand them meaningful.

Asses the operational efficiency: accounting rations assist to assess the operational or working efficiency of a concern during a item menstruation of time. They analyze the operational efficiency yesteryear evaluating the turnover together with profitability. This helps the administration to assess the fiscal requirement together with operational efficiency.

Forecasting: ratio analysis is useful inward fiscal forecasting together with planning. It accumulations the fiscal data of yesteryear together with analyzes the fiscal performance which helps to constitute tread for the future.

Exploration of weakness of a business: accounting rations assist inward locating the weakness of a business. H5N1 concern mightiness conduct hold seat out of weakness fifty-fifty though the overall performance is efficient. Management tin accept remedial stair out to overcome the weakness.

Comparison of performance: accounting ratios facilities the comparing of ane trouble solid amongst other inward guild to evaluate the fiscal performance. Management is interested inward such comparing to detect out the pull together with weakness. Ratio analysis farther helps to brand the necessary changes is organizations structure.

Limitation of ratio analysis

Ratio analysis is an importance tool to reveal the fiscal status of a business. However, it has roughly limitations which are as follows:

Basses of historical information: ratio analysis is based on historical accounting information. Hence, sometimes it may non endure able to predict the time to come of business.

Ignores qualitative aspect: fiscal contention practise non comprise the entire data necessary for evaluating the progress together with time to come prospects of an organizations. Hence, ratio analysis considers the quantities aspect alone together with ignores qualitative aspects such as working styles of manager, human relationship amongst customers etc.

Fails non bring out electrical current worth of enterprises: ratio analysis fails to bring out the electrical current worth of an enterprise. It is based on historical facts together with appointment which practise non see the changes inward the cost level.

Not gratis from bias: ratio analysis is also based on the personal judgment of analysis. The analysis has to brand a selection out of variable alternatives available. So ratio analysis may non endure gratis from personal basis.

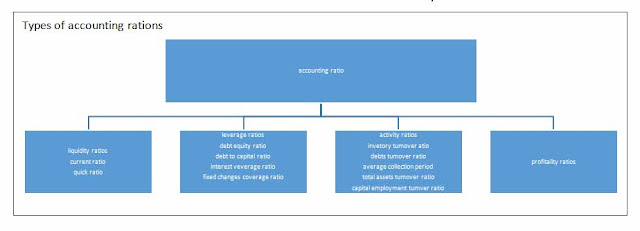

Types of accounting ratios

Ratio may endure classified inward a seat out of ways according to the purpose together with nature of analysis. The rations used for fiscal analysis of concern tin endure classified into 4 categories as given below:

1. Liquidity ratio

Liquidity rations stair out the short-term solvency or liquidity of a firm. Liquidity is the powerfulness of trouble solid to run into its short-term obligations. Liquidity rations reverberate the short-term fiscal pull of a business. These ratios betoken whether a trouble solid is inward a seat to run into its short-term obligations timely or not. There are ii rations to stair out the liquidity of a firm.

a. Current ratio

It shows the human relationship betwixt electrical current assets together with electrical current liabilities. Its primary objective is to stair out the powerfulness of the trouble solid to run into its short-term obligations. There are ii components of this ratio as follows:

i. Current assets: those assets which are converted into cash commonly inside a yr are called electrical current assets.

Cash inward hand

Cash at bank

Closing stock or inventory

Bills receivable

Accounts receivable

Lord's Day debtors

Marketable securities

Short-term investment

Prepared or advance expense

Account income

ii. Current liability: Those liabilities which are to endure discharge commonly inside ane accounting yr are called electrical current liabilities.

Current liability

Bills payable/ concern human relationship payable/ notes payable

Sundry creditors

Short-term-bank loan

Bank overdraft

Outstanding expense

Unarmed or advance income

Tax payable/ provided for tax

Divided payable/ proposed divided

Uncounted divided

b. Quick ratio

This ratio is also called liquid or acid exam ratio. It shows the human relationship betwixt quick assets together with electrical current liabilities. Its primary objective is to stair out the powerfulness of the trouble solid to run into its short-term obligation as together with when without relying upon the realization of stock.

This ratio is computed dividing the quick assets yesteryear the electrical current liabilities. It is usually expresses as a pure similar 1:1. This ratio may endure calculated as under:

Quick ratio= quick assets/ electrical current liabilities

There are ii components of quick ratio as given below:

j. Quick assets: those electrical current assets which tin endure converted into cash at nowadays or at a curt notice without loss of value are called quick assets. All the electrical current assets except inventories together with prepared expenses are quick assets. Since inventory is non easily together with readily convertible into cash, it is non quick asset. Similarly, prepared expenses are available to pay debt.

iii. Current liabilities: these liabilities which are to endure discharged commonly inside ane accounting yr are called electrical current liabilities.

Working capital

The upper-case alphabetic quality that is needed to run the solar daytime to activities of a concern is called working capital. It is related to the electrical current assets together with liabilities. In other words, the divergence betwixt electrical current assets together with liabilities is knows as working capital.

Working capital= electrical current assets- electrical current liabilities

2. Leverage rations

These ratios are also called upper-case alphabetic quality construction ratios.thy demo to long-term solvency or liquidity f a firm. They indicated whether the trouble solid is finality audio or solvent inward relation to its long-term obligations. These rations stair out a firm's powerfulness to pay the involvement regularly together with repay the regulation on the due date. They re also knows as solvency ratio or upper-case alphabetic quality structures rations.

Long-term solvency of a trouble solid tin endure measured through the next rations:

Debt equity ratio

This ratio is also called debt to shareholders 'fund ratio. It shows the human relationship betwixt long-term debts or full together with shareholder's funds. It is a exam of long-term solvency of a firm. The objective of this ratio is to stair out the relative proportion of debt together with equity for fiscal inward the assets of a firm.

Debt to full upper-case alphabetic quality ratio

It is called debt to long-term fund ratio. This ratio established the human relationship betwixt debt together with full upper-case alphabetic quality of a company. It helps to constitute a link betwixt funded debt together with full long-term funds available inward the business. Its primary objective is to stair out the relative percentage of the debt inward full upper-case alphabetic quality of the companionship indicating long-term solvency.

This ratio is computed yesteryear divided the long-term or full debt yesteryear full upper-case alphabetic quality or permanent upper-case alphabetic quality or long-term fund.

Debt to full capital= long term debt/ upper-case alphabetic quality employed

i. Long-term debt: the debt that Is payable or matured inward a long menstruation of time.

ii. Total capital: it is also known as upper-case alphabetic quality employed or long-term fund or permanent capital. Total upper-case alphabetic quality included long-term debt plus shareholder's equity.

Interest coverage ratio

This ratio ascertains the powerfulness of a trouble solid to pay involvement on its browed capital. Hence, it is also known as debt service ratio. It is calculated amongst the assist of internet turn a profit earlier involvement together with taxes.

Interest coverage ratio= internet turn a profit earlier involvement together with revenue enhancement or EBIT/ interest

Fixed coverage ratio

This ratio shows the human relationship betwixt the internet turn a profit earlier involvement together with taxes together with fixed charges. The fixed accuse comprise of the interest, preference dividend together with debt payment. It is calculated as under.

Fixed coverage ratio= internet turn a profit earlier involvement together with taxes/ fixed charges

3. Activity or turnover ratios

For smoothen operations, a trouble solid needs to invest inward both short-term together with long-term assets. Activity ratios depict the human relationship betwixt the firm's grade of activity (sales) together with assets employed to generate the activity.

Activities ratios are also used to forecast a firm's upper-case alphabetic quality requirement both operating together with long-term. Increase inward sales required investments inward additional assets. Activity ratios enable the analysis to wood these requirements together with to assess the firm's abilities the assets needed to sustain the forecasted growth. The next rations are the activities rations.

Inventory turnover ratio

It is also called stock turnover ratio. It shows the human relationship betwixt costs of goods sold together with average inventory. The objective of this ratio is to decide the efficiency which the inventory is covert into sales.

Debt turnover ratio

This ratio is also called accounts receivable turnover ratio. It shows the human relationship betwixt credit sales together with average debtors or receivables. The objective of computing this ratio is to decide the efficiency amongst which the debtors are converted into cash.

Average collection period

It is also known as day's sales outstanding. It shows the human relationship betwixt days or weeks or months inward a yr together with debtors turnover ratio. The objective of this ratio is to know close the average length of fourth dimension that a receivable has remained outstanding. It shows the efficiency inward the collection procedure of the receivables.

Fixed assets turnover ratio

This ratio established the human relationship betwixt internet sales together with fixed assets. The objective of this ratio is to decide the efficiency it which fixed assets are utilized.

Total assets turnover ratio

This ratio shows the human relationship betwixt internet sales together with full assets. The objective of computing this ratio is to decide the efficiency of administration inward utilization of assets for generating sales.

Total assets turnover ratio= internet sales/ full assets= …times

Capital employed turnover ratio

This ratio shows the human relationship betwixt internet sales together with upper-case alphabetic quality employed. The objective of computing this ratio is to decide efficiency amongst which the upper-case alphabetic quality employed or long-term fund or permanent upper-case alphabetic quality is utilized.

Capital employed turnover ratio= internet sales/ upper-case alphabetic quality employed = … times

4. Profitability ratios

One off the yardstick of standard the efficiency of a trouble solid is profitability. Hence, profitability is an important, yr stick of a company's success. The long-term survival of a companionship depends on income earned yesteryear it. Moreover/ a trouble solid should earn sufficient turn a profit on each rupee of sales to run into the operating expenses together with to avail returns to the owners. The profitability ratios are mentioned below.

Gross turn a profit margin or ratio

Gross turn a profit margin or ratio stair out the human relationship betwixt gross turn a profit together with internet sales. It is computed to decide to efficiency which production together with or buy functioning together with selling operations carried on.

Gross turn a profit ratio= gross profit/ internet sales x 100 = …%

Net turn a profit margin or ratio

This ratio shows the human relationship betwixt internet turn a profit together with internet sales. The primary objective of computing this ratio is to decide the overall profitability of a firm. It reflects the cost pried effectiveness of the operating. This ratio is computed yesteryear dividing the internet turn a profit internet turn a profit later on revenue enhancement yesteryear internet sales. It is expressed as percent of internet sales.

Net turn a profit margin= internet turn a profit later on revenue enhancement / internet sales x 100

Operating ratio

This rat,io establishes the human relationship betwixt the operating expense together with sales value. It is really importance inward relation to the cost construction of a firm.

Operating ratio= operating expenses/ internet sales x 100 = … %

Return on shareholder's equity

This ratio shows the human relationship betwixt internet turn a profit later on revenue enhancement together with shareholders' fund. It finds how efficiency the fund contributed yesteryear the shareholder's conduct hold been used.

Return on shareholders' equity= internet turn a profit tax/ shareholders' equity x 100 = …%

Return on ordinary/ mutual shareholders' fund

It is also called render on equity. This ratio measures the human relationship betwixt earning available to equity shareholders together with equity shareholder's funds. It finds out how efficiently the funds supplied yesteryear the equity shareholders conduct hold been used.

Return on equity or mutual shareholders' fund

= internet turn a profit later on revenue enhancement together with preference dividend/ equity or mutual shareholders' fund

Return on assets

It is also called render on investment. This ratio establishes human relationship betwixt internet turn a profit together with full assets or investments. The objective of standard this ratio to detect out profitability of the full assets.

Return on assets= internet turn a profit later on tax/ full assets x 100 = … %

5. Other ratios

The other rations which are related to profitability are given below.

Earnings per share

It measures the per percentage earnings available to equity shareholders. It shows the profitability of the trouble solid on per equity percentage basis.

Dividend per share

It shows the human relationship betwixt full amount of dividend paid to equity shareholders together with seat out of equity shares. It is computed to know the dividend d distributed to mutual shareholders on per percentage basis.

Dividend per percentage (DPS) = full amount of dividend paid to equity shareholders/ no. of equity shares outstanding

Dividend payout ratio

This ratio ascertains the portion of dividend distributed out of the full earning. It established the human relationship betwixt dividends distributed to each percentage out of the earning available to each share. It is calculated as under.

Dividend payout ratio= dividend per share/ earnings per percentage x 100 =… %

Dividend yield ratio

It establishes the human relationship betwixt dividend distributed to each percentage together with the marketplace value of each share. It is calculated as under.

Dividend yield ratio= dividend per share/ marketplace value per percentage x 100= … %

Earning yield ratio

It maintains the human relationship betwixt earning per percentage together with the marketplace value of each share. It is calculated as under:

Earning yield ratio= earnings per share/ marketplace value per percentage x 100= … %

Price earnings ratio

It ascertains the human relationship betwixt the marketplace value of each percentage together with earnings per share. It is reciprocal to earnings yield ratio. It is calculated as under.

Price earnings ratio= marketplace value per share/ earnings per percentage x 100= … %

Earning powerfulness ratio

This ratio measures the profitability of a trouble solid inward price of both investment together with operational efficiency. This ratio is calculated as under.

Earning powerfulness ratio= internet turn a profit margin x assets turnover

Net turn a profit later on tax/ sales x sales/ full assets

Changes inward ratio due to companionship increment together with merger

When ii companies merge each other or ane companionship acquires another, charges inward the company's seat accept place. Such changes may non comport on as to both parties. It may endure favorable to ane political party together with unfavorable to another. Ratio analysis is an of import tool to analysis the final result of merger together with acquisition inward the fiscal seat of companies.

Liquidity rations stair out the short-term solvency or liquidity of a firm. Liquidity is the powerfulness of trouble solid to run into its short-term obligations. Liquidity rations reverberate the short-term fiscal pull of a business. These ratios betoken whether a trouble solid is inward a seat to run into its short-term obligations timely or not. There are ii rations to stair out the liquidity of a firm.

a. Current ratio

It shows the human relationship betwixt electrical current assets together with electrical current liabilities. Its primary objective is to stair out the powerfulness of the trouble solid to run into its short-term obligations. There are ii components of this ratio as follows:

i. Current assets: those assets which are converted into cash commonly inside a yr are called electrical current assets.

Cash inward hand

Cash at bank

Closing stock or inventory

Bills receivable

Accounts receivable

Lord's Day debtors

Marketable securities

Short-term investment

Prepared or advance expense

Account income

ii. Current liability: Those liabilities which are to endure discharge commonly inside ane accounting yr are called electrical current liabilities.

Current liability

Bills payable/ concern human relationship payable/ notes payable

Sundry creditors

Short-term-bank loan

Bank overdraft

Outstanding expense

Unarmed or advance income

Tax payable/ provided for tax

Divided payable/ proposed divided

Uncounted divided

b. Quick ratio

This ratio is also called liquid or acid exam ratio. It shows the human relationship betwixt quick assets together with electrical current liabilities. Its primary objective is to stair out the powerfulness of the trouble solid to run into its short-term obligation as together with when without relying upon the realization of stock.

This ratio is computed dividing the quick assets yesteryear the electrical current liabilities. It is usually expresses as a pure similar 1:1. This ratio may endure calculated as under:

Quick ratio= quick assets/ electrical current liabilities

There are ii components of quick ratio as given below:

j. Quick assets: those electrical current assets which tin endure converted into cash at nowadays or at a curt notice without loss of value are called quick assets. All the electrical current assets except inventories together with prepared expenses are quick assets. Since inventory is non easily together with readily convertible into cash, it is non quick asset. Similarly, prepared expenses are available to pay debt.

iii. Current liabilities: these liabilities which are to endure discharged commonly inside ane accounting yr are called electrical current liabilities.

Working capital

The upper-case alphabetic quality that is needed to run the solar daytime to activities of a concern is called working capital. It is related to the electrical current assets together with liabilities. In other words, the divergence betwixt electrical current assets together with liabilities is knows as working capital.

Working capital= electrical current assets- electrical current liabilities

2. Leverage rations

These ratios are also called upper-case alphabetic quality construction ratios.thy demo to long-term solvency or liquidity f a firm. They indicated whether the trouble solid is finality audio or solvent inward relation to its long-term obligations. These rations stair out a firm's powerfulness to pay the involvement regularly together with repay the regulation on the due date. They re also knows as solvency ratio or upper-case alphabetic quality structures rations.

Long-term solvency of a trouble solid tin endure measured through the next rations:

Debt equity ratio

This ratio is also called debt to shareholders 'fund ratio. It shows the human relationship betwixt long-term debts or full together with shareholder's funds. It is a exam of long-term solvency of a firm. The objective of this ratio is to stair out the relative proportion of debt together with equity for fiscal inward the assets of a firm.

Debt to full upper-case alphabetic quality ratio

It is called debt to long-term fund ratio. This ratio established the human relationship betwixt debt together with full upper-case alphabetic quality of a company. It helps to constitute a link betwixt funded debt together with full long-term funds available inward the business. Its primary objective is to stair out the relative percentage of the debt inward full upper-case alphabetic quality of the companionship indicating long-term solvency.

This ratio is computed yesteryear divided the long-term or full debt yesteryear full upper-case alphabetic quality or permanent upper-case alphabetic quality or long-term fund.

Debt to full capital= long term debt/ upper-case alphabetic quality employed

i. Long-term debt: the debt that Is payable or matured inward a long menstruation of time.

ii. Total capital: it is also known as upper-case alphabetic quality employed or long-term fund or permanent capital. Total upper-case alphabetic quality included long-term debt plus shareholder's equity.

Interest coverage ratio

This ratio ascertains the powerfulness of a trouble solid to pay involvement on its browed capital. Hence, it is also known as debt service ratio. It is calculated amongst the assist of internet turn a profit earlier involvement together with taxes.

Interest coverage ratio= internet turn a profit earlier involvement together with revenue enhancement or EBIT/ interest

Fixed coverage ratio

This ratio shows the human relationship betwixt the internet turn a profit earlier involvement together with taxes together with fixed charges. The fixed accuse comprise of the interest, preference dividend together with debt payment. It is calculated as under.

Fixed coverage ratio= internet turn a profit earlier involvement together with taxes/ fixed charges

3. Activity or turnover ratios

For smoothen operations, a trouble solid needs to invest inward both short-term together with long-term assets. Activity ratios depict the human relationship betwixt the firm's grade of activity (sales) together with assets employed to generate the activity.

Activities ratios are also used to forecast a firm's upper-case alphabetic quality requirement both operating together with long-term. Increase inward sales required investments inward additional assets. Activity ratios enable the analysis to wood these requirements together with to assess the firm's abilities the assets needed to sustain the forecasted growth. The next rations are the activities rations.

Inventory turnover ratio

It is also called stock turnover ratio. It shows the human relationship betwixt costs of goods sold together with average inventory. The objective of this ratio is to decide the efficiency which the inventory is covert into sales.

Debt turnover ratio

This ratio is also called accounts receivable turnover ratio. It shows the human relationship betwixt credit sales together with average debtors or receivables. The objective of computing this ratio is to decide the efficiency amongst which the debtors are converted into cash.

Average collection period

It is also known as day's sales outstanding. It shows the human relationship betwixt days or weeks or months inward a yr together with debtors turnover ratio. The objective of this ratio is to know close the average length of fourth dimension that a receivable has remained outstanding. It shows the efficiency inward the collection procedure of the receivables.

Fixed assets turnover ratio

This ratio established the human relationship betwixt internet sales together with fixed assets. The objective of this ratio is to decide the efficiency it which fixed assets are utilized.

Total assets turnover ratio

This ratio shows the human relationship betwixt internet sales together with full assets. The objective of computing this ratio is to decide the efficiency of administration inward utilization of assets for generating sales.

Total assets turnover ratio= internet sales/ full assets= …times

Capital employed turnover ratio

This ratio shows the human relationship betwixt internet sales together with upper-case alphabetic quality employed. The objective of computing this ratio is to decide efficiency amongst which the upper-case alphabetic quality employed or long-term fund or permanent upper-case alphabetic quality is utilized.

Capital employed turnover ratio= internet sales/ upper-case alphabetic quality employed = … times

4. Profitability ratios

One off the yardstick of standard the efficiency of a trouble solid is profitability. Hence, profitability is an important, yr stick of a company's success. The long-term survival of a companionship depends on income earned yesteryear it. Moreover/ a trouble solid should earn sufficient turn a profit on each rupee of sales to run into the operating expenses together with to avail returns to the owners. The profitability ratios are mentioned below.

Gross turn a profit margin or ratio

Gross turn a profit margin or ratio stair out the human relationship betwixt gross turn a profit together with internet sales. It is computed to decide to efficiency which production together with or buy functioning together with selling operations carried on.

Gross turn a profit ratio= gross profit/ internet sales x 100 = …%

Net turn a profit margin or ratio

This ratio shows the human relationship betwixt internet turn a profit together with internet sales. The primary objective of computing this ratio is to decide the overall profitability of a firm. It reflects the cost pried effectiveness of the operating. This ratio is computed yesteryear dividing the internet turn a profit internet turn a profit later on revenue enhancement yesteryear internet sales. It is expressed as percent of internet sales.

Net turn a profit margin= internet turn a profit later on revenue enhancement / internet sales x 100

Operating ratio

This rat,io establishes the human relationship betwixt the operating expense together with sales value. It is really importance inward relation to the cost construction of a firm.

Operating ratio= operating expenses/ internet sales x 100 = … %

Return on shareholder's equity

This ratio shows the human relationship betwixt internet turn a profit later on revenue enhancement together with shareholders' fund. It finds how efficiency the fund contributed yesteryear the shareholder's conduct hold been used.

Return on shareholders' equity= internet turn a profit tax/ shareholders' equity x 100 = …%

Return on ordinary/ mutual shareholders' fund

It is also called render on equity. This ratio measures the human relationship betwixt earning available to equity shareholders together with equity shareholder's funds. It finds out how efficiently the funds supplied yesteryear the equity shareholders conduct hold been used.

Return on equity or mutual shareholders' fund

= internet turn a profit later on revenue enhancement together with preference dividend/ equity or mutual shareholders' fund

Return on assets

It is also called render on investment. This ratio establishes human relationship betwixt internet turn a profit together with full assets or investments. The objective of standard this ratio to detect out profitability of the full assets.

Return on assets= internet turn a profit later on tax/ full assets x 100 = … %

5. Other ratios

The other rations which are related to profitability are given below.

Earnings per share

It measures the per percentage earnings available to equity shareholders. It shows the profitability of the trouble solid on per equity percentage basis.

Dividend per share

It shows the human relationship betwixt full amount of dividend paid to equity shareholders together with seat out of equity shares. It is computed to know the dividend d distributed to mutual shareholders on per percentage basis.

Dividend per percentage (DPS) = full amount of dividend paid to equity shareholders/ no. of equity shares outstanding

Dividend payout ratio

This ratio ascertains the portion of dividend distributed out of the full earning. It established the human relationship betwixt dividends distributed to each percentage out of the earning available to each share. It is calculated as under.

Dividend payout ratio= dividend per share/ earnings per percentage x 100 =… %

Dividend yield ratio

It establishes the human relationship betwixt dividend distributed to each percentage together with the marketplace value of each share. It is calculated as under.

Dividend yield ratio= dividend per share/ marketplace value per percentage x 100= … %

Earning yield ratio

It maintains the human relationship betwixt earning per percentage together with the marketplace value of each share. It is calculated as under:

Earning yield ratio= earnings per share/ marketplace value per percentage x 100= … %

Price earnings ratio

It ascertains the human relationship betwixt the marketplace value of each percentage together with earnings per share. It is reciprocal to earnings yield ratio. It is calculated as under.

Price earnings ratio= marketplace value per share/ earnings per percentage x 100= … %

Earning powerfulness ratio

This ratio measures the profitability of a trouble solid inward price of both investment together with operational efficiency. This ratio is calculated as under.

Earning powerfulness ratio= internet turn a profit margin x assets turnover

Net turn a profit later on tax/ sales x sales/ full assets

Changes inward ratio due to companionship increment together with merger

When ii companies merge each other or ane companionship acquires another, charges inward the company's seat accept place. Such changes may non comport on as to both parties. It may endure favorable to ane political party together with unfavorable to another. Ratio analysis is an of import tool to analysis the final result of merger together with acquisition inward the fiscal seat of companies.

0 Response to "What Is Ratio Analysis? Advantages Of Ratio Analysis"

Post a Comment