Accounting for labour cost

Concept of labour costOut of many resources held past times an organization, human resources is the most meaning one. The success of an organisation largely depends on science together with efficiency of someone working inwards it. It is a critical task of the direction to contend human resource, which are unlike inwards nature together with hence hard to control. Management tries to brand the best utilization of available human resources together with minimize the total labour cost past times making them to a greater extent than productive. On the other hand, workers may seek to earn to a greater extent than past times putting lower efforts as much as possible. Due to these contradicting interests, the task of labour direction has larn to a greater extent than together with to a greater extent than hard inwards the electrical current days.

Labour cost refers to remuneration paid to the employees inwards from of wages, salary, together with bonus, allowances etc. for their fourth dimension together with endeavour used inwards producing goods or services. In other words, monetary resources payable to the employee for their mental together with physical sacrifice is called the labour cost. The institute of cost together with direction accountants (ICMA), London has defined labour cost as "the cost of remuneration of the employees of an undertaking". H5N1 meaning amount has to last sent to retain the employees inwards the organisation together with also to hold them satisfied together with so that they contribute their best. Labour cost tin lav last analyzed into the following:

Concept of labour costOut of many resources held past times an organization, human resources is the most meaning one. The success of an organisation largely depends on science together with efficiency of someone working inwards it. It is a critical task of the direction to contend human resource, which are unlike inwards nature together with hence hard to control. Management tries to brand the best utilization of available human resources together with minimize the total labour cost past times making them to a greater extent than productive. On the other hand, workers may seek to earn to a greater extent than past times putting lower efforts as much as possible. Due to these contradicting interests, the task of labour direction has larn to a greater extent than together with to a greater extent than hard inwards the electrical current days.

Labour cost refers to remuneration paid to the employees inwards from of wages, salary, together with bonus, allowances etc. for their fourth dimension together with endeavour used inwards producing goods or services. In other words, monetary resources payable to the employee for their mental together with physical sacrifice is called the labour cost. The institute of cost together with direction accountants (ICMA), London has defined labour cost as "the cost of remuneration of the employees of an undertaking". H5N1 meaning amount has to last sent to retain the employees inwards the organisation together with also to hold them satisfied together with so that they contribute their best. Labour cost tin lav last analyzed into the following:

a. Monetary benefits: salaries together with wages, dearness or other allowances, production incentive or bonus, overtime allowance, provident fund, payment for insurance scheme, former historic catamenia pension, retirement gratuity, salary inwards lieu of leave, turn a profit linked bonus etc are the benefits that are provided to the workers inwards monetary forms.

b. Non-monetary benefits or fringe benefits: subsidized nutrient together with housing, subsidized or complimentary transportation, clothing, didactics to employee's children, medical together with recreational facilities etc. are the benefits that are provided to the workers inwards non-monetary forms.

Types of labour cost

The labour cost tin lav last classified into direct together with indirect labour cost as mentioned below:

a. Direct labour cost: direct labour cost is that portion of payoff together with salaries, which tin lav last identified together with charged to a unmarried costing unit. It is the remuneration of the employees who are straight connected with the manufacturing operations or the conversion of raw materials into finished products. The of import feature of direct labour costs is that, it tin lav last indentified with together with allocated to workmen seat on definite jobs or products inwards the factory. Direct labour cost is also known as 'direct wages', 'productive wages', manufacturing wages', 'operating wages', manufacturing flora wages'. Direct labour cost is a component of the 'prime cost'.

b. Indirect labour cost: indirect labour cost is the remuneration of the employees who are non straight connected with manufacturing operations. The indirect employees are non straight associated with the conversion physical care for but assist inwards the physical care for past times means of supervision, mamintance, shipping of material, materials handling etc. their piece of work benefits all the items beingness produced together with cannot last specifically identified with the private product. These costs are accumulated together with apportioned to unlike cost centers on equitable solid soil together with absorbed into supervisor, foremen, storekeeper, clerical staff, etc., are the examples of indirect labour costs. Indirect labour cost is also known as 'indirect wages', unproductive wages' together with it is treated as a component of overhead.

Differences betwixt direct together with indirect labour cost

The differences betwixt the direct together with indirect labour costs are mentioned below:

Need of labour cost control

Labour costs may last real high due to inefficiency of about, idle fourth dimension together with odd overtime, inclusion of d dummy names inwards the pay rolls together with other related factors. Inefficient utilization of labour non solely increases the cost of production but also adversely affects the lineament of products. The primary objective of the management, therefore, is to utilize the labour as economically as possible. It is so necessary for the direction to device a proper scheme of labour cost control.

Control overlabour costs require proper work together with efficient utilization of labour force. These factors touching on the cost together with lineament of the products of whatsoever industrial labor together with ultimately its profitability. Labour cost command involves work of efficient workers, proper preparation of workers, proper fourth dimension keeping together with booking together with proper accounting for the payoff paid to them.

System of payoff payment

The success of a concern largely depends upon the efficiency of labour together with the efficiency of labour is considerably affected past times the amount of payoff paid to them. Some persons are of the persuasion threat the turn a profit of a concern tin lav last maximized solely past times reducing the payoff rates payable to the workers. But this persuasion is non correct. It should last remembered that low-paid workers are commonly inefficient leading to payoff of materials, costly utilization of tools, together with frequent breakdown of mechanism together with loss of fourth dimension as a final result of which the cost of production goes up. Reasonable together with fearfulness wage rates allowed to the workers ultimately atomic number 82 to to a greater extent than economical utilization of machines, tools, materials together with time. Therefore, the importance of thee method of payoff payment should never last under-estimated.

Method or systems of payoff payment must physical care for the next characteristics:

• Simple to operate together with slow to understand.

• Guarantee a minimum wage to every worker.

• Acceptable to the employer together with the employee.

• Flexible plenty together with so that changes may last made according to the requirements.

• Ensure the establishment of industrial peace.

Piece charge per unit of measurement system

In this method, payoff are paid to the employees afterward completions of work. Under it, a worker is paid on the solid soil of output, non the fourth dimension taken past times worker to perform the work. This is 1 of the simplest together with most commonly used systems of payoff payment. In this system, the payoff charge per unit of measurement is expressed inwards term of per unit of measurement of output, per chore or per work-order. The amount of payoff payable to a worker nether this method is to last calculated as follows:

Total payoff = total output x payoff charge per unit of measurement per unit of measurement of output

This scheme is suitable inwards the next cases;

• Where a piece of work is of a repetitive nature.

• Where the mensuration of piece of work is simple.

• Where the lineament together with accuracy of output is non real important.

• Where stick supervision is non possible.

Time charge per unit of measurement system

Under this system, the amount of remuneration or the total payoff payable to the workers depends on the fourth dimension for which he is employed. This is uncomplicated together with mutual method of payoff payment. In this method, the worker is paid an hourly, daily, monthly or yearly charge per unit of measurement of wages.

Thus the worker is paid on the solid soil of fourth dimension together with non on his performance or unit of measurement of output. The amount of payoff payable to a worker nether this method is to last calculated as follows:

Total payoff = actual fourth dimension taken x fourth dimension rate

This method is suitable to last applied inwards the next circumstances;

• Where the lineament of piece of work is to a greater extent than importance than production.

• Where the majority of production is non inside the command of labour.

• When it is hard to ready the unit of measurement of output.

• The nature of piece of work is such that at that spot is no solid soil for incentive plan.

• Where the amount of output cannot last accurately measured, counted together with standardized.

Premium plan: incentive payoff payment system

Incentive plans have got been developed to take the defects of both fourth dimension charge per unit of measurement together with slice charge per unit of measurement systems of payoff payment. Under these plans, the advantages of fourth dimension together with piece-wages system. Are combined, together with incentives are provided to workers to piece of work to a greater extent than efficiently. The characteristics of these are as follows;

a. Incentives past times means of bonus together with others are given to efficient workers for the fourth dimension saved.

b. H5N1 touchstone fourth dimension is fixed together with the worker is to perform the given piece of work inside the touchstone time. The touchstone fourth dimension is set afterward making fourth dimension studies for the performance of specific job.

The incentive is compromise betwixt the ii extremities, on the one. If the workers are paid according to time, they gain nil if fourth dimension is saved together with on the other hand, if they are paid on the solid soil of slice rate, employers larn nothings if fourth dimension is saved. Under incentive plans, the employer as good as the worker part the do goodness of fourth dimension saved, together with both labour together with overhead costs are reduced.

The incentive excogitation should last selected according to the nature of piece of work together with other circumstances. It should last accepted past times the direction as good as labour otherwise it does non functions successfully. The payment of payoff may last made according to whatsoever of the next plans.

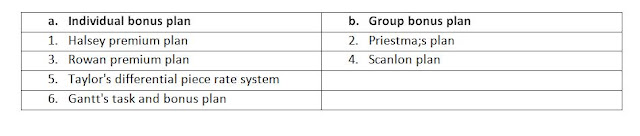

Individual bonus plan

According to private bonus plan, the bonus of each worker is calculated. Some methods of calculated payoff nether private bonus excogitation are discussed bellow.

a. Halsey premium plan

This excogitation payoff originated past times F.A. Halsey this scheme, an hourly charge per unit of measurement is guaranteed to all workers. A touchstone fourth dimension is fixed for each unit, chore or performance on the solid soil of fourth dimension together with displace studies together with the worker is paid the concord hourly charge per unit of measurement of payoff for the actual fourth dimension taken plus a fixed per centum of bonus on the fourth dimension saved. Generally, the amount of bonus or premium payable to the workers is half (50%) of the payoff of the fourth dimension saved. However, a fellowship tin lav increment or decrease the charge per unit of measurement of bonus.

The next for calculating bonus together with total wages/ total earning of the workers nether halsey premium excogitation are:

Basic payoff nether halsey excogitation = fourth dimension charge per unit of measurement x touchstone rate

Advantages of halsey premium plan

The advantages of halsey premium excogitation are mentioned below.

a. It is uncomplicated to empathize together with operate.

b. Every worker is guaranteed minimum payoff together with fifty-fifty the inefficient workers experience secured.

c. It encourages efficiency with workers past times inducing hem to goal their chore earlier the touchstone time.

d. The do goodness from the fourth dimension saved is shared as past times the employer together with the worker.

e. Generally workers do non oppose this method of payoff payment as it rewards fourth dimension saved rather than increased output.

Disadvantages of Halsey premium plan

The disadvantages of Halsey premium excogitation are mentioned below.

a. Workers are paid solely half of the payoff on the fourth dimension saved. So, the workers may oppose this method.

b. The worker may perform the piece of work inwards hurry past times neglecting the lineament of output to salvage fourth dimension together with earn higher bonus.

c. The touchstone fourth dimension fixed for finishing a chore non is scientific.

b. Rowan premium plan

This excogitation was developed past times David rowan. This excogitation guarantees an hourly charge per unit of measurement to all workers. H5N1 worker is paid the fixed charge per unit of measurement per hr for the actual fourth dimension spent on the chore a premium or bonus based on the fourth dimension saved. The amount of premium or bonus is non a fixed per centum of the payoff of the fourth dimension saved but it diverse according to the extent of the fourth dimension saved. The amount of bonus or premium payable nether this excogitation depends on the per centum of fourth dimension saved past times the workers. The bonus is calculating such percentages out of the solid soil wages.

Basic payoff = fourth dimension taken x touchstone fourth dimension charge per unit of measurement

Bonus = fourth dimension saved/ touchstone time

Total payoff = basic payoff + bonus

Advantages of rowan premium plan

The advantages of rowan premium excogitation are mentioned below.

a. This excogitation guarantees minimum payoff together with provided incentives for efficiency.

b. It does non have to rush through worker for increased bonus earning because the bonus increment at a decreasing charge per unit of measurement with higher levels of efficiency. Thus, an automatic depository fiscal establishment check for limiting production of inferior lineament of goods is earned.

c. The per unit of measurement fixed cost decrease with the increment inwards production

d. Under this method, the per unit of measurement cost decrease due to decrease inwards er unit of measurement labour cost.

Disadvantages of rowan premium plan

The disadvantages of rowan premium excogitation are mentioned below:

1. As the bonus is to last shared past times employer together with employees, it is non welcomed past times employees. They aspect total do goodness for their extra efficiency.

2. The calculation of earning nether this method is comparatively complicated together with fourth dimension consuming.

3. The preparation of labour budget together with estimated production labour cost are made hard past times the varying labour costs nether this plan.

4. Payment nether this excogitation is much less than that nether the Halsey excogitation past times means of bonus below 50% of the fourth dimension saved.

Comparison betwixt Halsey together with rowan plan

• Under both the schemes, basic wage are the same together with are guaranteed.

• Both the schemes allow for an incentive 9bonus) to efficient worker. But the amount of bonus payable is unlike nether these schemes.

• When a worker completes his piece of work inside half of the fourth dimension allowed, the bonus nether both the excogitation volition last same.

• If fourth dimension saved is less than 50% of fourth dimension allowed, the rowan excogitation is beneficial to the worker.

• If fourth dimension saved is to a greater extent than than 50% of the touchstone time, the Halsey excogitation is advantageous to the worker.

Why rowan excogitation is ameliorate than halsey plan?

• In the halsey plan, bonus is commonly set at 50% of the fourth dimension saved. It does non serve as a rigid incentive. One the other paw nether the rowan plan, bonus is that proportion of the payoff of the fourth dimension taken which the fourth dimension saved bears to the touchstone time; it serve as a rigid incentive for increasing the efficiency.

• In the rowan plan, the lineament of piece of work is non affected is non affected much. The worker is non induced to rush through the piece of work because bonus increases at a decreasing charge per unit of measurement at higher levels of efficiency. In the halsey plan, a worker is induced to rush through the piece of work because he gets extra payoff for every for every 50% of the fourth dimension saved.

• The effective labour charge per unit of measurement per hr inwards the rowan excogitation is higher upto 50% of the fourth dimension saved together with falls thereafter whereas inwards the halsey plan, the effective labour charge per unit of measurement per hr is lower upto 50% of the fourth dimension saved together with tin lav last double thereafter. Usually, workers are non able to salvage to a greater extent than than 50% of the fourth dimension allowed, together with so workers prefer the rowan excogitation for earning to a greater extent than wages.

c. Taylor's differential slice charge per unit of measurement system

This scheme was developed past times F.W. Taylor, who is known as the "father of scientific management." Taylor suggests that the worker producing the below touchstone degree should last paid according to the depression cost rate. Similarly, the worker producing at or inwards a higher house touchstone paid according to high slice rate. For this, a touchstone fourth dimension is fixed together with the worker who finishes the assigned piece of work earlier the touchstone fourth dimension or at touchstone are paid at a higher charge per unit of measurement a d the worker cannot consummate the task together with displace studies because it demarcates higher together with lower rates of wages. Thus, ii piece-rate are fixed, 1 for those who perform the together with lower rates of wages. Thus, ii slice rates are fixed; 1 for those who perform less than touchstone fourth dimension (may last termed as inefficient workers).

Usually rates are 120% together with 80% of the piecework charge per unit of measurement for efficient together with efficient workers respectively.

Following are the basic requirements for calculating total payoff or earning of the workers nether Taylor's differential slice charge per unit of measurement system:

j. Standard output/ touchstone yield = fourth dimension taken x touchstone output per fourth dimension unit

k. Standard charge per unit of measurement per unit/Normal slice charge per unit of measurement = touchstone payoff charge per unit of measurement for a period/ touchstone yield for that period

l. High slice charge per unit of measurement for at or inwards a higher house standard = 120% of normal slice rate

m. Low slice charge per unit of measurement for below standard = 80% of normal slice rate

Advantages of Taylor's differential piece-rate system

The advantages of Taylor's differential piece-rate scheme are mentioned below.

a. This scheme provided a neat incentive to workers to attain the touchstone output together with the deadening worker ever seek to attain greater efficiency.

b. The scheme is beneficial to workers as good as employers, since the workers larn payoff at an increased charge per unit of measurement according to units produced together with the employers larn increased output at lower cost of production.

Disadvantages of Taylor's differential piece-rate system

The disadvantages of Taylor's departure piece-rate scheme are mentioned below.

i. This scheme is hard to apply due to the fixation of unlike rates.

j. The touchstone output cannot last justified because if a worker simply fails to scope the touchstone output, the depression charge per unit of measurement of payoff volition last given to worker. However, if he simply reaches the standard, higher charge per unit of measurement of payoff volition last payable to worker.

k. There is a neat unlike of payoff betwixt the higher together with lower rates. It creates a large variation inwards the earning of the workers together with conflict may emerge with them.

l. Moreover, employer-employers relation may also last strained, if the touchstone is seat at a real high level.

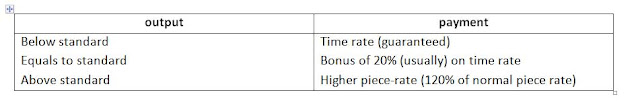

c. Gantt's task together with bonus scheme

This scheme was originated past times Mr. Gantt. This scheme is a combination of fourth dimension rate, differential piece-rate together with bonus scheme together with guarantees a minimum fourth dimension rate. Under this system, minimum payoff are guaranteed to workers who neglect to scope the standard. If the output of the worker, depression charge per unit of measurement is non necessary to determine total payoff for below touchstone together with if a worker's output is at or inwards a higher house standard, he is paid a higher charge per unit of measurement (up to 120% of normal rate) for the actual output.

Following are the basic requirements for calculating total wages/ earning of the worker nether Gantt's task together with Bonus plan:

a. Standard output/standard yield

b. Standard charge per unit of measurement per unit/ normal slice charge per unit of measurement / guaranteed slice rate

c. High slice charge per unit of measurement for at or inwards a higher house standard, mostly 120% of normal slice rate

The remuneration nether this method is estimator as follows:

Total wages/ earning of the worker for inwards a higher house standard:

= actual yield x high slice rate

Total wages/ earning of the workers for below standard:

= touchstone yield x normal slice rate

Total payoff of worker for at the standard

= (time taken x fourth dimension rate) + 20% of fourth dimension wages

Advantages of Gantt's task together with bonus scheme

The advantages of Gantt's task together with bonus scheme charge per unit of measurement mentioned below:

a. This scheme encourages the worker to improve the degree of performance.

b. The workers experience that they are getting the reward, which they are entitled to. Thus, it promotes satisfaction with the employees.

c. This method is real useful inwards jobs involving applied scientific discipline activities.

Disadvantages of Gantt's Task together with Bonus scheme

The disadvantage of Gantt's task together with bonus scheme are mentioned below.

a. Extreme attention is to last do inwards fixing the guaranteed fourth dimension charge per unit of measurement together with decision of touchstone output. Any fault caused due to lack of experience volition atomic number 82 to unfavorable consequences.

b. If the guaranteed fourth dimension charge per unit of measurement is fixed high, the incentive effect of the excogitation volition deteriorate.

Group Bonus schemes

If the premium plans discussed together with so far, the bonus payable to an private was ascertained. Sometimes it is non possible to apply an incentive excogitation to an private employs together with it may last possible to apply such a excogitation to the grouping of employees only. The grouping bonus scheme is peculiarly applicable when the workers deed inwards a grouping as a team. The grouping incentive plans tin lav last successfully implemented where:

a. Output depends on teamwork together with articulation efforts of grouping of workers.

b. It is hard to mensurate the private final result rather than the group's result.

c. It is necessary to piece of work as a fellow member of a squad rather than on private basis, e.g. inwards chemic physical care for industry, an private worker cannot influence the production of the plant.

d. Both direct together with indirect workers demand to last compensated equally.

e. Skills of the workers In the grouping do non vary widely.

Advantages of grouping bonus scheme

The advantages of grouping bonus scheme are mentioned below.

a. Increase inwards production together with saving inwards cost of production tin lav last achieved.

b. Supervision costs volition last reduced substantially.

c. The quantity cost volition last reduced substantially.

d. Absenteeism is reduced to minimum together with creates involvement inwards piece of work with the workers.

e. Routing together with scheduling problems are eliminated.

f. It creates team's spirit together with reduces cost per unit.

g. Minimum waste materials together with reduces cost per unit.

h. Clerical piece of work inwards calculation of bonus is reduced.

Disadvantages of grouping bonus scheme

The disadvantages of grouping bonus scheme are mentioned below:

a. Individual science together with efficiency are non considered inwards these systems.

b. Difficulty may arise inwards calculation of bonus together with method of its distribution to all the workers In the group.

c. The bonus is paid on grouping efforts; together with private worker may non seat his maximum endeavour inwards vies of equal sharing of bonus to inefficient workers.

d. An inefficient grouping leader may crusade the entire grouping to suffer.

a. Priestman's plan

Under this system, the touchstone output together with touchstone fourth dimension for each subdivision predetermined inwards consultation with the workers. Bonus is payable to the subdivision when the actual production exceeds the touchstone production. Where the actual production does non travel past times standard, no bonus is paid but fourth dimension rates are guaranteed. The bonus is calculated as a per centum on such excess production together with distributed to all employs inwards that particulars subdivision past times increment their normal payoff past times the same per centum the actual production increment over the standard.

In this system, the fourth dimension payoff are guaranteed if actual production of the item division, department, together with grouping is less than the touchstone output. This method is non solely applicable for excess of actual production over the touchstone but also saving inwards stuff together with labour costs is considered for payment of bonus. The chief drawback inwards this scheme is the efficiency of private worker is non considered together with inefficient workers tin lav also claim for bonus.

Bonus rate = increment inwards actual output/ touchstone output x 100

Bonus = basic payoff x bonus rate

Total wages = basic payoff + bonus

b. Scanlon plan

This excogitation was originanated past times joseph Scanlon. It was successfully used inwards the steel manufacture inwards the United States. Under this plan, a constant proportion (the ratio of payoff to sales value) of the added value of output is paid to workers, who are jointly responsible for the additions. The added value is measured past times modify inwards marketplace value 9including profit0 of a production resulting from a modify inwards form, location or availability of a production or service, excluding the cost of buy materials or services used inwards production.

Under this plan, the next steps are used to ascertain the amount of bonus available for distribution:

i. Determine the ratio of actual payoff to actual sales = actual wages/ actual sales

j. Then after, determine the ratio of given payoff to given sales = given wages/ given sales

k. Make the departure of the inwards a higher house mentioned ratio

l. Calculate the amount of bonus due to the laborers = Given sales x departure inwards ratio as per stride 3

m. Deduct the amount of have from amount of bonus to the laborers together with larn the amount of bonus available for distribution.

Labour turnover

Concept of labour turnover

An organisation has a perpetual Alexis, but its working strength does non rest the same all the time. Some former workers leave of absence the organisation together with some novel workers articulation it. This is a natural phenomenon inwards industrial sector together with it gives rising to the job of labour turnover. Labour turnover tin lav last defined as the charge per unit of measurement of changes inwards the average working strength of an organisation during a specified period. The discussion 'change' should last taken to hateful separations or accessions, replacements or the average of separations together with accessions according to the concept accepted past times management. Labour turnover is the charge per unit of measurement of displacement of the personnel employed inwards an organisation due to resignation, retirement or retrenchment. If the charge per unit of measurement of labour turnover is high, this is a sign of instability of labour together with it adversely affects efficiency as good as the profitability of the firm.

The cost of labour increment when the experienced workers exit of the line solid together with novel together with inexperienced workers are hired who are to last trained. Therefore, the labour turnover proverbs to last real costly for the line concern together with every endeavour should last made to cut down the frequency of labour turnover.

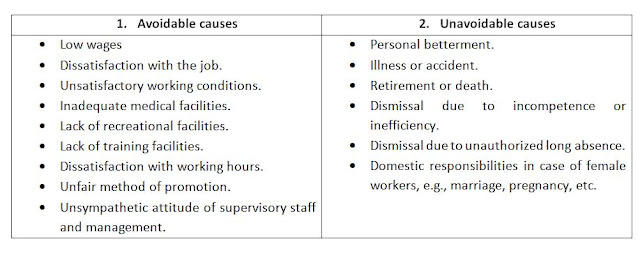

Cause of labour turnover

The chief causes of labour turnover tin lav last divided into ii categories:

Effects of labour turnover

High labour turnover final result inwards increased cost of production due to the next reasons:

• Interruption inwards piece of work leading to a decrease inwards production.

• Cost of selecting novel workers.

• Increased cost of training.

• New workers' inefficiency results inwards less economical utilization of tools together with equipment together with nonsuccessive wastage of materials.

• Higher accident rate.

• Overtime payoff increment due to an excessive release of separations, causing difficulties inwards adhering to the delivery dates of the contacts.

Cost of labour turnover

The cost of labour turnover tin lav last divided into ii parts:

a. Preventive costs: preventive costs announce the costs, which are incurred to forestall excessive labour turnover past times keeping a satistified labour force. These are the costs which are incurred inwards club to hold the workers satisfied together with thus to deed as discouragement against leaving employment. These include:

• Cost of personal administration.

• Cost of medical activities.

• Cost of welfare activities.

• Cost of gratuity together with pension schemes.

• H5N1 portion of high wages, bonus together with perquisites.

b. Replacement costs: replacement costs refer to the costs of the recruitment, preparation together with absorption of novel workers. These included:

• Cost of recruitment together with preparation of novel workers.

• Loss of output due to interruption together with inefficiency of novel workers.

• Cost of wastage, flake together with defective work.

• Compensation due to frequent accidents.

• Cost of additional supervision.

Preventive together with replacement cost calculation

Preventive costs are incurred to hold the workers satisfied together with discourage them to atomic number 82 the organization. They are treated as overhead charges together with apportioned to departments on the solid soil of release of someone inwards respective departments.

Replacement costs aeries on line concern human relationship of labour turnover together with consequent replacement of employees. There are ii atmospheric condition of handling of replacement costs.

a. The replacement costs should last charged straight to that subdivision if they are caused due to fault of whatsoever item department.

b. They should last charged as component of production overhead together with should last apportioned to departure departments on the solid soil of release of workers inwards each department.

Treatment of cost labour turnover

The preventive together with replacement costs are the costs caused due to labour turnover. Preventive costs should last charged as a works overhead item together with apportioned to unlike departments on the solid soil of release of workers engaged inwards each department. Replacement costs should also last treated on the same solid soil if they arise on line concern human relationship of brusque sighted policy of the management. However, if they arise on line concern human relationship of the fault a item department, they should last charged straight to that department.

It is to last noted that labour turnover cannot last completely avoided but its charge per unit of measurement tin lav last kept at a considerable depression degree past times taking such steps which improved morals together with do a congenial atmospheres inwards the organization.

Control together with minimization of labour turnover

Labour turnover tin lav last minimized past times taking next steps:

a. Right chore for the right man: this is the most meaning aspect on which the direction should concentrate. Every worker is non stand upwardly for to take hold every type of jobs. If a worker is placed as per the qualifications together with the mental attitude of the someone concerned problems are probable occur.

b. Farsightedness: direction should last also intend of requirements of the future. In the brusque run, it may have got to incur to a greater extent than expenditure on providing amenities to work.

c. Direct contact: at that spot should last a straight together with continues dialogue betwixt the workers together with management. It leads to disclosure of worker's problems together with their psychology. As a result, the problems tin lav last sorted out past times negotiations across the table.

d. Standardization of systems together with procedures: all systems together with procedures regarding selection, training, utilization of labour strength etc. should last standardized scientifically. Properly set downwards rules together with regulations results inwards less conflict.

e. Proper implementation of scientific systems with flexibility: a proper together with objective scheme of implementing the labour rules together with regulations should last developed. The direction has to bargain with human beings with the human approach.

Labour turnover ratios

Labour turnover may last measured past times whatsoever of the next method. The selection of a item method depends on whether emphasis is given on labour separations, replacements or both, but 1 time a item method is chosen, it should last adopted consistently together with so that comparing may last possible.

a. Separation charge per unit of measurement method: this is the most commonly used method. This method takes into consideration the release of workers left or discharged during the period. Labour turnover is determined past times dividing the total release of separations during the month/year past times the average release of workers employed during the month/year together with multiplying that past times 100.

Labour turnover = No. of workers separate during the catamenia / average no. of workers during the catamenia x 100

b. Replacement charge per unit of measurement method: this method takes into consideration the release of workers replaced during the catamenia irrespective of the release of workers left or discharged. Dividing the release of workers replaced during the month/ twelvemonth past times the average release of workers employed during the month/year together with multiplying that past times 100 determine labour turnover.

Labour turnover = No. of workers replaced during the period/ average release of workers during the catamenia x 100

c. Labour flux charge per unit of measurement method: this method takes into consideration both the release of workers left or discharged together with the release of workers replaced during the period. Thus, this method it the combination of the previous of ii method. The formula for calculation labour turnover nether this method is as follows:

Labour turnover = during of catamenia + during the period/ average no. of workers during the catamenia x 100

d. Equivalent annual charge per unit of measurement of labour turnover: inwards illustration it is decided to relate the labour turnover charge per unit of measurement for a calendar month or fraction of a calendar month to annual charge per unit of measurement of turnover, this may last done past times finding out "equivalent annual rate" with the aid of the next formula:

Equivalent annual charge per unit of measurement = turnover charge per unit of measurement x 365/ No. of days inwards the relevant catamenia x 100

0 Response to "Accounting For Labour Cost?"

Post a Comment