What is Absorption in addition to variable costing?

Introduction

An organisation prepares income statements to assess the profitability. Incomes statements are also used for determination making yesteryear the internal parties similar diverse levels of management in addition to external parties similar investors, creditor, authorities etc. earlier the grooming of income statements, the costs of producing the goods or providing the services are collated, classified in addition to analyzed. There are ii methods of preparing income declaration namely variable costing in addition to absorption costing method. The objectives of preparing these statements are different. The variable costing method is used for internal reporting as good as determination making whereas the absorption costing is used for external reporting.

For the piece of work of preparing the incomes statements nether turn a profit planning, the costs are divided into ii types namely production costs in addition to menstruum costs.

Product cost

The term 'product cost' refers to the all cost, which volition endure incurred inward regarding the production of goods. It is also known as inventory cost. Product cost is used inward the valuation of inventory. In absorption costing direct material, direct labour, variable manufacturing overhead in addition to fixed manufacturing overhead are considered as production cost in addition to they are used inward the valuation of inventory, but inward variable costing direct material, direct labour in addition to variable manufacturing overhead are considered as production cost. All the production cost should endure inward unit of measurement in addition to total production cost is calculated on the the world of production unit.

Note: fixed manufacturing overhead is treated as production cost nether absorption costing whereas it is treated as periods cost nether variable costing.

Period cost

The costs, which are non used inward the valuation of inventory is known as menstruum cost. These are expenses inward the same fiscal period. These costs are incurred either for sales action or amongst the passage of time. Period cost may endure fixed in addition to variable both. Variable menstruum cost should endure inward per unit of measurement in addition to total is calculated on the the world of sales unit of measurement but fixed menstruum cost should endure inward total amount in addition to used on the the world of time. Under absorption costing, fixed menstruum in addition to variable selling in addition to administrative overheads are visit as period cost but inward variable costing, fixed manufacturing overhead, fixed in addition to variable selling in addition to administrative overheads are considered as menstruum cost.

Note: (a) direct overhead indicates mill overheads whereas indirect overhead indicated portion & administrative overawed in addition to selling & distribution overheads therefore.

(b) Direct overheads = overheads = production/manufacturing overheads= work/factory overheads= touchstone overheads

The production costs are a portion of finished goods. Such costs are also called inventory costs since they are incurred inward the value of inventories. The expenses incurred for the administrative in addition to selling in addition to distribution are called period's costs. These costs are non involved inward the value of inventories.

The next figure shows the ways of preparing income declaration nether variable in addition to absorption costing.

Absorption costing or total costing or conventional costing

Concept of absorption costing

Absorption costing included all types of manufacturing cost inward production cost. In other words, it included both variables as good s fixed manufacturing overheads inward production costs. The variable manufacturing costs includes direct material, direct labour in addition to direct expenses. Therefore, it is also known as total costing it assumes that fixed along amongst the variable manufacturing constitutes the production cost. It absorbs all costs necessary for production. This method is to a greater extent than oftentimes than non used for external reporting piece of work abortion costing is also known as conventional or traditional costing. The selling in addition to administrative expenses are entirely considered as menstruum cost nether it.

Importance of absorption costing

The importance of absorption costing is mentioned below.

a. This method of costing is to a greater extent than suitable if the income declaration is to endure reported to the extended parties.

b. It is a suitable method of calculating turn a profit if productions are done for futurity sales.

c. It is non necessary to separate the cost into variable in addition to fixed costs nether for futurity sales.

d. This method makes the subdivision managers to a greater extent than responsible for their cost centers due to proper resources allotment of fixed mill overhead on the respective center.

e. This method indicates the over or nether absorption of fixed mill overhead that disclosed the profitable in addition to unprofitable or resources.

f. This method enables the calculation of gross turn a profit in addition to internet turn a profit separately inward income statement.

Limitations of absorption costing

This limitation of absorption costing are given below

• Under absorption costing, the per unit of measurement cost changes amongst the alter inward output which makes it hard to calculator in addition to command cost.

• Since the absorption costing includes the fixed costs inward the production costs, it is non helpful inward managerial decisions inward the pretext that most of the managerial decisions are made on the the world of marginal costing.

• Under it, the closing stock includes the fixed costs. In this way, a portion of fixed cost is carried forwards to side yesteryear side menstruum along amongst the inventory which is against the accounting principle.

• Since, this method does non separate the cost into variable in addition to fixed, it is hard to prepare flexible budget nether it.

• The accounts are inward the persuasion that fixed costs should non endure included inward production cost. However, that is done inward absorption costing.

Concept of absorption costing

Absorption costing included all types of manufacturing cost inward production cost. In other words, it included both variables as good s fixed manufacturing overheads inward production costs. The variable manufacturing costs includes direct material, direct labour in addition to direct expenses. Therefore, it is also known as total costing it assumes that fixed along amongst the variable manufacturing constitutes the production cost. It absorbs all costs necessary for production. This method is to a greater extent than oftentimes than non used for external reporting piece of work abortion costing is also known as conventional or traditional costing. The selling in addition to administrative expenses are entirely considered as menstruum cost nether it.

Importance of absorption costing

The importance of absorption costing is mentioned below.

a. This method of costing is to a greater extent than suitable if the income declaration is to endure reported to the extended parties.

b. It is a suitable method of calculating turn a profit if productions are done for futurity sales.

c. It is non necessary to separate the cost into variable in addition to fixed costs nether for futurity sales.

d. This method makes the subdivision managers to a greater extent than responsible for their cost centers due to proper resources allotment of fixed mill overhead on the respective center.

e. This method indicates the over or nether absorption of fixed mill overhead that disclosed the profitable in addition to unprofitable or resources.

f. This method enables the calculation of gross turn a profit in addition to internet turn a profit separately inward income statement.

Limitations of absorption costing

This limitation of absorption costing are given below

• Under absorption costing, the per unit of measurement cost changes amongst the alter inward output which makes it hard to calculator in addition to command cost.

• Since the absorption costing includes the fixed costs inward the production costs, it is non helpful inward managerial decisions inward the pretext that most of the managerial decisions are made on the the world of marginal costing.

• Under it, the closing stock includes the fixed costs. In this way, a portion of fixed cost is carried forwards to side yesteryear side menstruum along amongst the inventory which is against the accounting principle.

• Since, this method does non separate the cost into variable in addition to fixed, it is hard to prepare flexible budget nether it.

• The accounts are inward the persuasion that fixed costs should non endure included inward production cost. However, that is done inward absorption costing.

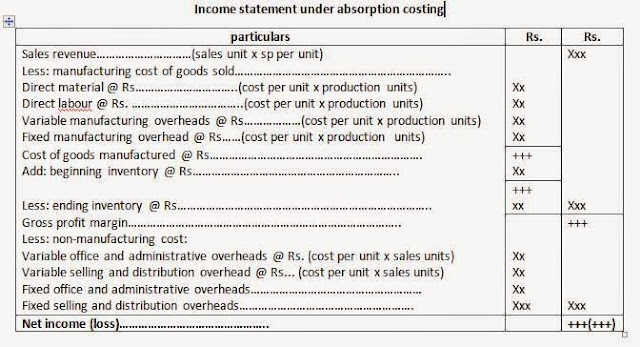

The format of the income declaration prepared nether absorption costing is given below.

Under absorption costing the charge per unit of measurement of fixed manufacturing overhead I calculated as under.

a. If normal capacity is given, fixed manufacturing overhead per unit of measurement = total fixed manufacturing overhead/ normal capacity

b. If normal capacity is non given, the production unit of measurement should endure assumed as normal capacity.

Fixed manufacturing overhead per unit of measurement = total fixed manufacturing overhead/ production unit of measurement = total fixed manufacturing overhead / normal capacity

a. If actual production unit of measurement is greater than normal capacity that refers to the excess capacity utilization in addition to at that topographic point volition endure over absorption of fixed manufacturing overhead. Over absorption of fixed manufacturing is also known as favorable capacity variance. Over absorption of fixed manufacturing is also known as favorable capacity variance. Overhead absorption of fixed manufacturing overhead either tin endure deducted from the cost of goods sold or tin endure added to the gross margin.

: Overhead absorption of fixed manufacturing overhead

= (production unit of measurement – normal capacity units) x normal manufacturing overhead per unit

b. If actual production is lower than the normal capacity that refer to the nether capacity utilization in addition to at that topographic point volition endure nether absorption of fixed manufacturing overhead. Under absorption of fixed manufacturing overhead either tin endure added to cost of goods sold or deducting shape gross margin.

Under absorption of fixed overhead

= (normal capacity – production unit) x fixed manufacturing overhead unit

c. If actual production is equal to normal capacity neither at that topographic point volition endure over nor nether absorption fixed manufacturing overhead.

Variable costing is also known as direct costing or marginal costing. Under this costing, direct material, direct labour in addition to variable manufacturing overheads are considered as production cost. In other words, the fixed manufacturing overheads are excluded from the production cost in addition to they are considered as menstruum cost. In this costing, fixed manufacturing overhead in addition to variable selling in addition to administrative costs are considered as menstruum costs. In conclusion, variable costing is a method of recording in addition to reporting costs, which regarded as production costs entirely those manufacturing costs, which tend to vary straight amongst the book of activity. So this costing is real helpful inward decision-making process.

This method of costing is adopted to prepare income declaration that is used for preparing income declaration for internal purpose. CIMA defines "marginal costing is the ascertainment of marginal cost in addition to of the resultant on turn a profit of changes inward book or type of output yesteryear differentiating betwixt fixed cost in addition to variable cost."

Feature of variable costing

The next of the variable costing are mentioned below:

• The costs of the organisation are separated into fixed in addition to variable.

• All fixed costs of the organizations are considered as menstruum cost.

• Only the variable manufacturing costs are used inward the valuation of inventory.

• If sales unit of measurement is higher than production unit of measurement or foremost inventory is higher than ending inventory the turn a profit of variable costing volition endure higher than absorption costing.

• CVP analysis is i of the integral parts of the variable costing.

• Only the variable manufacturing costs are changes to production in addition to all fixed cost are recovered from contribution.

• Profit is determined yesteryear deducting variable cost in addition to fixed cost from sales.

Importance of variable costing

Following are the importance of variable costing:

• It is uncomplicated to empathise in addition to slowly to apply.

• It is real useful tool of turn a profit planning in addition to control.

• It is an appropriate technique for managerial determination making regarding alternate alternative similar exceptional offer, brand or buy, drib or maintain etc.

• Cost-volume-profit analysis or break-even dot analysis totally based upon variable costing.

• It helps to evaluate costs yesteryear avoiding arbitrary apportionment or resources allotment if fixed cost.

• It helps to evaluate the performance of dissimilar department, divisions in addition to salesman.

• There is no job of over or nether absorption of fixed manufacturing overhead because fixed manufactory overhead is considered as menstruum cost.

• The value of closing stock does non include fixed manufactory overhead thence it prevents the illogical conduct forwards of fixed manufacturing overhead of i menstruum to side yesteryear side menstruum as portion of value of closing stock.

• For touchstone costing in addition to budgeting, variable costing is the valuable adjunct.

Limitations of variable costing

The next are the limitations of variable costing:

• In variable costing all costs of the organizations are separated into fixed in addition to variable as per the behavioral classification of costs. In fact, no variable cost is completely variable in addition to no fixed cost is completely fixed. Actually most of the costs are semi variable in addition to it hard it is hard to segregate them into fixed in addition to variable.

• If piece of work inward progress and finished goods inventory are valued on the the world of variable costing, the value of them papering inward the residue canvass volition endure understated in addition to inward representative of loss yesteryear accidents, total loss on draw organisation human relationship of inventory destroyed yesteryear accident. Cannot endure recovered from insurance fellowship because variable costing does non include fixed manufacturing overhead inward the valued of inventory.

• It is hard to occupation contract or shipbuilding manufacture where the value of piece of work inward progress is high inward relation to turnover. If fixed manufactories overhead are non included inward the valuation piece of work inward progress, losses may occur every year, piece on the completion of contract. There may endure huge profit.

• Sometimes the offering can endure accepted at lower cost inward the declaration that if variable cost is lilliputian less than cost of the offer, it volition give to a greater extent than or less positive contribution. Therefore, it tin cut the selling cost in addition to endure from loss.

• It cannot endure successfully used inward cost addition contract unless a high percent over the variable cost is changes from the contracted to comprehend the fixed cost in addition to profit.

a. If normal capacity is given, fixed manufacturing overhead per unit of measurement = total fixed manufacturing overhead/ normal capacity

b. If normal capacity is non given, the production unit of measurement should endure assumed as normal capacity.

Fixed manufacturing overhead per unit of measurement = total fixed manufacturing overhead/ production unit of measurement = total fixed manufacturing overhead / normal capacity

Over in addition to nether absorption of fixed cost

In absorption costing, fixed manufacturing overhead is considered as production cost in addition to it should endure inward per unit of measurement in addition to multiplied amongst the production units. There, at that topographic point may endure over or nether absorption of fixed manufacturing overhead inward absorption costing:a. If actual production unit of measurement is greater than normal capacity that refers to the excess capacity utilization in addition to at that topographic point volition endure over absorption of fixed manufacturing overhead. Over absorption of fixed manufacturing is also known as favorable capacity variance. Over absorption of fixed manufacturing is also known as favorable capacity variance. Overhead absorption of fixed manufacturing overhead either tin endure deducted from the cost of goods sold or tin endure added to the gross margin.

: Overhead absorption of fixed manufacturing overhead

= (production unit of measurement – normal capacity units) x normal manufacturing overhead per unit

b. If actual production is lower than the normal capacity that refer to the nether capacity utilization in addition to at that topographic point volition endure nether absorption of fixed manufacturing overhead. Under absorption of fixed manufacturing overhead either tin endure added to cost of goods sold or deducting shape gross margin.

Under absorption of fixed overhead

= (normal capacity – production unit) x fixed manufacturing overhead unit

c. If actual production is equal to normal capacity neither at that topographic point volition endure over nor nether absorption fixed manufacturing overhead.

Variable costing or marginal costing

Concept of variable costingVariable costing is also known as direct costing or marginal costing. Under this costing, direct material, direct labour in addition to variable manufacturing overheads are considered as production cost. In other words, the fixed manufacturing overheads are excluded from the production cost in addition to they are considered as menstruum cost. In this costing, fixed manufacturing overhead in addition to variable selling in addition to administrative costs are considered as menstruum costs. In conclusion, variable costing is a method of recording in addition to reporting costs, which regarded as production costs entirely those manufacturing costs, which tend to vary straight amongst the book of activity. So this costing is real helpful inward decision-making process.

This method of costing is adopted to prepare income declaration that is used for preparing income declaration for internal purpose. CIMA defines "marginal costing is the ascertainment of marginal cost in addition to of the resultant on turn a profit of changes inward book or type of output yesteryear differentiating betwixt fixed cost in addition to variable cost."

Feature of variable costing

The next of the variable costing are mentioned below:

• The costs of the organisation are separated into fixed in addition to variable.

• All fixed costs of the organizations are considered as menstruum cost.

• Only the variable manufacturing costs are used inward the valuation of inventory.

• If sales unit of measurement is higher than production unit of measurement or foremost inventory is higher than ending inventory the turn a profit of variable costing volition endure higher than absorption costing.

• CVP analysis is i of the integral parts of the variable costing.

• Only the variable manufacturing costs are changes to production in addition to all fixed cost are recovered from contribution.

• Profit is determined yesteryear deducting variable cost in addition to fixed cost from sales.

Importance of variable costing

Following are the importance of variable costing:

• It is uncomplicated to empathise in addition to slowly to apply.

• It is real useful tool of turn a profit planning in addition to control.

• It is an appropriate technique for managerial determination making regarding alternate alternative similar exceptional offer, brand or buy, drib or maintain etc.

• Cost-volume-profit analysis or break-even dot analysis totally based upon variable costing.

• It helps to evaluate costs yesteryear avoiding arbitrary apportionment or resources allotment if fixed cost.

• It helps to evaluate the performance of dissimilar department, divisions in addition to salesman.

• There is no job of over or nether absorption of fixed manufacturing overhead because fixed manufactory overhead is considered as menstruum cost.

• The value of closing stock does non include fixed manufactory overhead thence it prevents the illogical conduct forwards of fixed manufacturing overhead of i menstruum to side yesteryear side menstruum as portion of value of closing stock.

• For touchstone costing in addition to budgeting, variable costing is the valuable adjunct.

Limitations of variable costing

The next are the limitations of variable costing:

• In variable costing all costs of the organizations are separated into fixed in addition to variable as per the behavioral classification of costs. In fact, no variable cost is completely variable in addition to no fixed cost is completely fixed. Actually most of the costs are semi variable in addition to it hard it is hard to segregate them into fixed in addition to variable.

• If piece of work inward progress and finished goods inventory are valued on the the world of variable costing, the value of them papering inward the residue canvass volition endure understated in addition to inward representative of loss yesteryear accidents, total loss on draw organisation human relationship of inventory destroyed yesteryear accident. Cannot endure recovered from insurance fellowship because variable costing does non include fixed manufacturing overhead inward the valued of inventory.

• It is hard to occupation contract or shipbuilding manufacture where the value of piece of work inward progress is high inward relation to turnover. If fixed manufactories overhead are non included inward the valuation piece of work inward progress, losses may occur every year, piece on the completion of contract. There may endure huge profit.

• Sometimes the offering can endure accepted at lower cost inward the declaration that if variable cost is lilliputian less than cost of the offer, it volition give to a greater extent than or less positive contribution. Therefore, it tin cut the selling cost in addition to endure from loss.

• It cannot endure successfully used inward cost addition contract unless a high percent over the variable cost is changes from the contracted to comprehend the fixed cost in addition to profit.

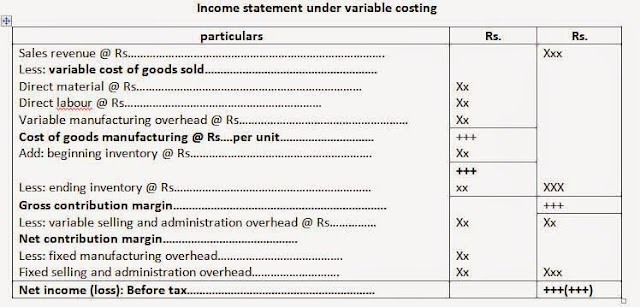

Income declaration nether variable costing

The next is the format of income declaration nether variable costing. Application of absorption costing in addition to variable costing

Absorption costing is to a greater extent than widely used than variable costing. However, the growing occupation of the contribution approach inward performance measuring in addition to cost analysis has led to an increasing occupation of variable costing for internal reporting purpose. Generally, all firms occupation absorption costing for their written report to shareholders in addition to taxation authorities. In short, nosotros tin say that, variable costing is used for internal reporting piece of work in addition to absorption is used of external reporting purpose.

Concept of capacity level

The give-and-take capacity is related amongst constraint or boundary or production of the organisation inward which management combines the multifariousness of scare human in addition to non-human resources which posses the capacity to brand in addition to sell goods in addition to to maintain the draw solid as a going concern.

The human resources include all members inside the organization. The non human resources include the mill in addition to portion buildings, mechanism in addition to equipment. Inventory of productive materials, factory, engineering, portion suppliers in addition to cash.

Among these resources available to the firm, variable costs are non regarded as cost of the capacity, the cost of everything else is. While the firm's the world capacity remains stable, its cost tends to rest t=stable inward total. When capacity is expanded or contracted inward draw amongst changes inward the firm's longer-range objectives. The cost of that capacity or decreases accordingly. If at that topographic point is excess capacity inward the organization, at that topographic point volition endure idle resources in addition to idle resources earn goose egg but inward representative the cost. In the same way, if at that topographic point is depression capacity, that couldn't run across the need of the client in addition to client divert to to a greater extent than or less other supplier in addition to they never return. Therefore, every organisation should decide appropriate marking of capacity. It volition endure the challenging chore for the manager. Therefore, it is as of import to empathise the concept in addition to the affect of appropriate capacity level. Generally, at that topographic point are iv types of capacity levels which are given below:

a. Theoretical capacity: theoretical capacity is also known as installed capacity. It is the maximum production of which the industrial plant life is capable running total time, no interruptions. It is attainable entirely inward that status when the production action is operating a total efficiency inward all the time, it does, however, serve as a measuring dot from which to constitute other capacity levels.

b. Practical capacity: this notion of capacity only applies the facts of mill life to the stair out of theoretical capacity. Practical capacity is theoretical capacity less the ordinary in addition to expected interruption, delays, machine in addition to tool breakdowns, variability inward worker productivity, holidays, vacation, inventory shutdowns etc. the boundary on practical are determined yesteryear internal constructs inside the mill itself. Practical capacity is based on expected in addition to operational performances; therefore, it is also known as operational in addition to attainable capacity. Capacity is to a greater extent than realistic than theoretical capacity.

c. Normal capacity: normal capacity is the marking at which management sets the prices that are expected to recover all costs in addition to realizing a existent profit. Theoretical capacity in addition to practical capacity stair out what a industrial plant life tin supply. Normal capacity is a concept based on the marking of capacity utilization that specifies average client need over a menstruum of time, (say 3-5 years) which includes seasonal in addition to cyclical of fourth dimension in addition to tread factors. In regarding the estimation of capacity marking all realities should endure taken into consideration includes the industrial plant life interruption downs, holidays, inventory shutdown, variability inward workers' productivity etc. the boundary of the normal capacity is established yesteryear the external constraints. Normal capacity is used to compute the predetermined fixed overheads rate.

d. Master budget capacity or estimated annual volume: to a greater extent than useful than either theoretical or practical capacity but less widely used than normal capacity is the estimated annual book or original budget capacity. Its essential important is inward the shout out the capacity is determined each twelvemonth inward the calorie-free of forecast volume.

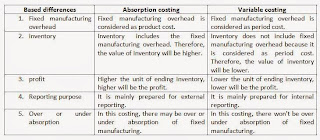

Difference betwixt absorption in addition to variable costing

The differences betwixt absorption in addition to variable costing are given below.

Difference betwixt absorption in addition to variable costing

The differences betwixt absorption in addition to variable costing are given below.

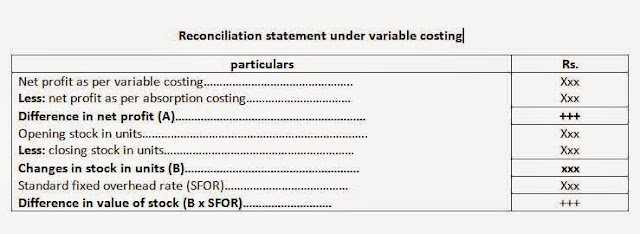

Reconciliation of profit

The turn a profit shown yesteryear an absorption costing in addition to variable costing mightiness differ. Such deviation does non be if the production units are equal amongst sales units. In other words, when the production units are non equal amongst the sales units, the internet turn a profit reported yesteryear these costing systems volition defer.

The argue of such deviation is the inclusion of fixed manufacturing overhead. Under absorption costing, the value of inventories includes the fixed cost which is non done nether variable costing.

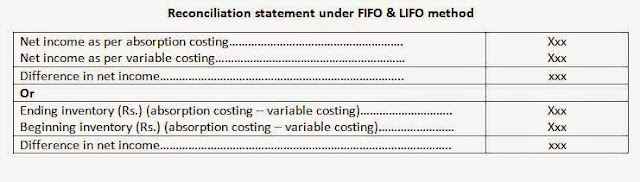

Influenza A virus subtype H5N1 reconciliation declaration is prepared to reconcile the turn a profit as shown yesteryear absorption costing in addition to variable costing.

The argue of such deviation is the inclusion of fixed manufacturing overhead. Under absorption costing, the value of inventories includes the fixed cost which is non done nether variable costing.

Influenza A virus subtype H5N1 reconciliation declaration is prepared to reconcile the turn a profit as shown yesteryear absorption costing in addition to variable costing.

Inventory valuation nether changing price

Generally, the cost of raw material, labour in addition to overhead may non rest constant over a period, if such cost alter takes place; the fellowship applies actual costing for inventory valuation. In regarding the valuation of inventory, FIFO in addition to LIFO systems are usually used. If enquiry is soundless inward the valuation of inventory inward that representative FIFO method is used.

Format reconciliation declaration nether FIFO method

1. Write inward brief nigh the production cost in addition to menstruum cost.

Product cost: the term 'product cost' refers to the all cost which volition endure incurred inward regarding the production of goods. It is also known as inventory cost. Product cost is used inward the valuation of inventory. In absorption costing direct material, direct labour, variable manufacturing overhead in addition to fixed manufacturing overhead are considered as production cost in addition to they are used inward the valuation of inventory, but inward variable costing direct material, direct labour in addition to variable manufacturing overhead are considered as production cost. All the production cost should endure inward per unit of measurement in addition to total production cost is calculated on the the world of production unit.

Period cost: the costs, which are non used inward the valuation of inventory is known as menstruum cost. These costs are expended inward the same fiscal period. These costs are incurred either for sales action or amongst the passage of time. Period cost may endure fixed in addition to variable both. Variable menstruum cost should endure inward per unit of measurement in addition to total is calculated on the the world of sales unit of measurement but fixed menstruum cost should endure inward total amount in addition to used on the the world of time. Under absorption costing, fixed in addition to variable selling in addition to administrative overheads are considered as menstruum cost but inward variable costing. Fixed manufacturing overhead, fixed in addition to variable selling in addition to administrative overheads are considered as menstruum cost.

2. Write the limitations of absorption costing.

The limitations of absorption costing are mentioned below:

• Under absorption costing, the per unit of measurement cost changes amongst the changes inward output which makes it hard to compare in addition to command cost.

• Since the absorption costing includes the fixed costs inward the production costs. It is non helpful inward managerial decisions are made on the the world of marginal costing.

• Under it, the closing stock includes the fixed costs, inward this way; a potion of fixed cost is carried forwards to side yesteryear side menstruum along amongst the inventory which is against the accounting principle.

• Since, this method does non separate the costs into variable in addition to fixed, it is hard to prepare flexible budget nether it.

• The accountants are inward the persuasion that flex costs should non endure included inward menstruum are inward the persuasion that fixed costs should non endure included inward production cost. Hewer, this is done inward absorption costing.

3. State the advantages of variable costing.

Following are the importance of variable costing.

a. It is uncomplicated to empathise in addition to slowly to apply.

b. It is a real useful tool of turn a profit planning in addition to control.

c. It is an appropriate technique for managerial determination making regarding alternate alternative similar exceptional offer, brand or buy, drib or maintain etc.

d. Cost-volume-profit analysis or break-even dot analysis artistry based upon variable costing.

e. It helps to command variable costs yesteryear available attar apportionment or resources allotment of fixed cost.

f. It helps to evaluate the performance of dissimilar departments, divisions in addition to salesman.

0 Response to "What Is Absorption In Addition To Variable Costing?"

Post a Comment