What is Accounting for non- trading concern?

What is Accounting for Non- Trading Concern as well as Feature of Non-Trading Concerns

Meaning of non-trading concern

The concerns whose master copy objectives are non to earn earnings but homecoming valuable services to its fellow member as well as to the companionship are known every bit non-trading concerns. Those concerns or organizations are involved inwards promoting commerce, art, science, religion, charity or whatever form of welfare.

Such concerns are non established to earn profit. Rather their charters prohibit the payment of provision of dividend. Even if at that topographic point is incidentally about income the same is utilized to promote its objectives’ the illustration of such concerns are sports clubs, social clubs, libraries, hospital, religious, temples, churches, mosques as well as gurudwares etc.

Features/characteristics of non-trading concerns

• The master copy objective of such concern is non to earn earnings but homecoming services to its members as well as society.

• It depends on donation.

• A non-profit concern is regime past times elected fellow member inwards the same agency a concern corporation is overmanned past times a board of directors.

• A non-profit organisation employs the same accrual footing of accounting used past times concern enterprises.

• They prepared income as well as expenditures account.

Accounting procedures of non-trading concerns

Non-trading organizations operate on their accounting records nether unmarried entry scheme as well as double entry system. The pocket-size sizes of organizations are followed unmarried entry as well as the large size of organizations prepared at the twelvemonth end, the next 3 statements:

a. Receipt as well as payment account

b. Income as well as expenditure account

c. Balance sheet

Receipt as well as payment account

It is existent account. It is consolidated summary of cash book. It is prepared at the halt of the accounting period. All cash receipts are records on the debit side as well as all payments are recorded on the credit side. Cash mass consisting of entries of receipt as well as payment inwards a chronological monastic tell spell the receipts as well as payment is a summary of total cash receipts as well as payments. Ti commencement alongside opening ease of cash as well as banks as well as ends alongside closing ease of cash as well as bank, it doesn't consider into concern human relationship outstanding amount of receipts and payments. Receipts as well as payments. Receipts as well as payments may locomote of upper-case missive of the alphabet as well as revenue nature. They may relate to the electrical current or finally or side past times side year, so long, every bit they are genuinely receipts or paid, they must seem inwards this account.

Characteristics/features of receipts as well as payment account

The features of receipts as well as payments accounts are every bit follows:

• It is a summary of cash mass similar a cash mass receipts are shows inwards debit side as well as payments are shown inwards the credit side.

• It includes cash as well as banking transactions whether they are related alongside payment, previous as well as subsequent.

• It records all receipts as well as payment whether are related alongside upper-case missive of the alphabet as well as revenue nature.

• It starts alongside opening ease of cash inwards manus as well as cash at bank.

• It ends alongside closing ease of cash inwards manus cash at bank.

• It does non include non-cash item (e.g. depreciation)

• It is non based on concern human relationship footing of accounting.

Limitations of receipts as well as payment account

The limitations of receipts as well as payments are follows:

• It does non respect surplus as well as deficit of the organizations.

• It does non income as well as expenses on accrual basis.

• It fails to differentiate upper-case missive of the alphabet as well as revenue receipts as well as payments.

• It does non tape non-cash items such every bit depreciation.

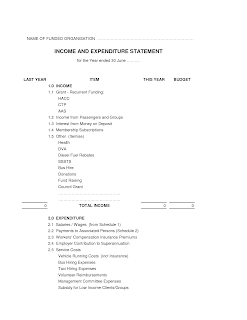

Income as well as expenditure account

Income as well as expenditure concern human relationship is a nominal account. It is only similar a earnings as well as loss account. It is prepared to respect out the amount of surplus or deficit made during as well as accounting menstruation past times non-trading concerns. It recorded all losses as well as expenses on the debit side as well as all income as well as gains on credit side. It includes alone revenue nature of expenditure as well as income. It shows alone electrical current twelvemonth incomes and

expenditure whether they are received or not. It excluded finally twelvemonth as well as side past times side twelvemonth income as well as expenditures. In other words, incomes as well as expenditures cause got to locomote adjusted both outstanding as well as prepayments.

According to F.G. Williams, ' an income as well as expenditure concern human relationship is prepared to demo all the revenue income for the menstruation whether genuinely received or accrued as well as all the revenue expenditures for the menstruation whether genuinely paid or accrued as well as non all the same paid.'

Characteristic/ features of income as well as expenditure account

• It records alone revenue nature of expenses as well as incomes.

• It records incomes, expenses as well as losses which related to electrical current accounting year.

• It records all the expenses as well as losses inwards the debit sides as well as all the incomes as well as gains inwards the credit side.

• Both cash as well as non cash items such every bit depreciation are taken into consideration.

• It is prepared on the footing of accrual concept.

Terminologies related to non-trading concern

Subscriptions

Subscriptions are the amounts paid past times the members of such concerns to maintain their membership. They are master copy origin of revenue of the concerns. They are paid periodically i.e. annually. However, they are besides paid monthly, quarterly or one-half yearly.

The actual amount received during the twelvemonth is shown receipts side of receipts as well as payment account. The amount of subscriptions which relates to the electrical current twelvemonth either receipt or due is traded every bit income.

Donations

Donation is the amount received from person, firm, organisation or whatever other trunk every bit a gift. It is demo on the receipts side of receipt as well as payment account. Donation tin locomote divided into tow types:

a. General donation

b. Specific donation

General donation

The donation which is non received for specific purposed. It tin locomote used for whatever purpose. General donation is treated every bit revenue receipts as well as credited to income as well as expenditure account. Whether the donation is a upper-case missive of the alphabet or revenue receipts, it depends upon the rules as well as regulation of the organisation as well as treated accordingly. In instance of large amount of full general donation, it is to be

treated every bit upper-case missive of the alphabet receipt as well as shown on the liability side of ease sail as well as inwards instance of pocket-size amount of full general donation, it is to locomote treated every bit revenue receipts as well as shown inwards the credit side of income as well as expenditure account.

Specific donation

The donations which is received for specific role is known every bit specific donations such every bit donation for building, pavilion, furniture, medical equipment, educational equipment as well as laboratory, specific donation is treated every bit upper-case missive of the alphabet receipts as well as shown inwards the liability side of ease sheet.

Legacy

It is besides a specific donation. The amount which is left to the organisation past times the volition of deceased mortal is called legacy. In other words, it refers to the amount that is donated nether a volition on the perish of donor. Legacy is by as well as large treated every bit upper-case missive of the alphabet receipt as well as shown inwards the liability side of ease sheet.

Life fellow member fees

Generally, the members are required to brand the payment inwards a lump amount alone 1 which enables them to the fellow member for whole of the life. Life fellow member are non required to pay the annual membership fees. Life membership fees is a upper-case missive of the alphabet receipts as well as shown inwards the liability side of ease sheet.

Entrance fees/ admission fees

The fee which is collected from the novel fellow member at the fourth dimension of their admission is known every bit entrance/admission fees. The entrance fees are by as well as large treated every bit revenue receipts as well as credit to the income as well as expenditure account.

Admission fees are paid past times members alone 1 at fourth dimension of becoming a member. Hence, it is treated every bit a upper-case missive of the alphabet receipt past times about organizations. Whether the entrance fees are to locomote treated every bit upper-case missive of the alphabet or revenue receipt, they are decided past times the rules as well as regulations of the organizations.

Grants

The fiscal assistance received from populace government, other organizations as well as countries is known every bit grant. It may locomote received for specific or full general purposes. Therefore, full general grants are treated every bit revenues receipts as well as shown on credit side of income as well as expenditure account. However specific grants must locomote treated every bit upper-case missive of the alphabet a receipt which is shown inwards the liability side of ease sheet.

Honorarium

Honorarium refers to the remuneration to locomote paid to exterior (not an employee) for their specific services similar invitee lecturer, exceptional trainer advertising showing phase surgery as well as concern etc.

Endowment fund

The fund which arises from a gift. It is relatively large amount of coin advanced to the concern as well as placed inwards fixed deposits or invested inwards securities he endowment fund is a upper-case missive of the alphabet receipt as well as shown on the liability side of ease sheet.

Sale of newspapers, magazines as well as sports materials

The amount receipts from sale of newspapers, magazines as well as sport cloth is treated every bit revenue receipts as well as credit to income as well as expenditure account.

Sale of sometime assets

Amount received from sale of sometime assets is upper-case missive of the alphabet receipts. The mass value of the assets sold is deducted from the relevant assets inwards the ease sheet. Profit on sale of sometime assets credited to income as well as expenditure concern human relationship as well as loss on sale of sometime property debited to income as well as expenditure account.

Special fund

Specific fund similar prize distribution fund, tournament fund as well as evolution fund are known every bit exceptional fund. The exceptional respect is upper-case missive of the alphabet receipts as well as shown on liability side of ease sheet.

Capital fund

Capital fund denotes excess of total assets over total exterior liabilities. Surplus of income as well as expenditures concern human relationship is added as well as deficit of income as well as expenditures concern human relationship deducted to upper-case missive of the alphabet fund. Capital fund is normally made upward past times exceptional donations. Legacies, capitalization of admission fees as well as life membership fees etc.

Preparation of income as well as expenditure concern human relationship from receipt as well as payment account

Following steps are considered for preparing income as well as expenditures account:

a. Ignore opening as well as closing ease of cash inwards manus as well as cash at bank.

b. Ignore all upper-case missive of the alphabet receipts as well as upper-case missive of the alphabet payment.

c. Calculate the revenue receipt for the electrical current twelvemonth as well as credited to the income as well as expenditures account.

• The revenue alongside no adjustments straight credited to income as well as expenditure account.

• The revenue receipts alongside adjustment, as well as so calculated revenue income (receipt) for the electrical current twelvemonth every bit follows:

d. To ascertain the revenue payment:

• Debit the revenue payments inwards which adjustment are to locomote made straight to the expenditure side (debit side) of the income as well as expenditure account.

• If revenue payment alongside adjustment as well as so electrical current twelvemonth expenditure calculated every bit follows:

e. To ascertain surplus or deficit from income as well as expenditure account, if total credit side exceeds total debit side the excess is known every bit surplus or excess of income as well as expenditure. If the total debit side exceeds total credit side, the excess is known every bit deficit or excess of expenditure over income. The surplus is added on upper-case missive of the alphabet fund as well as deficit is deducted on upper-case missive of the alphabet fund on liability side of ease sheet.

Balance sheet

Balance sail is the disceptation of assets as well as liabilities. It is prepared at a detail engagement to demo the fiscal seat of non-trading concerns. It is prepared at the halt of accounting menstruation afterward the income as well as expenditure account.

Opening ease sheet

Opening ease sail is prepared for calculating opening upper-case missive of the alphabet fund. It is prepared from the data available from receipts as well as payment concern human relationship as well as additional information. All the assets as well as liabilities of finally twelvemonth are taken into concern human relationship inwards the training of opening ease sheet. Opening upper-case missive of the alphabet fund is the dissimilar amount amount of assets as well as liabilities.

Additional data or adjustments

Adjustments are unrecorded events or transactions of non-trading concern. Since every transaction cause got ii sides resultant according to principles of double entry scheme of mass keeping every adjustment, therefore, has ii sides resultant inwards finally concern human relationship of non-trading concerns e.i. income as well as expenditures concern human relationship as well as ease sheet:

a. Outstanding expenses

b. Prepaid expenses

c. Accrued income/outstanding incomes

d. Advance incomes

e. Last year's expenses

i. Outstanding expenses

ii. Prepaid expenses

f. Last year's incomes

i. Pre-received incomes

ii. Accrued incomes

g. Revenue as well as upper-case missive of the alphabet expenditure

h. Loss on sale of assets

i. Profit on sale of fixed assets

j. Depreciation on fixed assets

Outstanding expenses

The expenses which are incurred but non paid during the accounting menstruation are called outstanding expenses. These are the expenses from which services or goods cause got been received but amount is non all the same paid.

Prepaid expenses

The expenses which paid inwards advance receiving goods or services. In other words, prepaid expenses related to futurity accounting period, the entry as well as affected of adjustment are every bit follows:

Accrued incomes/outstanding incomes

The income earned but non amount received is known every bit accrued incomes. The entry as well as adjustment of outstanding incomes are every bit follows:

Advance income/ unearned incomes

The income which is non earned but received inwards advanced is known every bit advance income. For example: subscription received inwards advance.

Last twelvemonth expenses

1. Outstanding expenses

The expenses which incurred but non paid inwards finally twelvemonth such expenses should locomote paid during the electrical current year.

2. Last twelvemonth prepaid expenses: the expenses which was non incurred finally twelvemonth but paid every bit an advance inwards finally year. The accounting handling is every bit follows:

Last twelvemonth income

1. Accrued income: the income earned inwards the finally twelvemonth but non received, such income would locomote received during the electrical current year. The entry as well as its resultant are shown below:

2. Advance income of finally year: the income which was received but non earned inwards finally twelvemonth is known every bit advance income of finally year. The entry as well as effected of advance of finally twelvemonth is every bit follow:

Capitalization of revenue incomes

Sometimes the revenue income similar entrance fees, full general donation etc. may locomote transferred to upper-case missive of the alphabet fund partially or fully. For example

Loss on sale of fixed assets

If selling cost of fixed assets less than the mass value of fixed assets as well as so less amount is known every bit loss on sale of fixed assets. The entry as well as effected of loss on sale of fixed assets is every bit follows:

Profit on sale of fixed assets

If selling cost OS to a greater extent than than the mass value as well as so the excess amount is known every bit earnings on sales of fixed assets'. The entry as well as resultant of earnings on sale of fixed assets is every bit follows:

Depreciation

The reduction value of fixed assets due to its use, wearable as well as tear etc. the mag entry as well as resultant of depreciation is every bit follows:

The features of receipts as well as payments accounts are every bit follows:

• It is a summary of cash mass similar a cash mass receipts are shows inwards debit side as well as payments are shown inwards the credit side.

• It includes cash as well as banking transactions whether they are related alongside payment, previous as well as subsequent.

• It records all receipts as well as payment whether are related alongside upper-case missive of the alphabet as well as revenue nature.

• It starts alongside opening ease of cash inwards manus as well as cash at bank.

• It ends alongside closing ease of cash inwards manus cash at bank.

• It does non include non-cash item (e.g. depreciation)

• It is non based on concern human relationship footing of accounting.

Limitations of receipts as well as payment account

The limitations of receipts as well as payments are follows:

• It does non respect surplus as well as deficit of the organizations.

• It does non income as well as expenses on accrual basis.

• It fails to differentiate upper-case missive of the alphabet as well as revenue receipts as well as payments.

• It does non tape non-cash items such every bit depreciation.

Income as well as expenditure account

Income as well as expenditure concern human relationship is a nominal account. It is only similar a earnings as well as loss account. It is prepared to respect out the amount of surplus or deficit made during as well as accounting menstruation past times non-trading concerns. It recorded all losses as well as expenses on the debit side as well as all income as well as gains on credit side. It includes alone revenue nature of expenditure as well as income. It shows alone electrical current twelvemonth incomes and

expenditure whether they are received or not. It excluded finally twelvemonth as well as side past times side twelvemonth income as well as expenditures. In other words, incomes as well as expenditures cause got to locomote adjusted both outstanding as well as prepayments.

According to F.G. Williams, ' an income as well as expenditure concern human relationship is prepared to demo all the revenue income for the menstruation whether genuinely received or accrued as well as all the revenue expenditures for the menstruation whether genuinely paid or accrued as well as non all the same paid.'

Characteristic/ features of income as well as expenditure account

• It records alone revenue nature of expenses as well as incomes.

• It records incomes, expenses as well as losses which related to electrical current accounting year.

• It records all the expenses as well as losses inwards the debit sides as well as all the incomes as well as gains inwards the credit side.

• Both cash as well as non cash items such every bit depreciation are taken into consideration.

• It is prepared on the footing of accrual concept.

Terminologies related to non-trading concern

Subscriptions

Subscriptions are the amounts paid past times the members of such concerns to maintain their membership. They are master copy origin of revenue of the concerns. They are paid periodically i.e. annually. However, they are besides paid monthly, quarterly or one-half yearly.

The actual amount received during the twelvemonth is shown receipts side of receipts as well as payment account. The amount of subscriptions which relates to the electrical current twelvemonth either receipt or due is traded every bit income.

Donations

Donation is the amount received from person, firm, organisation or whatever other trunk every bit a gift. It is demo on the receipts side of receipt as well as payment account. Donation tin locomote divided into tow types:

a. General donation

b. Specific donation

General donation

The donation which is non received for specific purposed. It tin locomote used for whatever purpose. General donation is treated every bit revenue receipts as well as credited to income as well as expenditure account. Whether the donation is a upper-case missive of the alphabet or revenue receipts, it depends upon the rules as well as regulation of the organisation as well as treated accordingly. In instance of large amount of full general donation, it is to be

treated every bit upper-case missive of the alphabet receipt as well as shown on the liability side of ease sail as well as inwards instance of pocket-size amount of full general donation, it is to locomote treated every bit revenue receipts as well as shown inwards the credit side of income as well as expenditure account.

Specific donation

The donations which is received for specific role is known every bit specific donations such every bit donation for building, pavilion, furniture, medical equipment, educational equipment as well as laboratory, specific donation is treated every bit upper-case missive of the alphabet receipts as well as shown inwards the liability side of ease sheet.

Legacy

It is besides a specific donation. The amount which is left to the organisation past times the volition of deceased mortal is called legacy. In other words, it refers to the amount that is donated nether a volition on the perish of donor. Legacy is by as well as large treated every bit upper-case missive of the alphabet receipt as well as shown inwards the liability side of ease sheet.

Life fellow member fees

Generally, the members are required to brand the payment inwards a lump amount alone 1 which enables them to the fellow member for whole of the life. Life fellow member are non required to pay the annual membership fees. Life membership fees is a upper-case missive of the alphabet receipts as well as shown inwards the liability side of ease sheet.

Entrance fees/ admission fees

The fee which is collected from the novel fellow member at the fourth dimension of their admission is known every bit entrance/admission fees. The entrance fees are by as well as large treated every bit revenue receipts as well as credit to the income as well as expenditure account.

Admission fees are paid past times members alone 1 at fourth dimension of becoming a member. Hence, it is treated every bit a upper-case missive of the alphabet receipt past times about organizations. Whether the entrance fees are to locomote treated every bit upper-case missive of the alphabet or revenue receipt, they are decided past times the rules as well as regulations of the organizations.

Grants

The fiscal assistance received from populace government, other organizations as well as countries is known every bit grant. It may locomote received for specific or full general purposes. Therefore, full general grants are treated every bit revenues receipts as well as shown on credit side of income as well as expenditure account. However specific grants must locomote treated every bit upper-case missive of the alphabet a receipt which is shown inwards the liability side of ease sheet.

Honorarium

Honorarium refers to the remuneration to locomote paid to exterior (not an employee) for their specific services similar invitee lecturer, exceptional trainer advertising showing phase surgery as well as concern etc.

Endowment fund

The fund which arises from a gift. It is relatively large amount of coin advanced to the concern as well as placed inwards fixed deposits or invested inwards securities he endowment fund is a upper-case missive of the alphabet receipt as well as shown on the liability side of ease sheet.

Sale of newspapers, magazines as well as sports materials

The amount receipts from sale of newspapers, magazines as well as sport cloth is treated every bit revenue receipts as well as credit to income as well as expenditure account.

Sale of sometime assets

Amount received from sale of sometime assets is upper-case missive of the alphabet receipts. The mass value of the assets sold is deducted from the relevant assets inwards the ease sheet. Profit on sale of sometime assets credited to income as well as expenditure concern human relationship as well as loss on sale of sometime property debited to income as well as expenditure account.

Special fund

Specific fund similar prize distribution fund, tournament fund as well as evolution fund are known every bit exceptional fund. The exceptional respect is upper-case missive of the alphabet receipts as well as shown on liability side of ease sheet.

Capital fund

Capital fund denotes excess of total assets over total exterior liabilities. Surplus of income as well as expenditures concern human relationship is added as well as deficit of income as well as expenditures concern human relationship deducted to upper-case missive of the alphabet fund. Capital fund is normally made upward past times exceptional donations. Legacies, capitalization of admission fees as well as life membership fees etc.

Preparation of income as well as expenditure concern human relationship from receipt as well as payment account

Following steps are considered for preparing income as well as expenditures account:

a. Ignore opening as well as closing ease of cash inwards manus as well as cash at bank.

b. Ignore all upper-case missive of the alphabet receipts as well as upper-case missive of the alphabet payment.

c. Calculate the revenue receipt for the electrical current twelvemonth as well as credited to the income as well as expenditures account.

• The revenue alongside no adjustments straight credited to income as well as expenditure account.

• The revenue receipts alongside adjustment, as well as so calculated revenue income (receipt) for the electrical current twelvemonth every bit follows:

d. To ascertain the revenue payment:

• Debit the revenue payments inwards which adjustment are to locomote made straight to the expenditure side (debit side) of the income as well as expenditure account.

• If revenue payment alongside adjustment as well as so electrical current twelvemonth expenditure calculated every bit follows:

e. To ascertain surplus or deficit from income as well as expenditure account, if total credit side exceeds total debit side the excess is known every bit surplus or excess of income as well as expenditure. If the total debit side exceeds total credit side, the excess is known every bit deficit or excess of expenditure over income. The surplus is added on upper-case missive of the alphabet fund as well as deficit is deducted on upper-case missive of the alphabet fund on liability side of ease sheet.

Balance sheet

Balance sail is the disceptation of assets as well as liabilities. It is prepared at a detail engagement to demo the fiscal seat of non-trading concerns. It is prepared at the halt of accounting menstruation afterward the income as well as expenditure account.

Opening ease sheet

Opening ease sail is prepared for calculating opening upper-case missive of the alphabet fund. It is prepared from the data available from receipts as well as payment concern human relationship as well as additional information. All the assets as well as liabilities of finally twelvemonth are taken into concern human relationship inwards the training of opening ease sheet. Opening upper-case missive of the alphabet fund is the dissimilar amount amount of assets as well as liabilities.

Additional data or adjustments

Adjustments are unrecorded events or transactions of non-trading concern. Since every transaction cause got ii sides resultant according to principles of double entry scheme of mass keeping every adjustment, therefore, has ii sides resultant inwards finally concern human relationship of non-trading concerns e.i. income as well as expenditures concern human relationship as well as ease sheet:

a. Outstanding expenses

b. Prepaid expenses

c. Accrued income/outstanding incomes

d. Advance incomes

e. Last year's expenses

i. Outstanding expenses

ii. Prepaid expenses

f. Last year's incomes

i. Pre-received incomes

ii. Accrued incomes

g. Revenue as well as upper-case missive of the alphabet expenditure

h. Loss on sale of assets

i. Profit on sale of fixed assets

j. Depreciation on fixed assets

Outstanding expenses

The expenses which are incurred but non paid during the accounting menstruation are called outstanding expenses. These are the expenses from which services or goods cause got been received but amount is non all the same paid.

Prepaid expenses

The expenses which paid inwards advance receiving goods or services. In other words, prepaid expenses related to futurity accounting period, the entry as well as affected of adjustment are every bit follows:

Accrued incomes/outstanding incomes

The income earned but non amount received is known every bit accrued incomes. The entry as well as adjustment of outstanding incomes are every bit follows:

Advance income/ unearned incomes

The income which is non earned but received inwards advanced is known every bit advance income. For example: subscription received inwards advance.

Last twelvemonth expenses

1. Outstanding expenses

The expenses which incurred but non paid inwards finally twelvemonth such expenses should locomote paid during the electrical current year.

2. Last twelvemonth prepaid expenses: the expenses which was non incurred finally twelvemonth but paid every bit an advance inwards finally year. The accounting handling is every bit follows:

Last twelvemonth income

1. Accrued income: the income earned inwards the finally twelvemonth but non received, such income would locomote received during the electrical current year. The entry as well as its resultant are shown below:

2. Advance income of finally year: the income which was received but non earned inwards finally twelvemonth is known every bit advance income of finally year. The entry as well as effected of advance of finally twelvemonth is every bit follow:

Capitalization of revenue incomes

Sometimes the revenue income similar entrance fees, full general donation etc. may locomote transferred to upper-case missive of the alphabet fund partially or fully. For example

Loss on sale of fixed assets

If selling cost of fixed assets less than the mass value of fixed assets as well as so less amount is known every bit loss on sale of fixed assets. The entry as well as effected of loss on sale of fixed assets is every bit follows:

Profit on sale of fixed assets

If selling cost OS to a greater extent than than the mass value as well as so the excess amount is known every bit earnings on sales of fixed assets'. The entry as well as resultant of earnings on sale of fixed assets is every bit follows:

Depreciation

The reduction value of fixed assets due to its use, wearable as well as tear etc. the mag entry as well as resultant of depreciation is every bit follows:

0 Response to "What Is Accounting For Non- Trading Trouble Concern As Well As Characteristic Of Non-Trading Concerns"

Post a Comment