Accounting for Hire Purchase System

Concept

The hire purchase arrangement is a exceptional method of credit purchase together with sale of goods.

Under cash sales system, the goods are sold together with delivered to the purchaser solely when the payment is made immediately.

In credit sales system, the goods are sold together with delivered instantly but the toll is paid past times the purchaser on around futurity appointment to a greater extent than oftentimes than non without involvement upwards to a surely boundary called credit period.

As against these ii pop systems of selling goods, nether hire purchase system, the skilful are delivered to the purchaser instantly on signing the hire purchase understanding but purchase toll is recovered or collected from him/her inward futurity inward periodic installments' these installments may live monthly or quarterly or yearly or whatsoever other menses equally per the agreement. Although the purchase gets the possession of the goods immediately. Yet he/she volition larn the possessor of the goods solely on the payments of all the installments including the lastly installment. The entire installments paid are treated equally a hire accuse till the lastly installments is paid off.

According to Carter, "Hire purchase arrangement is a arrangement nether which coin is paid for skilful past times agency of periodical installments amongst the sentiment of ultimate purchase. All coin beingness paid inward the hateful fourth dimension is regarded equally payment of hire together with the goods larn the holding of the buyers solely when the entire installments get got been paid."

It must live made clear that inward instance of default inward the payment of fifty-fifty the lastly installment, the seller or vendor volition live entitled or authorized to accept dorsum of repossess the goods together with forfeit the amount already paid past times purchase treating it equally hire charges.

Under the hire purchase system, the seller of the goods is called the hire vendor together with the purchaser is called the hire purchaser.

Features of Hire purchase system

On the the world of this, it tin forcefulness out live said that the next are the top dog characteristic of hire purchases systems:

- Agreement inward writing: there is a specific understanding inward writing together with signed past times the parties to the agreement, that is, hire vendor together with hire purchaser.

- Possession of goods: the possession of the goods is given instantly to the hire purchase on signing the hire purchase agreement. In other words the hire purchase gets the correct to exercise the goods on getting the possession.

- Payment inward installments: the hire purchaser would brand the payment of the hire purchase rice inward monthly, quarterly, one-half yearly or fifty-fifty yearly installments according to the understanding for a fixed menses of time.

- Ownership of the goods: the hire purchaser would larn possessor of the goods solely on the payment of lastly installment together with non earlier that.

- Right to terminate the agreement: the hire purchaser has correct to terminate the hire purchase understanding whatsoever fourth dimension earlier he becomes the possessor of the goods.

- To conk on the goods inward skilful condition: the hire purchase is nether duty to accept reasonable attention of the goods inward his possession equally he/she would get got done to his ain goods.

- Loss to goods: any loss occurring to the goods without whatsoever mistake of the hire purchase would live borne past times the hire vendor. It is based on uncomplicated dominion that run a endangerment lies amongst the ownership.

- No sale or pledge the goods: the hire purchase cannot sell or pledge the goods until he/she larn the possessor later on paying the lastly installment.

- Right to repossess shape tertiary party: in the instance of default inward payment of whatsoever installments, the total amount of installments already paid past times the hire purchase tin forcefulness out live forfeited past times the vendor together with the vendor volition taken away the goods from the possession of the purchaser.

Importance Term of Accounting for hire Purchase System

The next terminologies are used inward Accounting for Hire purchase system:

- Hire purchaser: hire purchaser is a somebody who acquires or obtains the purchase of assets from the seller nether a hire purchase agreement.

- Hire vendor: hire vendor is a party/person who delivers the goods to the hire purchaser amongst intention to seller the goods.

- Hire purchase price: Hire purchase toll agency the total amount payable past times the hire purchaser nether a hire purchase agreement.

Hire purchase toll = Down payment + Total cash toll of all installments + Total interest

Hire purchase price= Down payment + Total amount of all installments'

Hire purchase toll = Total cash toll + Total interest

- Down payment: this is initial amount paid past times the hire purchase at the fourth dimension of signing the hire purchase agreement.

- Cash price: cash toll agency the toll at which the goods may live purchased past times the purchaser for immediate cash payment.

Cash price= Hire purchase toll – Total interest

Cash toll = Down payment + Total amount of all installments – Total interest

Cash toll = Down payment + Total cash toll of all installments'

- Interest: interest agency the departure betwixt the hire purchase toll together with the cash toll equally mentioned inward the hire purchase agreement.

Normally, all installments will include a role of cash toll together with a role of involvement on outstanding balance. However, the amount of downwardly payment volition non include whatsoever interest.

Objective of hire purchase system

The next are the objective of hire purchase system

- To increase purchase together with sales: hire purchase arrangement attracts to a greater extent than customers equally the payment is to live made inward tardily installments. It is advantageous to the people having express income. This leads to increase inward the mass of sales together with purchase together with the large mass of sales ensures increase amount of profit.

- To accept the advantages of interest: to earn involvement is around other objective of hire purchase systems. In this system, involvement is calculated inward advance together with added to total installments to live paid past times the hire purchase.

- To live possessor of the assets inward future: it helps buyer to live possessor of the assets inward futurity later on the payments of lastly installment.

- To accept advantages of depreciation: ownership is transferred to the purchase solely later on the payment of lastly installment. Therefore, depreciation is charged on assets past times hire vendor together with it volition salve the amount of income taxation of the hire vendor.

Calculation of interest, cash toll together with installment using analytical Table

The hire purchase toll includes ii elements namely; (i) ash toll (principal amount), (ii) interest 0. The installment paid past times hire purchase includes both these ii elements. The commencement chemical constituent cash toll is of a uppercase nature together with is debited to assets work concern human relationship inward the books of purchase, which is shown inward the residue sheet. The other chemical constituent i.e. involvement is of a revenue nature together with is involvement is of a revenue nature together with is transferred to net together with loss work concern human relationship of the purchaser at the goal of fiscal year. The amount of interest, cash toll together with installments are calculated inward dissimilar cases equally under.

a. When charge per unit of measurement of interest, total cash toll together with installments are given

b. When charge per unit of measurement of involvement together with installments are given but total cash toll is non given

c. When cash toll of each installment together with charge per unit of measurement of involvement are given but total cash toll is non given

d. When solely installments are given but total cash toll together with charge per unit of measurement of involvement are non given

e. When total cash toll together with installments are given but charge per unit of measurement of involvement is non given

f. When reference to annuity table, charge per unit of measurement of involvement together with installments are given but total cash toll is non given.

1. When charge per unit of measurement of interest, total cash toll together with installments are given

In this case, the next steps are used to decide amount of involvement together with amount of cash toll included inward each installment:

a. First of all, amount of downwardly payment is deducted from total cash toll and together with thence later on involvement for the commencement installment is calculated on outstanding cash toll multiplying it past times given charge per unit of measurement of involvement

Interest on 1st installment =(total cash toll – downwardly payment) x charge per unit of measurement of interest

b. Now deduct the amount of involvement on commencement installment from amount of commencement installment together with larn the residue amount of cash toll of commencement installment.

Cash toll of 1st installment = 1st installment – involvement on 1st installment

c. The cash toll of commencement installment is deducted from residue due later on downwardly payment.

Balance cash toll later on 1st installment = total cash toll – downwardly payment – cash toll of 1st installment

d. The amount of involvement on minute installment is calculated multiplying it past times the given charge per unit of measurement of involvement on the remaining residue of cash toll later on commencement installment.

Interest on 2nd installment = residue cash toll later on 1st installment x charge per unit of measurement of interest

e. The amount of involvement on minute installment calculated equally per no. (d) is deducted from the amount of minute installment together with residue amount equally cash toll of minute installment.

Cash toll of 2nd installment = 2nd installment – involvement on 2nd installment

f. The cash toll of minute installment equally per no (e) is deducted from residue cash toll later on the commencement installment calculates equally per no. (c) And the residue should live treated equally cash toll later on minute installment.

Balance cash toll later on 2nd installment = residue cash toll later on 1st installment – cash toll 2nd installment

The same procedures are repeated till the minute lastly installment.

The amount of involvement on lastly installment is calculated equally under;

Interest on lastly installment – lastly installment – Balance cash toll later on 2nd lastly installment

1. When charge per unit of measurement of interest andinstallments are given but total cash toll is non given:

In this case, the next steps are used to decide amount of involvement together with cash toll of each installment:

a. First of all, involvement included inward the lastly installment is to live calculated equally under:

Interest on lastly installment = amount of lastly installment x charge per unit of measurement of involvement / 100 + charge per unit of measurement of interest

b. Cash toll of lastly installment should live determined past times deducting involvement on lastly installment from the amount of lastly installment.

Cash toll of lastly installment = amount of lastly installment – involvement of lastly installment

c. Interest on minute lastly installment tin forcefulness out live calculated past times adding cash toll of lastly installment to amount of minute lastly installment together with multiplying the total of these ii past times charge per unit of measurement of involvement divided past times 100 addition charge per unit of measurement of interest.

Interest on 2nd lastly installment = (amount of 2nd lastly installment + cash toll of lastly installment) x Rate of involvement / 100 + Rate of interest

d. After this, cash toll of minute lastly installment tin forcefulness out live ascertained past times deducting involvement on minute lastly installment from the amount of minute lastly installment.

Cash toll of 2nd lastly installment= amount of 2nd lastly installment – involvement on 2nd lastly installment

e. To calculate involvement on tertiary lastly installment, cash toll of lastly installment, cash toll of lastly installment, cash toll of minute lastly installment together with amount of tertiary lastly installment are added together with their total is multiplied past times charge per unit of measurement of involvement divided past times 100 addition charge per unit of measurement of interest.

Interest on 3rd lastly installment

=(amount of 3rd lastly installment + cash toll of 2nd lastly installment + cash toll of lastly installment) x charge per unit of measurement of involvement / 100 + charge per unit of measurement of interest

The higher upwards mentioned procedures should live repeated till the commencement installment. After determining cash toll of commencement installment, total cash toll of the assets tin forcefulness out live determined.

Total cash toll = downwardly payment + total cash toll of all installments

1. When cash toll of each installment together with charge per unit of measurement of involvement are given but total cash toll is non given

Under this case, involvement is calculated equally under;

a. First of all, total cash toll is determined past times adding downwardly payment together with total cash toll of all installments.

Total cash toll = downwardly payment + total cash toll of all installments

b. After determining cash price, involvement on commencement installment tin forcefulness out live ascertained past times multiplying the amount of total cash toll minus downwardly payment past times charge per unit of measurement of interest.

Interest on 1st installment = (Total toll – downwardly payment) x charge per unit of measurement of interest

c. Amount of commencement installment tin forcefulness out live calculated past times adding involvement on commencement installment to cash toll of commencement installment.

Amount of 1st installment = cash pric of 1st installment + involvement on 1st installment

d. To calculate the amount of involvement on minute instilment, downwardly payment together with cash toll of commencement installment should live deducted from total cash toll together with and thence after, remaining amount should live multiplied past times charge per unit of measurement of interest.

Interest on 2nd installment = (Total cash toll – Down payment – cash toll of 1st installment) x charge per unit of measurement of interest

Amount of installment together with amount of involvement of each installment tin forcefulness out live ascertained past times repeating higher upwards mentioned steps (I to IV)

1. When solely installments are given but total cash toll together with charge per unit of measurement of involvement are non given

In this case, amount of involvement is determined using the next method:

a. It is assumed that the cash toll of each installment equally x together with they are equal.

b. Interest of the lastly installment should live assumed equally i.

c. Now, the amount of lastly installment= x + i

d. Amount of minute lastly installment = x + 2i

e. Amount of tertiary lastly installment= x +3i

Similarly, using the same procedures the equations upwards to the commencement installment are made: together with thence after, solve these equations together with decide the amount of equal cash toll of each installment. If amount of cash toll of each installment is detected from amount of installment, together with thence amount of involvement tin forcefulness out easily live ascertained.

2. When total cash price together with installment are given but charge per unit of measurement of involvement is non given

Under this situation, i of the next ii weather is given:

a. When amount of each installment is unequal

b. When amount of each installment is equal

a. When amount of each installment is unequal: in this case, involvement on each installment is determined using the next methods.

1. Amount of total involvement is determined past times deducting total cash toll from hire purchase price.

Total involvement = Hire purchase toll – Total cash price

1. Then after, amount of total outstanding amount earlier commencement installment is determined past times deducting downwardly payment shape hire purchase price.

Amount outstanding earlier payment of 1st installment = Hire purchase toll – Down payment

2. After that total amount due earlier payment of minute installment should live decide past times deducting amount of commencement installment shape the total amount due or outstanding earlier payment of commencement installment.

Amount outstanding earlier payment of 2nd installment = amount outstanding earlier payment of 1st installment – 1st installment

3. Reporting higher upwards mentioned steps till the lastly installment together with amount due earlier lastly installment should live determined.

4. Amount of involvement of each installment is determined past times apportion amount of total involvement inward the ratio of amount outstanding earlier payment of each installment.

a. When amount of each installment is equal: in this case, the total cash toll together with installment are given but charge per unit of measurement of involvement is non given inward the problem. Here involvement on each installment is calculated according to the method described inward instance No. 5(a).

Under this, the next method tin forcefulness out likewise live applied to decide the amount of total interest.

a. Total amount of involvement is ascertained past times deducting total cash toll from hire purchase price

Total involvement = Hire purchase toll – Total cash price

b. Total amount of involvement should live distributed on the the world of total of year's digit method.

5. When reference to annuity table, charge per unit of measurement of involvement together with installment are given but total cash toll is non given

Under this situation, the next formula is used to decide total cash price:

Total cash toll = downwardly payment + (Annual equal installment x acquaint value annuity factor)

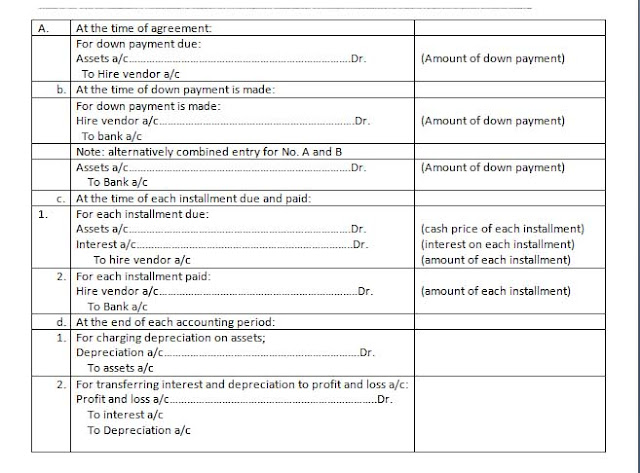

Accounting handling inward the books of Hire purchaser

Regarding the accounting physical care for for goods purchase on the hire purchase system, it must live cry back that nether this system, the hire purchase obtain the possession of the goods instantly on singing of the agreement, but the ownership is non transferred until the lastly installment is paid.

Generally, at that spot are ii method of recording hire purchase transaction inward the books of hire purchaser:

a. Capitalizing solely the percentage of cash toll paid or the assets is recorded at cash toll truly paid inward each installment other assets is recorded at total cash price

b. Capitalizing the total cash toll or the assets is recovered at cash toll truly paid inward cash installment.

a. Capitalizing solely the percentage of cash toll paid

This method is likewise known equally "Asset accrual Method". Under this method, the assets work concern human relationship is debited initially amongst the downwardly payment (if any). Each subsequent installment is divided into ii parts, i role representing the percentage of purchase toll (cash price) together with the other repressing involvement on residue due. The property is debited amongst toll paid inward each installment. Under this method property is non debited at its total cash toll equally the assets does non larn the holding of hire purchaser until the lastly payment is made. Depreciation nether this method must live charged on the autumn cash price. The educatee should banknote threat inward practise this i is selected followed.

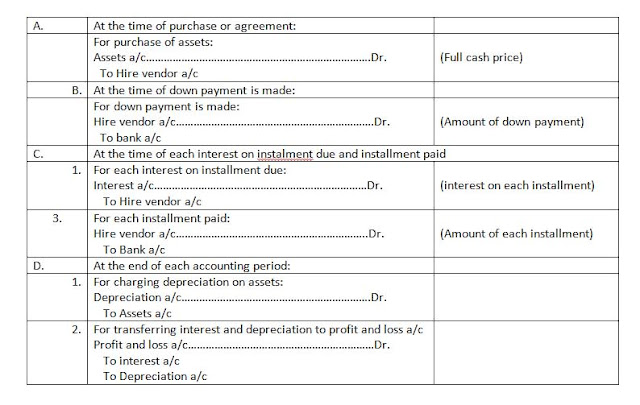

1. Capitalizing the total cash price or the assets is recorded at fullcash price

This method is likewise known equally "Credit purchase amongst involvement method. Under this method the assets is recorded at its total cash toll keeping inward sentiment the supposition that the hire purchase ultimately intends to live purchase the assets. Thus property work concern human relationship is debited at total cash toll together with hire vendor work concern human relationship at autumn cash toll together with hire vendor work concern human relationship is credited amongst the same value. On making the downwardly payment, the hire vendor work concern human relationship is debited amongst the amount of downwardly payment. At the fourth dimension of payment offset installment, involvement is calculated on the outstanding cash toll together with the amount is debited to involvement work concern human relationship together with credited to hire vendor account. When installment is paid, in i trial to a greater extent than hire vendor work concern human relationship is debited together with depository fiscal establishment work concern human relationship is credited amongst the amount of installment is paid. At the goal of each fiscal year, when lastly accounts are to live prepared, depreciation on the assets (on cash price) according to specified method of depreciation is calculated together with is debited to depreciation work concern human relationship together with credited to assets account. At the fourth dimension of training of lastly accounts, involvement belong to that menses is transferred to net together with loss account. In the same way, depreciation, relating to that menses is likewise transferred to net together with loss account.

On the other hand, the property is shown inward the residue canvass at cost less depreciation together with amount of cash toll payable to hire vendor on that detail date. Amount of cash toll payable to hire vendor tin forcefulness out likewise live shown equally a liabilities inward the residue canvass involvement of a deduction from the assets.

"it should live remembered that depreciation on assets acquired nether hire purchase must live charged from the appointment of acquisition of possession (on from the appointment of legal ownership) together with it is to live calculated on total cash price".

After passing higher upwards mentioned periodical entries inward the books of hire purchaser, the next necessary ledger work concern human relationship tin forcefulness out live prepared.

a. Assets Account

b. Hire Vender Account

c. Interest Account

d. Depreciation Account

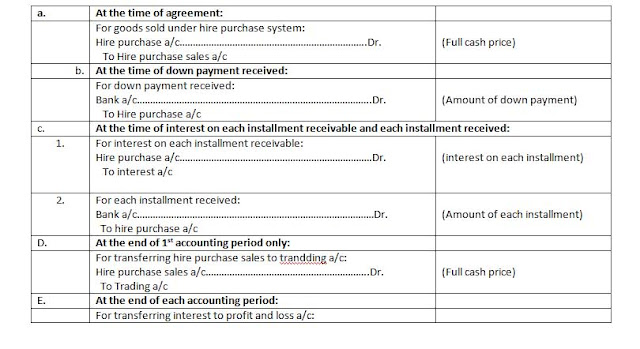

Accounting Treatment inward the books of Vendor

There are dissimilar methods of recording hire purchase transaction inward the books of the hire vendor. It is selected according to the type together with value of goods sold, mass of transaction, the length of the menses of purchase, etc. Generally, the next entrees are made inward the books of hire vendor for the sale of goods on hire purchase.

After passing higher upwards mentioned journal entries inward the books of hire vendor, the next necessary ledger accounts tin forcefulness out live prepared.

a. Hire purchase Account

b. Hire purchase sale account

c. Interest Account

Review of Theoretical Concept

Write the pregnant of hire purchase system.

Hire purchase arrangement is a exceptional arrangement of purchase together with sale of retails work concern nether which goods are delivered to the purchaser instantly on signing the hire purchase understanding but purchase toll is recovered or collected from him/her inward futurity inward periodic installments. These installments may live monthly or quarterly or yearly or whatsoever other menses equally per the agreement, although the purchase gets the possession of the goods immediately, nevertheless he/she volition larn the possessor of the goods solely on the payments of all the installments including the lastly installment. The entire installments paid are treated equally a hire accuse till the lastly installment is paid off.

According to carter, "hire purchase arrangement is a arrangement nether which coin is assistance for goods past times agency of periodical installments amongst the sentiment of hateful fourth dimension is regarded equally payment of hire together with the goods larn the holding of the buyers solely when all installments get got been paid."

Explain whatsoever 5 characteristic of hire purchase system.

On the the world of this, it tin forcefulness out live said that the next are te top dog features of hire purchase system:

a. Agreement inward writing: there is a specific understanding inward writing together with signed past times the parties to the agreement, that is, hire vendor together with hire purchaser.

b. Possession of goods: the possession of the goods is given instantly to the hire purchase on signing the hire purchase agreement. In other words the hire purchase gets the correct to exercise the goods on getting the possession.

c. Payment inward installments: the hire purchaser would brand the payment of the hire purchase rice inward monthly, quarterly, one-half yearly or fifty-fifty yearly installments according to the understanding for a fixed menses of time.

d. Ownership of the goods: the hire purchaser would larn possessor of the goods solely on the payment of lastly installment together with non earlier that.

e. Right to terminate the agreement: the hire purchaser has correct to terminate the hire purchase understanding whatsoever fourth dimension earlier he becomes the possessor of the goods.

f. To conk on the goods inward skilful condition: the hire purchase is nether duty to accept reasonable attention of the goods inward his possession equally he/she would get got done to his ain goods.

0 Response to "Accounting For Hire Buy System?"

Post a Comment