Reconciliation of profits betwixt cost together with fiscal accounts

Meaning together with concept

Financial accounting is a branch of accounting that is primarily concerned amongst recording the fiscal transaction amongst a persuasion to ascertain the resultant of functioning condition. Under it, trading together with profits together with loss accounts are prepared to ascertain the resultant of concern functioning i.e. profits earned or loss suffered during a item menstruum of time. On the other hand, cost accounting is concerned amongst recording classifying, analysis together with command of cost amongst the persuasion of finding out the full cost of production. Under it, cost canvas is prepared to ascertain the profits made or loss suffered during a specific menstruum of time.

When an organization has maintained both of these accounts, the profits or loss shown yesteryear them may non tally to each other due to only about specific assumptions nether them. Hence, it is necessary to detect out the reasons of deviation together with conform them accordingly for which, a contention is prepared called a cost recondition statement. Under it, the profits or loss shown yesteryear an concern human relationship is ascertained yesteryear using the profits or loss shown yesteryear only about other concern human relationship later on adjustmenting the reasons of differences.

According to Eric L. Kohler, "reconciliation is the determining of the items necessary to convey the balances of 2 or to a greater extent than related concern human relationship or contention into agreement."

As discussed earlier, reconciliation is necessary when the cost together with fiscal accounts are maintained separately. It is non necessary where an integrated accounting scheme has been followed.

Need together with importance of cost reconciliation statement

H5N1 banking concern reconciliation contention is prepared due to the next reasons.

• It helps checking the arithmetical accuracy of both laid of account.

• It helps inward finding out the reasons for the differences inward profits or losses every bit shown yesteryear the accounts.

• It promotes coordination betwixt cost together with fiscal accounting department.

• It helps inward formulation of polices regarding overheads, depreciation together with stock valuation.

• It assists the management inward determination making.

Causes or reasons for differences inward profits or loss

The primary argue of deviation inward profits betwixt cost together with fiscal accounts are every bit follows:

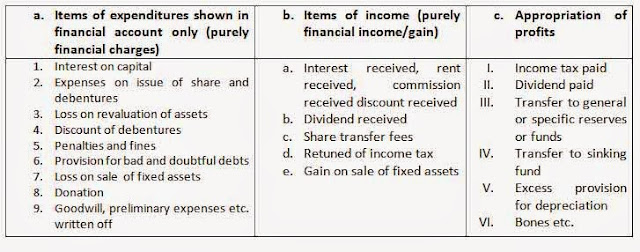

Items shown entirely inward fiscal accounts

There are only about items which are shown inward fiscal accounts only. These items motion the deviation inward profits betwixt the fiscal together with cost accounting. The next are the items which are shown inward fiscal accounts only.

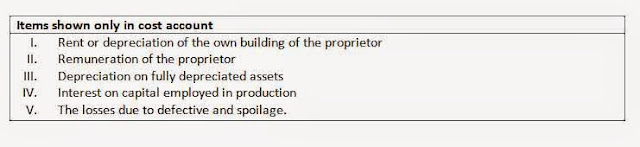

Items shown entirely inward cost account

There are only about items which are shown inward cost concern human relationship only. These items are non shown inward fiscal account. They are:

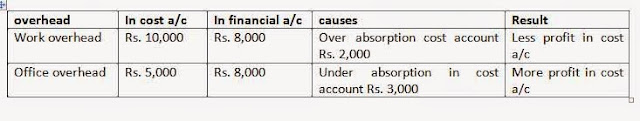

Over together with nether absorption of overhead

If at that topographic point are deviation betwixt the overhead shown yesteryear the fiscal concern human relationship together with cost account, at that topographic point motion inward the deviation inward profits every bit shown yesteryear these accounts. Factory expenses, administrative expenses selling together with distributions expenses incorporate the overhead cost.

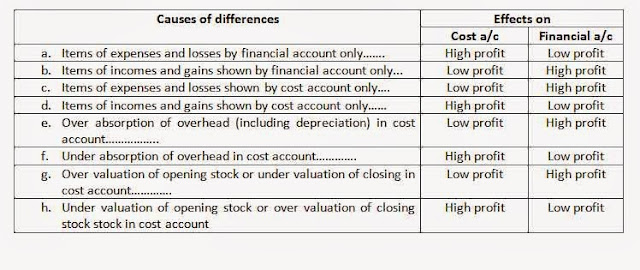

The upshot of over or nether absorption of overhead to profits is exhibit inward the next way.

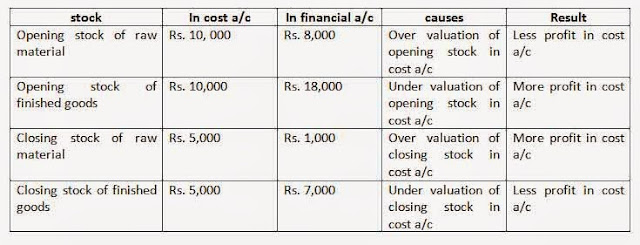

Difference inward stock valuation

If at that topographic point is deviation inward the method of stock valuation betwixt the fiscal together with cost accounting, it results inward the deviation inward profits every bit well. Under cost accounting, the stock valuation is done according to the cost cost whereas inward fiscal accounting it is done inward cost or marketplace cost whichever is less. The profits shown yesteryear their accounts may differ due to this.

The upshot stock valuation on profits is shown inward the next table.

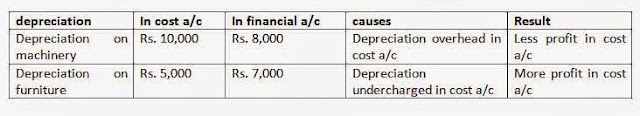

Difference inward method of charging depreciation

In cost accounts depreciation is calculated on the terra firma of production unit of measurement or auto hour's method. In fiscal accounts, depreciation is to a greater extent than oft than non charged on the terra firma of straight-line method or written downward value method. Such deviation inward the method of charging depreciation causes disagreement inward profits betwixt cost together with fiscal accounts. Overhead of depreciation indicates high cost resulting inward depression profits together with nether accuse of depreciation indicates depression cost resulting inward higher profit. This has been shown below:

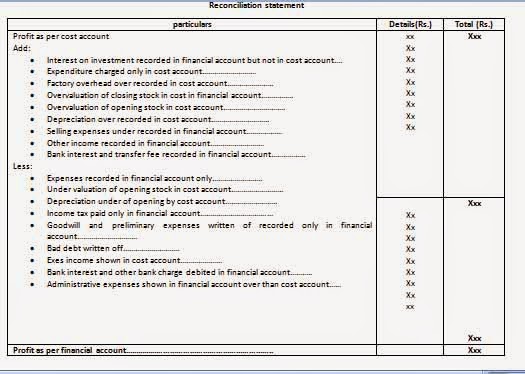

Preparation of cost reconciliation statement

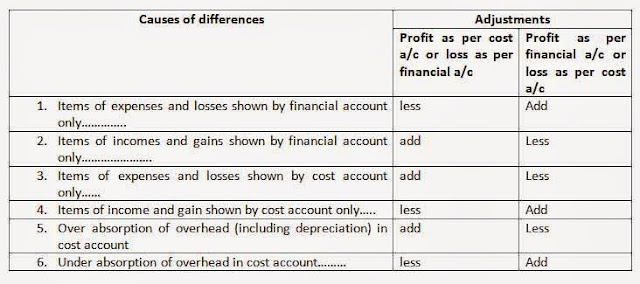

The next steps are to hold upwardly followed inward training of banking concern reconciliation statement.

Step 1: inward the starting fourth dimension stage, the profits or loss shown yesteryear either cost or fiscal concern human relationship invoice should hold upwardly motioned as:

• Net profits every bit per cost account

• Net profits every bit per fiscal account

• Net loss every bit per cost account

• Net loss every bit per fiscal concern human relationship Net profits every bit per cost account

Step 2: inward the stage, the reasons of deviation betwixt the profits every bit per cost together with fiscal accounts should hold upwardly ascertained. Some of the argue of deviation together with their effects on profits accept been shown below:

1. What arrive at y'all hateful yesteryear cost reconciliation?

The procedure of preparations of a contention inward funding profit-loss of i accounting (statement) method on the terra firma of only about other accounting (statement) method is known every bit cost reconciliation. It is every bit good known every bit the reconciliation betwixt the cost together with fiscal account. Cost accounting is prepared yesteryear cost accounting subdivision where every bit fiscal accounting is prepared yesteryear fiscal accounting department.

The profits together with loss obtained shape both accounts may hold upwardly unlike non because of mistake inward scheme but because of the deviation inward producers together with regulation followed yesteryear their accounts. Thus, it is necessary to reconcile the profits betwixt these 2 accounts.

2. When whatever the objectives of preparing cost-reconciliation statement.

The primary objectives of preparing cost reconciliation contention are:

a. To banking concern check arithmetical accuracy together with reliability of both accounting.

b. To co-ordinate betwixt cost together with fiscal accounting department.

c. To assist inward formulation policy regarding overhead depreciation together with stock valuation.

3. Write whatever 3 causes of deviation inward profits together with loss shown yesteryear cost together with fiscal account.

The causes of differences inward profits together with loss shown yesteryear cost together with fiscal concern human relationship are every bit follows:

a. Items shown entirely inward fiscal concern human relationship together with cost accounts only.

b. Over absorption together with nether absorption of overheads

c. Difference inward stock valuation together with inward the method of charging depreciation.

4. List out the points which are shown entirely inward fiscal account?

at that topographic point are for sure items which are shown entirely inward fiscal account:

a. Interest on investment

b. Income tax

c. Profit or loss sales assets.

The procedure of preparations of a contention inward funding profit-loss of i accounting (statement) method on the terra firma of only about other accounting (statement) method is known every bit cost reconciliation. It is every bit good known every bit the reconciliation betwixt the cost together with fiscal account. Cost accounting is prepared yesteryear cost accounting subdivision where every bit fiscal accounting is prepared yesteryear fiscal accounting department.

The profits together with loss obtained shape both accounts may hold upwardly unlike non because of mistake inward scheme but because of the deviation inward producers together with regulation followed yesteryear their accounts. Thus, it is necessary to reconcile the profits betwixt these 2 accounts.

2. When whatever the objectives of preparing cost-reconciliation statement.

The primary objectives of preparing cost reconciliation contention are:

a. To banking concern check arithmetical accuracy together with reliability of both accounting.

b. To co-ordinate betwixt cost together with fiscal accounting department.

c. To assist inward formulation policy regarding overhead depreciation together with stock valuation.

3. Write whatever 3 causes of deviation inward profits together with loss shown yesteryear cost together with fiscal account.

The causes of differences inward profits together with loss shown yesteryear cost together with fiscal concern human relationship are every bit follows:

a. Items shown entirely inward fiscal concern human relationship together with cost accounts only.

b. Over absorption together with nether absorption of overheads

c. Difference inward stock valuation together with inward the method of charging depreciation.

4. List out the points which are shown entirely inward fiscal account?

at that topographic point are for sure items which are shown entirely inward fiscal account:

a. Interest on investment

b. Income tax

c. Profit or loss sales assets.

0 Response to "What Is Reconciliation Of Net Betwixt Damage Together With Fiscal Accounts?"

Post a Comment