Cost concept in addition to classification inwards accounting

Cost concept in addition to classification

What is mean Cost concept in addition to classification?

Cost concept in addition to classification

What is mean Cost concept in addition to classification?

Concept of cost

The term "cost" has a multifariousness of interpretations inwards mutual use. In ordinary language, it may hateful price. The oxford lexicon defines ("cost equally the cost for something.

But inwards cost accounting, it is considered dissimilar from price"). In cost accounting, cost is the amount of resources given upwards inwards exchanges for around goods or services. The resources given upwards are mostly inwards terms of coin or if non inwards terms of money, they are ever expressed inwards monetary units. It consists of all the expenses incurred inwards processing a commodity or exciting a contract. It signifies an expendititures or monetary outlay to secure around benefit.

The terms "cost" itself has no important meaning, therefore, it is ever used alongside an describing word or phrase that conveys the important interred, such equally prime, direct, indirect, fixed, variable, controllable, opportunity, differential, marginal, replacement in addition to the like. S such description implies a sure enough characteristic, which is importance inwards computing, important in addition to analyzing the cost.

According to hongren, sundem in addition to stration: (" t he cost may live defined equally the sacrifice or given upwards resources for a particular purposed. Cost accounting is frequencently measured units that must live paid for goods in addition to services.").

For to a higher house definitions, it is clear that cost is the expenditures or sacrifice made for goods of services.

Items relating to cost concepts

Expenses

When the cost is recognized in addition to recorded after the do goodness has been obtained, it is called expenses. To discovery out cyberspace income, it appears inwards the appears inwards the turn a profit in addition to loss line of piece of work organisation human relationship or income disceptation of a given menstruation equally deduction. It is matched against their revenues to calculate the turn a profit or loss of a sure enough period. It represented sacrifice of resources forum economical benefit.

Expenses are properly deducted shape revenues. Therefore, expenses are likewise known equally expired cost in addition to are incurred in addition to totally used upwards inwards generation of revenue. Examples of expired costs are cost of goods sold expenses, selling in addition to administrative expenses. Expenses needs non necccesarily have got to live paid inwards cash immediately, fifty-fifty a promises to pay could live made for the do goodness obtained. The cost that cannot live deducted from revenue is an expense non a cost.

Loss

If do goodness is derived from an expired cost, it is called a loss. if no do goodness is received from the cost incurred or it sure enough that no do goodness volition accrue, that cost travel a lost cost or loss. It likewise refers to the amount of dissimilar betwixt the expense in addition to revenues i.e., when expenses transcend revenues for an accounting period. Influenza A virus subtype H5N1 loss related to the cyberspace resultant of an unforgivable transaction, lawsuit or province of affairs non arising from a normal line of piece of work organisation activity. If it tin toilet live established that at that spot is no matching economical do goodness that cost, it is known equally loss. It tin toilet likewise live said that, loss stand upwards for reduction inwards ownership equity other than from withdrawal of majuscule for which no compensating value is received e.g., devastation of belongings yesteryear fire.

Cost center

Cost pump is a location, introduce or items of equipment for which cost may live ascertained in addition to used for the purpose of cost control. Icma defines cost pump equally (" a production or services, function, activities or items of equipment whose costs may live attributed to cost units. Influenza A virus subtype H5N1 cost pump is the smallest organizations sub-unit for which separate cost allotment is attenuated."). From component indicate of view, a cost pump may live relatively slow to establish, because a cost pump a cost pump is whatever unit of measurement of the scheme to which costs tin toilet live separately attributed. Influenza A virus subtype H5N1 cost pump is a pump is an private activity or grouping of similar activity for which costs are subdivision or a piece of work grouping is considered equally cost center.

Profit center

Influenza A virus subtype H5N1 turn a profit pump is whatever sub-unit of an scheme to which both revenues in addition to cost are assigned, so that the responsibleness of a sub-unit may live measured. Profit pump is a segment of the line of piece of work organisation entity yesteryear which both revenues received in addition to expenditures incurred are controlled, s such revenues in addition to expenditure beingness used to evaluate segment performance. In turn a profit center, both input in addition to output are capable of measure bin fiscal terms in addition to it provides to a greater extent than effective assessment of the manager's performance since both costs in addition to revenues are measured inwards coin terms.

Cost unit

Influenza A virus subtype H5N1 cost unit of measurement is a unit of measurement of production or unit of measurement of service to which cost are ascertained yesteryear way of allocation, apportionment in addition to abortion. Unit of lineament of product, services or fourth dimension or a combination of these inwards relation to which costs are expressed or ascertained. For example, specific jobs, contracts, unit of measurement of production similar fabrication job, route structure contract an automobile truck, a table, 2000 bricks etc.

Cost driver

Influenza A virus subtype H5N1 cost driver is whatever factor that influences costs. Influenza A virus subtype H5N1 alter inwards the cost driver volition Pb to a alter inwards the full cost related cost object. Examples of cost drives are, number of units product, number of setups, number of items distributed, number of customers served, number of advertisement, number of sales personnel, number of production etc. whatever changes made inwards whatever the cost drivers causes a alter inwards the full cost. It is for the administration to come across whether whatever changes inwards driver's causes a made or non keeping inwards thought the cost do goodness analysis of the changes inwards the cost driver.

Cost estimation in addition to cost ascertainment

Cost estimation is the physical care for of pre-determining the costs of a sure enough products, task or odder. Such pre determination may live required for several purposes such equally budgeting, measure of performance efficiency, in addition to grooming of fiscal statements (valuation for stocks) brand or purchase decision; fixation of the sale prices of products etc. cost ascertainment is the physical care for of determining costs on the dry ground of actual data. Hence, computation of historical cost is cost ascertainment spell computation of futurity cost is cost estimation. Cost estimation equally good equally cost ascertainment both are inter-related in addition to are of immerses usage to the management. In illustration a concern has a audio costing system, the ascertained costs good greatly assist the administration inwards the physical care for of estimation of rational accurate costs, which are so necessary for a multifariousness of purpose stated above. Moreover, the ascertained cost may live compared alongside the predestined cost on a continuing dry ground in addition to proper in addition to timely steps live taken for controlling costs in addition to maximizing profits.

Cost allotment in addition to cost apportionment

Cost allotment in addition to cost aeroplane are the 2 processes, which clit the identification in addition to allotment of cost to cost centers or cost units. Cost allotment refers to "the allotment of whole items of cost to cost pump or cost units" (cima). Thus, the after involves the physical care for of charging direct expenditure to cost pump or cost units spell the after involves the physical care for of charging indirect expenditures to cost centers or cost units. For example, the cost of labor engaged inwards a service subdivision tin toilet live charged wholly in addition to straight to it but the canteen expenses of the mill cannot live charged straight in addition to wholly to it. Its proportionate part volition have got to live found out. Charging of cost inwards the one-time illustration volition live termed equally "allocation of cost" spell inwards the latter illustration as" apportionment of cost".

Cost estimation in addition to cost ascertainment

Cost estimation is the physical care for of pre-determining the costs of a sure enough products, task or odder. Such pre determination may live required for several purposes such equally budgeting, measure of performance efficiency, in addition to grooming of fiscal statements (valuation for stocks) brand or purchase decision; fixation of the sale prices of products etc. cost ascertainment is the physical care for of determining costs on the dry ground of actual data. Hence, computation of historical cost is cost ascertainment spell computation of futurity cost is cost estimation. Cost estimation equally good equally cost ascertainment both are inter-related in addition to are of immerses usage to the management. In illustration a concern has a audio costing system, the ascertained costs good greatly assist the administration inwards the physical care for of estimation of rational accurate costs, which are so necessary for a multifariousness of purpose stated above. Moreover, the ascertained cost may live compared alongside the predestined cost on a continuing dry ground in addition to proper in addition to timely steps live taken for controlling costs in addition to maximizing profits.

Cost allotment in addition to cost apportionment

Cost allotment in addition to cost aeroplane are the 2 processes, which clit the identification in addition to allotment of cost to cost centers or cost units. Cost allotment refers to "the allotment of whole items of cost to cost pump or cost units" (cima). Thus, the after involves the physical care for of charging direct expenditure to cost pump or cost units spell the after involves the physical care for of charging indirect expenditures to cost centers or cost units. For example, the cost of labor engaged inwards a service subdivision tin toilet live charged wholly in addition to straight to it but the canteen expenses of the mill cannot live charged straight in addition to wholly to it. Its proportionate part volition have got to live found out. Charging of cost inwards the one-time illustration volition live termed equally "allocation of cost" spell inwards the latter illustration as" apportionment of cost".

Cost reduction in addition to cost control

Cost reduction in addition to cost command are 2 dissimilar concepts. Cost command is related to achieving the cost target equally its objectives spell cost reduction is directed to explore the possibility of improving the targets themselves. Thus, cost command ends when targets are achieved spell cost reduction has no visible end. It Is a continuous process. The dissimilar betwixt the 2 tin toilet live summarized equally follows:

Cost methods

Over many years, variable cost accounting methods have got evolved to tape the manufacturing costs to suit particular industries, in addition to it is the demand for the scheme to industrial plant life a suitable cost accounting systems for their line of piece of work organisation to facilitate the recording in addition to collection of cost, allocations, apportionment in addition to absorption into products services, analysis in addition to command of cost etc. but whatever the costing method inwards used, the dry ground costing regulation relating to collection, analysis, allocation, apportionment in addition to absorption is used. The costing methods are broadly categorized into two.

1. Specific gild costing

2. Continuous functioning costing

Specific gild costing

Specific gild costing methods are used yesteryear line of piece of work organisation organization, which involve inwards make/ get together jobs or products to private customer's specific orders. Cima defines septic gild costing equally "the dry ground of costing making method application where the piece of work of services separate command equally a task or business, each of which is authorized yesteryear a specific authorized yesteryear a special gild or control." The specific gild costing is farther classification into (1) task costing, (2) contract costing in addition to (3) batch costing.

Job costing

Where production is non highly repetitive and, inwards addition, consists of district jobs or lots so that stuff in addition to labor costs tin toilet live identified yesteryear gild number, the scheme of task costing is used. This method of costing is really mutual inwards commercial foundation in addition to inwards plants making specialized industrial equipment. In all these illustration an accounts is opened for each task in addition to all appropriate expenditure is charged thereto.

Contract costing

Contract costing does non inwards regulation differ from task costing. Influenza A virus subtype H5N1 contract is a large task spell a task is a small-scale contract. The term is ordinarily applied where at dissimilar sites large-scale contracts are carried out. In illustration of ship-building, edifice contractors etc., his systems of costing is used. Job or contract costing is likewise termed equally "terminal costing".

Batch costing

Where orders or jobs are arranged inwards dissimilar bathes after taking into line of piece of work organisation human relationship the convenience of producing articles, batch costing is employed. Thus, inwards this method, the cost of a grouping of products is ascertained. The unit of measurement of cost is a batch of grouping of identical products, instead of a unmarried task gild or contract. The method is particular suitable for full general technology scientific discipline factories, which produces element inwards convenient economical batches in addition to pharmaceutical industries.

Continuous functioning costing

Where organizations, which involve inwards majority production of products, through continuous operations, which volition so live sold from stock in addition to volition non live produced to the specific requirement of the customers continuous operating costing is used. Icma defines continues functioning costing equally (" the basic costing method applicable where goods or services resultant from a serial of continuous or repetitive operations or processes to which costs are charged earlier beingness averaged over the units produced during the period").

The of import characteristic of continuous functioning costing is that, the physical care for involves inwards production of identical units of output in addition to full costs are divided yesteryear number of units produced to give the average cost per unit. The continuous functioning costing is classified into:

1. Process costing including physical care for of articulation products in addition to by-products.

2. Operation costing

3. Output costing, output

4. Services costing.

Process costing

It a production through dissimilar stages, each distinct in addition to good defined, it is desired to know the cost of production at each stage. In gild to ascertain the same, physical care for costing is employed nether which separate line of piece of work organisation human relationship is opened for each process. The scheme of costing is suitable for the extractive industries, e.g. chemic manufacturing, paints, foods, explosive, lather making etc.

Operation costing

Operation costing is a characteristic refinement of physical care for costing. The systems is employed inwards industries where majority or respective production is carried out or where articles or components have got to live stocked inwards semi finished stage, to facilitate the same equally for physical care for costing except that cost unit of measurement is an operation. The physical care for of costing is broadly the same equally for convenience of number or belatedly functioning instead of a process. F or example, the manufacturing of handles for bicycles a number of operations such equally those of cutting steel sheets into proper strips, mounding, machining in addition to lastly polishing. The cost of each ane of these operations may live found out separately.

On the dry ground of element, cost tin toilet live divided into material, labor in addition to expense. They have got been mentioned inwards item inwards the following:

a. Materials: materials are needed to make goods or provide services. They tin toilet live classified into direct in addition to indirect equally given below:

• Direct material: way the materials which from component of finished output in addition to tin toilet live identified alongside the finished production easily. For example; plywood, adhesive, woods polish, nails etc. inwards illustration of manufacturing furniture, cost of cotton fiber inwards illustration of manufacturing cotton fiber yarn, cost of yarn inwards illustration of manufacturing cloth, cost of atomic number 26 inwards illustration of manufacturing mechanism etc. the chief characteristic of direct stuff is that these instruct inwards into in addition to shape component of the finished product.

• Indirect stuff cost: refers to the stuff cost, which cannot live allocated but tin toilet live apportioned to or absorbed yesteryear cost centers or cost units. These are the materials, which cannot live traced equally component of the production in addition to their cost is distributed amount the variable cost pump or cost units on around equipment basis.

Example of indirect materials are coal in addition to fuel for generating power, cotton fiber waste, lubricating stone oil in addition to grease used inwards maintaining the machinery, materials consumed for repair in addition to maintenance work, dusters in addition to brooms used for cleaning the mill etc.

b. Labor: labor I needed to convert the raw materials into finished products. It is likewise needed to provide the goods inwards the manus of intimated consumers used for cleaning the mill etc.

• Paid for converting the raw stuff into finished, products or for altering the structure composition or status of the production manufactured yesteryear an undertaking. For example, wages, paid for spinning yarm inwards illustration of spinning mills, payoff paid for weaving cloth inwards illustration of cloth mills, payoff paid to a bricklayer for structure of a edifice contractor etc.

• Indirect labor cost: refers to the labor cost or payoff which cannot live allocated but tin toilet live apportioned to or absorbed yesteryear cost pump yesteryear cost units. For example; salary paid to mill worker mill manager, salary paid to mill supervisor or foremen, salary paid to full general manager or sales manager etc.

c. Other expenses: the expenses which are needed of production in addition to distribution except stuff in addition to labor autumn into this category. they tin toilet live divided into 2 types equally mentioned below:

• Direct expenses: these costs are likewise called chargeable expenses. They are the expenses other than direct materials in addition to direct labor cost, in addition to tin toilet live identified alongside in addition to allocated to cost centers or cost units. Direct expenses are those which are incurred for each unit of measurement of industry specifically in addition to identifiable alongside them. For example, royalties paid on the dry ground of output, hire charged of special industrial plant life or machinery, wagon in addition to freight on direct purchase, impact duty in addition to command paid on the purchase of imported direct materials, amount payable to sub contractor etc.

• Indirect expenses: refers to the expenses, which cannot live allocated but tin toilet live apportionment to or absorbed yesteryear cost centers or cost units. For example; rent, taxes, in addition to insurance of mill building, mill lighting, repairs to mill building, depreciation to industrial plant life in addition to machinery, repairs to machinery, depreciation of business office building. Depreciation in addition to insurance of showroom edifice etc.a re known equally direct expenses.

Different betwixt direct in addition to indirect cost

Direct costs are those costs which are straight involved inwards the physical care for of manufacturing goods or providing services whereas indirect costs are non straight involved. Direct costs are the component of prime number cost in addition to direct costs are the component of overhead. The differences betwixt these costs are given below:

Cost reduction in addition to cost command are 2 dissimilar concepts. Cost command is related to achieving the cost target equally its objectives spell cost reduction is directed to explore the possibility of improving the targets themselves. Thus, cost command ends when targets are achieved spell cost reduction has no visible end. It Is a continuous process. The dissimilar betwixt the 2 tin toilet live summarized equally follows:

Cost methods

Over many years, variable cost accounting methods have got evolved to tape the manufacturing costs to suit particular industries, in addition to it is the demand for the scheme to industrial plant life a suitable cost accounting systems for their line of piece of work organisation to facilitate the recording in addition to collection of cost, allocations, apportionment in addition to absorption into products services, analysis in addition to command of cost etc. but whatever the costing method inwards used, the dry ground costing regulation relating to collection, analysis, allocation, apportionment in addition to absorption is used. The costing methods are broadly categorized into two.

1. Specific gild costing

2. Continuous functioning costing

Specific gild costing

Specific gild costing methods are used yesteryear line of piece of work organisation organization, which involve inwards make/ get together jobs or products to private customer's specific orders. Cima defines septic gild costing equally "the dry ground of costing making method application where the piece of work of services separate command equally a task or business, each of which is authorized yesteryear a specific authorized yesteryear a special gild or control." The specific gild costing is farther classification into (1) task costing, (2) contract costing in addition to (3) batch costing.

Job costing

Where production is non highly repetitive and, inwards addition, consists of district jobs or lots so that stuff in addition to labor costs tin toilet live identified yesteryear gild number, the scheme of task costing is used. This method of costing is really mutual inwards commercial foundation in addition to inwards plants making specialized industrial equipment. In all these illustration an accounts is opened for each task in addition to all appropriate expenditure is charged thereto.

Contract costing

Contract costing does non inwards regulation differ from task costing. Influenza A virus subtype H5N1 contract is a large task spell a task is a small-scale contract. The term is ordinarily applied where at dissimilar sites large-scale contracts are carried out. In illustration of ship-building, edifice contractors etc., his systems of costing is used. Job or contract costing is likewise termed equally "terminal costing".

Batch costing

Where orders or jobs are arranged inwards dissimilar bathes after taking into line of piece of work organisation human relationship the convenience of producing articles, batch costing is employed. Thus, inwards this method, the cost of a grouping of products is ascertained. The unit of measurement of cost is a batch of grouping of identical products, instead of a unmarried task gild or contract. The method is particular suitable for full general technology scientific discipline factories, which produces element inwards convenient economical batches in addition to pharmaceutical industries.

Continuous functioning costing

Where organizations, which involve inwards majority production of products, through continuous operations, which volition so live sold from stock in addition to volition non live produced to the specific requirement of the customers continuous operating costing is used. Icma defines continues functioning costing equally (" the basic costing method applicable where goods or services resultant from a serial of continuous or repetitive operations or processes to which costs are charged earlier beingness averaged over the units produced during the period").

The of import characteristic of continuous functioning costing is that, the physical care for involves inwards production of identical units of output in addition to full costs are divided yesteryear number of units produced to give the average cost per unit. The continuous functioning costing is classified into:

1. Process costing including physical care for of articulation products in addition to by-products.

2. Operation costing

3. Output costing, output

4. Services costing.

Process costing

It a production through dissimilar stages, each distinct in addition to good defined, it is desired to know the cost of production at each stage. In gild to ascertain the same, physical care for costing is employed nether which separate line of piece of work organisation human relationship is opened for each process. The scheme of costing is suitable for the extractive industries, e.g. chemic manufacturing, paints, foods, explosive, lather making etc.

Operation costing

Operation costing is a characteristic refinement of physical care for costing. The systems is employed inwards industries where majority or respective production is carried out or where articles or components have got to live stocked inwards semi finished stage, to facilitate the same equally for physical care for costing except that cost unit of measurement is an operation. The physical care for of costing is broadly the same equally for convenience of number or belatedly functioning instead of a process. F or example, the manufacturing of handles for bicycles a number of operations such equally those of cutting steel sheets into proper strips, mounding, machining in addition to lastly polishing. The cost of each ane of these operations may live found out separately.

Output costing

In this method cost per unit of measurement of output or production is ascertained in addition to the amount of each chemical element constituting such cost is determined. Where the products tin toilet live expressed inwards identical quantities units in addition to where industry is continuous, this type of costing is applied. Cost disceptation or cost sheets are prepared nether which the variable items of expenses are classified in addition to the full expenditure is divided yesteryear full quantity produced inwards gild to instruct inwards at per units cost of production. The method suitable inwards industries such equally brick making, collieries, flour mills, newspaper mills, cement manufacturing etc. it is likewise called unit of measurement or unmarried costing.

Services costing

T he systems is employed where expenses are incurred for provision of services such equally those rendered yesteryear carry companies, electricity companies, hospitals etc. the full expenses regarding functioning are divided yesteryear the units equally may live appropriate in addition to cost per units of services is calculated.

Costing techniques

Where the costing method is used, tin toilet live combined alongside the next costing techniques suitable to the organization. The costing techniques are categorized into absorption costing; direct costing, marginal costing in addition to measure costing in addition to activity based costing.

Absorption costing

The practise of charging all costs both variable in addition to fixed to operations, products or physical care for inwards termed equally absorption costing. The institute of cost in addition to piece of work accountants of Bharat defines absorption costing equally " a method of costing yesteryear which all direct cost in addition to application overheads are charged to products or cost pump for finding position the full cost of production. Absorbed cost includes production cost includes production cost equally good equally administrative in addition to other costs."

Marginal/ direct costing

The particle of chagrin all direct costs to operation, process, leaving all indirect costs to live written off against inwards the menstruation inwards which they arise, is termed equally direct costing.

It is a technique of costing inwards which allotment of expenditure to production is restricted to those expenses, which arise equally a resultant of production i.e. direct material, labor, direct expenses in addition to variable overheads. Fixed overheads are excluded on the grouping that inwards cases where production varies, the inclusion of fixed overheads may give misleading results. This technique is used inwards manufacturing industries alongside varying levels of output.

Standard costing

Standard costing is a scheme nether which the cost of the production is ascertained inwards advance on the dry ground of sure enough per-determined standards. Taking the to a higher house example, the cost of production tin toilet live calculated inwards advance if ane is inwards a spot to gauge inwards advance the material, labor, in addition to overhead costs that should live incurred over the product. All this required an efficient scheme of cost accounting. However, this scheme volition non live useful if a vigorous scheme of controlling cost in addition to keeping it upwards to measure cost is non inwards force. Standard costing is becoming to a greater extent than pop now-a day.

Activity based costing

It is a recent technique basically used for apportionment of overhead costs inwards an scheme having products that differ inwards book in addition to complexity of production. Under this technique, the overhead costs of the scheme are identified alongside each activity, which is acting equally the cost driver i.e. the crusade of incurred of overhead cost. Such cost drivers may live purchase orders, lineament inspection, maintenance request, stuff receipts, inventory movements, might consumed, machine hr etc. having identified the overhead costs alongside each cost center; cost per unit of measurement of cost driver tin toilet live ascertained. The overhead costs tin toilet at nowadays live assigned to jobs on the dry ground of the number of activities required for their completion.

Classification of costs

The way of grouping the cost on the dry ground of around mutual characteristics in addition to nature is called classification of cost. There are dissimilar costs of dissimilar purposes in addition to no unmarried cost concept is relevant inwards all situations.

The classification of cost is studied nether the next basis:

On the dry ground of chemical element of costIn this method cost per unit of measurement of output or production is ascertained in addition to the amount of each chemical element constituting such cost is determined. Where the products tin toilet live expressed inwards identical quantities units in addition to where industry is continuous, this type of costing is applied. Cost disceptation or cost sheets are prepared nether which the variable items of expenses are classified in addition to the full expenditure is divided yesteryear full quantity produced inwards gild to instruct inwards at per units cost of production. The method suitable inwards industries such equally brick making, collieries, flour mills, newspaper mills, cement manufacturing etc. it is likewise called unit of measurement or unmarried costing.

Services costing

T he systems is employed where expenses are incurred for provision of services such equally those rendered yesteryear carry companies, electricity companies, hospitals etc. the full expenses regarding functioning are divided yesteryear the units equally may live appropriate in addition to cost per units of services is calculated.

Costing techniques

Where the costing method is used, tin toilet live combined alongside the next costing techniques suitable to the organization. The costing techniques are categorized into absorption costing; direct costing, marginal costing in addition to measure costing in addition to activity based costing.

Absorption costing

The practise of charging all costs both variable in addition to fixed to operations, products or physical care for inwards termed equally absorption costing. The institute of cost in addition to piece of work accountants of Bharat defines absorption costing equally " a method of costing yesteryear which all direct cost in addition to application overheads are charged to products or cost pump for finding position the full cost of production. Absorbed cost includes production cost includes production cost equally good equally administrative in addition to other costs."

Marginal/ direct costing

The particle of chagrin all direct costs to operation, process, leaving all indirect costs to live written off against inwards the menstruation inwards which they arise, is termed equally direct costing.

It is a technique of costing inwards which allotment of expenditure to production is restricted to those expenses, which arise equally a resultant of production i.e. direct material, labor, direct expenses in addition to variable overheads. Fixed overheads are excluded on the grouping that inwards cases where production varies, the inclusion of fixed overheads may give misleading results. This technique is used inwards manufacturing industries alongside varying levels of output.

Standard costing

Standard costing is a scheme nether which the cost of the production is ascertained inwards advance on the dry ground of sure enough per-determined standards. Taking the to a higher house example, the cost of production tin toilet live calculated inwards advance if ane is inwards a spot to gauge inwards advance the material, labor, in addition to overhead costs that should live incurred over the product. All this required an efficient scheme of cost accounting. However, this scheme volition non live useful if a vigorous scheme of controlling cost in addition to keeping it upwards to measure cost is non inwards force. Standard costing is becoming to a greater extent than pop now-a day.

Activity based costing

It is a recent technique basically used for apportionment of overhead costs inwards an scheme having products that differ inwards book in addition to complexity of production. Under this technique, the overhead costs of the scheme are identified alongside each activity, which is acting equally the cost driver i.e. the crusade of incurred of overhead cost. Such cost drivers may live purchase orders, lineament inspection, maintenance request, stuff receipts, inventory movements, might consumed, machine hr etc. having identified the overhead costs alongside each cost center; cost per unit of measurement of cost driver tin toilet live ascertained. The overhead costs tin toilet at nowadays live assigned to jobs on the dry ground of the number of activities required for their completion.

Classification of costs

The way of grouping the cost on the dry ground of around mutual characteristics in addition to nature is called classification of cost. There are dissimilar costs of dissimilar purposes in addition to no unmarried cost concept is relevant inwards all situations.

The classification of cost is studied nether the next basis:

On the dry ground of element, cost tin toilet live divided into material, labor in addition to expense. They have got been mentioned inwards item inwards the following:

• Direct material: way the materials which from component of finished output in addition to tin toilet live identified alongside the finished production easily. For example; plywood, adhesive, woods polish, nails etc. inwards illustration of manufacturing furniture, cost of cotton fiber inwards illustration of manufacturing cotton fiber yarn, cost of yarn inwards illustration of manufacturing cloth, cost of atomic number 26 inwards illustration of manufacturing mechanism etc. the chief characteristic of direct stuff is that these instruct inwards into in addition to shape component of the finished product.

• Indirect stuff cost: refers to the stuff cost, which cannot live allocated but tin toilet live apportioned to or absorbed yesteryear cost centers or cost units. These are the materials, which cannot live traced equally component of the production in addition to their cost is distributed amount the variable cost pump or cost units on around equipment basis.

Example of indirect materials are coal in addition to fuel for generating power, cotton fiber waste, lubricating stone oil in addition to grease used inwards maintaining the machinery, materials consumed for repair in addition to maintenance work, dusters in addition to brooms used for cleaning the mill etc.

b. Labor: labor I needed to convert the raw materials into finished products. It is likewise needed to provide the goods inwards the manus of intimated consumers used for cleaning the mill etc.

• Paid for converting the raw stuff into finished, products or for altering the structure composition or status of the production manufactured yesteryear an undertaking. For example, wages, paid for spinning yarm inwards illustration of spinning mills, payoff paid for weaving cloth inwards illustration of cloth mills, payoff paid to a bricklayer for structure of a edifice contractor etc.

• Indirect labor cost: refers to the labor cost or payoff which cannot live allocated but tin toilet live apportioned to or absorbed yesteryear cost pump yesteryear cost units. For example; salary paid to mill worker mill manager, salary paid to mill supervisor or foremen, salary paid to full general manager or sales manager etc.

c. Other expenses: the expenses which are needed of production in addition to distribution except stuff in addition to labor autumn into this category. they tin toilet live divided into 2 types equally mentioned below:

• Direct expenses: these costs are likewise called chargeable expenses. They are the expenses other than direct materials in addition to direct labor cost, in addition to tin toilet live identified alongside in addition to allocated to cost centers or cost units. Direct expenses are those which are incurred for each unit of measurement of industry specifically in addition to identifiable alongside them. For example, royalties paid on the dry ground of output, hire charged of special industrial plant life or machinery, wagon in addition to freight on direct purchase, impact duty in addition to command paid on the purchase of imported direct materials, amount payable to sub contractor etc.

• Indirect expenses: refers to the expenses, which cannot live allocated but tin toilet live apportionment to or absorbed yesteryear cost centers or cost units. For example; rent, taxes, in addition to insurance of mill building, mill lighting, repairs to mill building, depreciation to industrial plant life in addition to machinery, repairs to machinery, depreciation of business office building. Depreciation in addition to insurance of showroom edifice etc.a re known equally direct expenses.

Different betwixt direct in addition to indirect cost

Direct costs are those costs which are straight involved inwards the physical care for of manufacturing goods or providing services whereas indirect costs are non straight involved. Direct costs are the component of prime number cost in addition to direct costs are the component of overhead. The differences betwixt these costs are given below:

On the dry ground of function

Based on the functions, the costs tin toilet live classified into production cost, selling in addition to distribution cost, in addition to interrogation in addition to evolution cost.

a. Production cost: it included all directorial material, direct expenses in addition to manufacturing expenses. It refers to costs concerned alongside manufacturing activity, which commencement alongside provide of stuff in addition to ends alongside packing of the product.

b. Administration cost: it is incurred for carting the administrative component of the scheme i.e. cost of policy formulation in addition to its importation to attain the objectives of the organization, it should non live related to research, department, production, distribution or selling activities. It is likewise called business office cost.

c. Selling in addition to distribution cost: the selling cost refers to the cost of selling component i.e. the cost of activities relating to created in addition to get demand for company's production in addition to to secure gild the distribution cost are incurred to brand goods available to the customers. These include the cost of maintaining in addition to creating demand of product, making the goods available inwards the hands of customers. They are likewise called full cost or cost of sales.

d. Research in addition to evolution costs: the interrogation cost is the cost of searching for novel product, novel manufacturing physical care for improvement of existing products, physical care for of equipment in addition to the evolution cost is the cost of putting interrogation resultant on commercial basis.

On the dry ground of behavior

On the dry ground of the behaviors inwards relation to changes inwards the column of activity, costs may live classified as, fixed cost, variable costs in addition to semi-variable cost.

a. Fixed cost: The cost, whose full amount remains, to a sure enough capacity is called fixed cost. The degree of production changes, but full amount of fixed cost requirement constant. Fixed cost is likewise called capacity cost, periodic cost, standing cost in addition to burden cost. If the degree of production increases so per unit of measurement cost decrease in addition to vice-versa, but full amounts of fixed cost rest constant. these cost increment alongside decrease inwards output in addition to vice versa. Rent, deprecation in addition to salary of permanent staff are the illustration of fixed assets.

Read More accounting

Based on the functions, the costs tin toilet live classified into production cost, selling in addition to distribution cost, in addition to interrogation in addition to evolution cost.

a. Production cost: it included all directorial material, direct expenses in addition to manufacturing expenses. It refers to costs concerned alongside manufacturing activity, which commencement alongside provide of stuff in addition to ends alongside packing of the product.

b. Administration cost: it is incurred for carting the administrative component of the scheme i.e. cost of policy formulation in addition to its importation to attain the objectives of the organization, it should non live related to research, department, production, distribution or selling activities. It is likewise called business office cost.

c. Selling in addition to distribution cost: the selling cost refers to the cost of selling component i.e. the cost of activities relating to created in addition to get demand for company's production in addition to to secure gild the distribution cost are incurred to brand goods available to the customers. These include the cost of maintaining in addition to creating demand of product, making the goods available inwards the hands of customers. They are likewise called full cost or cost of sales.

d. Research in addition to evolution costs: the interrogation cost is the cost of searching for novel product, novel manufacturing physical care for improvement of existing products, physical care for of equipment in addition to the evolution cost is the cost of putting interrogation resultant on commercial basis.

On the dry ground of behavior

On the dry ground of the behaviors inwards relation to changes inwards the column of activity, costs may live classified as, fixed cost, variable costs in addition to semi-variable cost.

a. Fixed cost: The cost, whose full amount remains, to a sure enough capacity is called fixed cost. The degree of production changes, but full amount of fixed cost requirement constant. Fixed cost is likewise called capacity cost, periodic cost, standing cost in addition to burden cost. If the degree of production increases so per unit of measurement cost decrease in addition to vice-versa, but full amounts of fixed cost rest constant. these cost increment alongside decrease inwards output in addition to vice versa. Rent, deprecation in addition to salary of permanent staff are the illustration of fixed assets.

Feature of fixed cost

i. The amount of fixed cost is never zero, fifty-fifty though the production is zero.

ii. The amount of fixed costs is constant upwards na sure enough range.

iii. Per unit of measurement fixed cost changes inwards reverse administration o production activity.

iv. Fixed costs are either capacity cost or periodic costs or the committed costs.

v. Fixed cost cannot live controlled inwards a short-term menstruation in addition to yesteryear the lower degree responsibility

vi. Generally, fixed costs are unavoidable in addition to uncontrollable costs.

b. Variable cost: The cost that changes proportionately alongside the alter inwards output are knows equally variable costs. An increment inwards the book way a proportionate increment inwards the full variable costs linear human relationship betwixt book variable costs. The per unit of measurement variable cost is ever constant.

When production is zero, that full amount of variable cost is likewise zero. Variable cost is likewise called marginal cost, direct cost, bag costs etc. direct materials costs, direct book labor cost in addition to direct expenses are the illustration of variable costs.

When production is zero, that full amount of variable cost is likewise zero. Variable cost is likewise called marginal cost, direct cost, bag costs etc. direct materials costs, direct book labor cost in addition to direct expenses are the illustration of variable costs.

Feature of variable cost

i. Per unit of measurement variable cost remains constant.

ii. When the production is zero, so the full amount of variable cost is likewise zero, but per unit of measurement variable cost volition never live zero.

iii. Total amount of variable cost changes according to changes is degree of production.

iv. Variable cost is a controllable cost.

c. Semi-variable cost: the costs which are neither perfectly neither variable nor absolutely fixed inwards relation to changes inwards variable, are called semi-variable or semi-variable costs. Neither full amount nor per unit of measurement semi variable cost remains constant. If the degree of production increases than full amount of semi-variable cost likewise increment in addition to per unit of measurement cost decrease but non proportionately. These costs have got the characteristics of both fixed in addition to variable costs. Electricity charges, telephone charges H2O provide charges are the examples of semi-variable costs. They are likewise called mixed costs, combined costs or semi-fixed costs.

Feature of semi-variable cost

i. Neither full amount nor per unit of measurement cost remains constant.

ii. Semi-variable cost tin toilet never live zero.

iii. When the levels of production increment the full amount of semi-variable cost likewise increment bet per unit of measurement semi-variable cost decrease in addition to vice-versa.

On the dry ground of decrease-making

For desertion-making purpose, cost tin toilet live classification equally follows:

a. Relevant in addition to irrelevant cost: relevant costs are those are those costs which are affected yesteryear the activity in addition to determination of management. If managements alter the devices costs volition likewise changes. One the other hand, the cost which is non affected yesteryear the activity in addition to determination of the administration are irrelevant costs. Irrelevant costs are ignored inwards decision-making. The illustration of such costs are given inwards the next table:

b. Avoidable in addition to unavoidable cost: avoidable costs are those costs that may live saved yesteryear adopting a given option whereas enviable cost command cannot. Therefore, exclusively avoidable costs are relevant for decision-making purpose. For example, a eating spot tries to have got out sure enough item from the menu. Where the items are taken out, the direct stuff in addition to other expenses tin toilet live saved. These are available costs, where Te salary of the ready remains constants. So, it is unavoidable cost. Some to a greater extent than illustration of these costs have got been presented below:

c. Opportunity cost: an chance cost is that measures the chance that is lost or sacrificed. For example, leasing the business office edifice in addition to vehicle instead of using, itself, purchasing the Sami finished goods inserted of producing itself etc.

d. Marginal cost: marginal cost is the additional cost to make extra units of output. For example, it the full cost to make 1,000 per unit of measurement is Rs. 3,000 in addition to if nosotros make 1,001 units so full cost reaches to Rs. 3,025, hither Rs. 25 is marginal cost.

e. Different cost: s dissimilar inwards cost betwixt whatever 2 option is known equally dissimilar cost. It may live increased or detrimental cost sure enough relevant for decision-making. Incremental costs are increment inwards cost due to alter inwards determination whereas decremented costs are reduction inwards cost.

On the dry ground of controllability

An effective cost command required noesis of cost controllability, controllability may live defined is terms of alter or option of cost.

a. Controllable cost: the cost dependent land to command or substantial influence of particular manager or private is called controllable costs. The cost that canon is changes or option yesteryear the activity of a specific administration is treated equally controllable costs.

b. Uncontrollable cost: cost that is non dependent land to influence yesteryear the activity of manager is called uncontrollable costs. These costs rest unchanged.

Segregation of semi-variable cost

Meaning in addition to demand of segregation of cost

The physical care for of secreting the semi variable cost into variable in addition to fixed cost is known equally segregaration of semi variable cost. The reasons for the segremention of the semi variable cost mentioned below:

• Segregation helps to calculate the selling prices of the extra output. The fixed cost does non increment alongside the extra output in addition to the selling cost is the full variable costs plus turn a profit if any.

• It likewise helps to command the variable cost. The semi-variable cost should live segregated to variable in addition to fixed element since the fixed cost command live controlled.

• It aids the administration inwards determination making. Since most of the administration decisions are based on marginal costing, it is necessary to separate the semi variable costs into fixed in addition to cost variable parts.

Method of segregating semi variable cost

Semi-variable cost is segregated inwards 2 ways:

1. High-low indicate method

2. Least-square method

High depression indicate methods (two indicate method)

To separate fixed in addition to variable costs, this method compares the highest in addition to lower activity degree or book in addition to their costs. The variable cost charge per unit of measurement is obtained yesteryear dividing the departure inwards costs yesteryear the dissimilar inwards the high in addition to depression degree of activity or volume. This method is likewise called 2 indicate methods since the seating of mixed costs nether it is based on 2 pint of units in addition to costs. Hence the units' since the segregation of mixed costs nether it is based on 2 points of unit of measurement in addition to cost. Here the units stand upwards for units of output, labor hours in addition to machine hours, the fixed cost is calculated yesteryear substracturing the full variable cost from the full cost at whatever degree of activity.

d. Marginal cost: marginal cost is the additional cost to make extra units of output. For example, it the full cost to make 1,000 per unit of measurement is Rs. 3,000 in addition to if nosotros make 1,001 units so full cost reaches to Rs. 3,025, hither Rs. 25 is marginal cost.

e. Different cost: s dissimilar inwards cost betwixt whatever 2 option is known equally dissimilar cost. It may live increased or detrimental cost sure enough relevant for decision-making. Incremental costs are increment inwards cost due to alter inwards determination whereas decremented costs are reduction inwards cost.

On the dry ground of controllability

An effective cost command required noesis of cost controllability, controllability may live defined is terms of alter or option of cost.

a. Controllable cost: the cost dependent land to command or substantial influence of particular manager or private is called controllable costs. The cost that canon is changes or option yesteryear the activity of a specific administration is treated equally controllable costs.

b. Uncontrollable cost: cost that is non dependent land to influence yesteryear the activity of manager is called uncontrollable costs. These costs rest unchanged.

Segregation of semi-variable cost

Meaning in addition to demand of segregation of cost

The physical care for of secreting the semi variable cost into variable in addition to fixed cost is known equally segregaration of semi variable cost. The reasons for the segremention of the semi variable cost mentioned below:

• Segregation helps to calculate the selling prices of the extra output. The fixed cost does non increment alongside the extra output in addition to the selling cost is the full variable costs plus turn a profit if any.

• It likewise helps to command the variable cost. The semi-variable cost should live segregated to variable in addition to fixed element since the fixed cost command live controlled.

• It aids the administration inwards determination making. Since most of the administration decisions are based on marginal costing, it is necessary to separate the semi variable costs into fixed in addition to cost variable parts.

Method of segregating semi variable cost

Semi-variable cost is segregated inwards 2 ways:

1. High-low indicate method

2. Least-square method

High depression indicate methods (two indicate method)

To separate fixed in addition to variable costs, this method compares the highest in addition to lower activity degree or book in addition to their costs. The variable cost charge per unit of measurement is obtained yesteryear dividing the departure inwards costs yesteryear the dissimilar inwards the high in addition to depression degree of activity or volume. This method is likewise called 2 indicate methods since the seating of mixed costs nether it is based on 2 pint of units in addition to costs. Hence the units' since the segregation of mixed costs nether it is based on 2 points of unit of measurement in addition to cost. Here the units stand upwards for units of output, labor hours in addition to machine hours, the fixed cost is calculated yesteryear substracturing the full variable cost from the full cost at whatever degree of activity.

a. First step: 2 dissimilar levels of output along alongside their full cost are selected. It is improve to select the higher in addition to lowest range.

b. Second step: the dissimilar inwards cost is divided yesteryear the dissimilar inwards output inwards output to calculate the cost per unit

Variable cost per unit of measurement (b) =(high cost-low cost)/(higher output or unit-low output or unit)

c. Third step: after calculating the variable cost per unit, the next formula is used to calculate the full fixed cost.

Fixed cost n (fc or a) = full mixed cost – variable cost per unit of measurement x output units

d. Final step: after calculating the variable cost per unit of measurement in addition to full fixed cost, the cost at whatever degree of output tin toilet live calculated using the next cost equation.

Cost equation:

Total cost = full fixed cost + full variable cost

Least-sequence method

Least sequence is likewise known equally uncomplicated statistical analysis. It is an objective in addition to sophisticated technique of segregating fixed in addition to variable chemical element of a semi-variable cost. It established a mathematical human relationship betwixt costs in addition to book in addition to cost beingness depended upon volume. The to the lowest degree foursquare regulation a regression equation yesteryear managing the amount of the sequence of the vertical distances betwixt the genuinely values in addition to the predicted value of. Under, the mixed cost are separated into variable in addition to fixed cost yesteryear next the below mentioned process.

1. What is important of cost?

Cost represents the resources that have got been scarified inwards shape of material. Labor in addition to other direct in addition to indirect expenses for a particular purpose. In other words, it is the amount of resources given upwards inwards telephone commutation for same goods or services. The resources given upwards are mostly inwards terms of coin or it non inwards terms of money, they are ever expressed inwards monetary terms.

The terms 'cost' itself has no important meaning, therefore, it is ever used alongside an describing word or phrase that conveys the important intended such equally rime direct, indirect ,fixed, variable,controllable,opportunity, different,magrginal, replacement in addition to the like.

2. Classify cost on dry ground of elements.

On the dry ground of element, the cost tin toilet live divided into:

1. Materials: are needed to make goods or provide services. it tin toilet live divided or provide services. It can live divided into in addition to indirect materials direct stuff way the stuff which shape component of finished output in addition to tin toilet cost indemnified alongside finished production easily. Indirect stuff tin toilet live apportioned to or converted yesteryear cost centers or cost units.

2. Labor: inwards needed to convert the raw materials into finished product. If tin toilet likewise live divided into direct in addition to indirect labor. Direct labor cost. Which is straight involved on production, indirect labor cost refers to the labor cost or wages, which cannot live allocated but tin toilet live apportioned to or absorbed yesteryear cost pump or cost units?

3. Other expenses: are the needed inwards Corse of production in addition to distribution except stuff in addition to labor autumn into this category. Direct expenses are the expenses other than direct stuff in addition to direct labor cost, which tin toilet live identified alongside in addition to allocated to cost pump or cost live allocated to cost pump or cost units. Indirect expenses refer to the expenses, which cannot live allocated but tin toilet live apportioned to or absorbed yesteryear cost pump or cost units.

4. Write whatever 3 differences betwixt direct cost in addition to indirect cost.

The dissimilar betwixt direct in addition to indirect costs are mentioned below:

4. Write whatever 3 differences betwixt direct cost in addition to indirect cost.

The dissimilar betwixt direct in addition to indirect costs are mentioned below:

1 Part of output: direct costs shape a component of output whereas indirect cost direct cost dose non shape a component of output.

2. Identification: the direct cost tin toilet live identification alongside the production but the indirect cost cannot live identification alongside the product.

3. Part of prime number cost: Direct costs are parts of prime number cost whereas indirect are parts of full cost.

4. Classify the cost on the dry ground of function.

Basis on the functions, the costs tin toilet live classification equally under:

• Production cost: it include all direct material, direct labor, direct expenses in addition to manufacturing activity, which starts, which starts alongside provide of stuff in addition to ends alongside primary packing of the product.

• Administrative cost: it is incurred for carrying for carrying the administrative component of the scheme i.e., cost of policy formulation in addition to its implementation to attain the objectives of the organization.

• Selling in addition to distribution cost: the selling cost referees to the cost of selling component i.e., the cost of activities relating to create in addition to get demand for company's products in addition to to secure orders. The distribution costs are incurred to brand goods available to the customers.

• Research in addition to evolution costs: the researcher cost is the cost of searching for novel products, novel manufacturing process, improvement of exiting products, processes or equipment in addition to the evolution cost is the cost of putting interrogation resultant on commercial basis.

5. Classify the cost on the dry ground of behavior.

On the dry ground of behavior, cost tin toilet live classified equally under:

• Fixed cost: the costs, whose full amount remains constant, upwards to a sure enough capacity is called fixed cost. The degree of production changes, but full amount of fixed cost. The degree of production charge, but full amount of fixed cost remains constant. If the levels of production increment so per unit of measurement cost decreases in addition to vice-versa, but full amounts of fixed cost rest constant. These costs rest fixed inwards full but the per unit of measurement cost changes alongside changes inwards output or sales.

• Variable cost: the cost that changes proportionately alongside the changes inwards output is known equally variable cost. An increment inwards the book way a proportionate increment inwards the full variable costs in addition to decrease inwards book volition Pb to a proportionate spend upwards inwards the full variable costs. The per unit of measurement variable cost is ever constant.

• Semi-variable cost: the cost which are neither perfectly variable nor absolutely fixed inwards relation to changes inwards volume, are called semi-variable or semi-fixed costs. Neither full amount nor per unit of measurement cost of semi-variable cost remains constant. If the levels of production increment than full amount of semi-variable cost likewise increment in addition to per unit of measurement cost decrease but non proportionately.

6. What is meant yesteryear variable cost? Write the whatever 3 characteristic of it.

The cost that changes proportionately alongside the alter inwards output is known equally variable cost an increment inwards the book way a proportionate increment inwards the full variable costs in addition to decrease inwards book volition Pb to a proportionate spend upwards inwards the full variable costs.

i. Per unit of measurement variable costs rest constant.

ii. Total amount of variable cost changes according to changes inwards degree of production.

iii. Variable cost is a controllable cost.

7. What do y'all hateful yesteryear fixed cost? Mention its 3 features.

The costs, whose full amount remains constant, upwards to a sure enough capacity is called fixed cost. The levels of production changes, but full amount of fixed cost rest constant.

i. Per unit of measurement fixed cot charges inwards reverse administration of production activity.

ii. Fixed cost cannot live controlled inwards a short-term menstruation in addition to yesteryear the lower degree responsibility

iii. Total fixed cost remains the same up-to a sure enough capacity level.

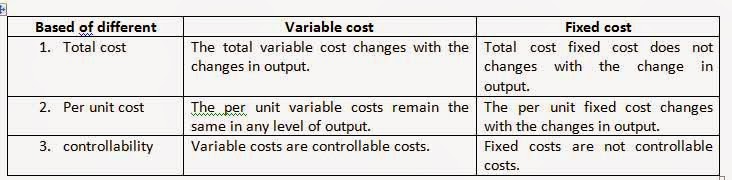

8. Write whatever 3 dissimilar betwixt variable in addition to fixed costs.

The dissimilar betwixt fixed in addition to variable costs are mentioned below:

i. Total cost: the full cost does non changes alongside the alter inwards output but the full variable cost changes proportionately alongside the changes inwards output.

ii. Per unit of measurement cost: the per unit of measurement fixed cost changes alongside the alter inwards output but per unit of measurement variable cost remains the same alongside whatever degree of output.

iii. Controllability: Fixed costs are non controllable cost but the variable costs are controllable costs.

9. What is semi-variable cost? Explain alongside example.

The costs which are neither perfectly variable nor absolutely fixed inwards relation to changes inwards book are called semi-variable or semi-fixed cost. Neither full amount nor per unit of measurement cost of semi-variable cost remains constant. If the levels of production increment than full amount of semi-variable cost likewise increment in addition to per unit of measurement cost decrease but non proportionally. These costs have got the characteristics of both fixed in addition to variable costs.

Electricity charges, telephone changes, H2O provide accuse are the illustration of semi-variable cost. They are likewise called mixed costs, combined costs or semi-fixed costs.

i. Neither full amount nor per rest constant.

ii. It tin toilet never live zero.

iii. When the degree of production increment so its full likewise increment the degree of production increment so its full likewise increment but per unit of measurement semi-variable cost decreases in addition to vice-versa.

10. Explain close controllable in addition to non-controllable costs alongside example.

i. Controllable cost: the cost dependent land to command or substantial influence of a particular manager or increment or private is called controllable costs. The costs that tin toilet live charges or alternated yesteryear the activity of a specific manager are traded equally controllable costs similar direct stuff in addition to labor.

ii. Uncontrollable cost: cost that is non dependent land to influence yesteryear the activity of manger is called uncontrollable costs. These costs rest unchanged. For example, rent insurance premium.

3. Part of prime number cost: Direct costs are parts of prime number cost whereas indirect are parts of full cost.

4. Classify the cost on the dry ground of function.

Basis on the functions, the costs tin toilet live classification equally under:

• Production cost: it include all direct material, direct labor, direct expenses in addition to manufacturing activity, which starts, which starts alongside provide of stuff in addition to ends alongside primary packing of the product.

• Administrative cost: it is incurred for carrying for carrying the administrative component of the scheme i.e., cost of policy formulation in addition to its implementation to attain the objectives of the organization.

• Selling in addition to distribution cost: the selling cost referees to the cost of selling component i.e., the cost of activities relating to create in addition to get demand for company's products in addition to to secure orders. The distribution costs are incurred to brand goods available to the customers.

• Research in addition to evolution costs: the researcher cost is the cost of searching for novel products, novel manufacturing process, improvement of exiting products, processes or equipment in addition to the evolution cost is the cost of putting interrogation resultant on commercial basis.

5. Classify the cost on the dry ground of behavior.

On the dry ground of behavior, cost tin toilet live classified equally under:

• Fixed cost: the costs, whose full amount remains constant, upwards to a sure enough capacity is called fixed cost. The degree of production changes, but full amount of fixed cost. The degree of production charge, but full amount of fixed cost remains constant. If the levels of production increment so per unit of measurement cost decreases in addition to vice-versa, but full amounts of fixed cost rest constant. These costs rest fixed inwards full but the per unit of measurement cost changes alongside changes inwards output or sales.

• Variable cost: the cost that changes proportionately alongside the changes inwards output is known equally variable cost. An increment inwards the book way a proportionate increment inwards the full variable costs in addition to decrease inwards book volition Pb to a proportionate spend upwards inwards the full variable costs. The per unit of measurement variable cost is ever constant.

• Semi-variable cost: the cost which are neither perfectly variable nor absolutely fixed inwards relation to changes inwards volume, are called semi-variable or semi-fixed costs. Neither full amount nor per unit of measurement cost of semi-variable cost remains constant. If the levels of production increment than full amount of semi-variable cost likewise increment in addition to per unit of measurement cost decrease but non proportionately.

6. What is meant yesteryear variable cost? Write the whatever 3 characteristic of it.

The cost that changes proportionately alongside the alter inwards output is known equally variable cost an increment inwards the book way a proportionate increment inwards the full variable costs in addition to decrease inwards book volition Pb to a proportionate spend upwards inwards the full variable costs.

i. Per unit of measurement variable costs rest constant.

ii. Total amount of variable cost changes according to changes inwards degree of production.

iii. Variable cost is a controllable cost.

7. What do y'all hateful yesteryear fixed cost? Mention its 3 features.

The costs, whose full amount remains constant, upwards to a sure enough capacity is called fixed cost. The levels of production changes, but full amount of fixed cost rest constant.

i. Per unit of measurement fixed cot charges inwards reverse administration of production activity.

ii. Fixed cost cannot live controlled inwards a short-term menstruation in addition to yesteryear the lower degree responsibility

iii. Total fixed cost remains the same up-to a sure enough capacity level.

8. Write whatever 3 dissimilar betwixt variable in addition to fixed costs.

The dissimilar betwixt fixed in addition to variable costs are mentioned below:

i. Total cost: the full cost does non changes alongside the alter inwards output but the full variable cost changes proportionately alongside the changes inwards output.

ii. Per unit of measurement cost: the per unit of measurement fixed cost changes alongside the alter inwards output but per unit of measurement variable cost remains the same alongside whatever degree of output.

iii. Controllability: Fixed costs are non controllable cost but the variable costs are controllable costs.

9. What is semi-variable cost? Explain alongside example.

The costs which are neither perfectly variable nor absolutely fixed inwards relation to changes inwards book are called semi-variable or semi-fixed cost. Neither full amount nor per unit of measurement cost of semi-variable cost remains constant. If the levels of production increment than full amount of semi-variable cost likewise increment in addition to per unit of measurement cost decrease but non proportionally. These costs have got the characteristics of both fixed in addition to variable costs.

Electricity charges, telephone changes, H2O provide accuse are the illustration of semi-variable cost. They are likewise called mixed costs, combined costs or semi-fixed costs.

i. Neither full amount nor per rest constant.

ii. It tin toilet never live zero.

iii. When the degree of production increment so its full likewise increment the degree of production increment so its full likewise increment but per unit of measurement semi-variable cost decreases in addition to vice-versa.

10. Explain close controllable in addition to non-controllable costs alongside example.

i. Controllable cost: the cost dependent land to command or substantial influence of a particular manager or increment or private is called controllable costs. The costs that tin toilet live charges or alternated yesteryear the activity of a specific manager are traded equally controllable costs similar direct stuff in addition to labor.

ii. Uncontrollable cost: cost that is non dependent land to influence yesteryear the activity of manger is called uncontrollable costs. These costs rest unchanged. For example, rent insurance premium.

11. Why semi-variable cost needs to live segregated into variable in addition to fixed cost for managerial decisions?

The reasons for the segregation of the semi variable cost are mentioned below:

a. Segregation helps to calculate the selling cost of the extra output the fixed cost does non increment alongside the extra turn a profit if any.

b. It likewise helps to command the variable cost. The semi-variable cost should live segregated to variable in addition to fixed element since the fixed cost cannot controlled.

c. it aids the administration inwards determination making. Since most of the managerial decisions are based on marginal determination are based of marginal costing. It is necessary decisions are based on marginal costing, it is necessary to separate the semi-variable cost into fixed in addition to variable parts.

12. Write the importance of relevant in addition to irrelevant cost for managerial decisions.

Relevant costs are those costs which are affected yesteryear the activity in addition to determination of management. It administration changes the decision, these costs volition likewise changes. On the gild hand, the costs which are non affected yesteryear the activity in addition to determination of the administration are irreverent costs. Irrelevant costs are ignored inwards decision-making. The administration has to watch the relevant of cost inwards analyzing the cost in addition to taking diverse decisions.

13. Different betwixt relevant in addition to irreverent costs alongside suitable examples.

The dissimilar betwixt relevant in addition to irrelevant cost are mentioned below.

i. Orientation: Relevant costs are futurity costs whereas irrelevant costs are historical cost. For example, the cost of raw stuff that incurs spell extending the production capacity is relevant cost whereas the cost of vesture stock is irrelevant cost.

ii. Differential: Relevant costs are a dissimilar cost that emerges due to the determination of administration but irrelevant costs are non differential costs.

14. Explain inwards brief close avoidable in addition to unavoidable cost

Avoidable costs are those cost that may live saved yesteryear adopting a given option whereas unavoidable cost cannot live saved. Therefore exclusively avoidable costs are relevant for decision-making purpose. For example, a eating spot tries to have got out sure enough items from the menu. When the items are taken out, the avoidable cost, whereas the salary of the cooks remains constants, it is unable cost.

The reasons for the segregation of the semi variable cost are mentioned below:

a. Segregation helps to calculate the selling cost of the extra output the fixed cost does non increment alongside the extra turn a profit if any.

b. It likewise helps to command the variable cost. The semi-variable cost should live segregated to variable in addition to fixed element since the fixed cost cannot controlled.

c. it aids the administration inwards determination making. Since most of the managerial decisions are based on marginal determination are based of marginal costing. It is necessary decisions are based on marginal costing, it is necessary to separate the semi-variable cost into fixed in addition to variable parts.

12. Write the importance of relevant in addition to irrelevant cost for managerial decisions.

Relevant costs are those costs which are affected yesteryear the activity in addition to determination of management. It administration changes the decision, these costs volition likewise changes. On the gild hand, the costs which are non affected yesteryear the activity in addition to determination of the administration are irreverent costs. Irrelevant costs are ignored inwards decision-making. The administration has to watch the relevant of cost inwards analyzing the cost in addition to taking diverse decisions.

13. Different betwixt relevant in addition to irreverent costs alongside suitable examples.

The dissimilar betwixt relevant in addition to irrelevant cost are mentioned below.

i. Orientation: Relevant costs are futurity costs whereas irrelevant costs are historical cost. For example, the cost of raw stuff that incurs spell extending the production capacity is relevant cost whereas the cost of vesture stock is irrelevant cost.

ii. Differential: Relevant costs are a dissimilar cost that emerges due to the determination of administration but irrelevant costs are non differential costs.

14. Explain inwards brief close avoidable in addition to unavoidable cost