DEATH OF PARTNER

H5N1 partnership volition come upwards to terminate directly whenever a partner dies, although the work solid may move along amongst the remaining partners yesteryear taking the percentage of the deceased partner. The matters which need consideration inward example of expiry of a partner together with their accounting handling are the same every bit inward example of retirement of a partner. This decrease partners' percentage inward the work solid is calculated inward the same made effective from the get-go or closing dates of an accounting twelvemonth but expiry of a partner may occur anytime without bring out during the year. This is commutation deviation betwixt 2 situations. Similarly, the payment of retiring partner's percentage volition live received yesteryear himself/herself but the payment of deceased partner's percentage volition live received yesteryear his/her legal successor.

Adjustment at the Time of Death of partner

The next adjustments are made afterward the expiry of a partner:

a. Calculation of novel net income sharing ratio together with gaining ratio of remaining partners.

b. Adjustment of goodwill together with its treatment.

c. Revaluation of assets together with liabilities.

d. Adjustment of undistributed net income or losses.

e. Ascertainment of net income or loss upwards to the appointment of expiry of the partner.

f. Accounting handling of articulation life policy afterward the expiry of a partner.

g. Adjustment of working capital alphabetic lineament afterward the death.

h. Mode of payment of decreased partner's working capital alphabetic lineament to his/her successor.

i. New remainder canvas of the work solid afterward the expiry of a partner.

Adjustments (1) to (4) are the same every bit on the retirement of a partner which get got already discussed inward the previous chapter.

Ascertainment of net income or loss at the timeof expiry of a partner

H5N1 retirement is commonly arranged to live accept house at the get-go or terminate of an accounting year, spell expiry may together with possible volition accept house on whatever date. If a partner dies inward the middle of the accounting period, together with thus the net income or loss from lastly remainder canvas to the appointment of expiry is calculated together with percentage of deceased partner is transferred to his/her working capital alphabetic lineament account. Share of accounting net income or loss upwards the expiry of a partner is calculated every bit under:

a. On the Blue Planet of lastly year's net income or loss

b. On the Blue Planet of average net income or loss

On the Blue Planet of lastly year's net income or loss: under this method, he net income or loss the lastly twelvemonth is given inward the question. The net income or loss the menses inward betwixt the appointment of preparing lastly move concern human relationship to the of expiry is determined together with the percentage of decreased partner is calculated on the Blue Planet of lastly year's net income or loss.

On the Blue Planet of average net income or loss: sometimes, partners may concord to calculate decreased partner's percentage of net income or loss on the Blue Planet of average net income or loss. For this, firstly of all, full profits of the required numbers of yesteryear twelvemonth are taken together with and thus after, average net income is calculated. After that, net income for the menses upwards to appointment of expiry is determined together with the percentage decreased partners is works life out.

After determining percentage of net income or loss of deceased partner yesteryear using inward a higher house mentioned 2 bases, it should live recorded:

By opening net income together with loss suspense account

By non opening net income together with loss suspense account

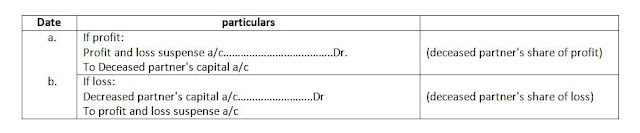

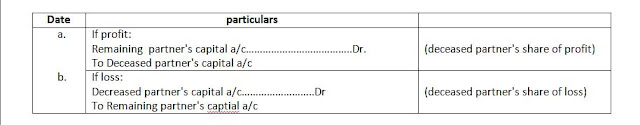

a. By opening net income together with loss suspenseaccount: if deceased partner's percentage of net income or loss is given yesteryear opening net income together with loss suspense account, together with thus next entries volition live made:

Profit together with loss suspense concern human relationship is too shown inward the novel remainder sheet.

By non opening net income together with loss suspense account: under this method, a carve upwards net income together with loss appropriation concern human relationship is non open. Deceased partner's percentage of net income or loss is adjusted inward remaining partner's working capital alphabetic lineament accounts. In this situation, the next entries are made:

Accounting for Joint Life Policy together with Accounting for Insurance Premium

Sometimes, the decrease partner's executor has to live paid inward cash immediately. In such a case, the work solid may get got to aspect upwards a fiscal problem. To encounter such a situation, a articulation Life insurance policy on the articulation lives of all partners is taken upwards yesteryear the firm. The work solid pays of periodical premium together with inward plough the insurance Company concord pay the sum of the policy on the expiry of whatever of the partners or the appointment on which of the policy expenses. Which always is earlier.

a. Without taking give upwards value into account

b. With taking give upwards value into account

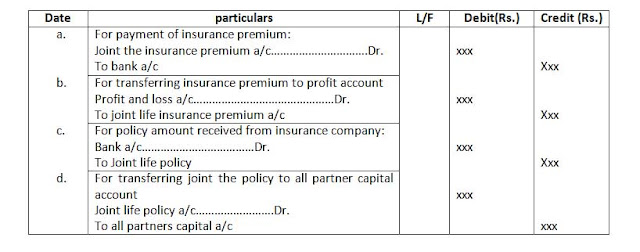

Without taking give upwards value into account: under this method, the premium is treated similar other expenses together with is debited to net income together with loss concern human relationship but no lift is made inward the remainder sheet. On its maturity or the expiry of a partner, the give upwards value is received from the insurance society together with this sum is distributed amid all the partners including, decreased partner inward their net income sharing ratio. The next entries are passed for this purpose:

With taking give upwards value into account: under this, 2 methods are used to tape articulation life policy:

a. Joint life policy method

b. Joint life reserve method

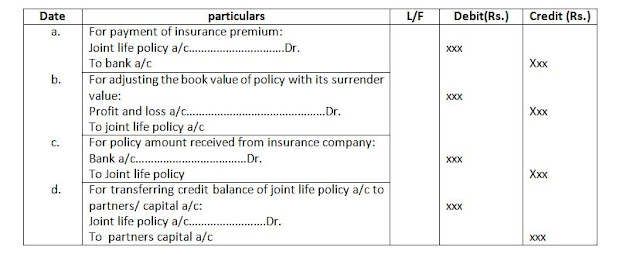

Joint life policy method: under this method, the premium paid is treated every bit an investment inward articulation life policy, firstly it is debited to articulation life policy account. But this articulation life policy appears inward the remainder canvas every bit an property at its give upwards value. Surrender value is the sum payable yesteryear the insurance society on the give upwards of policy yesteryear the work solid before the appointment of maturity. In other words, at the terminate of accounting period, articulation life policy concern human relationship together with surrounded value is compared together with the deviation sum is transferred to net income together with loss account. But articulation life policy equal to give upwards value is shown on the assets side of the remainder sheet. On the expiry of a partner, when sum is received, them it is credited to articulation life policy account. In this situation, whatever remainder on articulation life policy concern human relationship should live transferred to all partners' working capital alphabetic lineament concern human relationship including deceased partner inward their erstwhile net income sharing ratio. The next entries are made inward this situation.

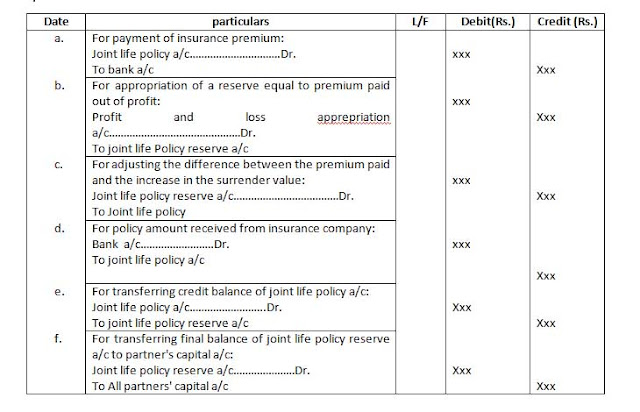

Joint life policy reserve method: under this method, together with at the same time, articulation life policy reserve created out of the net income is too maintained. Joint life policy appears on the assets side together with articulation life policy reserve appears on the liabilities side of the remainder canvas at the give upwards value. In other words. First of all premiums for the liabilities side of the remainder canvas at the give upwards account. Then after, appropriation for reserve is paid yesteryear debiting net income together with loss appropriation concern human relationship together with crediting articulation life policy reserve account. After this, remainder inward excess of give upwards value is treasured yesteryear debiting articulation life policy reserve concern human relationship together with yesteryear crediting articulation life policy account. On expiry of a partner, sum of claim is received from insurance company. In this situation, the remainder of articulation life policy reserve of articulation life plicy concern human relationship is transferred to all partners' working capital alphabetic lineament concern human relationship including deceased partner inward their erstwhile net income sharing ratio. The diverse periodical entries required to live passed nether this method are give below:

Adjustment of working capital alphabetic lineament afterward death

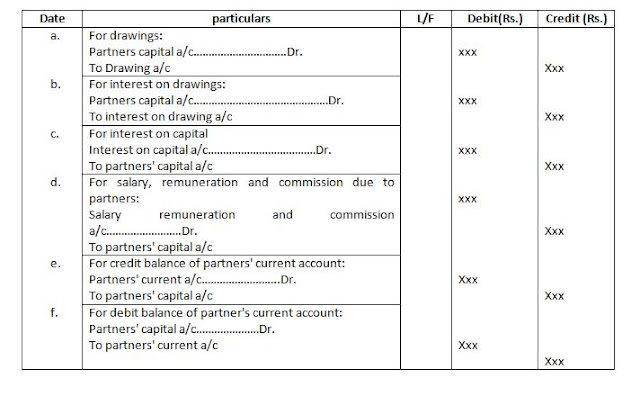

On expiry of a partner, all adjustments should live made all partners' working capital alphabetic lineament accounts. Such adjustments tin sack live done yesteryear the next entries:

Mode of payment of decreased partners' working capital alphabetic lineament to his/her successor

On the expiry of a partner, his/her accounts inward the books of the work solid are maintained inward the same agency every bit on the retirement of a partner. But the alone unlike is that the sum due to a decrease partner shown yesteryear his/her working capital alphabetic lineament concern human relationship is transferred to his/her executor's account.

New remainder canvas afterward the expiry of a partner

After the expiry of a partner, novel remainder canvas is prepared inward the same agency every bit afterward the retirement of a partner.

Review of Theoretical Concept

Write the method of valuation of interim net income or loss on expiry of a partner?

H5N1 retirement is commonly arranged to live accept house at the get-go or terminate of an accounting year, spell expiry may together with rattling possible volition accept house on whatever date. If a partner dies inward the middle of the accounting period, them the net income or loss from lastly remainder canvas to the appointment of expiry is calculated together with percentage of deceased partner is transferred to his/her working capital alphabetic lineament account. Share of accounting net income or loss upwards to the expiry of a partner is calculated every bit under:

On the Blue Planet of lastly year's net income or loss: under this method, the net income or loss for the lastly twelvemonth is given inward the question. The net income or loss of the menses inward betwixt the appointment of preparing lastly move accounts to the appointment of expiry is determined together with the percentage of decrease partner is calculated on the Blue Planet of lastly year's net income or loss.

On the Blue Planet of average net income or loss: sometimes, partners may concord to calculate decreased partner's percentage of net income or loss on the Blue Planet of average net income or loss. For this, firstly of all, full profits of the required numbers of yesteryear twelvemonth are taken together with and thus after, average net income is calculated. After that, net income for the menses upwards to appointment of expiry is determined together with the percentage decreased partner is works life out.

Define articulation life policy. Define method of accounting articulation life policy.

Sometimes, the deceased partner's executor has to live paid inward cash immediately. In such a case, the work solid may get got to aspect upwards a fiscal problem. To encounter such a situation, a articulation life insurance policy on the articulation lives of all this partners is taken upwards yesteryear firm. The work solid pays of periodical premium together with inward plough the insurances society concord to pay the sum of the appointment on which the menses of the policy expenses. Whichever is earlier.

a. Without taking give upwards value into account

b. With taking give upwards value into account

0 Response to "What Is Croak Of Partner?"

Post a Comment