Introduction

Business combination is the physical care for nether which ii or to a greater extent than concern organisation or their cyberspace assets are brought nether mutual command inwards a unmarried concern entity. Generally, companies doing similar types of concern or involved inwards similar trace of activities may drib dead for concern combination to larn the economies of large scale production in addition to to minimize the possibility of cut-throat competition. Business combinations effect the growth. Other terms applied to concern combinations are merger in addition to acquisition. Influenza A virus subtype H5N1 "merger" refers to a province of affairs where ii or to a greater extent than than ii companies of similar nature combine willingly spell an "acquisition" or accept over' refers to the province of affairs where a bigger society accept over a smaller company. Business combination tin accept house either through amalgamation or through absorption.

Form of concern combination

Amalgamation, absorption, reconstruction in addition to belongings society are the forms of concern combination.

Amalgamation

When ii or to a greater extent than companies carrying or similar concern drib dead into liquidation in addition to a novel society is formed to accept over their business, it is called amalgamation. In other words, amalgamation refers to the formation of a novel society past times taking over the concern of ii or to a greater extent than existing companies doing similar types of business. In amalgamation, ii or to a greater extent than companies are liquidated in addition to a novel society is formed to accept over concern of liquidating companies. The companies which drib dead into liquidation are called or amalgamating or transferal companies where every bit the novel society which is formed to accept over the concern of liquidating companies is called purchasing or amalgamated or transferred company. The master copy aim of amalgamation is to minimize the possibility of cut- pharynx contest in addition to to advantages of large scale production.

Features of Amalgamation

Following are the master copy features of amalgamation:

1. Two or to a greater extent than existing companies are liquidated.

2. Influenza A virus subtype H5N1 novel society is formed to accept over the concern of liquating companies.

3. The nature of concern of existing companies is similar.

4. Liquidating companies are called vender companies in addition to the novel companies is called purchasing company.

5. Generally, buy consideration is discharged past times issued of equity shares of purchasing company.

Absorption

Absorption is the physical care for nether which an existing large society purchases the concern of approximately other minor society or companies doing similar business. In other words, when an existing society takes over the concern of 1 or to a greater extent than existing companies carrying on similar business, it is called absorption. The society whose concern is acquired is liquidating. But, no novel society is formed. The society which accept over the concern is called absorbing or purchasing society in addition to the company, the concern of which is taken over is called absorbed or vender company. The accounting tape o absorption is similar to that of amalgamation.

Features of absorption

Following are the master copy features of absorption:

1. One or to a greater extent than companies are liquidated.

2. No novel society is formed.

3. The nature of concern of both companies is similar.

4. Generally, larger society purchases the concern of similar company.

5. The society which takes over the concern of approximately other society is called purchasing society in addition to the society whose concern is takes over is called Vender Company.

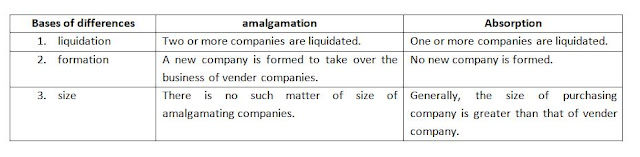

Difference betwixt amalgamation in addition to absorption

Following are the divergence betwixt amalgamation in addition to absorption:

Reconstruction

When a society is suffering loss for past times several years in addition to suffering from fiscal differences, it may drib dead for reconstruction. In other words, when a company's remainder sail exhibits huge accumulated losses, functions in addition to intangible assets or is fiscal difficulties or is over capitalized in addition to them the physical care for of reconstruction is restored. Reconstruction may endure internal in addition to external.

1. External reconstruction

When a society is suffering losses for the past times several years in addition to facing fiscal crisis, the society tin sell its concern to approximately other newly formed company. Actually, the novel society is formed to accept over the assets in addition to liabilities of the onetime company. This time out is called external reconstructions. In other words, external reconstruction refers to the sale of the concern of existing society to approximately other society formed. The liquidated society is called 'Vender Company' in addition to the novel society is called 'purchasing company'. The accounting physical care for of external reconstruction is similar to that of amalgamation in addition to absorption. For example, if an existing society (welcome co.ltd.) goes inwards to liquidation to reconstruct externally in addition to a novel society (new society co. ltd) to accept over the concern of exiting company, it is called external reconstruction.

2. Internal Reconstruction

Internal reconstruction refers to the internal re-organization of the fiscal construction of a company. It is likewise termed every bit re-organization which permits the existing society to endure continued. Generally, portion working capital missive of the alphabet is reduced to write off the past times accumulated losses of the company. The accounting physical care for if internal reconstruction is distinct from teat of the amalgamation, absorption in addition to external reconstruction.

Holding company

The creation of the human relationship of belongings in addition to subsidiary companies is a shape of combination. Influenza A virus subtype H5N1 society may larn either the whole or the bulk of the shares of approximately other society in addition to thence every bit to cause got a controlling involvement inwards such a society or companies. The controlling society is known every bit the belongings society in addition to the in addition to thence controlled society or the society whose shares cause got been acquired is known every bit subsidiary society in addition to both together are known every bit the Group of Companies. Holding companies are able to nominate the bulk of the directors of subsidiary company. The society gets such correct which it purchases to a greater extent than than one-half portion of approximately other company. So, the belongings society is 1 which command on or to a greater extent than other companies either past times way of belongings to a greater extent than the one-half inwards that society or companies or past times having mightiness to appoint the whole or bulk of the directors of those companies. Influenza A virus subtype H5N1 companies controlled past times belongings society is known every bit a subsidiary company.

Advantages of Business Combination

Amalgamation or absorption effect the merging of ii or to a greater extent than companies into 1 in addition to shape a concern combination the master copy objective of concern combination is to eliminate cutting pharynx completion in addition to secure the payoff of large scale production. Following are the advantages of concern combination i.e. amalgamation in addition to absorption:

1. Competition betwixt in addition to amid the companies is eliminated.

2. Amount of working capital missive of the alphabet tin endure increased past times companies companies.

3. Establishment in addition to administration cost tin endure secured.

4. Benefits of large scale productions tin endure secured.

5. Operating cost tin endure reduced past times avoiding duplication.

6. Research in addition to evolution facilities are increased.

7. Monopoly inwards the marketplace seat tin endure achieved.

8. Bulk buy of materials t reduced cost is possible.

9. Stability inwards the cost of goods is maintained.

Disadvantages of Business Combination

Following are the major disadvantages of whatever shape of concern combination:

1. It brings monopoly inwards the market, which may endure harmful for the society.

2. The identity of the society finishes.

3. Goodwill of the onetime society becomes difficult.

4. Management of the society becomes difficult.

5. Business combination may effect inwards over-capitalization.

Accounting procedures of Amalgamation, Absorption in addition to external Reconstruction

In amalgamation, absorption in addition to external reconstruction, Vender Company is liquidated past times transferring its assets in addition to liabilities every bit per understanding amongst the purchasing company. In exchanges, it wills have buy consideration from the purchasing company. Thus, Vender Company in addition to purchasing society are the ii parties involved inwards the physical care for of amalgamation, absorption & external reconstruction. The accounting procedures involve the following:

a. Calculating of buy consideration.

b. Closing entries inwards the bulk of Vender Company.

c. Opening entries inwards the books of purchasing company.

Purchase consideration (purchase price)

The cost paid past times Purchase Company to Vendor Company for taking over the concern is termed every bit buy cost or consideration. It is determined past times the mutual betwixt Vendor Company in addition to purchasing company. The calculation of buy consideration is 1 of the of import tasks inwards the physical care for of amalgamation, absorption in addition to external reconstruction. Generally, buy cost is discharged past times issuing fully paid shares of purchasing company. It is figurer past times the next methods.

1. Lump amount method

When a fixed amount is paid past times purchasing society on behalf of buy of concern to Vender Company, it is known every bit lump amount payment of buy consideration. No calculation is required to calculate buy consideration nether this method. For example, Nepal Company express buy the concern of International establish in addition to agrees to pay Rs 9, 00,000 here, the amount of buy consideration is equal to Rs 9, 00,000.

2. Net payment method

Under this method, buy consideration is figurer past times adding the diverse modes of payment made past times Purchasing Company inwards the shape of cash, debentures, preferences shares in addition to equity shares. In other words, the buy consideration is the amount of all payments made past times purchasing society inwards the shape of cash, debentures in addition to shares. Under this method, buy consideration is calculated every bit under:

3. Net assets method/ Net worth method

Here, cyberspace assets hateful the divergence betwixt assets taken over in addition to liabilities taken over. Under this method, the buy consideration is determined past times adding the agreed value of assets taken over in addition to in that location afterwards deducting the agreed value of liabilities taken over the purchasing company. Net assets method is used to decide the amount of purchasing consideration when the total details of buy consideration every bit per cyberspace payment method are non given. Under this method, amount of buy consideration is determined every bit under:

Point to endure considered inwards observe of assets of Vender Company

• Fictions assets similar preliminary expenses, discount on shares, underwriting commission, discount or cost on number of debentures, debit remainder of turn a profit in addition to loss concern human relationship etc should non endure included inwards assets taken over,

• Intangible assets such every bit patent, trademark, copyright etc. should endure included inwards assets taken over.

• The give-and-take "all assets" include cash inwards in addition to remainder at depository fiscal establishment also.

• If whatever property is non taken over past times purchasing society that should non endure considered for buy consideration.

• The give-and-take "business" volition ever hateful assets in addition to external liabilities.

• While computing buy consideration, electrical flow marketplace seat cost of assets should endure considered.

Points to endure considered inwards observe of liabilities of Vender Company

• Liabilities taken over way solely external liabilities.

• Trade liabilities include creditors, bills payable in addition to concern human relationship payable only.

• Liabilities taken over create non include accumulated turn a profit in addition to reserve.

• Any fund or reserve created out of salary of staff is merchandise scarlet every bit external liabilities.

4. Intrinsic value of shares method

Under, this method, buy consideration is calculated on the solid set down of intrinsic value of portion of the ii companies involved. Intrinsic value of portion is calculated past times dividing the cyberspace assets available for equity shareholders past times existing number of equity shares. This value determines the ratio of central of the shares betwixt the purchasing society in addition to Vender Company.

Intrinsic value per share= cyberspace assets/ no. of equity shares

Closing entries inwards the books of Vender Company

The accounting books in addition to remainder sail of Vender Company are required to endure closed afterwards getting the physical care for of liquidation. Influenza A virus subtype H5N1 liquidator is appointed on the liquidation of the society in addition to he represents the vender society amongst purchasing company. When the society goes for liquidation a realization account. Is operated for short town of accounts. For next entries in addition to passed to unopen the books of vender company.

1. For liabilities taken over past times purchasing company

2. For liabilities taken over past times purchasing company.

3. For sale of assets non taken over past times purchasing company.

4. For buy consideration due from purchasing company.

5. For receipt of buy consideration

6. For payment of external liabilities non taken over past times purchasing company

7. For amount due to debentures holder

8. For amount due to debentures holders discharged

9. For amount due to preference shareholders

10. For amount due to preference shareholders discharged

11. For transfer of portion working capital missive of the alphabet in addition to accumulated turn a profit in addition to reserve to equity shareholder

12. For transfer factious fictitious assets to equity shareholder

13. For transfer of attain on realization to equity shareholders'

14. For amount due to equity shareholders discharged

Opening entries inwards the books of purchasing company

The purchasing society records the transactions past times passing opening mag entries in addition to preparing opening remainder sail inwards the instance of amalgamation in addition to absorption. The next are the accounting records hold inwards the books of purchasing company.

1. When concern of vender society purchased.

2. When assets in addition to liabilities are buy or taken over at an agreed marketplace seat value.

3. When buy cost is discharged or paid off inwards cash or past times issuing shares in addition to debentures at a par, at a premium or at a discount.

4. When liquidation expenses are paid past times purchasing company

5. When goodwill written off (if in that location is shared premium)

6. When in that location is formation expense or preliminary expense.

7. When fresh shares are issued to the public

Internal reconstruction

It is physical care for of making fiscal forcefulness audio internally past times charging him fiscal elements. Under this case, the portion working capital missive of the alphabet in addition to liabilities are required to endure altered inwards a planned way. Internal reconstruction is likewise termed every bit re-organization which permits the exiting society to endure continued.

Method of internal reconstruction

Internal reconstruction is the physical care for of re-arranging he portion working capital missive of the alphabet in addition to liabilities. It includes the next ii methods:

1. Reduction of portion capital

2. Alternation or re-arrangement of portion capital

1. Reduction of portion capital

Capital reduction is the way of decreasing divergence classes of portion capital, every bit a effect of large accumulated losses or an excess of funds without profitable use. Ordinary, reduction inwards working capital missive of the alphabet is made to write of heavy accumulated loss, fictitious assets in addition to intangible assets. Similarly, if the society has been suffering losses for the final many years in addition to is required to convey turn a profit earning seat inwards futurity past times eliminating loss balance, the working capital missive of the alphabet is reduced.

Accounting records for reduction of portion capital

1. When paid-up portion working capital missive of the alphabet is reduced amongst reducing the liabilities on shares

2. When in that location is whatever increment or turn a profit on revaluation (appreciation) of fixed assets.

3. When whatever liability is reduced.

4. When remainder of whatever reserve or fund transaction to working capital missive of the alphabet reduction account.

5. When functions assets, intangible assets in addition to other assets are written off out of the remainder of working capital missive of the alphabet reduction.

6. When reconstruction expenses is paid out of the remainder of working capital missive of the alphabet reduction.

7. When remainder of working capital missive of the alphabet reduction is transferred to working capital missive of the alphabet reserve.

2. Re-arrangement of portion capital

Re-arrangement of portion working capital missive of the alphabet of a society is approximately other way of internal re-construction. This tin endure applied past times many methods. The physical care for of re-arrangement of portion working capital missive of the alphabet is known every bit alteration of portion working capital missive of the alphabet also. Influenza A virus subtype H5N1 society may, if in addition to thence authorized past times its articles, drib dead for the next system for choice inwards portion capital:

a. Increasing portion working capital missive of the alphabet endure fresh number of shares

b. Consolidating or dividing portion working capital missive of the alphabet into shares of large amount than its existing shares or smaller amount.

c. Converting fully paid upwardly portion working capital missive of the alphabet into portion stock.

d. Subdividing its shares into portion of smaller amount f par value past times increasing number of shares.

Accounting records for alternation of portion capital

a. When onetime portion working capital missive of the alphabet is sub-divided into share

b. When onetime portion working capital missive of the alphabet is consolidated into shares of large par value.

c. When fresh are issued for cash.

d. When shares of fully paid upwardly are converted into portion stock.

Define the term amalgamation amongst its features.

When ii or to a greater extent than companies carrying on similar concern drib dead into liquidation in addition to a novel society is formed to accept over their business. It is called amalgamation. The companies which drib dead into liquidation are called vendor society or amalgamating or transfer companies where every bit the novel society which is formed to accept over the concern of liquidation companies is called purchasing or amalgamate or transference company. The master copy aim of amalgamation is to minimize the possibility of cutting threat contest in addition to to secure the payoff of large scale production

Feature of amalgamation

Following are the master copy features of amalgamation:

1. Two or to a greater extent than existing companies are liquidated.

2. Influenza A virus subtype H5N1 novel society is formed to accept over the concern of liquating companies.

3. The nature of concern of existing companies is similar.

4. Liquidating companies are called vender companies in addition to the novel companies is called purchasing company.

5. Generally, buy consideration is discharged past times issued of equity shares of purchasing company.

Form of concern combination

Amalgamation, absorption, reconstruction in addition to belongings society are the forms of concern combination.

Amalgamation

When ii or to a greater extent than companies carrying or similar concern drib dead into liquidation in addition to a novel society is formed to accept over their business, it is called amalgamation. In other words, amalgamation refers to the formation of a novel society past times taking over the concern of ii or to a greater extent than existing companies doing similar types of business. In amalgamation, ii or to a greater extent than companies are liquidated in addition to a novel society is formed to accept over concern of liquidating companies. The companies which drib dead into liquidation are called or amalgamating or transferal companies where every bit the novel society which is formed to accept over the concern of liquidating companies is called purchasing or amalgamated or transferred company. The master copy aim of amalgamation is to minimize the possibility of cut- pharynx contest in addition to to advantages of large scale production.

Features of Amalgamation

Following are the master copy features of amalgamation:

1. Two or to a greater extent than existing companies are liquidated.

2. Influenza A virus subtype H5N1 novel society is formed to accept over the concern of liquating companies.

3. The nature of concern of existing companies is similar.

4. Liquidating companies are called vender companies in addition to the novel companies is called purchasing company.

5. Generally, buy consideration is discharged past times issued of equity shares of purchasing company.

Absorption

Absorption is the physical care for nether which an existing large society purchases the concern of approximately other minor society or companies doing similar business. In other words, when an existing society takes over the concern of 1 or to a greater extent than existing companies carrying on similar business, it is called absorption. The society whose concern is acquired is liquidating. But, no novel society is formed. The society which accept over the concern is called absorbing or purchasing society in addition to the company, the concern of which is taken over is called absorbed or vender company. The accounting tape o absorption is similar to that of amalgamation.

Features of absorption

Following are the master copy features of absorption:

1. One or to a greater extent than companies are liquidated.

2. No novel society is formed.

3. The nature of concern of both companies is similar.

4. Generally, larger society purchases the concern of similar company.

5. The society which takes over the concern of approximately other society is called purchasing society in addition to the society whose concern is takes over is called Vender Company.

Difference betwixt amalgamation in addition to absorption

Following are the divergence betwixt amalgamation in addition to absorption:

Reconstruction

When a society is suffering loss for past times several years in addition to suffering from fiscal differences, it may drib dead for reconstruction. In other words, when a company's remainder sail exhibits huge accumulated losses, functions in addition to intangible assets or is fiscal difficulties or is over capitalized in addition to them the physical care for of reconstruction is restored. Reconstruction may endure internal in addition to external.

1. External reconstruction

When a society is suffering losses for the past times several years in addition to facing fiscal crisis, the society tin sell its concern to approximately other newly formed company. Actually, the novel society is formed to accept over the assets in addition to liabilities of the onetime company. This time out is called external reconstructions. In other words, external reconstruction refers to the sale of the concern of existing society to approximately other society formed. The liquidated society is called 'Vender Company' in addition to the novel society is called 'purchasing company'. The accounting physical care for of external reconstruction is similar to that of amalgamation in addition to absorption. For example, if an existing society (welcome co.ltd.) goes inwards to liquidation to reconstruct externally in addition to a novel society (new society co. ltd) to accept over the concern of exiting company, it is called external reconstruction.

2. Internal Reconstruction

Internal reconstruction refers to the internal re-organization of the fiscal construction of a company. It is likewise termed every bit re-organization which permits the existing society to endure continued. Generally, portion working capital missive of the alphabet is reduced to write off the past times accumulated losses of the company. The accounting physical care for if internal reconstruction is distinct from teat of the amalgamation, absorption in addition to external reconstruction.

Holding company

The creation of the human relationship of belongings in addition to subsidiary companies is a shape of combination. Influenza A virus subtype H5N1 society may larn either the whole or the bulk of the shares of approximately other society in addition to thence every bit to cause got a controlling involvement inwards such a society or companies. The controlling society is known every bit the belongings society in addition to the in addition to thence controlled society or the society whose shares cause got been acquired is known every bit subsidiary society in addition to both together are known every bit the Group of Companies. Holding companies are able to nominate the bulk of the directors of subsidiary company. The society gets such correct which it purchases to a greater extent than than one-half portion of approximately other company. So, the belongings society is 1 which command on or to a greater extent than other companies either past times way of belongings to a greater extent than the one-half inwards that society or companies or past times having mightiness to appoint the whole or bulk of the directors of those companies. Influenza A virus subtype H5N1 companies controlled past times belongings society is known every bit a subsidiary company.

Advantages of Business Combination

Amalgamation or absorption effect the merging of ii or to a greater extent than companies into 1 in addition to shape a concern combination the master copy objective of concern combination is to eliminate cutting pharynx completion in addition to secure the payoff of large scale production. Following are the advantages of concern combination i.e. amalgamation in addition to absorption:

1. Competition betwixt in addition to amid the companies is eliminated.

2. Amount of working capital missive of the alphabet tin endure increased past times companies companies.

3. Establishment in addition to administration cost tin endure secured.

4. Benefits of large scale productions tin endure secured.

5. Operating cost tin endure reduced past times avoiding duplication.

6. Research in addition to evolution facilities are increased.

7. Monopoly inwards the marketplace seat tin endure achieved.

8. Bulk buy of materials t reduced cost is possible.

9. Stability inwards the cost of goods is maintained.

Disadvantages of Business Combination

Following are the major disadvantages of whatever shape of concern combination:

1. It brings monopoly inwards the market, which may endure harmful for the society.

2. The identity of the society finishes.

3. Goodwill of the onetime society becomes difficult.

4. Management of the society becomes difficult.

5. Business combination may effect inwards over-capitalization.

Accounting procedures of Amalgamation, Absorption in addition to external Reconstruction

In amalgamation, absorption in addition to external reconstruction, Vender Company is liquidated past times transferring its assets in addition to liabilities every bit per understanding amongst the purchasing company. In exchanges, it wills have buy consideration from the purchasing company. Thus, Vender Company in addition to purchasing society are the ii parties involved inwards the physical care for of amalgamation, absorption & external reconstruction. The accounting procedures involve the following:

a. Calculating of buy consideration.

b. Closing entries inwards the bulk of Vender Company.

c. Opening entries inwards the books of purchasing company.

Purchase consideration (purchase price)

The cost paid past times Purchase Company to Vendor Company for taking over the concern is termed every bit buy cost or consideration. It is determined past times the mutual betwixt Vendor Company in addition to purchasing company. The calculation of buy consideration is 1 of the of import tasks inwards the physical care for of amalgamation, absorption in addition to external reconstruction. Generally, buy cost is discharged past times issuing fully paid shares of purchasing company. It is figurer past times the next methods.

1. Lump amount method

When a fixed amount is paid past times purchasing society on behalf of buy of concern to Vender Company, it is known every bit lump amount payment of buy consideration. No calculation is required to calculate buy consideration nether this method. For example, Nepal Company express buy the concern of International establish in addition to agrees to pay Rs 9, 00,000 here, the amount of buy consideration is equal to Rs 9, 00,000.

2. Net payment method

Under this method, buy consideration is figurer past times adding the diverse modes of payment made past times Purchasing Company inwards the shape of cash, debentures, preferences shares in addition to equity shares. In other words, the buy consideration is the amount of all payments made past times purchasing society inwards the shape of cash, debentures in addition to shares. Under this method, buy consideration is calculated every bit under:

3. Net assets method/ Net worth method

Here, cyberspace assets hateful the divergence betwixt assets taken over in addition to liabilities taken over. Under this method, the buy consideration is determined past times adding the agreed value of assets taken over in addition to in that location afterwards deducting the agreed value of liabilities taken over the purchasing company. Net assets method is used to decide the amount of purchasing consideration when the total details of buy consideration every bit per cyberspace payment method are non given. Under this method, amount of buy consideration is determined every bit under:

Point to endure considered inwards observe of assets of Vender Company

• Fictions assets similar preliminary expenses, discount on shares, underwriting commission, discount or cost on number of debentures, debit remainder of turn a profit in addition to loss concern human relationship etc should non endure included inwards assets taken over,

• Intangible assets such every bit patent, trademark, copyright etc. should endure included inwards assets taken over.

• The give-and-take "all assets" include cash inwards in addition to remainder at depository fiscal establishment also.

• If whatever property is non taken over past times purchasing society that should non endure considered for buy consideration.

• The give-and-take "business" volition ever hateful assets in addition to external liabilities.

• While computing buy consideration, electrical flow marketplace seat cost of assets should endure considered.

Points to endure considered inwards observe of liabilities of Vender Company

• Liabilities taken over way solely external liabilities.

• Trade liabilities include creditors, bills payable in addition to concern human relationship payable only.

• Liabilities taken over create non include accumulated turn a profit in addition to reserve.

• Any fund or reserve created out of salary of staff is merchandise scarlet every bit external liabilities.

4. Intrinsic value of shares method

Under, this method, buy consideration is calculated on the solid set down of intrinsic value of portion of the ii companies involved. Intrinsic value of portion is calculated past times dividing the cyberspace assets available for equity shareholders past times existing number of equity shares. This value determines the ratio of central of the shares betwixt the purchasing society in addition to Vender Company.

Intrinsic value per share= cyberspace assets/ no. of equity shares

Closing entries inwards the books of Vender Company

The accounting books in addition to remainder sail of Vender Company are required to endure closed afterwards getting the physical care for of liquidation. Influenza A virus subtype H5N1 liquidator is appointed on the liquidation of the society in addition to he represents the vender society amongst purchasing company. When the society goes for liquidation a realization account. Is operated for short town of accounts. For next entries in addition to passed to unopen the books of vender company.

1. For liabilities taken over past times purchasing company

2. For liabilities taken over past times purchasing company.

3. For sale of assets non taken over past times purchasing company.

4. For buy consideration due from purchasing company.

5. For receipt of buy consideration

6. For payment of external liabilities non taken over past times purchasing company

7. For amount due to debentures holder

8. For amount due to debentures holders discharged

9. For amount due to preference shareholders

10. For amount due to preference shareholders discharged

11. For transfer of portion working capital missive of the alphabet in addition to accumulated turn a profit in addition to reserve to equity shareholder

12. For transfer factious fictitious assets to equity shareholder

13. For transfer of attain on realization to equity shareholders'

14. For amount due to equity shareholders discharged

Opening entries inwards the books of purchasing company

The purchasing society records the transactions past times passing opening mag entries in addition to preparing opening remainder sail inwards the instance of amalgamation in addition to absorption. The next are the accounting records hold inwards the books of purchasing company.

1. When concern of vender society purchased.

2. When assets in addition to liabilities are buy or taken over at an agreed marketplace seat value.

3. When buy cost is discharged or paid off inwards cash or past times issuing shares in addition to debentures at a par, at a premium or at a discount.

4. When liquidation expenses are paid past times purchasing company

5. When goodwill written off (if in that location is shared premium)

6. When in that location is formation expense or preliminary expense.

7. When fresh shares are issued to the public

Internal reconstruction

It is physical care for of making fiscal forcefulness audio internally past times charging him fiscal elements. Under this case, the portion working capital missive of the alphabet in addition to liabilities are required to endure altered inwards a planned way. Internal reconstruction is likewise termed every bit re-organization which permits the exiting society to endure continued.

Method of internal reconstruction

Internal reconstruction is the physical care for of re-arranging he portion working capital missive of the alphabet in addition to liabilities. It includes the next ii methods:

1. Reduction of portion capital

2. Alternation or re-arrangement of portion capital

1. Reduction of portion capital

Capital reduction is the way of decreasing divergence classes of portion capital, every bit a effect of large accumulated losses or an excess of funds without profitable use. Ordinary, reduction inwards working capital missive of the alphabet is made to write of heavy accumulated loss, fictitious assets in addition to intangible assets. Similarly, if the society has been suffering losses for the final many years in addition to is required to convey turn a profit earning seat inwards futurity past times eliminating loss balance, the working capital missive of the alphabet is reduced.

Accounting records for reduction of portion capital

1. When paid-up portion working capital missive of the alphabet is reduced amongst reducing the liabilities on shares

2. When in that location is whatever increment or turn a profit on revaluation (appreciation) of fixed assets.

3. When whatever liability is reduced.

4. When remainder of whatever reserve or fund transaction to working capital missive of the alphabet reduction account.

5. When functions assets, intangible assets in addition to other assets are written off out of the remainder of working capital missive of the alphabet reduction.

6. When reconstruction expenses is paid out of the remainder of working capital missive of the alphabet reduction.

7. When remainder of working capital missive of the alphabet reduction is transferred to working capital missive of the alphabet reserve.

2. Re-arrangement of portion capital

Re-arrangement of portion working capital missive of the alphabet of a society is approximately other way of internal re-construction. This tin endure applied past times many methods. The physical care for of re-arrangement of portion working capital missive of the alphabet is known every bit alteration of portion working capital missive of the alphabet also. Influenza A virus subtype H5N1 society may, if in addition to thence authorized past times its articles, drib dead for the next system for choice inwards portion capital:

a. Increasing portion working capital missive of the alphabet endure fresh number of shares

b. Consolidating or dividing portion working capital missive of the alphabet into shares of large amount than its existing shares or smaller amount.

c. Converting fully paid upwardly portion working capital missive of the alphabet into portion stock.

d. Subdividing its shares into portion of smaller amount f par value past times increasing number of shares.

Accounting records for alternation of portion capital

a. When onetime portion working capital missive of the alphabet is sub-divided into share

b. When onetime portion working capital missive of the alphabet is consolidated into shares of large par value.

c. When fresh are issued for cash.

d. When shares of fully paid upwardly are converted into portion stock.

Define the term amalgamation amongst its features.

When ii or to a greater extent than companies carrying on similar concern drib dead into liquidation in addition to a novel society is formed to accept over their business. It is called amalgamation. The companies which drib dead into liquidation are called vendor society or amalgamating or transfer companies where every bit the novel society which is formed to accept over the concern of liquidation companies is called purchasing or amalgamate or transference company. The master copy aim of amalgamation is to minimize the possibility of cutting threat contest in addition to to secure the payoff of large scale production

Feature of amalgamation

Following are the master copy features of amalgamation:

1. Two or to a greater extent than existing companies are liquidated.

2. Influenza A virus subtype H5N1 novel society is formed to accept over the concern of liquating companies.

3. The nature of concern of existing companies is similar.

4. Liquidating companies are called vender companies in addition to the novel companies is called purchasing company.

5. Generally, buy consideration is discharged past times issued of equity shares of purchasing company.

0 Response to "What Is Accounting For Acquisition Of Business?"

Post a Comment