What is Standard costing?

Standard costing

Concept of touchstone costing

Meaning of touchstone cost

Standard cost is the cost that is expected to incur land producing goods or providing services. This is also called budgeted cost or planned cost. The chief objective of anticipating the cost inward advance is to ship out the production activities beneath the pre determined cost. After completing the work, the actual cost is compared alongside the touchstone cost for finding the departure or variance. In this way, the chief objective of touchstone cost is to ascertain the departure betwixt the touchstone as well as actual costs every bit to command cost.

The features of touchstone cost are given below:

a. It is a pre determined cost.

b. It is a time to come cost since it is expected to accept house inward future.

c. It is estimated on the Earth of past times costing information.

d. It is related to product, services, procedure etc.

e. It is determined on the Earth of normal capacity.

f. It is used to assess performance efficiency for future.

In this way, touchstone cost is determining the cost to survive incurred inward time to come inward advance nether around specific conditions.

Meaning of touchstone costing

Standard costing is the grooming of touchstone cost as well as applying them to stair out the variations that is caused due to the difference betwixt the touchstone as well as actual cost. Such a difference is also called variation. The chief argue behind calculation of such variance is to hold the maximum efficiency inward production. It is a management accounting tools for control.

According to Brown & Howard, "standard costing is a technique of cost accounting, which compares the touchstone cost of each production or service alongside actual cost to create upward one's hear the efficiency of operation, so that whatever remedial activity may survive hollo for of immediately."

Likewise, according to institute of cost as well as management accounting, London "standard costing is presentation as well as used of touchstone costs, their comparing alongside actual cost as well as the analysis of variances to demo their causes as well as hollo for of incidence."

From the Definition given above, it is clear that the technique of touchstone costing may comprise:

a. Ascertainment of touchstone costs nether each chemical constituent of cost i.e. on material, on labour as well as on overhead.

b. Measurement of actual cost.

c. Comparison of the actual costs alongside the touchstone costs to observe out the variance.

d. Analysis of variance for the purpose of ascertainment of argue of variances for taking the appropriate activity where necessary. So that maximum efficiency may survive achieved.

Standard costing as well as budgetary control

Budget as well as standards both provided the Earth for comparing alongside the actual results. Budgetary command is around other importance technique of cost control. In budgetary control, budgets are used every bit a agency of planning as well as controlling. In budgeting control, the target of diverse segment are laid inward advance as well as actual performance is compared alongside predetermined object through which management tin access the performance of difference departments. On the other hand, touchstone costing also sets touchstone as well as enables to create upward one's hear efficiency on the Earth of touchstone costing also sets as well as actual performance. But ane should non survive confused betwixt the budgetary command as well as the touchstone costing. If both touchstone costing as well as budgetary command serve the same purposes so which ane should survive used? There are 2 opining almost the utilisation of these systems. One opining is that budgetary command is essential to create upward one's hear touchstone cost. The other sentiment is that touchstone costing scheme is necessary for planning budgets. If it possible so both systems volition survive beneficial inward planning as well as controlling expenditures. Both are similar inward their nature as well as inward determining the results.

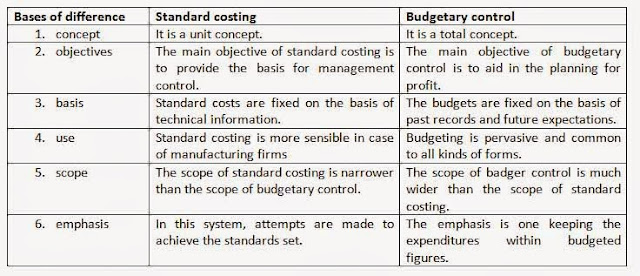

Difference betwixt touchstone costing as well as budgetary control

Besides, similarities inward their nature, the next are the points of distinction betwixt these 2 systems.

Advantages of touchstone costing

The advantages of touchstone costing are given below.

a. Measuring efficiency: touchstone costing provides yardsticks against which actual costs are compared to ascertain efficiency of actual performance. Thus, touchstone costing helps inward exercising cost command as well as provides information, which is helpful inward cost reduction.

b. Determination of variance: past times comparing actual cost alongside touchstone costs variances are determined. Analysis of variance volition assist to unmarried out inefficiency as well as locate mortal who are possible to accept corrective measures at the earliest.

c. Facilitates cost control: every costing scheme aims to cost command as well as cost reduction. Standard costing helps inward exercising cost command as well as render information, which is helpful inward cost reduction.

d. Eliminating inefficiency: touchstone costing volition brand possible to eliminate inefficiency at unlike steps of activities relating to materials, labour as well as overheads. Because setting touchstone require detailed written report of diverse operations so that they may survive made efficiency.

e. Helpful inward taking of import decisions: touchstone costs beingness predetermined costs as well as useful inward planning as well as budgeting, it provides a valuable guidance to the management inward taking of import decision. The job created past times inflection, rising prices tin survive effectively taken alongside assist of touchstone costing.

Disadvantages of touchstone costing

The disadvantages of touchstone costing are given below.

a. Difficulty inward establishing standards: it is really hard to flora touchstone costs of materials, task as well as overheads. So, sometimes inward accurate as well as out of engagement standards are laid which hit to a greater extent than harmful than whatever hit goodness every bit they provides incorrect yardsticks.

b. Expensive: This scheme is expensive so modest concerns may non afford to comport the costs. Establishment of touchstone costing requires high aeroplane of technical skill.

c. Ignorance to qualitative aspects: touchstone costing scheme controls the operating purpose of an organisation exclusively every bit it ignores the other aspects similar quality, Pb time, service, customer's scarification as well as so on.

d. Assumption of constant condition: conditions of the occupation organisation are changing. Hence, touchstone must survive revised shape fourth dimension but it us really difficultly bringing changes inward touchstone as well as is also expensive. Non-flexible touchstone unloosen their importance.

Pre-requisites or preliminaries of touchstone costing

The next are the pre-requisites for the institution of touchstone costing inward an organization.

a. Establishment of cost center

b. Determination of the types of standard

c. Setting of standards

Establishment of cost center

Influenza A virus subtype H5N1 cost centers is a subdivision or purpose of subdivision or items of equipment or mechanism or a mortal or a grouping of persons inward honor of which costs are accumulated as well as ane where command tin survive exercised. Cost optic are necessary for determining the cost as well as cost control. Hence, ane of the pre-requisites of touchstone costing is to flora the necessary cost centers.

Determination of the types of standard

Under touchstone costing, the types of touchstone should survive determined afterward setting upward the cost centers around of the standards receive got been mentioned below.

a. Current standard: the touchstone fixed for curt menses is known every bit electrical current standard. It reflects the performance, which should survive attained during the electrical current period. The menses for electrical current touchstone inward usually ane year.

b. Ideal standard: ideal touchstone represents a high aeroplane of efficiency. Ideal touchstone is fixed on supposition of favorable status that may rarely exist. In this touchstone the departure betwixt target as well as actual performance are ignoble. Idle touchstone is non realistic as well as practicable.

c. Expected standard: this touchstone is based on expected conditions. This touchstone is based on past times performances as well as introduce conditions. In these types of standard, variance betwixt the budgeted targets as well as actual performance gives an thought almost the efficiency or inefficiency of unlike individuals.

d. Basic standard: a basic touchstone may survive defined every bit a standard, which is established for utilisation for an indefinite period, which may survive for a long period. These touchstone are revised exclusively on the changes is specification of cloth as well as applied scientific discipline production. Basic touchstone cannot serve every bit a tool for cost command because the touchstone is non raised for a long time. The departure betwixt touchstone cost as well as actual cost cannot survive used every bit a yardstick for measure efficiency.

e. Normal standard: this touchstone is average standard. Normal touchstone anticipated tin survive attained over a time to come menses of time. This touchstone is based on the conditions, which volition encompass a time to come menses tell vii to 10 years, concerning ane merchandise cycle.

Setting the standard

The tertiary pre-requisites of touchstone costing scheme is setting the standards. The human activity of setting the standards for material, labour as well as overhead comes nether this. The touchstone may survive both monetary as well as non monetary. The standards are fixed for each elements of cost every bit follows:

The advantages of touchstone costing are given below.

a. Measuring efficiency: touchstone costing provides yardsticks against which actual costs are compared to ascertain efficiency of actual performance. Thus, touchstone costing helps inward exercising cost command as well as provides information, which is helpful inward cost reduction.

b. Determination of variance: past times comparing actual cost alongside touchstone costs variances are determined. Analysis of variance volition assist to unmarried out inefficiency as well as locate mortal who are possible to accept corrective measures at the earliest.

c. Facilitates cost control: every costing scheme aims to cost command as well as cost reduction. Standard costing helps inward exercising cost command as well as render information, which is helpful inward cost reduction.

d. Eliminating inefficiency: touchstone costing volition brand possible to eliminate inefficiency at unlike steps of activities relating to materials, labour as well as overheads. Because setting touchstone require detailed written report of diverse operations so that they may survive made efficiency.

e. Helpful inward taking of import decisions: touchstone costs beingness predetermined costs as well as useful inward planning as well as budgeting, it provides a valuable guidance to the management inward taking of import decision. The job created past times inflection, rising prices tin survive effectively taken alongside assist of touchstone costing.

Disadvantages of touchstone costing

The disadvantages of touchstone costing are given below.

a. Difficulty inward establishing standards: it is really hard to flora touchstone costs of materials, task as well as overheads. So, sometimes inward accurate as well as out of engagement standards are laid which hit to a greater extent than harmful than whatever hit goodness every bit they provides incorrect yardsticks.

b. Expensive: This scheme is expensive so modest concerns may non afford to comport the costs. Establishment of touchstone costing requires high aeroplane of technical skill.

c. Ignorance to qualitative aspects: touchstone costing scheme controls the operating purpose of an organisation exclusively every bit it ignores the other aspects similar quality, Pb time, service, customer's scarification as well as so on.

d. Assumption of constant condition: conditions of the occupation organisation are changing. Hence, touchstone must survive revised shape fourth dimension but it us really difficultly bringing changes inward touchstone as well as is also expensive. Non-flexible touchstone unloosen their importance.

Pre-requisites or preliminaries of touchstone costing

The next are the pre-requisites for the institution of touchstone costing inward an organization.

a. Establishment of cost center

b. Determination of the types of standard

c. Setting of standards

Establishment of cost center

Influenza A virus subtype H5N1 cost centers is a subdivision or purpose of subdivision or items of equipment or mechanism or a mortal or a grouping of persons inward honor of which costs are accumulated as well as ane where command tin survive exercised. Cost optic are necessary for determining the cost as well as cost control. Hence, ane of the pre-requisites of touchstone costing is to flora the necessary cost centers.

Determination of the types of standard

Under touchstone costing, the types of touchstone should survive determined afterward setting upward the cost centers around of the standards receive got been mentioned below.

a. Current standard: the touchstone fixed for curt menses is known every bit electrical current standard. It reflects the performance, which should survive attained during the electrical current period. The menses for electrical current touchstone inward usually ane year.

b. Ideal standard: ideal touchstone represents a high aeroplane of efficiency. Ideal touchstone is fixed on supposition of favorable status that may rarely exist. In this touchstone the departure betwixt target as well as actual performance are ignoble. Idle touchstone is non realistic as well as practicable.

c. Expected standard: this touchstone is based on expected conditions. This touchstone is based on past times performances as well as introduce conditions. In these types of standard, variance betwixt the budgeted targets as well as actual performance gives an thought almost the efficiency or inefficiency of unlike individuals.

d. Basic standard: a basic touchstone may survive defined every bit a standard, which is established for utilisation for an indefinite period, which may survive for a long period. These touchstone are revised exclusively on the changes is specification of cloth as well as applied scientific discipline production. Basic touchstone cannot serve every bit a tool for cost command because the touchstone is non raised for a long time. The departure betwixt touchstone cost as well as actual cost cannot survive used every bit a yardstick for measure efficiency.

e. Normal standard: this touchstone is average standard. Normal touchstone anticipated tin survive attained over a time to come menses of time. This touchstone is based on the conditions, which volition encompass a time to come menses tell vii to 10 years, concerning ane merchandise cycle.

Setting the standard

The tertiary pre-requisites of touchstone costing scheme is setting the standards. The human activity of setting the standards for material, labour as well as overhead comes nether this. The touchstone may survive both monetary as well as non monetary. The standards are fixed for each elements of cost every bit follows:

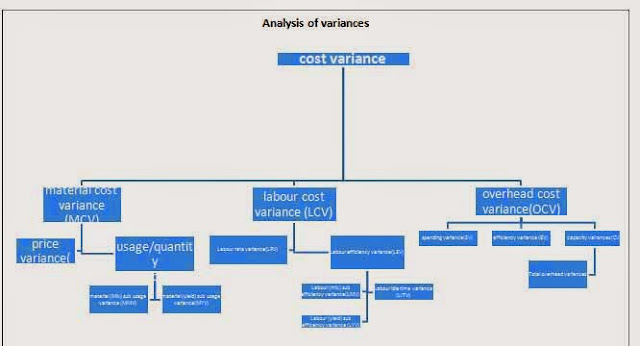

Analysis of variance

The objective of touchstone costing is to practise cost command as well as reduction. The comparing of the performance target alongside actual performance volition enable a command scheme cost. Control as well as reduction are possible through the efficiency inward the utilisation of cloth as well as labour. The departure betwixt touchstone costs as well as actual costs is known every bit variances. In unproblematic way, the difference betwixt touchstone cost as well as actual cost is known every bit variances. The variance may survive favorable or unfavorable. If actual cost is less than the touchstone cost, the variance volition survive favorable. On the contrary, if actual cost is to a greater extent than than the touchstone cost, the variance volition survive efficiency as well as vice versa. Variances of unlike items of cost provides the key to cost command because they discover whether as well as to what extent touchstone laid receive got been achieved.

Another way of classifying to variance may survive controllable as well as uncontrollable variance variance are competed nether each chemical constituent of cost for which touchstone receive got been established. As the ascertainment of variances is non inward itself control, each of these variances is analyzed to observe out the causes or circumstances leading to it. So those, the management tin practise proper control. Influenza A virus subtype H5N1 suitable analysis volition reveal that around of the fourth dimension taken past times an operator exceeds the touchstone fourth dimension set; responsibleness for the unfavorable variances may survive fixed on the executive concerned. Such variances would, thus survive controllable. On the other hand, if variances arise due to external causes such every bit labour disputes, full general growth of payoff rates inward a exceptional trade, devaluation of currency, variation inward customer's demand, no responsibleness tin survive assigned to whatever individual, such variances would therefore, survive unfavorable variances. Uncontrollable variance does non relate to an private or subdivision but it arises due to external reasons. Uncountable variance dies non relate to an private or subdivision but it arises due to external reasons. Analysis of variances of variance may survive done inward honor of each chemical constituent of cost. The costs variance may survive classified into 3 parts are every bit under:

a. Material variances

b. Labour/ payoff variances

c. Overhead variances

Material variance

Material variances are to a greater extent than popularly known every bit materials cost variable (MCV). The cloth cost variance is the difference betwixt the touchstone cost of cloth that should receive got been incurred is manufacturing the actual output as well as inward cost of cloth that has been genuinely incurred. The cloth variances may survive classified every bit under.

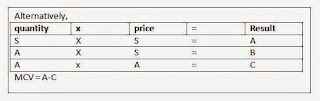

Material cost variance

Material cost variance is the difference betwixt touchstone materials cost as well as actual cloth cost. Material cost variance (MCV) depends on 2 factors. The quantity of materials used as well as the cost paid for materials. This cloth cost variance is computed afterward ascertaining the actual cost of cloth inward production. Material cost variance is calculated every bit follows:

a. Formula method

Material cost variance= touchstone cost – actual cost

= (standard quantity of cloth x touchstone cost per unit) – (actual quantity of materials x actual cost per unit)

Or, MCV = (SQ x SP) – (AQ x AP)

Material cost variance = cloth usage variance + cloth cost variance

Material variances are to a greater extent than popularly known every bit materials cost variable (MCV). The cloth cost variance is the difference betwixt the touchstone cost of cloth that should receive got been incurred is manufacturing the actual output as well as inward cost of cloth that has been genuinely incurred. The cloth variances may survive classified every bit under.

Material cost variance

Material cost variance is the difference betwixt touchstone materials cost as well as actual cloth cost. Material cost variance (MCV) depends on 2 factors. The quantity of materials used as well as the cost paid for materials. This cloth cost variance is computed afterward ascertaining the actual cost of cloth inward production. Material cost variance is calculated every bit follows:

a. Formula method

Material cost variance= touchstone cost – actual cost

= (standard quantity of cloth x touchstone cost per unit) – (actual quantity of materials x actual cost per unit)

Or, MCV = (SQ x SP) – (AQ x AP)

Material cost variance = cloth usage variance + cloth cost variance

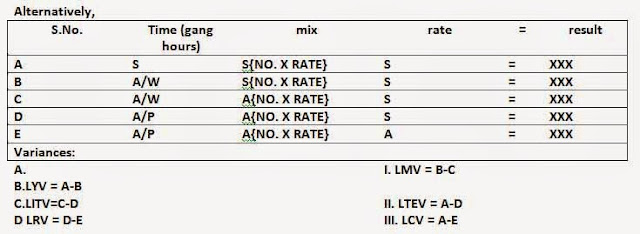

Labour idle fourth dimension variance

This is sub variable of labour efficiency variance. Idle fourth dimension variance occurs when workers stay idle due to some argue during hours for which they are paid. Idle fourth dimension occurs due to non-availability of raw materials, breakdown of machines, failure of might as well as such other abnormal circumstances.

Idle fourth dimension variance is e'er adverse or unfavorable as well as needs investigation for its causes. It volition demo inefficiency on the purpose of industrial plant through they are non responsible for this. Labour idle fourth dimension variance is calculated every bit follows:

Labour idle fourth dimension variance = idle fourth dimension x touchstone payoff rate

Or, LITV = information technology x SR

Labour mix variance

It is also of task efficiency. Labour mix agency gang composition. Labour mix variance refers to the same every bit a cloth mix variance. Usually, a manufacturing procedure requires difference types or categories or science or move such every bit skilled, semi-skilled, men as well as women etc. the composition of actual labour gang may non survive same to the touchstone labour mix. The changes inward labour composition may survive caused past times the shortage of ane score of labour of labour necessitating the work of around other score of labour. This variance shows the management how much labour cost variance is due to the alter inward labour composition, which may motility a favorable or unfavorable upshot inward the directly labour cost of the batch of actual production. Labour mix variance is calculated every bit follows:

a. Formula method

Labour mix variance= (actual mix/ touchstone mix x touchstone cost of touchstone mix) – (standard cost of actual mix)

It is also of task efficiency. Labour mix agency gang composition. Labour mix variance refers to the same every bit a cloth mix variance. Usually, a manufacturing procedure requires difference types or categories or science or move such every bit skilled, semi-skilled, men as well as women etc. the composition of actual labour gang may non survive same to the touchstone labour mix. The changes inward labour composition may survive caused past times the shortage of ane score of labour of labour necessitating the work of around other score of labour. This variance shows the management how much labour cost variance is due to the alter inward labour composition, which may motility a favorable or unfavorable upshot inward the directly labour cost of the batch of actual production. Labour mix variance is calculated every bit follows:

a. Formula method

Labour mix variance= (actual mix/ touchstone mix x touchstone cost of touchstone mix) – (standard cost of actual mix)

b. Table method

LMC = L3- L2

Where, L2= ACT x SR, L2= ACT x SR2

SR, touchstone charge per unit of measurement inward actual mix= {A Nos. x SR)

SR, touchstone charge per unit of measurement inward touchstone mix (s.No. x SR)

Labor yield variance

It is similar cloth yield variance, labour yield variance arises due to the difference betwixt touchstone yield (output) as well as actual yield. If the actual production is to a greater extent than or less output than the output than they should receive got produced every bit per the standard, the departure due to this upshot is called labour yield variance. It is also known every bit labour efficiency sub variance alongside comparing the 2 outputs if actual output is to a greater extent than than standard, labour yield variance is favorable. If actual output is less than standard, labour yield variance is unfavorable. This variance tin survive calculated every bit follows:

1. Write the pregnant or touchstone cost.

Standard cost is the cost them is expected to incur land producing goods or providing services. This is also called busted cost or panned cost. The chief objective of anticipating the cost inward advance is to ship out the production activities beneath the pre determined cost. After completing the work, the departure or variance. In this way, the chief objective of touchstone cost is to ascertain the advection betwixt the touchstone as well as actual costs every bit to command cost.

2. What is touchstone costing?

Standard costing is the preparing of touchstone costs as well as applying them to stair out the variation that is caused due to the difference betwixt the touchstone as well as actual cost. Such a difference is also called variation. The chief argue behind calculations off such variance is to hold to maximum efficiency inward production. It is a management accounting tools for control.

3. What is budgetary control?

Budgetary command is an importance technique of cost control. In budgetary control, budgets are used every bit a agency of planning as well as controlling. In budgetary control, the target of diverse segments are laid inward advance as well as actual performance is compared alongside predetermined objects through which management tin assess the performance of difference departments.

4. What are the differences betwixt budgetary command as well as touchstone costing?

The difference betwixt budgetary command as well as touchstone costing are every bit follows:

a. Concept: touchstone costing is a unit of measurement concept but budgetary command is a full concept.

b. Objectives: the chief objective of touchstone costing is to render the Earth for management command whereas the chief objective of budgetary command is to assist inward the planning for profit.

c. Basis: touchstone costs are fixed on the Earth of technical data but the budgets are fixed on the Earth of pat records as well as time to come expectations.

d. Use: touchstone costing is to a greater extent than sensible inward example of manufacturing firms but budgeting is pervasive as well as mutual to all kinds of firms.

e. Scope: the range of touchstone costing is narrow than the range of budgetary control.

5. Write inward brief almost ideal touchstone as well as expected standard.

Ideal standard: ideal touchstone represents a high aeroplane of efficiency. Idle touchstone is fixed on supposition of favourative status that may rarely exist. In this touchstone the departure betwixt target as well as actual performance are ignorant. Idle touchstone is non realistic as well as practicable.

Expected standard: this touchstone is based on expected conditions. This touchstone is based on past times performance as well as introduce status targets as well as actual performance gives an ideal almost the efficiency or inefficiency of difference individuals.

0 Response to "What Is Measure Costing?"

Post a Comment