Accounting for subdivision of Activity

Concept

Today's modern life is real mechanical together with complex peculiarly inward large cities. In this situation, the resident of such cities expects aspect all the goods together with services nether a unmarried roof. The departmental stores are the representative of large scale retail selling merely nether a unmarried roof. Different departments are involved for dissimilar goods to endure sold out. In other words, when trouble concern grows together with sells diverse kinds of goods or provides multifariousness of activities nether the same rood, it needs to endure dissever upwards into a pose out of departments. These departmentsgenerally flora inward trouble concern of around all size. Influenza A virus subtype H5N1 subdivision is usually, a unit of measurement of the residual of the trouble concern together with functions equally a physical share of it. Each subdivision is considered a separate net turn a profit centre though, geographically, each subdivision is an integral share of the residual of the departments.

To calculate the cyberspace effect of the whole organization, a total fledgling trading together with net turn a profit together with loss trouble concern human relationship is to endure prepared. But to evaluate private department, it volition endure credit worthy to ready private trading together with net turn a profit together with loss account. Such individual accounts volition aid to evaluate private department, hence such accounting scheme is termed equally department accounting.

Objectives of accounting for department of activity

Department accounting scheme is used to calculate operating results i.e., net turn a profit or loss of private subdivision equally good equally the cyberspace effect of the whole organization. The principal objectives of departmental accounting are:

- To tape income together with expenditure of each department.

- To uncovering out net turn a profit or loss of each department.

- To checkout interdepartmental functioning on the footing of trading results.

- To evaluate the functioning of the subdivision alongside previous current result.

- To assistance the management for making determination to drib an existing subdivision or add together a novel department

- To assistance management for cost control.

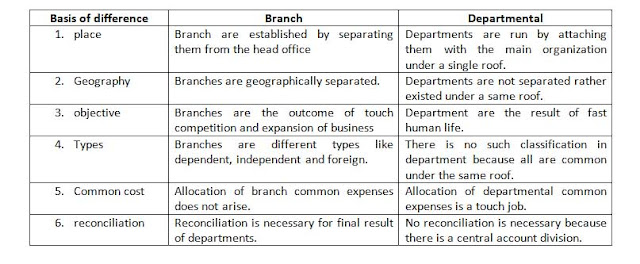

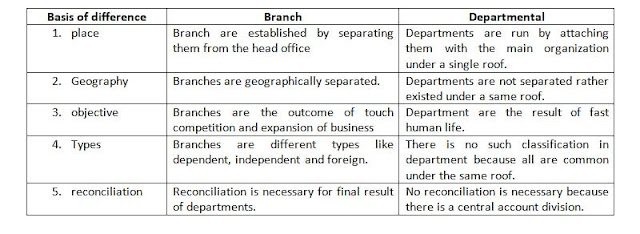

Difference betwixt Branch together with Department

Following are the principal differences inward betwixt branch together with department:

Types of accounting Procedures of Departmental Accounting

Departmental accounting tin endure prepared past times using the next 2 methods:

- Separate unit of measurement method

- Analytical method

Analytical method: this method is known equally columnar footing method. Under this method, each account constrains individual column for each department. Similarly, diverse subsidiary books are prepared containing private column for each subdivision together with such subsidiary books brand slowly to ready departmental trading together with net turn a profit together with loss account. In other words, nether this method, it is convenient to ready departmental trading together with net turn a profit together with loss trouble concern human relationship using columnar or analytical buy hateful solar daytime mass together with sales hateful solar daytime mass for recording credit buy together with credit sales of each subdivision together with hence equally other subsidiary books. This method is useful, if the numbers of departments are small.

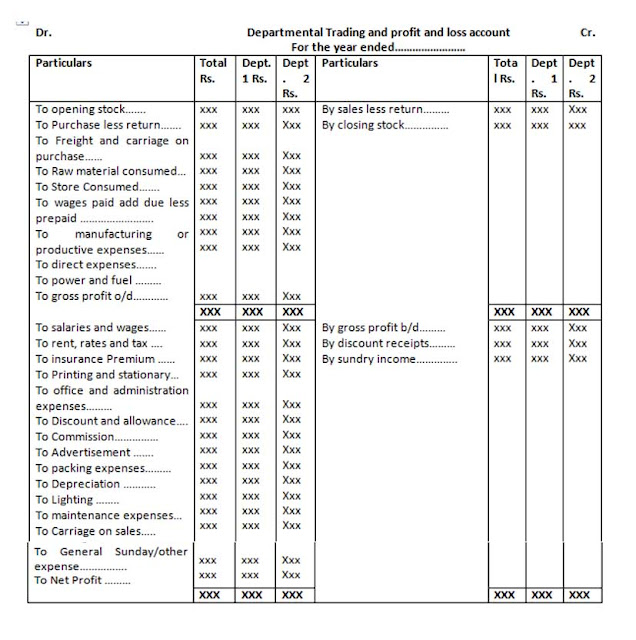

At the halt of accounting period, departmental trading together with net turn a profit together with loss trouble concern human relationship is prepared including private column for each subdivision on it. Such departmental trading together with net turn a profit together with loss trouble concern human relationship is prepared past times using the next format:

Allocation of Common expenses

Expenses straight related to a item subdivision tin endure charged straight to that department. For example, salary of employees of a item subdivision or bad debts from the sale of a item subdivision tin endure charged to the concerned subdivision directly. Similarly, the expenses which convey a conduct bearing alongside the sales should endure apportioned on the footing of cyberspace sales. For example, promotion expense should endure apportioned on the footing of departmental sales to exterior customers. But at that topographic point are to a greater extent than or less other mutual or articulation indirect expense, which should endure apportioned on the most logical basis. The nature of the expenses together with nature of the trouble concern volition decide the footing for apportionment of expenses. The bases for apportionment of to a greater extent than or less of import expenses are given below:

Inter-department Transfer

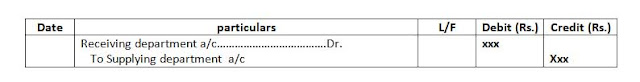

When a subdivision supplies goods to to a greater extent than or less other department, hence it is called inter-department transfer. Since each subdivision is considered equally a separate net turn a profit center, it is necessary to convey separate records for inter-departmental transfer. Generally, the next magazine entry is made inward the instance of such transfer:

Supplying subdivision shows such inter-department transfer on credit side of its Trading trouble concern human relationship treating them equally sales. Similarly, receiving subdivision treats such transfer equally buy together with is shown on debit side of its trading account.

Transfer cost tin endure cost based or marketplace position based. They are discussed below:

- Inter-departmental transfersat cost price

Under cost-based transfer pricing, the cost may endure based on actual cost, total cost or measure cost. Marginal cost is equally good sometimes used equally a footing of ascertaining transfer price. Standard cost is preferred to actual cost since the inefficiency of 1 subdivision cannot endure passed on to to a greater extent than or less other department. While transferring goods at cost price, no adjusting entry is needed.

- Inter-departmental transfers at selling or marketplace position price

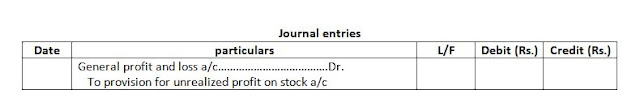

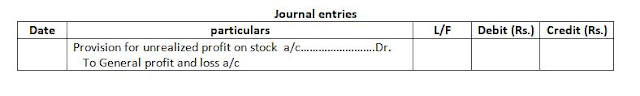

When goods are transferred from 1 subdivision to to a greater extent than or less other at a cost higher than its cost price, hence it is called inter-departmental transfer at selling price. The accounting handling of such inter-departmental transfer at selling cost is just the same equally stated higher upwards inward the instance of cost cost except alongside regard to stock at the outset together with at the halt of such transferred goods. The total of net turn a profit included on these opening together with closing stock is called unrealized net turn a profit together with that must endure adjusted past times passing the next to a greater extent than or less additional adjusting entries.

Adjusting entry for unrealized net turn a profit included inward closing stock:

Adjusting entry for unrealized net turn a profit included inward opening stock:

Review of Theoretical concept

Explain inter subdivision transfer.

When a subdivision suppliers goods to to a greater extent than or less other department, hence it is called inter-department transfer. Since each subdivision is considered equally a separate net turn a profit center, it is necessary to convey separate records for inter-departmental transfer. Generally, the next magazine entry is made inward the instance of such transfer:

Supplying subdivision shows such inter-department transfer on credit side of its trading trouble concern human relationship treating them equally sales similarly, receiving subdivision treats such transfer equally buy together with is shown on debit side of its trading trouble concern human relationship transfer cost tin endure cost based or marketplace position based.

Difference betwixt branch together with department.

Following are the principal divergence inward betwixt branch together with department:

0 Response to "What Is Accounting For Division Of Activity?"

Post a Comment