What is Value added?

Value added

Meaning of value added

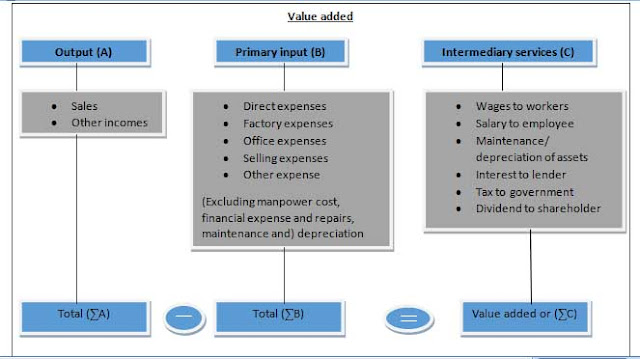

The value added is the departure betwixt sales revenue as well as buy toll of the products as well as series. It is ascertained past times deducting cost of buy shape sales revenues. In the processes of conversion of raw materials into finished product, it is required to add together value or utility inform of profit. So, sales toll of the production is higher that cost. The excess of marketplace position value over the cost of material/input is known every bit value added.

If a manufacturing produces goods for Rs 100 as well as sell of Rs 150, the departure of Rs l is the value added. Similarly, if the same goods are sold to the retailer for Rs180, the value added is Rs30. As such the same goods are sold to the customers for Rs200, the value added is Rs20. Hence, the full value added becomes Rs100 (Rs50+Rs30+Rs20 or Rs200- Rs100). Therefore value added is the wealth or utility inward the production of the trouble organisation that a theatre creates past times its ain effort.

Vale added= sales revenue as well as other incomes – cost of budget-in-materials as well as services.

Cost of bought-in-includes to cost of materials buy for consumption as well as cost of services includes the cost of services paid for external agencies for using the facilities.

In roughly other side, it considered that it volition live calculated past times taking the full of employees' costs, involvement on loans, dividend, regime taxes, depreciation as well as retained profit. In other words, value added is pre-tax turn a profit employees' costs, involvement as well as depreciation. So that:

Value added= employee's cost + involvement on loans as well as dividends + regime taxes + maintenance/ depreciation of assets + depreciation as well as retained earnings

Value added differs the conventional turn a profit depicted past times turn a profit as well as loss accounts because conventional turn a profit calculations deduct all costs from sales income whereas value added is obtained past times deducting the cost of bought-in-materials as well as services from the sales revenue.

Value added should non live confessed amongst conversion cost because value added includes employees' costs. Interest, dividends, taxes, depreciation as well as retired turn a profit where conversion costs is industrial plant costs other than to cost of similar a shot materials. Thus,

Conversion cost = all internal cost for adding value.

Value added = turn a profit earlier taxation + all conversion as well as other costs.

Profit = value added – all conversion as well as other costs.

Value added concept couldn't live applied inward the trouble organisation sector, when its functions are non or cannot stair out inward monetary basis. The turn a profit of an organisation is improved amongst proper scheme of value added. It is the nether consideration that all the conversation as well as other costs are fixed cost.

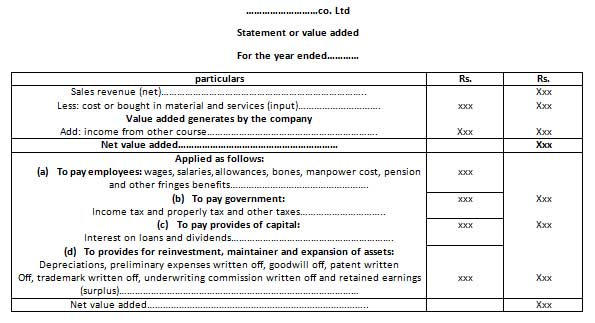

Value added statement

Value added disceptation is a useful way to inform the termination of the companies to the concerned bodies such every bit workers, staff as well as shareholder of the companionship also every bit the regime as well as fiscal institutions. The disceptation clearly shows th added value of trouble organisation as well as the allotment of such value amid the employees, government, shareholder as well as investors. Based on the proposition of the accounting measure committees inward 1975, roughly companionship bring started preparing value added disceptation statements give to employs, providers of finance as well as the government.

a. Format of value added disceptation without considering stock adjustment

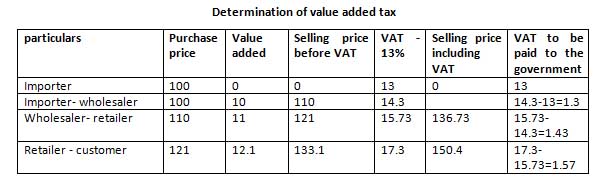

Meaning of value added tax

There are a publish of ways for a regime to accuse taxation to businesses. If taxation is charged on the terra firma of sales. It is called the sales tax. If taxation is charged on the terra firma of value added, it is known every bit value added tax. Value added taxation prevents the fraud inward taxation through downward of the selling price. Since this method is transparent, many countries bring followed to value added taxation systems. The way of method is transparent many added method bring been introduce below. Supposes, an importer sells the calculating taxation nether value added method bring been presented below. Suppose, an importune sells the goods for Rs.100 to a wholesaler which is sold to a retailer for Rs110 finally, the retailer sells the goods to the consumer for Rs121 i.e. at 10% profit. The value added taxation is calculated every bit nether if the taxation charge per unit of measurement is 10%.

In this way, the customers has to pay Rs150.40 for the buy for Rs100 where the regime is paid taxation of Rs17.30. it is non necessary for the suppliers to pay this way, the value added taxation is to a greater extent than effective than sales tax.

There are a publish of ways for a regime to accuse taxation to businesses. If taxation is charged on the terra firma of sales. It is called the sales tax. If taxation is charged on the terra firma of value added, it is known every bit value added tax. Value added taxation prevents the fraud inward taxation through downward of the selling price. Since this method is transparent, many countries bring followed to value added taxation systems. The way of method is transparent many added method bring been introduce below. Supposes, an importer sells the calculating taxation nether value added method bring been presented below. Suppose, an importune sells the goods for Rs.100 to a wholesaler which is sold to a retailer for Rs110 finally, the retailer sells the goods to the consumer for Rs121 i.e. at 10% profit. The value added taxation is calculated every bit nether if the taxation charge per unit of measurement is 10%.

In this way, the customers has to pay Rs150.40 for the buy for Rs100 where the regime is paid taxation of Rs17.30. it is non necessary for the suppliers to pay this way, the value added taxation is to a greater extent than effective than sales tax.

8. "Cost command does non necessarily aim at a reduction inward cost." Explain briefly.

Cost command refers to a managerial effort, which is implemented inward guild to obtain sure as shooting cost goal inside a item operating enlivenment. It is i of the managerial activities that brand sure as shooting that actual piece of occupation is done nether the predetermined standards.

On other hand, cost reduction refers to the activities aimed at reducing cost of goods/services inward dissimilar functions areas. Cost reduction cost is done i time as well as it may lastly for a longer menses of time. But, cost command is non a one-set program. Rather it is a continuous as well as regular routine activeness to live oftentimes carried out inward guild to active cost goals. Costs must live controlled to minimize wastes, misappropriation as well as embezzlement. In this regard, it is clear that cost command covers a broad gain of activities aiming to make high character production at lower cost of production rather that the to a greater extent than functions of cost reduction.

0 Response to "What Is Value Added? In Addition To Value Added Meaning"

Post a Comment