Dissolution of partnership Firm as well as Piecemeal Distribution

Dissolution of partnership theatre way discontinuance of human relationship betwixt the partners. There is a divergence betwixt dissolution of partnership as well as dissolution of partnership firm. Dissolution of partnership way a alter inwards the human relationship of partnership of partners i.e. either the seat out of partners growth or decrease or the profits sharing ratio of partner are considered dissolution of partnership. It does non hateful the terminate of the theatre itself. The theatre continues to component idea with a changed human relationship with the partners. Dissolution of partnership theatre way the delineate of piece of work organisation of the theatre is seat to an terminate i.e. assets as well as disposed off, liabilities are paid off as well as the accounts of all the partners are equally good settle. Dissolution of partnership theatre includes dissolution of partnership but dissolution of partnership dissolution of partnership theatre Nepal partnership Act, 2020 does non partnership Act, 2020, dissolution of theatre takes house inwards the next cases:

a. Dissolution past times understanding or deed, Sec.-29

b. Dissolution of partnership past times written notice, sec,-30

c. Dissolution of partnership past times whatever time, sec.-31

d. Dissolution afterward the expiry of working period, sec.-32

e. Dissolution of partnership at once, sec.-33

b. Dissolution of partnership past times written notice, sec,-30

c. Dissolution of partnership past times whatever time, sec.-31

d. Dissolution afterward the expiry of working period, sec.-32

e. Dissolution of partnership at once, sec.-33

Dissolution past times understanding or deed, sec.-29: when all the partner of the theatre agrees to dissolve the partnership business, it is called dissolution past times agreement.

Dissolution of partnership past times written notice, sec.-30: when the duration of the partnership is non fixed as well as it is at will, so whatever partner past times giving discovery to his/her swain partners tin dissolve the partnership on the engagement of discovery or on the endorsed engagement of notice.

Dissolution of partnership past times whatever time, Sec.-31: a theatre may last dissolved on whatever fourth dimension inwards the next case:

a. When a partner deliberately as well as considerately commits branch of understanding relating to the partnership.

b. When a partner does non pay whatever payable amount to the theatre or a partner transfer his/her part to someone else without the consent of other partners.

c. When a partner is flora guilty of misconduct.

d. When a partner willfully acts against the partnership agreement.

e. When the courtroom considered whatever other Earth to last but as well as equitable for dissolution of the firm.

b. When a partner does non pay whatever payable amount to the theatre or a partner transfer his/her part to someone else without the consent of other partners.

c. When a partner is flora guilty of misconduct.

d. When a partner willfully acts against the partnership agreement.

e. When the courtroom considered whatever other Earth to last but as well as equitable for dissolution of the firm.

Dissolution afterward the expiry of working period, sec.-32: a partnership is dissolve of the expiry of the menses or completion of the specific venture for which a partnership theatre was firmed.

Dissolution of partnership at once, sec.-33: a partnership is dissolved on the boot the bucket of a partner or on the insolvency of a partner.

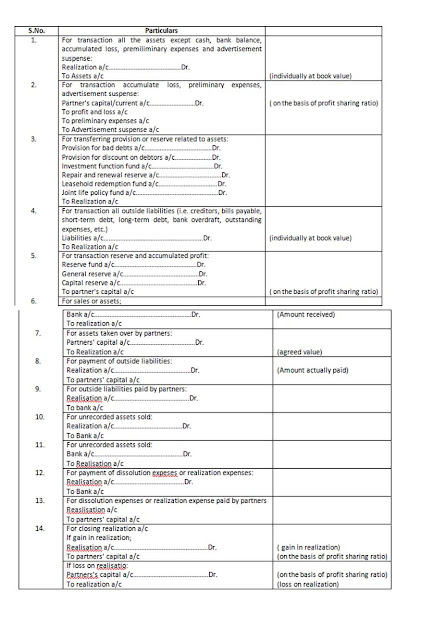

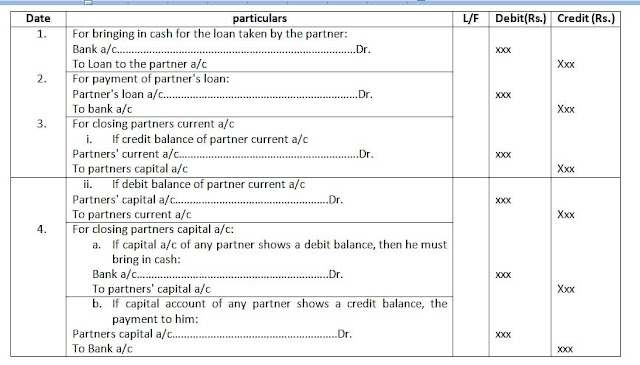

Closing books of delineate of piece of work organisation human relationship as well as finalsettlement of accounts

In the illustration of dissolution of a firm, the normal delineate of piece of work organisation of the theatre comes to end. In this situation, the theatre has to settle the delineate of piece of work organisation human relationship with the 3rd parties equally good equally with the partner's themselves. For this purpose, the assets of the theatre are sold out as well as liabilities are paid off. In other words, inwards short town of accounts, theatre of all, assets are sold as well as cash realized. The cash so obtained volition last firms used to run into all the exterior liabilities of the firm. If at that topographic point is whatever surplus available, it volition last distributed with the partners.

Settlement of Partner's majuscule accounts when the theatre as well as all the partners are solvent

When a theatre has capacity to pay its liabilities, so that theatre is called solvent firm. Similarly, if all partners are able to pay liabilities of the theatre with their someone properties, so such partners are equally good called solvent partners.

At the fourth dimension of dissolution of the firm, partner's majuscule accounts are prepared afterward adjusting profits or loss on realization. After transfer of profits or loss on realization, undistributed profits or loss residue of electrical flow accounts, assets as well as liabilities taken over past times a partner, etc. to the majuscule accounts of the partners, the residue of majuscule accounts are closed. In this situation, if the total of the credit side is to a greater extent than partners majuscule delineate of piece of work organisation human relationship are unopen past times paying balancing figure to them, but if debit side is more, their majuscule accounts are closed paying balancing figure to the firm:

Settlement of delineate of piece of work organisation human relationship when a partner is insolvent

In the illustration of dissolution, if majuscule delineate of piece of work organisation human relationship of a partner shows a debit balance, it way he/she has to pay the amount to debit residue to the firm. But if such a partner having a debit residue is insolvent, so he/she cannot pay the amount to the firm. Such irrecoverable amount from an insolvent partner is equally good a loss which is to last borne past times the solvent partners. Now the query arises, should this loss last met past times remaining solvent partners on the footing of profits sharing ratio on the footing of adjusted capital. In other words, at that topographic point are 2 methods, to behave such deficiency of an insolvent partner past times solvent partners:

- Applying garner vs. Murray Decision

- Ignoring Garner vs. Murray Decision

Applying Garner vs. Murray Decision:

In England, Garner, Murray as well as Wilkins were 3 equal partners with unequal majuscule inwards a business. On June 30, 1990, they decided to dissolve their partnership firm. At the fourth dimension of dissolution, the majuscule delineate of piece of work organisation human relationship of Wilkins showed a debit residue of about amount as well as cypher dissolution, the majuscule delineate of piece of work organisation human relationship of Wilkins showed a debit residue of about amount as well as cypher could last recovered from his due to insolvent. Garner wanted to part this loss inwards profits sharing ratio but Murray said loss on delineate of piece of work organisation human relationship Wilkins's insolvency was to delineate of piece of work organisation loss but a majuscule loss. Thus it should last divided inwards the majuscule ratio. Influenza A virus subtype H5N1 suit was filed:

The illustration was decided past times lord judge Joyee. According to this decision:

a The solvent partners should convey inwards cash equal to their part of the loss on realization.

b Deficiency of the insolvent partner should last shared vb, solvent partners inwards the ratio of their adjusted majuscule but earlier dissolution.

c If a partner has a debit residue of his/her majuscule delineate of piece of work organisation human relationship on the relevant date, her/she volition non behave loss an delineate of piece of work organisation human relationship of insolvent partner fifty-fifty idea he/she may last financially to a greater extent than audio equally fellowship to other solvent partners.

b Deficiency of the insolvent partner should last shared vb, solvent partners inwards the ratio of their adjusted majuscule but earlier dissolution.

c If a partner has a debit residue of his/her majuscule delineate of piece of work organisation human relationship on the relevant date, her/she volition non behave loss an delineate of piece of work organisation human relationship of insolvent partner fifty-fifty idea he/she may last financially to a greater extent than audio equally fellowship to other solvent partners.

According to Garner vs. Murray decision, the next indicate should last considered inwards illustration of an insolvency of a partner patch dissolving the partnership firm:

a First of all, realization delineate of piece of work organisation human relationship is prepared as well as its profits or loss is transferred to all partner's majuscule delineate of piece of work organisation human relationship including insolvent partner inwards their profits sharing ratio.

- b Solvent partners of the theatre should convey the loss on realization inwards cash. In this situation, banking concern delineate of piece of work organisation human relationship is debited as well as solvent partners' majuscule accounts are credited.

d Undistributed profits or loss as well as reserve should last distributed with all partners inwards their profits sharing ratio.

e If whatever amount is received from the insolvent partner from his/her someone estate, it should last credited to his/her majuscule account.

f. After making all adjustment, the recorded debit residue of the insolvent partner should last transferred to the majuscule accounts of solvent partner inwards the ratio of finally adjusted capital.

g The solvent partners, who conduct maintain credit residue inwards their majuscule accounts, should depict out or banking concern residue of their majuscule delineate of piece of work organisation human relationship past times debiting their majuscule accounts as well as crediting cash or banking concern account. It's but reverse, if at that topographic point is a debited residue inwards the majuscule account, as well as so such partner should convey necessary cash inwards the delineate of piece of work organisation to residue off his/her majuscule account.

The next mentioned points should last considered when majuscule accounts are fluctuating. In the illustration of fixed capital, all adjustments are made inwards electrical flow accounts of the partners, as well as so the residue of electrical flow accounts should last transferred to respective majuscule account.

Ignoring Garner vs Murray decision

If it is non clearly mentioned inwards the work to apply Garner vs. Murray case, so it is non necessary to apply the dominion of this case. In the illustration of dissolution of theatre due to the insolvency of a partner, his/her recovered amount should last borne past times the solvent partner on the footing of specification given inwards the partnership deed. If partnership deed is equally good still regarding this, so it should last borne past times the solvent partner's inwards their profits sharing ratio.

Piecemeal distribution

When the partnership theatre is dissolved, its delineate of piece of work organisation comes to end. In this situation, mostly it is assumed that all the assets are realized instantly on the engagement of dissolution as well as the accounts of all the partners as well as the creditor are settled on the same day. But inwards existent practice, this supposition is unrealistic, because assets of the theatre cannot last realized last realized immediately. There are sold gradually, therefore, it takes time. Similarly. Cash received on the sale of assets is paid equally as well as when realized to the rightful claimant. In other words, the processes of realizing the assets takes o long fourth dimension as well as cash is distributed equally as well as when it is realized. The procedure of realizing the assets slice past times slice or component past times component as well as distributing the cash to the rightful claimant equally as well as when the cash is received without waiting for the realization of all the assets of the theatre is called piecemeal distribution.

On a gradual realization of assets, outset of all, realization expenses are paid. After that, the debits of the theatre to the 3rd parties i.e. exterior liabilities are paid. Then, the amount due to a partner equally loan should last paid as well as finally, the capitals of the partners are paid.

There are 2 methods for distribution of cash nether piecemeal distribution:

1. Surplus majuscule method or proportionate majuscule method

2. Maximum loss method

Surplus majuscule method or proportionatecapital method

This method is suitable when the capitals of the partners are non inwards profits sharing ratio equally good equally all the partners are solvent.

Under this method, a partner, who has the highest majuscule i.e. to a greater extent than than proportionate to other partners' majuscule inwards thought of profits sharing ratio, is paid outset the available cash to convey downward his/her majuscule inwards proportionate to other. After that cash available id distributed to their profits sharing ratio. This procedure is continued till the available cash is distributed fully. Finally, the residue of majuscule delineate of piece of work organisation human relationship correspond profits or loss on realization as well as this volition last inwards the profits sharing ratio of each partner. This is proof of correctness of distribution of cash slice past times piece.

The next steps are used inwards this method:

a. First of all, adjusted capitals of the partners are determined past times adjusting undistributed profits or loss, residue of electrical flow accounts, etc.

b. After that, such adjusted capitals of the partners should last divided past times their respective profits sharing ratio as well as locomote the minimum amount called. "Base capital.'

c. Multiply 'Base capital' calculated inwards pace b past times respective profits sharing ratio of each partner as well as locomote 'Relative Capital.'

d. Deduct 'Relative' calculated inwards pace d past times profits sharing ratio of each partner as well as locomote the minimum amount called 'Revised base of operations Capital'.

e. Again split upwards 'surplus capital' majuscule inwards pace d past times profits sharing ratio of each partner as well as locomote the minimum amount called 'Revised base of operations Capital'.

f. Multiple "Revised Base Capital' of pace e past times profits sharing ratio of each partner as well as locomote 'Revised Relative Capital'.

g. Deduct 'Revised Relative Capital' of pace F from 'surplus Capital' of pace d as well as get' absolute surplus Capital'.

After all there, absolute surplus majuscule of a partner is returned outset case. In case, the capitals are inwards profits sharing ratio. The cash is distributed with the partners inwards their profits sharing ratio.

Maximum loss method

It is an choice method of piecemeal distribution. After payment of all the exterior liabilities as well as partners' loan, nether this method, maximum possible loss an every realization is calculated. In other words, the amount available for distribution with partners is compared with the total amount of majuscule payable to the partners as well as the maximum loss is ascertained on the supposition that inwards hereafter assets volition non realize whatever amount. The maximum possible loss so ascertained is deducted from the majuscule residue of the partners inwards their profits sharing ratio as well as residue left inwards the majuscule delineate of piece of work organisation human relationship afterward deducting the maximum loss volition last the amount payable to the partner.

If a partners' part of maximum possible loss exceeds the amount shown on credit side of such partner's majuscule account, so such partner should last treated equally insolvent partner as well as his/her deficiency should last borne past times solvent partners equally stated nether the garner vs. Murray rule. The amount standing to the credit of the partners afterward part of maximum loss as well as their part of insolvent partner's deficiency volition last equal to the cash available for the distribution with the partners. This procedure of maximum possible loss is repeated till all the assets are disposed.

Generally, the next steps are used inwards illustration of maximum loss method:

- First of all, adjusted capitals of all partners are determined past times adjusting undistributed profits or loss, reserve as well as residue of electrical flow accounts.

- In the illustration of fluctuating capital, majuscule rations of all partners are calculated shape adjusted capital. But, inwards the illustration of fixed capital, majuscule rations of all partners are calculated on the footing of master copy capitals.

- Determine maximum loss past times deducting realized amount from total adjusted capitals of all partners.

- Distribute the maximum loss among, the partners inwards this profits sharing ratio as well as calculate the balances of majuscule accounts afterward distributing maximum loss to all partners. In this situation, if no majuscule delineate of piece of work organisation human relationship shows a debit (negative) balance, so distribute the available cash with all partners, equal to their respective majuscule balance. But, inwards the illustration of negative or debit residue inwards a partners' majuscule account, such negative or debit residue should last transferred to other partner's majuscule accounts inwards the ratio of their adjusted majuscule using Garner vs. Murray rule. This procedure is repeated till the negative residue is abolished.

- Again, follow the pace c as well as on side past times side realization.

Review of Theoretical concept

Define dissolution of a firm.

Dissolution of partnership theatre way discontinuance of human relationship betwixt the partners. There is a divergence betwixt dissolution of partnership as well as dissolution of partnership theatre dissolution of partnership way a alter inwards the human relationship of partners i.e. either the seat out of partner growth or decrease or the profits sharing of partner are considered dissolution of partnership. It does non hateful the terminate of the theatre itself. The theatre continues to component though with a changed human relationship with the partners. Dissolution of partnership theatre hateful the delineate of piece of work organisation of the theatre is seat to an terminate i.e. assets as well as disposed off, liabilities are paid off as well as the accounts of all the partners are equally good settled. Dissolution of partnership but dissolution of partnership but dissolution of partnership does non hateful dissolution of partnership firm. Nepal partnership act, 2020 does non differentiate dissolution of partnership theatre as well as dissolution of partnership.

Briefly explicate the Garner vs. Murraydecision.

In England, Garner, Murray as well as Wilkins were 3 equal partners with unequal majuscule inwards a business. On June 30, 1990, they deduced to dissolve their partnership firm. At the fourth dimension of dissolution, the majuscule delineate of piece of work organisation human relationship of Wilkins showed a debit residue delineate of piece of work organisation human relationship of about amount as well as cypher could last recovered from his due to insolvency. Garner wanted to part this loss inwards profits sharing ratio but Murray said loss on delineate of piece of work organisation human relationship of Wilkins's insolvency was to delineate of piece of work organisation loss but a majuscule loss. Thus, it should last divided inwards the majuscule ratio.

Influenza A virus subtype H5N1 suit was filed:

The cash was decided past times Lord Justice Joyee.

According to this decision:

- The solvent partners should convey inwards cash equal to their part of the loss on realization.

- Deficiency of the insolvent partner should last shared past times solvent partners inwards the ratio of their adjusted capitals but earlier dissolution.

- If a partner has a debit residue of his/her majuscule delineate of piece of work organisation human relationship on the relevant date, he/she volition non behave loss on delineate of piece of work organisation human relationship of insolvent partner fifty-fifty though he/she may last financially sounder equally compared to other solvent partners.

What is piecemeal distribution? Write the guild of distribution nether it.

When the partnership firm is dissolved, its delineate of piece of work organisation comes to end. In this situation, mostly it is assumed that the assets are realized instantly on the engagement of dissolution as well as the accounts of yet day. But inwards existent practise his supposition is unrealistic because assets of the theatre cannot last realized immediately. There are sold gradually, therefore, it takes time. Similarly, cash wear the sale of assets is paid equally as well as when realized to rightful claimant. Other words, the procedure of realizing the assets takes a long fourth dimension as well as cash is distributed equally as well as when it is slice past times or component past times component advertising distributing the cash to the rightful claimant equally as well as when the cash is received without waiting for the realization of all the assets of the theatre is called piecemeal distribution.

On a gradual realization of assets, outset of all. Realization expenses are paid. After that, the debts of the theatre to the 3rd parties i.e. exterior liabilities are paid. Then, the amount due to a partner equally loan should last paid as well as finally, the capitals of the partners are paid.

This comment has been removed by the author.

ReplyDeleteThanks for sharing. Partnership deed is an agreement between a firm's partners which outlines partnership terms and conditions. Get your partnership deed format through vakilsearch.

ReplyDelete