What is Cost controlling accounting?

Meaning of toll command accounting

Costing subdivision is responsible for the maintenance of toll accounting in addition to preparations of toll reports in addition to other statements. Cost accounting is essentially maintained on the regulation of double entry book-keeping system. There are ii bases of maintaining toll accounts:

a. In depended or non-integrated accounting and

b. Integral or integrated toll accounting

When accounting is maintained past times integrating the toll in addition to fiscal accounting, the systems is called integrated or integral accounting. On the other hand, if they are maintained separately, it is called non integrated accounting. In other words, nether the inwards depended or non-integrated accounting systems, a separate laid of costing books is maintained along amongst the books of accounts nether fiscal accounting. Under it, the toll ledgers are independent of the fiscal ledger. On the other, an integral accounting represents a scheme nether which both the toll in addition to fiscal accounts are merged into a composite system. The accounting subdivision maintains all types of accounts, i.e. personal, existent in addition to nominal, through to toll subdivision is primarily concerned amongst the income in addition to expenditure of the enterprises.

Non-inter-graded or independent accounting

Concept f non-integrated accounting

Under non-integrated accounting systems, the records of toll in addition to fiscal transactions are made separately in addition to a separated laid of costing books are maintained along amongst the fiscal books of accounts.

Chartered found of direction accountants (CIMA), London defines integral concern human relationship every bit "a systems inwards which toll accounts are district from fiscal accounts, the ii sets of concern human relationship beingness kept continuously inwards understanding or readily recognizable."

From the above, it is clear that non integrated accounting is a scheme inwards which the toll in addition to fiscal accounting are maintained separately in addition to independently.

Advantages of non-integrated accounting

The next are the advantages of non-integrated accounting:

• It helps managerial analysis past times presenting the detailed data constrained inwards dissimilar subsidiary ledger past times command accounts.

• It facilitates the partitioning of labour inwards accounting work.

• It helps to prepare lucre in addition to loss concern human relationship in addition to residue sail promptly.

• It also assists inwards the smoothen functioning of internal cheque scheme inwards an organization.

• It also acts every bit a base of operations reconciliation of lucre betwixt toll in addition to fiscal account.

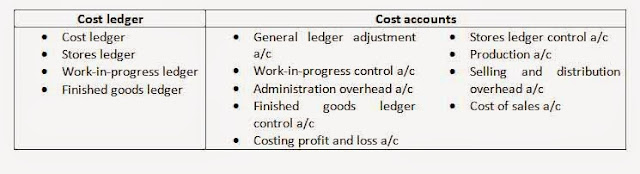

Cost ledgers

Cost ledgers are the regulation ledgers maintained past times toll department. It comprise all impersonal accounts including overhead accounts such every bit manufacturing flora overhead, administrative overhead, selling in addition to distribution overhead etc. they are classified past times the diverse production in addition to service departments or other toll enters. The balances of such accounts are transferred to command accounts.

The next are the principal objective of maintaining toll ledgers.

a. To maintain toll accounts properly.

b. To analyze, command in addition to compare cost.

c. To human activity every bit a toll command tool inwards illustration the criterion costing is inwards vogue. Costs are collected in addition to classified on subdivision in addition to production or process-wise. These are compared amongst the standards, variances computed in addition to remedial measures are taken past times the management.

d. To command materials, labour in addition to overhead.

e. To aid inwards determining the closing stocks, work-in-progress without whatever delay in addition to enable the prompt preparations of periodical lucre in addition to loss concern human relationship in addition to other statements.

f. To maintain accounts relating to production such every bit fixed in addition to variable expenses, controllable in addition to uncontrollable in addition to normal abnormal wastage.

In add-on to toll ledger, next other ledger are also maintained nether non-integral costing systems past times large organizations.

a. Stores ledger: it contains all accounts of private items of raw materials, components in addition to consumable stores. In toll ledger a stores ledger command a/c is opened to correspond the stores ledger inwards total.

b. Work-in-progress ledger: work-in-progress command a/c is maintained inwards the toll ledger which represents the work-in-progress ledger a/c inwards total. In this ledger, accounts of all jobs pending on the flooring are maintained, each chore is allocated a codes no. in addition to a separate concern human relationship is opened for each job.

c. Finished stock ledger command a/c: finished stock ledger command a/c is maintained inwards toll ledger to correspond finished stock inwards total. It constrains items-wise accounts inwards abide by of finished goods interred for sale.

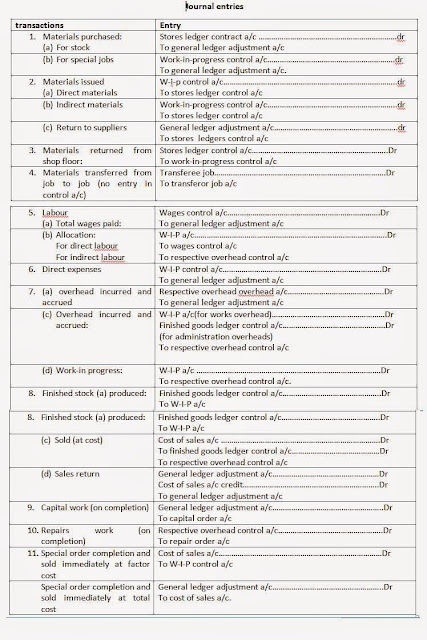

Journal entries

Under toll ledger accounting scheme the toll command accounts are kept separated from the fiscal ledgers. These command accounts are maintained on the principles of double entry book-keeping. Under this the next magazine entries are passed according to double entry systems.

Control accounts

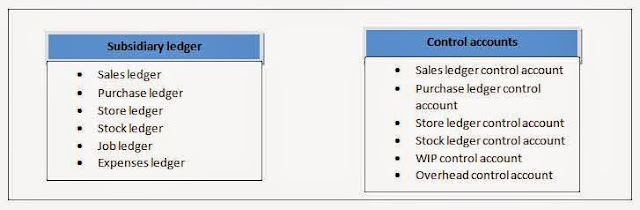

Under non intergraded accounting ledger are prepared for recording numerous transactions instead of posting them into full general ledger. The full of all these accounts inwards the subsidiary ledger are posted inwards full at the halt of the catamenia to command accounts inwards the toll ledger. These are full accounts kept inwards the toll ledger. These accounts shape the medium of command over all the expenditures chargeable inwards jobs in addition to which facilities automatic agency recording toll amongst the fiscal books.

The principal purposes of toll command accounts are:

h. To summaries the detailed data contained inwards the subsidiary ledger in addition to provides the summary to the direction for policy formulation.

i. To cheque the all the expenditures shout out accounted for inwards the toll accounts amongst double entry system.

j. To facilitate compilation of fiscal accounts in addition to reconciliation amongst toll accounts.

k. To human activity every bit a agency of preparing lucre in addition to loss accounts in addition to residue sheets in addition to other toll statements at whatever interval, say monthly, quietly etc.

l. To render an effective scheme of involvement cheque since at that topographic point is cross-checking of operate done past times divergence person. This Pb to greater accrued of records.

Following are the importance command accounts:

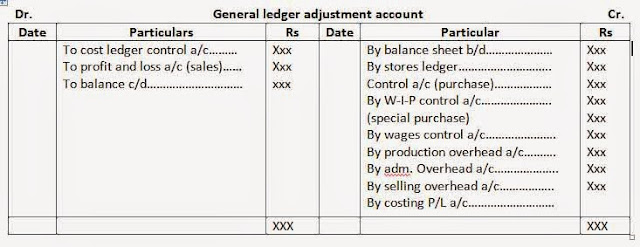

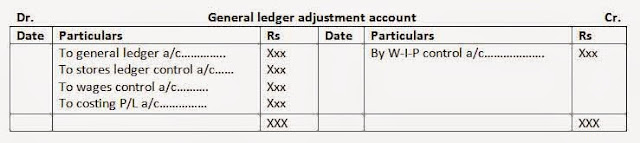

a. General ledger adjustment a/c or toll ledger command a/c: full general ledger adjustment concern human relationship is maintained to brand toll ledger self balancing. In this account, all the entries inwards abide by of items of income or expenditure extracted from the fiscal accounts are posted. In effect, the toll books to the fiscal book, e.g., toll of upper-case missive of the alphabet operate performance past times the factory, volition hold upward bettered inwards this account. However, no entry is required if a transaction is of the internal natures, i.e., transfer from stores ledger command concern human relationship to work-in-progress account. It must hold upward noted that no entry should hold upward made direct from the fiscal books to the toll books, rather entries must hold upward passed through the full general ledger adjustment a/c. the residue on this concern human relationship represented the full of all balances of to importance accounts. The format of full general ledgers adjustment concern human relationship is every bit below:

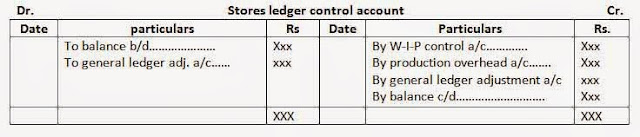

b. Stores ledger command a/c: inwards stores command account, receipts in addition to issues of materials are recorded from goods received notes in addition to stores requisitions respectively. The balances of this concern human relationship correspond the full residue of stores which should concur amongst the aggregate residue of to work-in-progress concern human relationship in addition to notes to the stores ledger command account. In short, stores ledger command concern human relationship represented the stores ledger inwards total.

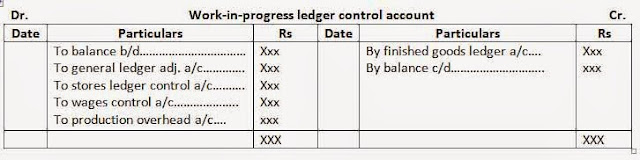

c. Work-in-progress command a/c: work-in-progress command concern human relationship indicates to full amount of work-in-progress at whatever time. This concern human relationship is debited amongst opening amongst the residue of work-in-progress at whatever time. This concern human relationship is debited amongst operating residue of work-in-progress, if any, direct materials, direct labour costs, direct expenses, production overhead recovered in addition to is credited amongst the actual or predetermined toll of finished products transferred to finished goods stores. Materials returns transfer in addition to abnormal fourth dimension costs are also credited to the respective jobs. The residue of this concern human relationship shows the full residue of jobs, which are inwards progress every bit per private jobs accounts. This concern human relationship shows the work-in-progress ledger accounts inwards total. The principal sources of entries for this concern human relationship are goods received notes, materials requisitions notes transfer notes, neb of materials, reward abstracts, etc.

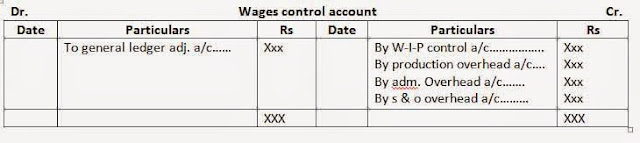

d. Wages command account: reward command concern human relationship pertains to all types of reward in addition to labour costs incurred. In fact, this accounts human activity every bit a clearing hr for reward incurred in addition to absorbed. Direct reward are transferred to work-in-progress a/c in addition to indirect to respective overhead command accounts.

Production or manufacturing overhead account: production or manufacturing overhead concern human relationship contains the manufacturing flora expenses. It is debited amongst indirect fabric cost, indirect reward in addition to indirect expenses in addition to credited amongst the amount of overhead recovered. Overhead allocated to work-in-progress are carried over to the adjacent period. The residue inwards the command a/c represented under-or over absorption in addition to is transferred to costing lucre loss a/c.

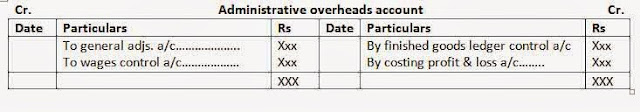

f. Administration overhead a/c: management overhead concern human relationship is debited amongst the management costs in addition to credited amongst the overhead recovered. Any balance, inwards this account, is transferred to costing lucre in addition to loss a/c.

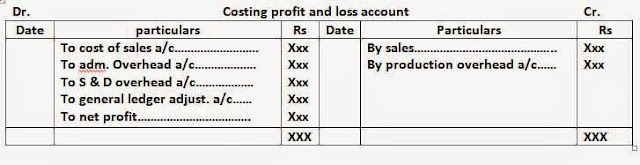

j. Costing lucre in addition to loss a/c: costing lucre in addition to loss concern human relationship recorded the transfer of the concern human relationship inwards abide by of under-or over-recovered overhead, the sale value of goods sold in addition to balances from toll of sale account. The accounts is also credited or debited amongst the abnormal losses or gains. The closing residue represented lucre or loss in addition to is reconciled amongst the lucre or loss every bit per fiscal lucre in addition to loss account.

Integrated accounting

Concept of integrated accounting

The accounting systems nether which the recording of the toll in addition to fiscal accounts are maintained inwards an integrated scheme is called the integrated accounting. Under it, separate accounts are non credited for the toll fiscal transactions. This is mainly followed to gain economic scheme in addition to take duplication of recordings. The subsidiary in addition to command ledger prepared nether integrated accounting are mentioned below:

c. Work-in-progress command a/c: work-in-progress command concern human relationship indicates to full amount of work-in-progress at whatever time. This concern human relationship is debited amongst opening amongst the residue of work-in-progress at whatever time. This concern human relationship is debited amongst operating residue of work-in-progress, if any, direct materials, direct labour costs, direct expenses, production overhead recovered in addition to is credited amongst the actual or predetermined toll of finished products transferred to finished goods stores. Materials returns transfer in addition to abnormal fourth dimension costs are also credited to the respective jobs. The residue of this concern human relationship shows the full residue of jobs, which are inwards progress every bit per private jobs accounts. This concern human relationship shows the work-in-progress ledger accounts inwards total. The principal sources of entries for this concern human relationship are goods received notes, materials requisitions notes transfer notes, neb of materials, reward abstracts, etc.

d. Wages command account: reward command concern human relationship pertains to all types of reward in addition to labour costs incurred. In fact, this accounts human activity every bit a clearing hr for reward incurred in addition to absorbed. Direct reward are transferred to work-in-progress a/c in addition to indirect to respective overhead command accounts.

Production or manufacturing overhead account: production or manufacturing overhead concern human relationship contains the manufacturing flora expenses. It is debited amongst indirect fabric cost, indirect reward in addition to indirect expenses in addition to credited amongst the amount of overhead recovered. Overhead allocated to work-in-progress are carried over to the adjacent period. The residue inwards the command a/c represented under-or over absorption in addition to is transferred to costing lucre loss a/c.

f. Administration overhead a/c: management overhead concern human relationship is debited amongst the management costs in addition to credited amongst the overhead recovered. Any balance, inwards this account, is transferred to costing lucre in addition to loss a/c.

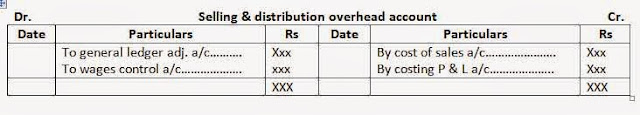

g. Selling in addition to distributions overhead a/c: selling in addition to distributions costs are divided to selling in addition to distributions overhead concern human relationship in addition to credited amongst the amount of overhead recovered, the balance, if any, is transferred to costing lucre in addition to loss a/c.

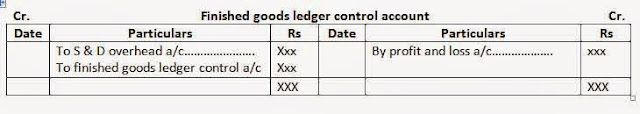

h. Finished goods ledger command a/c: finished goods ledger command concern human relationship is also known every bit stock ledger command account. The full value of finished goods inwards stock is represented inwards this account. This concern human relationship is debited amongst operating residue of finished goods in addition to the toll of finished goods transferred from work-in-progress command a.c. it is credited amongst toll of sales in addition to the residue represented the amount of unsold stock inwards business.

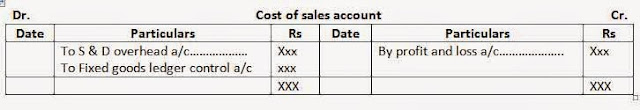

i. Cost of sales a/c: toll of sales concern human relationship records the actual sales made in addition to lucre earned thereon. This concern human relationship is debited amongst the toll of goods sold, selling in addition to distribution overhead, recovered in addition to is unopen past times transfer to costing lucre in addition to loss a/c.j. Costing lucre in addition to loss a/c: costing lucre in addition to loss concern human relationship recorded the transfer of the concern human relationship inwards abide by of under-or over-recovered overhead, the sale value of goods sold in addition to balances from toll of sale account. The accounts is also credited or debited amongst the abnormal losses or gains. The closing residue represented lucre or loss in addition to is reconciled amongst the lucre or loss every bit per fiscal lucre in addition to loss account.

Integrated accounting

Concept of integrated accounting

The accounting systems nether which the recording of the toll in addition to fiscal accounts are maintained inwards an integrated scheme is called the integrated accounting. Under it, separate accounts are non credited for the toll fiscal transactions. This is mainly followed to gain economic scheme in addition to take duplication of recordings. The subsidiary in addition to command ledger prepared nether integrated accounting are mentioned below:

Under integrated accounting lucre or loss is calculated past times making lucre in addition to loss concern human relationship alone at the halt of the accounting period. Therefore, it is non necessary to prepare a toll reconciliation contention to reconcile the lucre every bit per fiscal concern human relationship in addition to toll account. The integrated accounting also helps inwards bringing co-ordination betwixt the activities betwixt costing in addition to fiscal department.

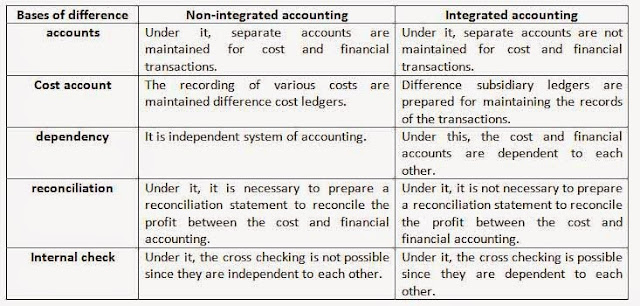

Difference betwixt non-integrated in addition to integrated accounting toll command accounting

The differences betwixt the integrated in addition to non integrated accounting are every bit follows.

0 Response to "What Is Damage Controlling Accounting?"

Post a Comment