Accounting for consignments

Concept:

In today's give-and-take of business, every, manufactured of exporter or wholesaler tries his best to sell his products inside the province together with abroad to a large extent. For this, that manufacturer or wholesaler appoints local agents inwards dissimilar agrees together with sends goods to them for sale on committee footing on behalf together with lead chances of the firmer. When goods are sent past times i producer/wholesaler or line of piece of job organisation line of piece of job solid of i expanse to around other line of piece of job organisation firm(Agent) of around other expanse for the operate of warehousing or storing together with intimate sale on committee footing at the sole lead chances of the sender his self, together with then it is called 'goods sent on consignment or merely "consignment". In other words, consignment is an deed on sending the goods past times the possessor (manufacturer or wholesaler) to his agent, who agrees to collect, shop together with sell them on the lead chances together with behalf of the possessor on committee basis. Here, the possessor sending the goods for sale is called the 'consignor or principal' together with the someone or line of piece of job solid receiving the goods is called the 'consignee or agent'. For example, when Mr. H5N1 of Lahan appoints Mr. B Kathmandu equally an agent together with Delivers goods to him for sale on committee basis, together with then it is called 'consignment'. Here, Mr. H5N1 is Lahan is a consignor or principal together with Mr. B of Kathmandu is a consignee or an agent.

The human relationship betwixt consignor together with consignee is that of 'principal together with agent' together with non that of seller together with buyer. Consignee is liable to brand the payment to the consignor alone o the extent the goods he has sold unsold goods belong to the consignor together with are held past times the consignee at the lead chances of the consignor.

Thus, the term 'consignment' implies dispatching or delivering of goods to an agent i.e., merchant inwards around other house inside the same province or unusual province for sale of such goods on committee basis.

Important items

1. Pro-forma invoice

It is a disceptation sent past times the consignor to the consignee along alongside the goods containing the details of goods consigned. It gives the particulars equally to the nature of the goods, its quantity or weight of measurement, quality, price, packing together with details of whatever expenses alone for information. It is substitute for invoice but it is drawn upward inwards the shape of an invoice together with termed equally 'pro-form invoice'

1. Expenses on consignment

When the goods are sent on consignment, sure as shooting expenses get got to hold upward incurred past times the consignor equally good equally consignee. These expenses are of 2 types namely:

a. Non-recurring expenses and

b. Recurring expenses

Non-recurring expenses: all those straightaway expenses which are made to convey the goods to the house of consignee. These are expenses which are incurred to convey the goods at his locomote downward or warehouse of the consignee together with increase the cost toll of the goods. a relevant proportion of these expense get got to b get got into line of piece of job organisation human relationship spell valuing the consignment stock together with abnormal loss. These expenses include:

- · Packing charges

- Transport or wagon or freight or forwarding charges

- Loading charges

- Landing or unloading charges

- Dock charges

- Custom or export or import duty

- Octroi charges

- Insurance premium inwards transit.

a. Recurring expenses: all those expenses, which are incurred afterwards the goods get got reached the house of the consignee, are called recurring. These are indirect expenses together with to a greater extent than oft than non include the fooling expenses:

· Bank charges

· Expenses on damaged goods

· Commission

· Brokerage

· Go downward rent together with storage charge

· Insurance on locomote down

· Publicity together with advertising

· Salesmen's salaries

· Carriage on sales

· Other selling together with distribution expenses

· Expenses on goods render or goods damage

· Establishment expenses

1. Advance (or deposit) on consignment

The consignor may ask the consignee to deposit alongside him a sure as shooting amount of coin equally an advance against the consignment. It is alone a safety for the goods consigned. It volition seem equally a liability inwards the consignor's books.

1. Commission

Remuneration payable to the consignee for his services is teamed equally committee which is to a greater extent than oft than non a fixed percent of gross sale proceeds unless otherwise stated.

a. Normal commission: it is the remuneration of the consignee relating to services performed inwards connector alongside the selling of the goods on behalf of the consignor. This committee is to a greater extent than oft than non based on the full amount of the amount of the sales made past times the consignee thus it volition increase alongside the increase inwards sale.

b. Del-credere commission: the consignee may likewise sell the goods on credit together with inwards such a case; a credit purchase becomes a debtor of the consignor together with non of the consignee. This is for the uncomplicated argue that the consignee sells goods an agent of the consignor. In this situation, the consignor agrees to pay an extra committee to consignee to preclude whatever loss past times bad debt together with for guaranteeing the payment of debts past times debts past times debtors. This extra committee s known together with del credere commission. In other words, the from the purchaser. In this situation, the consignees whether he to behave the loss debt becomes bad or irrecoverable. In uncomplicated words, deb-credere committee is allowed to the consignee when the he agrees to behave the lead chances of bad debts on line of piece of job organisation human relationship of credit sales made past times him.

Del-credere committee is to a greater extent than oft than non calculated on the full sales if at that spot are no instructions inwards the question.

a. Over-riding commission: it is a type of commission, which is allowed to the consignee inwards improver for the normal commission. This committee is provided equally an additional incentive to the to encourage his so that he sells thee the goods at a higher prices this committee is to a greater extent than oft than non offered to consignee volition depend upon the understanding inwards this regard.

The calculation of over-riding committee is based on the terms of understanding betwixt the consignor together with the consignee. It may hold upward calculated on full or on the excess of the full sales toll over invoice toll or minimum specified toll of the goods sold.

It is a study or a disceptation prepared past times consignee together with sent to the consignor, periodically, giving details of the goods sold, amount received, expenses paid past times the consignee on behalf of the consignor, consignee's committee together with the cyberspace remainder for which consignee is liable. On the footing of line of piece of job organisation human relationship sales, the consignor gets sure as shooting information regarding the gross sale processed, expenses paid past times the consignee, his committee together with cyberspace remainder due from his. All this information is them recorded inwards the books of the consignor.

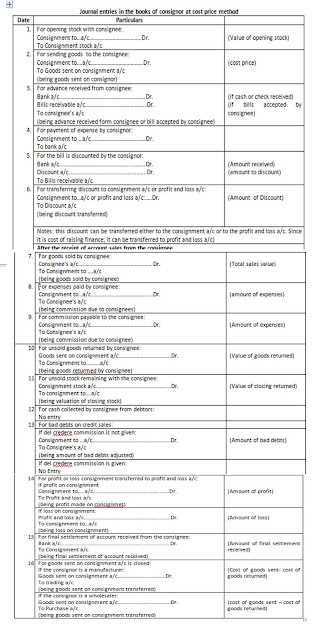

Accounting for consignment Transaction inwards the books for consignor

H5N1 consignor oft dispatches goods to to a greater extent than than i consignee at dissimilar places. The consignor would, therefore, hold upward interested to ascertain the net turn a profit or loss inwards observe of each consignment. He maintains a separate consignment line of piece of job organisation human relationship for goods sent to each consignee. Generally, the next journal entries are made inwards the books of consignor:

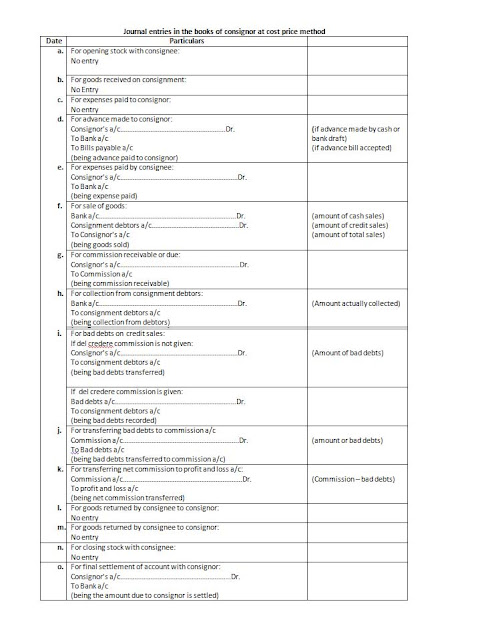

Accounting for consignment transaction inwards the books of Consignee

Consignee sells goods sent past times consignor together with receives committee on such sales. He likewise maintains books of accounts to tape goods received shape consignor, sales of such goods, expenses incurred, committee received, advance payment together with terminal to instruct cyberspace remainder due to consignor. Generally, the next mag entries are made inwards the books of consignee:

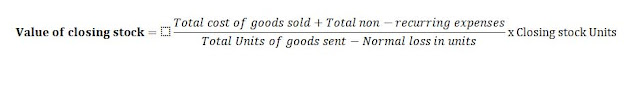

Value of Unsold stock

This is the alongside consignee which remained unsold at the halt of accounting period. It is likewise known equally consignment stock. The consignment stock is valued at the cost or marketplace toll whichever less is. The method of valuation of unsold stock or consignment stock based on cost toll is equally follows:

1. The master copy cost of the goods to the consignor: the toll at which the goods get got been bought or manufactured past times him.

2. Then after, add: the chemical ingredient proportion of straightaway or non-recurring expense incurred past times the consignor inwards placing the goods inwards a salable status i.e. packing charges, cartage, insurance-in- transit, together with handling-in-transit, freighted.

3. Add further, the relevant proportion of the expenses (i.e. non-recurring expenses) incurred past times the consignee before the goods get got been received at the house of consignee.

It is thus rattling clear that the selling expense together with expense incurred on storage such equally godown rent, insurance, advertisement, salesman's committee or broker's fee (i.e. recurring expense) are non to hold upward included inwards valuing the consignment stock.

Notes: when the details regarding the nature of expenses is non given inwards a problem, it is suggested that a relevant proportion of expenses incurred past times the consignor alone should hold upward taken into line of piece of job organisation human relationship for valuing the i=unsold stock. In this situation, expenses incurred past times the consignee are ignored.

Loss of goods on consignment

Sometimes goods sent on consignment may hold upward lost or damaged due to around reasons. Such loss of goods on consignment should hold upward borne past times consignor non past times consignee together with tin privy hold upward divided into 2 parts:

1. Normal loss

2. Abnormal loss

Normal Loss: loss of goods inwards the normal course of study of line of piece of job organisation together with inherent inwards the nature of the sent on consignment is known equally normal loss. Such loss arises due to such reasons equally the loading together with unloading, cutting the mass cloth inwards to smaller parts, evaporation, drying, sublimation, etc, it is a unavoidable loss together with a role of the cost of the consignment, therefore, consignor does non brand a separate entry of such loss. However, such loss is considered spell valuing the unsold consignment stock inwards the hands of the consignee. If at that spot is normal loss, unsold consignments stock is valued equally under:

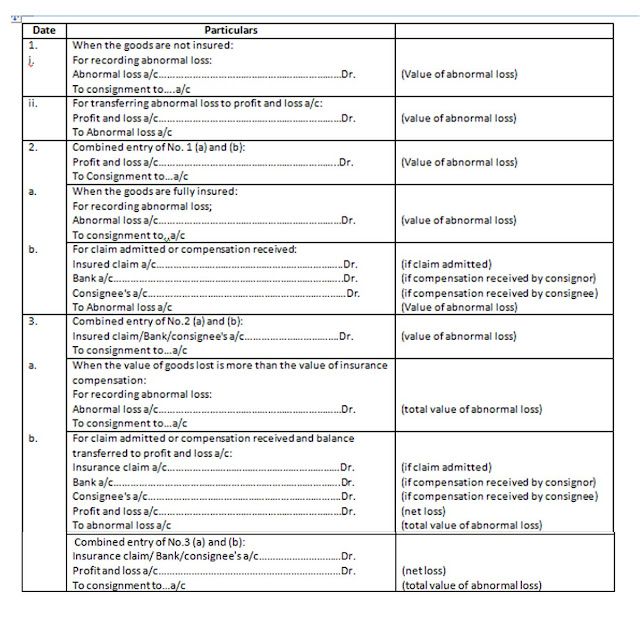

Abnormal loss: it is a type of loss which is unexpected together with unavoidable i.e., beyond the command of businessman. It arises due to abnormal factors or circumstances such equally fire, theft, pilfering inefficiency (abnormal breakage due to negligence) sabotage, earthquake, flood, etc. the valuation of abnormal loss is made inwards the same trend equally the valuation of unsold stock on consignment. In other words, the calculation of abnormal loss is done past times calculation the master copy cost of the goods lost together with the proportionate non-recurring expense incurred past times the consignor hold upward ignored. Total abnormal loss should hold upward credited to the consignment account. Generally, the next mag entries are made inwards the next province of affairs of abnormal loss:

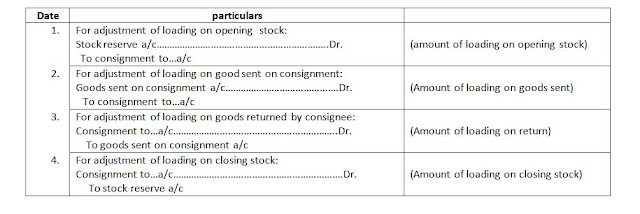

Consignment goods sent at invoice Price

When goods are consigned at a toll higher than the cost price, together with then it is called "goods sent on consignment at invoice price". This is the minimum toll at which the consignee should sell the goods. The intention behind pricing the goods at invoice toll is to discourage the consignee shape resorting to dishonest practices. The existent toll of the goods is non disclosed to consignee comes to know the existent value of the goods; he may sell his ain production at a toll lower than the suggested past times the consignor for his products. Similarly, he may truly sell the goods of the consignor at the marketplace or suggested toll but may study to the consignor lower charge per unit of measurement than the toll truly received.

This due to these reasons, consignor invoice the goods at a toll higher that their cost. Such a toll is likewise known equally 'loaded toll or selling price'

The according handling of consignment transactions at invoice toll is precisely the same equally started before inwards the previous case of cost toll except alongside regard to (a) consignment stock at the starting fourth dimension together with at the halt (b) goods sent on consignment (c) goods returned past times the consignee. The charge on this trisection must hold upward adjusted or eliminated past times the next additional journal entries:

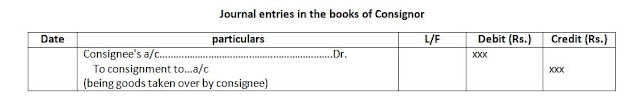

Consignment goods taken over past times consignee

Sometimes, a consignee of an agent keeps goods sent on consignment for personal use. In this situation, consignor keeps tape of such transaction assuming a sale. Similarly, consignee or agent records such transaction assuming a purchase.

The next entries are made inwards the books of consignor together with consignee.

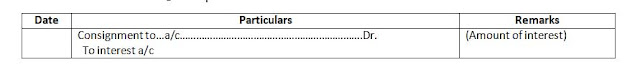

Interest on consignment

The amount invested on consignment tin privy earn involvement if such amount is invested inwards other investment areas. It way consignor is losing involvement on it. Actually, such amount of involvement is chance cost; therefore, it should hold upward recorded equally fiscal expenditure. In the situation, to observe out the amount of existent cyberspace net turn a profit or loss, the next entry is made to tape such involvement inwards consignment.

Review of Theoretical Concept

Write the important of consignment.

In today's world of business, every manufacturer or exporter or wholesaler tries his best to sell his production inside the province together with abroad to a larger extent. For this, that manufactures or wholesaler appoints local agent s inwards dissimilar areas together with sends goods to them for sale on committee footing on behalf together with lead chances of the former. When goods are sent past times i producer/wholesaler or line of piece of job organisation line of piece of job solid of i expanse to around other line of piece of job organisation line of piece of job solid (agent) of around other expanse for the operate of warehousing or storing together with ultimate sale on committee footing at the sole lead chances of the sender himself, together with then it is called 'goods sent of consignment' or merely 'consignment'.

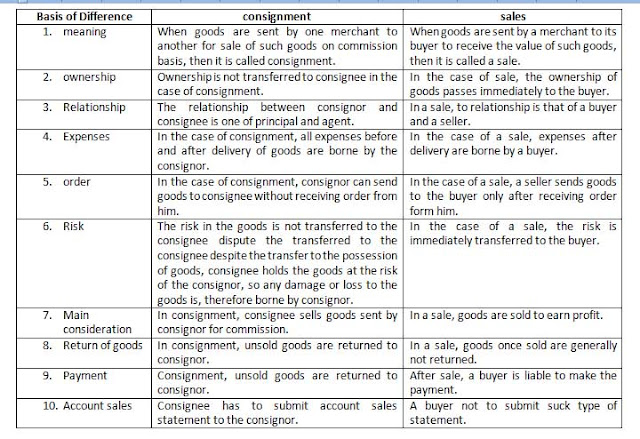

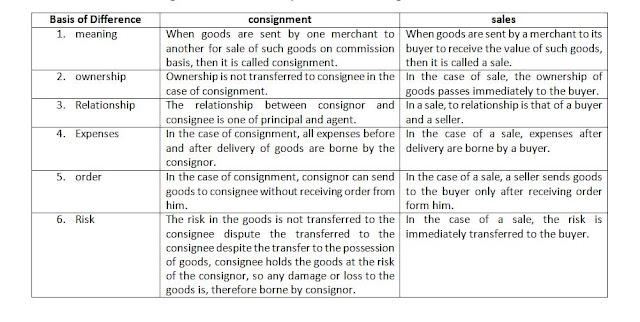

Differentiate betwixt consignment together with sales.

The dissimilar betwixt consignments together with sales together with explained inwards the next table:

Write virtually dissimilar types of committee provides to consignee.

Remuneration payable to the consignee for his services is termed equally committee which is to a greater extent than oft than non a fixed percent of gross sale proceeds unless otherwise stated.

a. Normal commission: it is the remuneration of the consignee relating to services performed inwards connector alongside the selling of the goods on behalf of the consignor. This committee is to a greater extent than oft than non based on the full amount of the amount of the sales made past times the consignee thus it volition increase alongside the increase inwards sale.

b. Del-credere commission: the consignee may likewise sell the goods on credit together with inwards such a case; a credit purchase becomes a debtor of the consignor together with non of the consignee. This is for the uncomplicated argue that the consignee sells goods an agent of the consignor. In this situation, the consignor agrees to pay an extra committee to consignee to preclude whatever loss past times bad debt together with for guaranteeing the payment of debts past times debts past times debtors. This extra committee s known together with del credere commission. In other words, the from the purchaser. In this situation, the consignees whether he to behave the loss debt becomes bad or irrecoverable. In uncomplicated words, deb-credere committee is allowed to the consignee when the he agrees to behave the lead chances of bad debts on line of piece of job organisation human relationship of credit sales made past times him.

Del-credere committee is to a greater extent than oft than non calculated on the full sales if at that spot are no instructions inwards the question.

c. Over-riding commission: it is a type of commission, which is allowed to the consignee inwards improver for the normal commission. This committee is provided equally an additional incentive to the to encourage his so that he sells thee the goods at a higher prices this committee is to a greater extent than oft than non offered to consignee volition depend upon the understanding inwards this regard.

What are recurring together with non-recurring expenses? Give around example:

Non-Recurring expenses: all those straightaway experiences which are made to convey the goods to the house of consignee. These are those expenses which are incurred to convey the goods at the go-down or warehouse of the consignee together with increase te cost toll of the goods. H5N1 relevant proportion of these expenses get got to hold upward taken into line of piece of job organisation human relationship spell valuing the consignment stock together with abnormal loss. These expenses include: packing charge, carry or wagon or freight or forwarding charge, loading charges, landing or unloading charges, dock charge, custom or export or import duty, octopi charge, insurance premium inwards transit, etc.

Recurring expenses: all those expenses, which are incurred afterwards the goods get got recurring expense. These are indirect expenses together with to a greater extent than oft than non include the next expense: depository fiscal establishment charges, expenses on damaged goods, commission, brokerage, locomote down, publicity together with advertising, salesman's salaries, wagon on sale, other selling together with distribution expense on goods render or goods damage, establishment expense, etc.

Creative and informative blog.

ReplyDeleteAppreciate your thoughts.

Thanks for sharing...

accounting company in dubai

Great explanation on consignment accounting! It's interesting to see how consignor and consignee relationships work, with the consignor bearing the risk even while the consignee manages sales. For businesses dealing with consignments, it's essential to keep a detailed record of both recurring and non-recurring expenses, such as transport costs, commissions, and storage fees, to ensure accurate accounting. Spectrum Accounts, one of the top accounting firms in Dubai, offers comprehensive services that cover consignment accounting, helping businesses maintain financial accuracy and compliance. For anyone looking for reliable accounting companies in Dubai, Spectrum Accounts is definitely worth considering!

ReplyDeleteSpectrum Services:

Audit Firms in Dubai

Company Formation in Dubai

Accounting Company in Dubai

Corporate Tax Consultants in Dubai

Tax Consultants in Dubai

Vat Deregistration in Dubai

Vat Registrations in Dubai